here - Department of Mathematics - National University of Singapore

advertisement

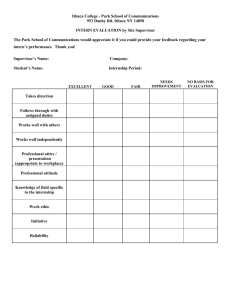

Holiday Internship Opportunities for students from the department (22 July 2015) Intern – Financial Accounting Advisory Services (3 to 6 months from July 2015) Financial Services, Assurance Services, Ernst & Young Solutions LLP Suitable for students pursuing a master's degree in quantitative finance or financial engineering is preferred or pursuing a bachelor’s degree in quantitative finance, physics or engineering with strong programming skills. Ernst & Young Solutions LLP has two vacancies for post-graduate interns who are able to commit for at least 3 to 6 months in its highly esteemed Assurance – FAAS service line commencing July 2015. For job description and application, please visit https://tas-ey.taleo.net/careersection/jobdetail.ftl?job=SIN001U6&lang=en Online application is highly recommended as the recruiter would need applicants to upload their results/transcripts, resume and cover letter to complete the internship application. Shortlisted candidates will be notified within 2-4 weeks. Page 1 of 6 Holiday Internship Opportunities for students from the department (11 June 2015) Actuarial Intern – General Insurance (Fulltime Intern from July-December 2015) AXIS Specialty Limited, Singapore Branch (Division of AXIS Re - Asia Pacific) BTG Pactual is the leading Investment Bank in Latin America, with 30 years’ experience in Brazilian and international markets, and currently 2,500 employees spread across 12 offices in Latin American countries (Brazil, Chile, Peru and Colombia), in addition to the US, the UK and China. In Singapore, BTG is a commodity house in multi-commodity products such as Agri Commodities, Energy, Metals. Job Description Support Zurich, New York and Singapore Actuarial on cleaning, validating and summarizing pricing data, loading data into pricing system and conducting preliminary pricing analysis Support Singapore actuarial on projects such as market large loss distribution, catastrophe modeling and pricing parameters consolidation Requirements 1. Statistics/Economics/Finance/Math/Actuarial major with good academic grades with expected graduation date in 2016 2. Good knowledge in probability/statistics/stochastic modeling 3. Skilled in Microsoft office especially Excel 4. Quick in picking up actuarial concepts, detail oriented, diligent and reliable Interested applicants please write to Mr Tony Gu at tony.gu@axiscapital.com Page 2 of 6 Holiday Internship Opportunities for students from the department (22 May 2015) Junior Commodity Market Research Analyst (1-2 Month Intern from June-July 2015) BTG Pactual BTG Pactual is the leading Investment Bank in Latin America, with 30 years’ experience in Brazilian and international markets, and currently 2,500 employees spread across 12 offices in Latin American countries (Brazil, Chile, Peru and Colombia), in addition to the US, the UK and China. In Singapore, BTG is a commodity house in multi-commodity products such as Agri Commodities, Energy, Metals. Responsibilities Transportation market understanding Literature review to determine what has been done / what is already existing Data collection through different websites / databases – to be determined – Setting up the SnDs Modeling Realize on-the-job studies, depending on the market needs Complete adhoc projects as directed by the Head of the team Person specification Candidates will be 0-2 years of experience Background: Finance/Economics/Statistics Languages used internally: VBA, Matlab desirable Source of ideas proposals Communication skills with the ability to explain detailed technical information in a clear and concise manner, to a variety of audience Flexible and very dynamic approach with good interpersonal skills Ability to multi-task and prioritize multiple projects at all times Ability to work under pressure Language skills of Japanese and Korean would be a plus Interested applicants please write to Ms Angel Jiang at Angel.Jiang@btgpactual.com Deadline: End May 2015 Page 3 of 6 Holiday Internship Opportunities for students from the department (5 June 2014) Teaching Assistant Stanford Pre-Collegiate Studies (SPCS) Honors Academy, V-Campus Pte Ltd V-Campus Pte Ltd organizes Honors Academies with curriculum from Stanford Pre-Collegiate Studies (SPCS), a division of Stanford University. SPCS was previously known as the Education Program for Gifted Youth (EPGY). V-Campus has been organizing these camps for more than 10 years. This year there would be one class of the Mathematical Logic and Problem Solving camp for students in grades 6-8 (Sec 1 to 3) from 23 June to 4 July 2014. 