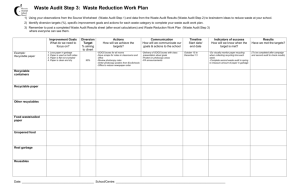

- Documents & Reports

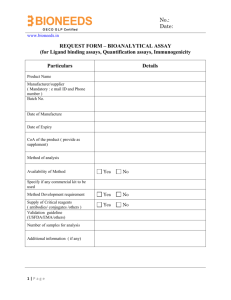

advertisement