Investments Syllabus - University of West Florida

advertisement

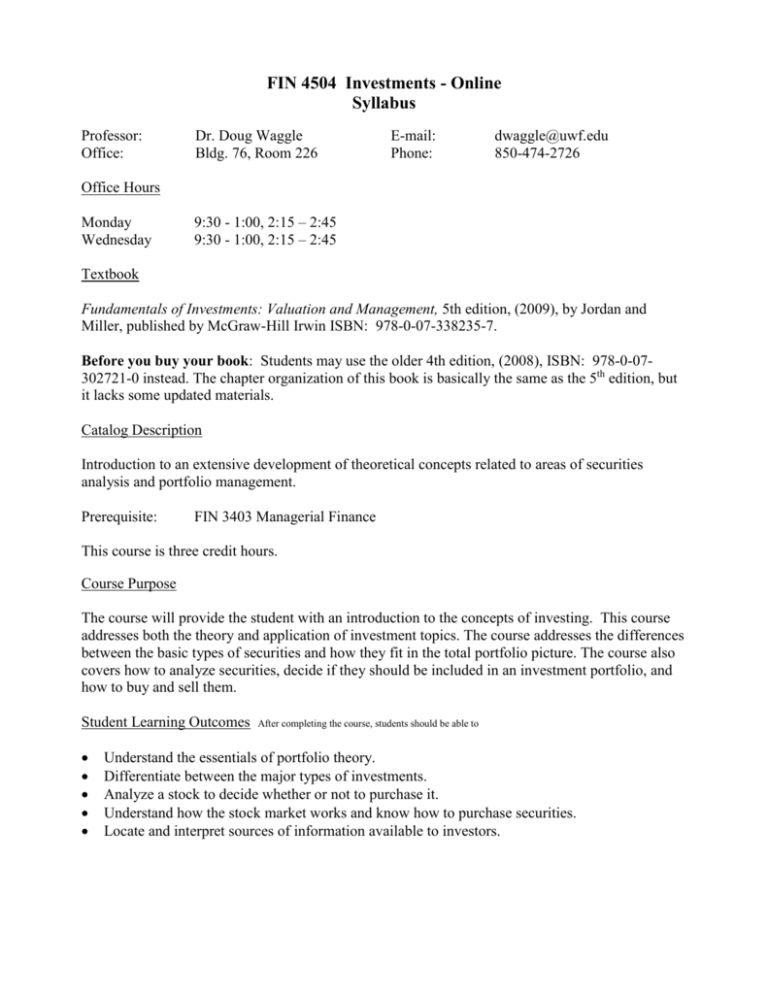

FIN 4504 Investments - Online Syllabus Professor: Office: Dr. Doug Waggle Bldg. 76, Room 226 E-mail: Phone: dwaggle@uwf.edu 850-474-2726 Office Hours Monday Wednesday 9:30 - 1:00, 2:15 – 2:45 9:30 - 1:00, 2:15 – 2:45 Textbook Fundamentals of Investments: Valuation and Management, 5th edition, (2009), by Jordan and Miller, published by McGraw-Hill Irwin ISBN: 978-0-07-338235-7. Before you buy your book: Students may use the older 4th edition, (2008), ISBN: 978-0-07302721-0 instead. The chapter organization of this book is basically the same as the 5th edition, but it lacks some updated materials. Catalog Description Introduction to an extensive development of theoretical concepts related to areas of securities analysis and portfolio management. Prerequisite: FIN 3403 Managerial Finance This course is three credit hours. Course Purpose The course will provide the student with an introduction to the concepts of investing. This course addresses both the theory and application of investment topics. The course addresses the differences between the basic types of securities and how they fit in the total portfolio picture. The course also covers how to analyze securities, decide if they should be included in an investment portfolio, and how to buy and sell them. Student Learning Outcomes After completing the course, students should be able to Understand the essentials of portfolio theory. Differentiate between the major types of investments. Analyze a stock to decide whether or not to purchase it. Understand how the stock market works and know how to purchase securities. Locate and interpret sources of information available to investors. Evaluation and Grading All exams must be proctored. The midterm and final exams must either be taken in person at a UWF campus (times and locations TBA) or be proctored at a testing facility approved by the instructor. See the information on “Testing Policies” below. Students can generally choose between 2 different course evaluation alternatives, with the decision being made before the final exam. Option A: Standard Midterm exam Final exam (Not comprehensive) Major exams Online Quizzes Homework Total 42% 42% 16% 100% Quiz Impact Option B: Standard 21% 63% 74 – 84% 0 – 10% 16% 100% Midterm exam Final exam (Comprehensive) Major exams Online Quizzes Homework Total 16% 100% Quiz Impact 74 – 84% 0 – 10% 16% 100% The typical or default selection is Option A with a final exam that is not comprehensive in nature. This is for students who have successfully mastered the material from the midterm and are satisfied with their grades on that material. Students should note that even though the final exam is not specifically comprehensive with Option A, an understanding of earlier concepts is still required. Option B, which involves a comprehensive final, is available for students who would like another opportunity to demonstrate their understanding of material from the midterm. With Option B, the weight placed on the midterm is reduced. Students must notify the instructor in advance of the final if they would like to select Option B. If you fall behind in the material, catching up may prove difficult. There are mandatory online quizzes that are designed to keep you on track. The quizzes are open book and open note, but you must do them on your own. You must take each quiz by the assigned completion date, which is noted in the quiz section of e-Learning. Failure to take a quiz by the due date results in a 0. If you take a quiz and make 50 or higher, then the quiz grade is optional. Individual quiz grades will only be included if they are higher than the average score of your major tests. If you make less than a 50, you are stuck with the grade. My reasoning here is that if you have gone through the presentations, you should be able to make at least a 50 with your notes available. So each quiz that you do well on will count roughly 1% of your grade. If you do well on 10 quizzes, they will be about 10% of your grade. If you do well on 7 quizzes, they will be about 7% of your grade. The extra weight on quizzes will reduce your major test weight. It is not as bad as it sounds. Homework assignments will primarily require the use of Microsoft Excel. Details of assignments and due dates will be provided. Late homework is generally not accepted. Grades will be assigned as follows: 93-100, A; 90-92, A-; 87 - 89, B+; 83-86, B; 80-82, B-; 77 - 79, C+; 73-76, C; 70-72, C-; 67 - 69, D+; 60-66, D; Below 60, F. Makeup Exam Policy Makeup exams are generally not given. If a student has an unexcused absence from an exam, the general method for making this up is through taking the comprehensive final. The comprehensive final will then receive additional weighting. Testing Policies As noted above, all exams must be proctored. Northwest Florida Students Students in the Pensacola and Fort Walton Beach areas should attend one of the announced proctored exams. If you live in NW Florida, but are unable to attend any of the