2 Teaching Assistants (TAs) are needed to assist the instructor (who would be flying in from Stanford) to conduct the Honors Academies. There will be an orientation at 3pm on Sunday 22 June 2014 which the TAs are also required to attend. Classes run from Mondays to Fridays from 9:00 am to 3:00 pm with a one-hour lunch break from 12:00 pm to 1:00 pm. Lunch would be provided by for the instructors, TAs and students. There are no classes on Saturdays and Sundays. The course introduces students to mathematical logic and reasoning with the goal of developing skills for understanding and solving problems using sound logical analysis and communicating mathematical ideas effectively. Topics to be covered include formal logic, combinatronics, game theory, probability, number theory and graph theory. In view of the course content, TAs should preferably be at least 2nd year university students majoring in Pure Mathematics, although those reading Applied Mathematics may also be considered. The venue of the camp and the orientation would be the United World College of South East Asia, Dover Campus. Each TA would be paid an allowance of S$500. Students who are interested the job are to apply in writing to Ms Lim Chaidoan at chaidoan@vcampus.sg with a copy of their CVs. For clarifications, they may contact Ms Lim at 63279201 (office) or 96636580 (mobile). They may also get more information of the company and its activities at www.vcampus.sg Page 4 of 6 Holiday Internship Opportunities for students from the department (7 May 2014) Internship, Gaming Technology Division Casino Regulatory Authority, Singapore For Singaporeans only The Casino Regulatory Authority of Singapore has 1 holiday internship position available. A summary of the job scope and duration can be found below. There will be two phase of selection: 1. Students who are keen will send their applications to the department. 2. The department will review and shortlist suitable candidates based on academic performance and any relevant experience. 3. The shortlist will then be reviewed by the Casino Regulatory Authority. The Authority will also be conducting an interview and will contact the shortlisted candidates about it. 4. The final candidate will be selected by the Authority after its selection process. Duration The Gaming Technology division is looking for 1 NUS student to intern for a period of 2 months from 2 Jun – 25 Jul (depending on the school’s internship schedule). Description of Research Project EGM (Electronic Gaming Machine) reinforces gambling behaviour by paying out variable prize awards after an unpredictable number of pulls. Hence, unpredictability in terms of when the prize will be given out and the associated amount of the prize is used to entice the player to continue playing. Hit frequency and amount of the prize is associated with the volatility of the game. Therefore, volatility is likely to be a key determinant of player addiction by sustaining play on the EGM. There are many ways to quantify volatility and the project entails devising a method/model to do so such that the proposed method can be used to predict the addictiveness of a game. Requirements 1 NUS student who must be a Singaporean due to the sensitive nature of the research project; Undergraduate majoring in Mathematics and Statistics with an analytical and creative mind; Experienced in programming (preferably in R). Application Students who are keen are to submit the following to me via email, before 3pm, 8 May 2014: Completed copy of the attached form; An updated CV; Latest transcript of all results in NUS. It is fine to provide the unofficial transcript downloaded from NUS system or copies of past result slips. Page 5 of 6 Holiday Internship Opportunities for students from the department (13 February 2014) Research Internship - Production/Validation Team Risk Management Institute, NUS Founded in August 2006, the Risk Management Institute (RMI) was established as a university-level research arm of the National University of Singapore (NUS) dedicated to the area in financial risk management. RMI strives to become a locally, regionally and globally recognized knowledge center in financial risk management where scholars, regulators and industry professionals gather to advance cutting edge knowledge that has immediate relevance to the financial system. In 2009, RMI commenced the Credit Research Initiative as a constructive response to the criticisms aimed towards Credit Rating Agencies. One of the important outcomes of this CRI is RMI’s operational probability of default system, which started producing daily probabilities of default for exchange listed companies in July 2010. At this point 106 economies in Asia, Western-Europe, North-America and Latin America are being covered, with the results available at http://rmicri.org/home/. NUS RMI undertakes an ongoing effort to spur research and development in the critical area of credit risk. We are currently looking for interns to complement our research team for AY 2014/2015 starting this summer 12 May 2014. Candidates who can start earlier will also be welcome. Production/Validation Team The selected interns will join either the Production or Validation Team within the Credit Rating Initiative. The interns’ main task is to work with senior and junior analysts to participate in undergoing and potential project(s), including: CRI project daily operation and improvement. Default model improvement and testing. Potential project(s) development. Requirements: Strong analytical and research skills. Strong programming ability in Matlab. Familiarity with SQL. Knowledge and interest in the financial markets, financial institutions and default prediction. Eager and able to work in a dynamic environment. Independent worker with a great sense of accuracy. Meticulous and reliable team player with good interpersonal skill and motivated attitude. [Candidate should be able to reasonably commit for the entire Academic Year.] Interested applicants should submit their applications via NUS TalentConnect here. Page 6 of 6