Understanding Credit Reports & Scores

advertisement

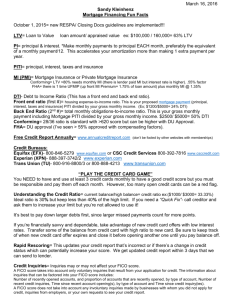

UNDERSTANDING Your CREDIT REPORT & SCORES www.credit.org Promoting Financial Literacy About Springboard Springboard is a non-profit organization founded in 1974. We offer personal financial education and assistance with money, credit, and debt management through educational programs and confidential counseling. About Springboard Accredited by the Council on Accreditation (COA) Member of the National Foundation for Credit Counseling (NFCC) Certified by the Department of Housing and Urban Development (HUD) Member of the Better Business Bureau (BBB) Our Services Include Credit and Debt Counseling Financial Education Programs – Seminars and Materials Debt Management Plans Homeowner Assistance (Foreclosure Prevention) First Time Home Buyer Education Seminars Reverse Mortgage Counseling Pre-Bankruptcy Budget and Credit Counseling Pre-Discharge Financial Management Instructional Course Introduction It is well established that credit scores are now a cornerstone of the U.S. credit system. Credit scores determine access to housing, unsecured credit lines, insurance, utility and cell phone services, and employment. It is imperative that the underlying data be correct for the score to have any meaning and consumers to accept the validity of credit scoring. POP Quiz Based on a study by the Public Interest Research Group, how many credit reports contain errors ? a. 3 in 5 b. 1 in 4 c. 2 in 2 b. 1 in 4 Credit History is Your Financial DNA According to study conducted by the Public Interest Research Group PIRG “Mistakes Do Happen: A Look at Errors in Consumer Credit Reports” www.pirg.org, in which it was found that one in four credit reports contains error serious enough to cause consumers to be denied credit, a loan, an apartment or home loan or even a job. Credit History is Your Financial DNA The importance of good credit More employers are reviewing credit reports of prospective employees Insurance companies review your credit report when you apply to insure you home and/or car. Without good credit, it is very difficult to obtain a credit card, which is helpful if an emergency arises. Many businesses prefer the use of credit cards. Many employment fields, such as financial services, gaming, military and law enforcement, continually monitor their employees’ credit reports. Make sure you get credit when credit is due An estimated 50 million Americans have little or no credit history and therefore can’t access mainstream credit. There are many businesses such as child care, private mortgages, payday lenders, gas, electric, water, telephone, utilities and cable TV that create regular monthly payment flows that are not aggregated to a credit history. Fair Isaac “Expansion Score” - Fair Isaac's FICO® Expansion® Score predicts credit risk for consumers without FICO® scores by bringing together data in real time from alternative credit data sources - www.myfico.com Payment Reporting Builds Credit (PRBC) - http://prbc.com/ Rent Reporters - RentReporters is a service that verifies your monthly rent payments with your landlord and provides that data to the credit bureaus to be added to your credit report. www.rentreporters.com First American CREDCO's Anthem Score represents a comprehensive and reliable underwriting score for consumers. who have little or no credit history. Anthem Report and Anthem Score http://www.credco.com Credit Reports What information is contained in my credit report? Identifying Information Public Record Credit Information Inquiries Identifying Information Identifying Information: Your name Current and previous addresses Telephone number Social Security Number Date of birth as well as current and previous employers. This information is not used in the scoring, but to verify your information with the information on an application. Also the first place you may spot identity theft! Public Records Public Record Information: Bankruptcy records, tax liens, monetary judgments, debts referred to collection agencies and, in some states, overdue child support is noted on the credit report. Bankruptcy Information can remain on a consumer’s credit report for up to 10 years. Unpaid tax liens can be reported indefinitely, and paid tax liens remain for seven years from the date paid. Other public record information can remain for up seven years. Credit Information or Trades Credit Information: Specific information about each account, such as the date the account was opened, the credit limit or loan amount, the balance due, monthly payment, and payment history during the past several years. For open accounts, positive credit information remains on the report indefinitely. Information on closed accounts and negative payment notations remain up to seven years. The report also states whether a spouse or co-signer is responsible for paying the account. Inquiries Inquiries: The credit report also lists the names of those who obtained information from the credit report for the past two years. “Hard” inquiries are those that result from an attempt to solicit credit or a loan. Other types of inquiries, such as those that result when a consumer requests a copy of his or her own report directly from the credit reporting agencies, are “soft” inquiries that are not viewed by prospective creditors but are recorded and remain on the report from one to two years. Employers, landlords, pre-approved not responded to are all soft inquires. Consumers should be aware that when they request copies of their credit reports from third party vendors, rather than directly from the credit reporting agency, the inquiry often looks like a request for credit. POP Quiz Consumers should check their credit reports how often? At least once every 12 months Your Credit Report You should review your credit reports at least once a year. You are entitled to one free report from each bureau every 12 months from: www.annualcreditreport.com 877-322-8228 Additional Free Credit Reports Anyone can request an additional free credit report for the following reasons: You have been