Stamp Duty in South Australia

advertisement

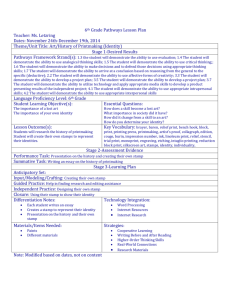

Stamp Duty in South Australia - Discussion Paper Stamp duty on the transfer of real property (land) within South Australia is a tax payable to the State Government when a property is transferred. The amount payable is based on the value of the land, including improvements, and in most instances the purchaser will be responsible for its payment. The payment of stamp duty is a legal requirement under the Stamp Duty Act 1923 (the Act) and must be paid within 30 days of settlement of the property. The payment is due at the time the purchaser arranges stamping and then lodges the documentation for registration at the Land Titles Office. While all transfers of land or sales of property attract a duty there are a number of concessions or exemptions that apply. Such concessions include buying off-the-plan apartments which meet certain criteria or exemptions for the transfer from an estate of a deceased person to a beneficiary under a will. As stamp duty is not applied by the Federal Government the amount levied against real property fluctuates between each State and Territory. A copy of the stamp duty rates across Australia is included in Appendix 1. Currently all States and Territories apply stamp duty to real property. However, the ACT has undergone a major reform of the taxation system and will be abolishing stamp duty through a 20 year phased process. Below is a table comparing the cost of stamp duty across all States and Territories for various housing process. While some States provide concessions for first home owners, these are not taken into consideration. ECM 587037 New South Wales Northern Territory South Australia Tasmania Victoria Queensla nd Western Australia $300,000 $400,000 $500,000 $750,000 $1,000,000 $5,000,000 State or Territory ACT Property Value $8,100 $12,600 $17,100 $29,600 $45,850 $275,000 $8,990 $13,490 $17,990 $29,240 $40,490 $260,490 $10,414 $16,514 $23,929 $37,125 $49,500 $272,500 $11,330 $16,330 $21,330 $35,080 $48,830 $268,830 $9,935 $13,998 $18,248 $28,935 $40,185 $305,613 $11,370 $16,370 $21,970 $40,070 $55,000 $275,000 $3,000 $5,250 $8,750 $19,600 $31,000 $241,000 $8,835 $13,015 $17,765 $29,741 $42,616 $241,000 Within South Australia stamp duty is the State Government's second biggest state-raised source of revenue at an estimated $805 million this financial year. Volatility in sales makes budget planning difficult. In September 2012 the Parliament of South Australia - Economic and Finance Committee resolved to inquire into and report on the South Australian taxation system. This review is specific to the taxes and levies available to State and Local Governments and the sustainability of these taxes. An interim report was tabled in November 2013 with overwhelming recommendations from witnesses calling for change to property taxation. It is understood that neither the Labour Government nor Liberals support the introduction of a land tax at this point in time. Australia's Future Tax Review System The Australia's Future Tax Review, also known as the Henry Tax Review, was established in 2008 by the Rudd Government to examine Australia's tax and transfer system, including states taxes and make recommendations to position Australia to deal with the demographic, social, economic and environmental challenges of the 21st century. As part of this review the effectiveness of stamp duty was reviewed. It was stated that stamp duty is a highly volatile, inequitable and highly inefficient tax on land and should be replaced with a more efficient means of raising revenue. The application of stamp duty discourages transactions of commercial and residential property and is also inequitable as people who need to move more frequently bear more tax irrespective of their income or wealth. By removing stamp duty housing affordability would also improve. The Review states that stamp duty on conveyances is ultimately inconsistent with the needs of a modern tax system and should be replaced with a more consistent and equitable taxation system. Within the Henry Tax Review land tax is provided as an alternative to stamp duty. Land tax, like Council rates, would be a charge on land based on the value of the given property so that the tax does not discriminate between different owners or uses of land. A tax-free threshold based on the value of the land could be set so there was no tax liability on most agricultural and low-value land. 1 Land tax is viewed as a more stable source of revenue for States as it is not tied to the volatility of the real estate market. Additionally, it is one of the most efficient means of raising revenue when applied uniformly across a broad base. 2 Currently no state applies a land tax to the primary place of residence. However, the Australian Capital Territory is undertaking a phased in approach of land tax which is expected to be fully introduced over the next 20 years. 