Personal Financial Planning Syllabus

advertisement

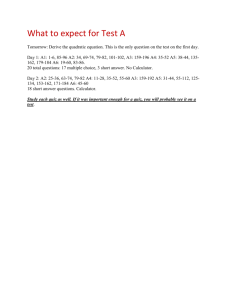

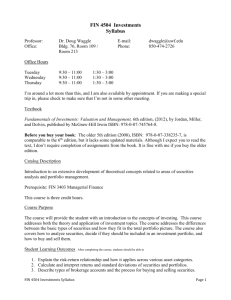

FIN 3140 Personal Financial Planning - Online Syllabus Professor: Office: Dr. Doug Waggle Bldg. 76, Room 226 E-mail: Phone: dwaggle@uwf.edu 850-474-2726 Office Hours: Available online or by appointment Required Text: Personal Financial Planning, 11th Edition, by Gitman and Joehnk, published by Thomson South-Western (2008). ISBN: 978-0-324-42286-5 Course Description Broad coverage of personal financial decisions, including basic financial planning, tax issues, managing savings and other liquid accounts, buying a house, the use of credit, insurance, managing investments and saving for retirement. Prerequisites: None. This course offers 3 hours of credit. Course Purpose The course will provide the student with an introduction to the various concepts associated with personal finance. A broad range of topics will be covered. The course is geared toward practical knowledge that is necessary for financial decision making in everyday life. Student Learning Outcomes After completing the course, students should be able to Make sound decisions relating to a personal financial plan. Understand budgeting, savings alternatives, and tax planning as they relate to individuals. Understand the use of credit and purchasing decisions as they relate to individuals. Understand the importance of insurance and the various types of insurance plans available to individuals. Understand the key long-term investments available to individuals. Evaluation, Grading, and Exams The midterm and final exams must be proctored. The midterm and final exams must either be taken in person at a UWF campus (times and locations TBA) or be proctored at a testing facility approved by the instructor. See the information on “Testing Policies” below. FIN 3140 Personal Financial Planning Syllabus Page 1 Grading is as follows: Quiz Impact Test 1 Final (Not comprehensive) Major Tests Online Quizzes Total 50% 50% 100% 90-100% 0 – 10% 100% There are mandatory online quizzes that are designed to keep you on track. If you fall behind in the material, catching up may prove difficult. The quizzes are open book and open note, but you must do them on your own. You must complete each quiz by the assigned completion date, which is noted in the quiz section of the e-Learning course page. Failure to take a quiz by the due date results in a 0. If you take a quiz and make a grade of 50 or higher, then the quiz grade is optional. These optional quiz grades will only be included if they are higher than the average score of your major tests. If you make less than a 50, you are stuck with the grade. My reasoning here is that if you have gone through the presentations, you should be able to make at least a 50 with your notes available. So each quiz that you do well on will count roughly 1% of your grade. If you do well on 10 quizzes, they will be about 10% of your grade. If you do well on 7 quizzes, they will be about 7% of your grade. The extra weight on quizzes will reduce your major test weight. It is not as bad as it sounds. Grades will be assigned as follows: 93-100, A; 90-92, A-; 87 - 89, B+; 83-86, B; 80-82, B-; 77 - 79, C+; 73-76, C; 70-72, C-; 67 - 69, D+; 60-66, D; Below 60, F. Makeup Exam Policy Makeup exams are generally not given. If a student has an unexcused absence from an exam, the general method for making this up is through taking a comprehensive final. The comprehensive final will then receive additional weighting. Testing Policies As noted above, all major exams must be proctored. Northwest Florida Students Students in the Pensacola and Fort Walton Beach areas should attend one of the announced proctored exams. If you live in NW Florida, but are unable to attend any of the exam sessions at the dates/times that are being offered, you can arrange for remote proctoring. See below for details. FIN 3140 Personal Financial Planning Syllabus Page 2 Students outside the Pensacola or Fort Walton Beach area Students who reside outside of this geographic area must make arrangements to have the exams proctored by an individual who is acceptable to the instructor. Most U.S. colleges and universities and military institutions can assist with proctoring. Proctors generally must have either a .edu or a military mailing address. Students should contact the testing center at their local university or community college and request such assistance. Students who will be using a non-UWF proctor must complete and submit a Proctor Approval Form (found at the course eLearning site). These forms should be submitted at least three weeks in advance of the exam being proctored. Only one form is needed for the semester. Other exam notes: Cell phones are not allowed in exams. This does not mean that you should turn your cell phone off during the exams. It means that they should not be brought to the exams at all. A financial calculator is required, and only approved financial calculators are allowed. (See the section on Financial Calculators for more information.) You may not share calculators during exams. A formula sheet will be provided to aid you on the exam. See the eLearning page for an example. Expectations for Academic Conduct As members of the University of West Florida, we commit ourselves to honesty. As we strive for excellence in performance, integrity—personal and institutional—is our most precious asset. Honesty in our academic work is vital, and we will not knowingly act in ways which erode that integrity. Accordingly, we pledge not to cheat, nor to tolerate cheating, nor to plagiarize the work of others. We pledge to share community resources in ways that are responsible and that comply with established policies of fairness. Cooperation and competition are means to high achievement and are encouraged. Indeed, cooperation is expected unless our directive is to individual performance. We will compete constructively and professionally for the purpose of stimulating high performance standards. Finally, we accept adherence to this set of expectations for academic conduct as a condition of membership in the UWF academic community. Assistance Students with a documented disability who require specific examination or course related academic accommodations should contact the Student Disability Resource Center (SDRC) by email at sdrc@uwf.edu or by phone at (850) 474-2387. Financial Calculators A financial calculator or a calculator that performs financial functions is required for this class. My preferred financial calculator (just because it’s what I have always used) is the Texas Instruments BAII-plus. (I now have the Professional version of it.) Another popular choice is the Hewlett Packard 10bII. If you do not have a financial calculator, I would pick one of these two FIN 3140 Personal Financial Planning Syllabus Page 3 choices. (Finance majors will likely be required to have one of these models in subsequent classes.) You may not share calculators during exams. FIN 3140 Personal Financial Planning Syllabus Page 4 Personal Financial Planning Course Outline and Schedule Week of … May 10 Chapter 1/2 May 17 2 Topic Personal Financial Planning / Financial Statements and Budgeting Time Value of Money May 24 May 31 3 4 5 Tax Considerations Savings and Payment Plans Making Automobile and Housing Decisions June 7 6/7 Introduction to Credit / Consumer Loans June 14 --- June 21 8 Mid-Term Exam (TBA) Chapters 1-7 Life Insurance June 28 9 Health and Disability Insurance July 5 10 Automobile and Home Insurance July 12 11 Investment Basics July 19 12 Introduction to Stocks and Bonds July 26 13 / 14 Introduction to Mutual Funds / Planning for Retirement August 2 *** Final Exam (TBA) Chapters 8-14 Note: This course outline and the dates established therein are tentative, and the instructor reserves the right to change them. This outline shows the approximate dates that material should be covered. Due dates for online quizzes are all noted on the course e-Learning page. Online quizzes are typically due by the middle of the week after inclusion on the schedule. FIN 3140 Personal Financial Planning Syllabus Page 5