exam sessions at the dates/times that are being offered, you can arrange for remote proctoring. See below for details. Students outside the Pensacola or Fort Walton Beach area Students who reside outside of this geographic area must make arrangements to have the exams proctored by an individual who is acceptable to the instructor. Most U.S. colleges and universities and military institutions can assist with proctoring. Proctors generally must have either a .edu or a military mailing address. Students should contact the testing center at their local university or community college and request such assistance. Students who will be using a non-UWF proctor must complete and submit a Proctor Approval Form (found at the course eLearning site). These forms should be submitted at least three weeks in advance of the exam being proctored. Only one form is needed for the semester. Other exam notes: Cell phones are not allowed in exams. This does not mean that you should turn your cell phone off during the exams. It means that they should not be brought to the exams at all. A financial calculator is required, and only approved financial calculators are allowed. (See the section on Financial Calculators for more information.) You may not share calculators during exams. A formula sheet will be provided to aid you on the exam. See the eLearning page for an example. Financial Calculators This particular class does not require extensive use of financial calculators, but one will be required when we study bonds and possibly at some other points. There are only two approved financial calculator models: Texas Instruments BAII Plus Hewlett Packard 10BII I recommend the TI calculator, simply because it is what I have always used. I can answer questions on the use of this particular calculator. Either one should work fine, though. You will need to become very familiar with your calculator. You should get your calculator as soon as possible and do all of your work with this calculator. Some other calculators that might be fine otherwise have text functions which would allow for storing notes and creating an unfair situation. These alternatives are not allowed. All business and finance majors should own and be proficient with a financial calculator. If, however, for some reason (I can’t imagine what that might be) you should decide that you would like to sell your calculator when the semester is over, here’s what you can do: 1) Post an ad on the Pensacola site for Craigslist.org that includes “UWF” and “Calculator” in the title and 2) Let me know. I’ll send out an advance notice to students signed up for the next semester’s course. Expectations for Academic Conduct As members of the University of West Florida, we commit ourselves to honesty. As we strive for excellence in performance, integrity—personal and institutional—is our most precious asset. Honesty in our academic work is vital, and we will not knowingly act in ways which erode that integrity. Accordingly, we pledge not to cheat, nor to tolerate cheating, nor to plagiarize the work of others. We pledge to share community resources in ways that are responsible and that comply with established policies of fairness. Cooperation and competition are means to high achievement and are encouraged. Indeed, cooperation is expected unless our directive is to individual performance. We will compete constructively and professionally for the purpose of stimulating high performance standards. Finally, we accept adherence to this set of expectations for academic conduct as a condition of membership in the UWF academic community. Assistance Students with a documented disability who require specific examination or course related academic accommodations should contact the Student Disability Resource Center (SDRC) by e-mail at sdrc@uwf.edu or by phone at (850) 474-2387. Investments Course Outline Week of … January 4 Chapter 1 January 11 1 3.1-3.3 Topic Introduction & Risk and Return January 25 2 5 Intro to Money Market, Stocks, and Bonds ** Martin Luther King Day – no class Monday! Buying and Selling Securities Stock Market February 1 Notes Common Stock Topics February 8 4 Mutual Funds February 15 6 Common Stock Valuation February 22 --- March 1 March 8 7 8 --- Mid-Term Exam – To Be Arranged (Chapters 1-6 and Notes on Stock Topics) Market Efficiency Behavioral Finance and Technical Analysis ** Spring Break – no class! March 15 Notes Asset Allocation Examples March 22 11 Diversification March 29 12 Risk and the CAPM April 5 13 Performance Evaluation and Risk Management April 12 18, 19, 20 Bond Basics April 19 10 Bond Prices and Yields January 18 Final Exam – To Be Arranged (Chapters 7, 8, 10-13, 18-20, and Notes on Asset Allocation) Note: This course outline and the dates established therein are tentative, and the instructor reserves the right to change them. April 26 --- This outline shows the approximate dates that material should be covered. Due dates for online quizzes are all noted on the course e-Learning page. Online quizzes are typically due by the middle of the week after inclusion on the schedule.