RMG-420 Mandatory use of the Commonwealth Contracting Suite

Resource Management Guide No. 420

Mandatory use of the Commonwealth Contracting Suite for procurement under $200,000

[OCTOBER 2015]

© Commonwealth of Australia 2015

ISBN: 978-1-925205-44-2 (Online)

With the exception of the Commonwealth Coat of Arms and where otherwise noted, all material presented in this document is provided under a Creative Commons Attribution 3.0 Australia

( http://creativecommons.org/licenses/by/3.0/au ) licence.

The details of the relevant licence conditions are available on the Creative Commons website

(accessible using the links provided) as is the full legal code for the CC BY 3 AU licence.

Use of the Coat of Arms

The terms under which the Coat of Arms can be used are detailed on the following website: www.itsanhonour.gov.au/coat-arms .

Contact us

Questions or comments about this guide should be directed to:

Procurement Policy & Advice Branch

Department of Finance

John Gorton Building

King Edward Terrace

Parkes ACT 2600

Email: ccsdesk@finance.gov.au

Internet: http://www.finance.gov.au/procurement/commonwealth-contracting-suite/

This guide contains material that has been prepared to assist Commonwealth entities and companies to apply the principles and requirements of the Public Governance, Performance and

Accountability Act 2013 and associated rules, and any applicable policies. In this guide the: mandatory principles or requirements are set out as things entities and officials ‘must’ do; and actions, or practices, that entities and officials are expected to take into account to give effect to those principles and/or requirements are set out as things entities and officials ‘should consider’ doing.

Audience

This Guide applies to all non-corporate Commonwealth entities (NCEs).

This Guide may be relevant to corporate Commonwealth entities (CCEs).

Key points

This Guide:

reflects the Government’s policy on the use of the Commonwealth Contracting Suite

(CCS) when conducting procurement;

explains when NCEs must use the CCS;

outlines the suite of documents that make up the CCS;

uses terms as defined in the Commonwealth Procurement Rules (CPRs); and

takes effect from 1 January 2016.

Resources

This Guide is available on the Department of Finance website at www.finance.gov.au

.

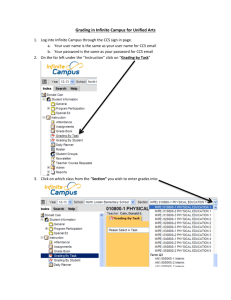

The CCS is available here: http://www.finance.gov.au/procurement/commonwealthcontracting-suite/ . This site includes a Decision Tree (to assist in following the process for procurement under $200,000) and non-mandatory process templates.

For any queries regarding this Guide, contact the Procurement Policy & Advice Branch at

CCSDesk@finance.gov.au

.

Policy

NCEs must use the CCS when purchasing goods or services valued under $200,000

(including GST) except where use of the CCS is not mandated as outlined in the Guidance section below. CCEs are encouraged to use best endeavours to apply this policy.

This policy does not apply to other forms of financial arrangements such as grants, disposals and investments.

Overview of the CCS

The CCS is designed to minimise the burden on businesses contracting with the Commonwealth

Government to support the Commonwealth’s deregulation agenda. The CCS streamlines and simplifies procurement processes for entities.

The CCS is composed of:

a Glossary covering all CCS documents, and

the Approach to Market (ATM) (incorporating the Commonwealth ATM Terms), and

the Response to ATM, and

the Commonwealth Contract (incorporating the Commonwealth Contract Terms); or

the Commonwealth Purchase Order Terms.

Resource Management Guide 420

Mandatory use of the Commonwealth Contracting Suite for procurement under $200,000

| 1

Guidance

NCEs must use the CCS when:

purchasing goods or services valued under $200,000 (including GST); and

one of the below exclusions does not apply.

Notes:

Use of the CCS ATM is not mandated where the approach to market is informal (for example phone quotes or simple requirements where no ATM is prepared).

Where no formal contract is established and a purchase order is the contracting mechanism the

CCS Purchase Order Terms must be used.

NCEs must not use the CCS when:

entering a financial arrangement that is not a procurement, such as a grant, disposal or an investment - refer Resource Management Guide No. 411 Grants, Procurements and

Other Arrangements for guidance on distinguishing between financial arrangements;

a risk assessment indicates that a bespoke contract is required to manage specific risks;

using a mandated whole of government arrangement or standing offer arrangement that prescribes alternative contract arrangements;

conducting a procurement of Information Communication Technology where SourceIT and SourceIT Plus model contracts templates are used – provided here: http://www.finance.gov.au/policy-guides-procurement/sourceit-model-contracts/ ;

where no contract is required (for example a procurement is valued below $10,000 and consistent with Resource Management Guide No. 416 Facilitating Supplier Payment

Through Payment Card, payment is made via payment card);

both procurement and delivery will take place outside Australia.

Use of the CCS is optional when:

procuring Construction Services;

procuring specialist military goods or services or specialist scientific equipment;

the procurement utilises paragraph 2.6 of the CPRs;

the procurement is significantly impacted by Prescribed Terms, that is, terms, conditions, guarantees and warranties implied by law into contracts which cannot be excluded, restricted or modified by agreement (for example lease agreements);

procuring goods and services valued at or above $200,000 (including GST); or

it is industry practice to use the supplier’s terms and conditions.

Resource Management Guide 420

Mandatory use of the Commonwealth Contracting Suite for procurement under $200,000

| 2