View Extended Abstract

advertisement

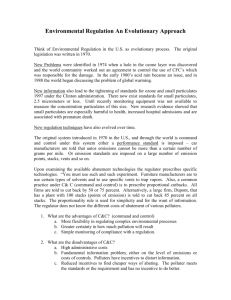

PERMIT MARKETS AND INVESTMENT IN POLLUTION ABATEMENT Gizem Keskin, Rice University, 2813529854, gizem@rice.edu Overview Production processes that use energy from fossil fuels as an input result in an unwanted byproduct, that is, air pollution. In the absence of government regulation (such as a standard, a tax, or a market), firms would not be willing to take on pollution control as it would be against their objective of profit maximization. Therefore, the regulator needs to step in and restrict emissions or create a market where the pollution can be priced. The policymaker may use either command and control (CAC) types of instruments (such as an emission standard or a technology standard) or market incentives for regulation. Although CAC instruments provide the policymaker with more control on the outcome of the regulation, they fail to utilize differences in firms’ abatement costs. Therefore, the overall cost of the regulation is not minimized. Alternatively, cap and trade systems can achieve the minimum cost to the economy by setting firms free to choose the way to comply as long as the overall emission target in the economy is met. Depending on their costs, firms may choose to purchase allowances on the market to cover emissions or invest in pollution abatement technologies to cut them. Although economic theory has proved that cap and trade systems are able to achieve pollution targets at the lowest cost (Montgomery, 1972), the real outcome may be different. In order for the policy tools to result in the planned outcome, the agents must behave in the way predicted by the policy makers. However, uncertainty inherent in the market may cause firms to be unwilling to participate and choose other options to comply while they may not be the lowest cost alternatives. This may reduce the cost advantage of a cap and trade system over alternative types of regulations. Therefore, it is worth analyzing the firm’s decision to choose alternative methods, such as investment in pollution abatement technologies, to comply with the regulation under a cap and trade system. This paper aims to look at the pollution abatement investment decision of a firm operating under a permit market. The paper aims to illustrate the optimal amount of investment for a base model and see the effects of regulatory uncertainty on firm’s investment decision. Methods Dynamic optimization techniques Results The production decision turns out to be a static one. As expected, higher price of output, higher stock of abatement capital, lower cost of input and lower price of permits lead to more production. The investment decision is dynamic. The results so far are for the base model and the effects of regulatory uncertainty are yet to be determined. Conclusions Permit markets assures that the target level of emissions will be met at a minimum cost to the economy. The firms are free to choose the compliance option that is to their best interest. They can choose to purchase permits or invest in pollution abatement, or combine both. However, the regulatory uncertainties (such as possible threat towards continued operation of the market, or intervention to market mechanism) may cause firms to favor safer options over the others, such as investment in abatement capital. As this would affect the cost advantage of a permit market compared to other regulatory options, it is worth analyzing the investment behavior of a firm operating in a cap and trade environment. This paper aims to fill this gap in the literature by looking at the pollution abatement investment of a firm in a dynamic set up. References Coggins, Jay S., and John R. Swinton. 1996. The price of pollution: A dual approach to valuing SO2 allowances. Journal of Environmental Economics and Management 30:58-72 Conrad, Klaus, and Robert E. Kohn. 1996. The US market for SO2 permits, policy implications of the low price and trading volume. Energy Policy 24(12):1051-1059 Fare, R., S. Grosskopf, C. A. K. Lovell, S. Yaisawarng. 1993. Derivation of shadow prices for undesirable outputs: A distance function approach. Review of Economics and Statistics 75: 374-380 Fullerton, Don, Shaun P. McDermott and Jonathan P. Caulkins. 1997. Sulfur dioxide compliance of a regulated utility. Journal of Environmental Economics and Management 34:32-53 Joskow, Paul L., Richard Schmalansee, and Elizabeth M. Bailey. 1998. The market for sulfur dioxide emissions. American Economic Review 88(4):669-685 Hahn, Robert W. 1984. Market power and transferable property rights. The Quarterly Journal of Economics 99(4):753-765 Magat, Wesley A. 1978. Pollution control and technological advance: A dynamic model of the firm. Journal of Environmental Economics and Management 5:1-125 Montgomery, David M. 1972. Markets in licenses and efficient pollution control program. Journal of Economic Theory 5:395-418 Muller, Nicholas Z., and Robert Mendelsohn. 2009. Efficient pollution regulation: getting the prices right. American Economic Review 99:5:1714-1739 Tietenberg, Thomas T. 1980. Transferable discharge permits and the control of stationary source air pollution: a survey and synthesis. Land Economics 56(4): 391-416 Winebrake, James J.,Alexander E. Farrell, Mark A. Bernstein.1995. The Clean Air Acts sulfur dioxide emissions market: Estimating the costs of regulatory and legislative intervention. Resource and Energy Economics 17:239-260 Zhao, Jinhua. 2009. Irreversible abatement investment under cost uncertainties: tradable emission permits and emission charges. Journal of Public Economics 87:2765-2789