1 Chapter 6.2 Australia's Future Tax System http://www.taxreview.treasury.gov.au/content/FinalReport.aspx?doc=html/publications/papers/Final_R eport_Part_1/chapter_6.htm 2 Chapter 6.2 Australia's Future Tax System ECM 587037 Appendix 1. Stamp duty rates across Australia South Australia Where value of the property conveyed Rate <$12,000 $1.00 for every $100 or part of $100 >$12,000 - $30,000 $120 plus $2.00 for every $100 or part of $100 over $12,000 >$30,000 - $50,000 $480 plus $3.00 for every $100 or part of $100 over $30,000 >$50,000 - $100,000 $1,080 plus $3.50 for every $100 or part of $100 over $50,000 >$100,000 - $200,000 $2,830 plus $4.00 for every $100 or part of $100 over $100,000 >$200,000 - $250,000 $6,830 plus $4.25 for every $100 or part of $100 over $200,000 >$250,000 - $300,000 $8,955 plus $4.75 for every $100 or part of $100 over $250,000 >$300,000 - $500,000 $11,330 plus $5.00 for every $100 or part of $100 over $300,000 >$500,000 $21,330 plus $5.50 for every $100 or part of $100 over $500,000 New South Wales Where value of the property conveyed Rate <$14,000 $1.25 for every $100 or part of the dutiable value $14,001 - $30,000 $175 plus $1.50for every $100 or part, by which the dutiable value exceeds $14,000 $30,001 - $80,000 $415 plus $1.75 for every $100 or part, by which the dutiable value exceeds $30,000 $80,001 - $300,000 $1,290 plus 3.50 for every $100 or part, by which the dutiable value exceeds $80,000 $300,001 - $1million $8,990 plus $4.50 for every $100 or part, by which the dutiable value exceeds $300,000 >$1m $40,490 plus $5.50for every $100 or part, by which the dutiable value exceeds $1,000,000 >$3m $150,490 plus $7.00 for every $100 or part, by which the dutiable value of the residential property exceeds $3,000,000 In NSW land tax does not apply to your principle place of residence. Victoria Where value of the property conveyed < $25,000 > $25,000 - $130,000 ECM 587037 Rate 1.4 per cent of the dutiable value of the property $350 plus 2.4 per cent of the dutiable value in excess of $25,000 > $130,000 - $960,000 > $960,000 $2,870 plus 6 per cent of the dutiable value in excess of $130,000 5.5 per cent of the dutiable value In Victoria land tax does not apply to your principle place of residence. Tasmania Where value of the property conveyed $1 - $1,300 $1,300 - $25,000 $25,000 - $75,000 $75,000 - $200,000 $200,000 - $375,000 $375,000 - $725,000 $725,000 and above Rate $20 $20 plus $1.75 for every $100, or part, by which the dutiable value exceeds $1,300 $435 plus $2.25 for every $100, or part, by which the dutiable value exceeds $25,000 $1,560 plus $3.50 for every $100, or part, by which the dutiable value exceeds $75,000 $5,935 plus $4.00 for every $100, or part, by which the dutiable value exceeds $200,000 $12,935 plus $4.25 for every $100, or part, by which the dutiable value exceeds $375,000 $27,810 plus $4.50 for every $100, or part, by which the dutiable value exceeds $725,000 In Tasmania land tax does not apply to your principle place of residence. Northern Territory Where the dutiable value does not exceed $525,000 in accordance with the following formula: D = (0.06571441 x V2) + 15V where D = the duty payable in $, and V = the dutiable value /1000 From 1 July 2011, where the dutiable value exceeds $525,000, but is less than $3 million, 4.95 percent of that amount From 1 July 2011, there the dutiable value is $3 million or more, 5.45 percent of that amount No land tax is charged in the Northern Territory. Queensland Where value of the property conveyed Up to $5,000 $5,000 to $75,000 $75,000 to $540,000 $540,000 to $1,000,000 More than $1,000,000 ECM 587037 Rate Nil $1.50 for each $100, or part of $100, by which the dutiable value is more than $5,000 $1,050 plus $3.50 for each $100, or part of $100, by which the dutiable value is more than $75,000 $17,325 plus $4.50 for each $100, or part of $100, by which the dutiable value is more than $540,000 $38,025 plus $5.75 for each $100, or part of $100, by which the dutiable value is more than $1,000,000 In Queensland land tax does not apply to your principle place of residence. ACT Where value of the property conveyed up to $200,000 $200,001 to $300,000 Rate $20 or $2.20 per $100 or part thereof, whichever is greater $4,400 plus $3.70 per $100 or part thereof by which the value exceeds $200,000 $300,001 to $500,000 $8,100 plus $4.50 per $100 or part thereof by which the value exceeds $300,000 $500,001 to $750,000 $17,100 plus $5.00 per $100 or part thereof by which the value exceeds $500,000 $750,001 to $1,000,000 $29,600 plus $6.50 per $100 or part thereof by which the value exceeds $750,000 $1,000,001 to $1,650,000 $45,850 plus $7.00 per $100 or part thereof by which the value exceeds $1,000,000 $1,650,001 and over A flat rate of $5.50 per $100 applied to the total transaction value In the ACT land tax is currently paid on rental properties. Stamp duty will be phased out over 20 years. ECM 587037