Chapter 17 - Working Capital Management * Notes

advertisement

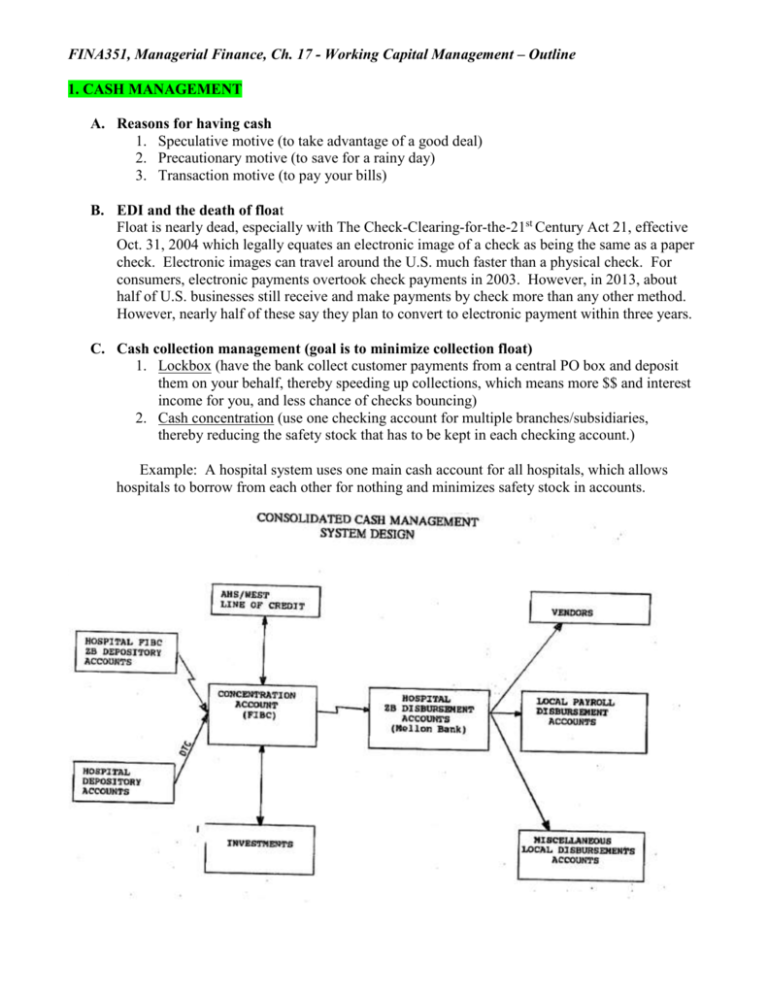

FINA351, Managerial Finance, Ch. 17 - Working Capital Management – Outline 1. CASH MANAGEMENT A. Reasons for having cash 1. Speculative motive (to take advantage of a good deal) 2. Precautionary motive (to save for a rainy day) 3. Transaction motive (to pay your bills) B. EDI and the death of float Float is nearly dead, especially with The Check-Clearing-for-the-21st Century Act 21, effective Oct. 31, 2004 which legally equates an electronic image of a check as being the same as a paper check. Electronic images can travel around the U.S. much faster than a physical check. For consumers, electronic payments overtook check payments in 2003. However, in 2013, about half of U.S. businesses still receive and make payments by check more than any other method. However, nearly half of these say they plan to convert to electronic payment within three years. C. Cash collection management (goal is to minimize collection float) 1. Lockbox (have the bank collect customer payments from a central PO box and deposit them on your behalf, thereby speeding up collections, which means more $$ and interest income for you, and less chance of checks bouncing) 2. Cash concentration (use one checking account for multiple branches/subsidiaries, thereby reducing the safety stock that has to be kept in each checking account.) Example: A hospital system uses one main cash account for all hospitals, which allows hospitals to borrow from each other for nothing and minimizes safety stock in accounts. D. Cash disbursement management (goal is to maximize disbursement float) Ethical or unethical devices to delay clearance include mailing from most distant or rural post office, having checking accounts in distant states, or calling to dispute the balance E. Zero balance and controlled disbursement accounts F. Investing idle cash -- want to minimize liquidity and default risk. Money market securities (those with a max. maturity of one year) include: 1. T-bills: U.S. Treasury Bills have no default risk and are very liquid. $10,000 minimum. 2. S/T tax exempts: municipal bonds issued by state & local governments have more default and liquidity risk than T-bills but they are exempt from federal income tax. $5,000 minimum. 3. Commercial paper: short-term loans (up to 270 days) given to finance companies, banks, and corporations. Has more liquidity and default risk than T-bills. $100,000 minimum. 4. Negotiable CDs: These certificates of deposit allow interest rates to be locked in for 3, 6, 9 or 12 months. They are liquid (there’s a secondary market) but they are not backed by the FDIC so they incur some default risk. $100,000 minimum. 5. Preferred stock: money market preferred stock has some liquidity and default risk but much or all of the dividend income is free from income tax for corporate investors. No minimum. Seasonal Cash Demands 2. MANAGING CREDIT & RECEIVABLES A. Offering credit Advantages: stimulates quantity and price of sales (e.g. you sell more stuff at higher prices) Disadvantages: costs of financing, monitoring, collecting and not-collecting receivables. B. Terms of sale: credit period, cash period, discount period The formula for calculating the price of not taking a cash discount is: Rate = Discount % / (1 – Discount %) To annualize the interest rate, use the following