denied credit, insurance, housing, or employment within the previous 60 days. You have been a victim of identity theft and have reason to believe that information is incorrect due to fraud. You are without employment and plan to apply for employment within the next 60 days. You are receiving public assistance. If a negative decision, in whole or in part, has been made in relation to the information that is in your credit report. If your credit report has been modified due to an investigation that you requested. Credit Score – FICO or FAKO? What is a credit score? Why are your three scores different? What affects your credit score? Experian Unfortunately, as of early 2009 Experian has stopped allowing consumers to access their FICO score. Only lenders may purchase a consumers Experian FICO score. This leaves consumers unable to know in advance what that score is in order to take steps to improve it before seeking credit. Consumers may still access their TransUnion and Equifax FICO scores directly by visiting www.myfico.com. Once your lender has obtained your FICO scores from the credit bureaus, you are entitled to request a copy from your lender, including your Experian score. True or False Missing just one or two credit card payments won’t hurt your credit rating. False Missing a payment is noted on your credit report. Negative information such as this can legally remain on your credit report for up to 7 years. What Affects Your FICO Score? Inquiries for Rate Shopping The score allows for “rate shopping.” Looking for a mortgage, auto or student loan may cause multiple lenders to request your credit report, even though you're only looking for one loan. To compensate for this, the score ignores all mortgage and auto inquiries made in the 30 days prior to scoring. So, if you find a loan within 30 days, the inquiries won't affect your score while you're rate shopping. In addition, the score looks on your credit report for auto or mortgage inquiries older than 30 days. If it finds some, it counts all those inquiries that fall in a typical shopping period as just one inquiry when determining your score. For FICO scores calculated from older versions of the scoring formula, this shopping period is any 14 day span. For FICO scores calculated from the newest versions of the scoring formula, this shopping period is any 45 day span. Each lender chooses which version of the FICO scoring formula it wants the credit reporting agency to use to calculate your FICO score. Simple Ways to Improve Your Credit Score Review credit reports regularly - Dispute any inaccuracies Make your payments on time/pay off unpaid debts -collections Keep balances below 50% of line of credit or less (Lenders prefer 25% or less) Keep old credit active – use the card at least once or twice a year to keep active Demonstrate a good mixture of credit history: Revolving, installment, mortgage Limit inquiries Credit Consumers Should Know Their Rights Fair Credit Reporting Act FCRA – Purpose is to promote accuracy and fairness, and to ensure the privacy of information in your credit reports along with dispute rights. Fair Debt Collections Practices Act FDCPA – Purpose is to prevent abusive, deceptive and unfair debt collection practices by debt collectors. Fair and Accurate Credit Transactions Act FACTA – Amendment to the FCRA, intended to primarily help consumers fight the growing crime of identity theft, accuracy, privacy, limits on information sharing, and new consumer rights to disclosure and free credit reports. Disputing Errors What can you dispute? Anything that is not yours (reported to the wrong credit report or id theft) Anything that is reported inaccurately Anything that is past the statute of limitations for reporting True or False Paid tax liens stay on the credit report for 7 years from the date it was paid. True Under the Fair Credit Reporting Act A paid tax lien will legally remain on your credit report for 7 years from date paid. Statute on Limitations for Reporting Typical retention periods (may vary by state): Chapter 7, 11 or 12 bankruptcies 10 years from the date filed Chapter 13 bankruptcy filings 7 years from date paid Chapter 13 bankruptcy that is not completed 10 years Bankruptcies voluntarily dismissed 7 years Civil judgments 7 years from the date filed Unpaid tax liens Indefinite Paid tax liens 7 years from date paid Collections paid or unpaid 7 years from date of the initial missed payment Charge off accounts 7 years from date of the initial missed payment Credit accounts 7 years from the date of initial missed payment Inquiries 2 years Basics of sending dispute letters 1. Provide a copy of your photo id, social security card, and proof of address (such as a utility bill, pay stub or bank statement) 2. Provide copies of any documentation supporting your dispute 3. Keep originals send copies 4. Send all letters certified mail or return receipt 5. Keep a separate file for each of the credit reporting agencies 6. Respond quickly 7. Know your rights! Opting Out You can remove your name from any list compiled by a credit reporting agency, whether the list is for pre-approved credit offers or direct marketing. To "opt-out," that is, to remove your name from mailing lists compiled by credit bureaus. Call the toll-free number all credit reporting agencies are required by law to maintain for this purpose: Opt out of pre-screened or pre-approved credit offers @ 1-888-5OPT-OUT or 1-888-567-8688. They can stop the selling of your personal information to creditors. Resources www.credit.org - Springboard’s Consumer Guide to Good Credit www.whatsmyscore.org - Visa’s educational interactive tutorial that explains credit, credit scores and how to build solid credit www.myfico.com - Fair Isaac’s Educational website www.ftc.gov – your rights, educational materials or to file a complaint Post-Test and Evaluation Please take a moment to complete your post- test. Your comments and feedback are greatly appreciated! Thank You! Springboard Nonprofit Consumer Credit Management 800-WISE-PLAN www.credit.org 4351 Latham St. Riverside CA. 92501 www.credit.org