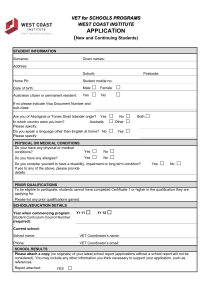

The VET FEE-HELP - Best Practice Regulation Updates

advertisement