formula: (1 + Rate) ^ (365/ (Net Credit Period less Cash Discount Period)) less 1 C. Setting the length of credit period: longer for customers who are more stable, have longer operating cycles, or carry non-perishable or high value inventory. D. Evaluating credit 1. The five C’s of credit: character, capacity, capital, collateral and conditions 2. Gathering information: financial statements, credit reports, payment history, etc. 3. Credit scoring: FICO for individuals, etc. (see www.annualcreditreport.com for free report – unfortunately you usually have to pay a little extra for FICO scores) The most common credit-scoring system used today for individual consumers is generated by Fair Isaac Corporation (ticker FICO), which provides a standardized credit-score for each person with a credit record in the US. Your FICO score is undoubtedly one of the most important personal statistics that influences your life. It affects just about everything, including whether an apartment landlord will rent to you, whether you get that car loan, your auto insurance rates, and whether you get that dream job (many prospective employers check your score as part of a background check). FICO scores are what a majority of lenders (75%) use to evaluate your creditworthiness. The scores are based on a number of factors that analyze the electronic credit files maintained on virtually all adults in the U.S. The scores range from the 300 to 850 (the higher the better). Many lenders reserve their most favorable terms for borrowers with FICO scores of 750 and above. Loan applicants below 600 get progressively higher rates and loan fees, if in fact they get a loan at all. The subprime mortgage loans that got the brunt of the blame for starting the mortgage crisis were loans to people who had credit scores below 620. Subprime E. Monitoring Receivable. An aging schedule is very helpful in keeping track of your customers. See example below. In addition, you can use various ratios, such as days sales in receivable, to keep track of how long it takes you, on average, to collect. F. Collection procedures: letters, telephone calls, collection agencies, lawyers, etc. You want to avoid the accounting getting to the stage where you have to turn to collection agencies or to very costly legal action. The average collection agency keeps about 25%, but some may keep up to half of collections. The Sample Collection Letter Five-Day Demand For Payment Dear U.R. Broke: On May 25, 2015, you were notified of your past due account in the amount of $666. To date, you have not responded or made payment to clear this account. Our accounting department has turned your past due account over to me hoping that I could persuade you to bring it current prior to forwarding your file to our legal department. When our firm extends credit to an individual such as yourself, it bases its decision on that applicant's previous credit history and ability to pay. When you requested credit from us, you met all of these criteria. Today, however, your account is substantially past due has reached a critical stage. You can avoid any additional costs if you mail your check in the amount of $666 today. Alternatively, you can call and charge the balance to a credit card. If I don’t hear from you within five days, further actions on our part will be necessary. Sincerely, Yew Ohmi Moni Director of Collections Management