Credit Package

advertisement

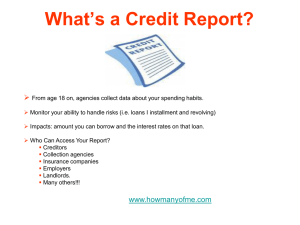

What’s a Credit Report? From age 18 on, agencies collect data about your spending habits. Monitor your ability to handle risks (i.e. loans I installment and revolving) Impacts: amount you can borrow and the interest rates on that loan. Who Can Access Your Report? Creditors Collection agencies Insurance companies Employers Landlords. Many others!!! What is in a Credit Report? Personal Data Employment History Public Records (liens, judgments, secured loans, foreclosures, bankruptcies, etc.) Collection Accounts (defaults and lateness) Credit Information (open accounts, date account was opened, payment status) Inquiries (approved requests and others seeking credit information) How Long Does the Information Remain On A Credit Report? TYPE Suits & Judgments Tax Liens – Paid Tax Liens – Unpaid Charged to Profit & Loss Criminal Record Limitations Other adverse information Late Payments Debt Collections Bankruptcy LIMITATION 7 years 7 years from payment No limitation 7 years No limitations 7 Years 7 Years 7 Years 10 Years Annual Credit Report The Fair Credit Reporting Act guarantees you access to a free credit report from each of the 3 nationwide reporting agencies — Experian, Equifax, and TransUnion — every twelve months. To get your free Credit Report By Internet: By phone: By mail: www.annualcreditreport.com 1-877-3222-8228 Annual Credit Report Request Service P.O. Box 105281, Atlanta, GA 30348-5281 Improving Your FICO Credit Score Credit Score • • • • • • What is a “Credit Score”? Why you need a credit score? How are these scores created? Why are there different types of scores? What hurts your score? Tips to improve your score. 6 What is a Credit Score? A tool created from your credit report which can assess your financial status, history, and debt repayment record. Credit rating is determined by three bureaus that all banks, employers, companies you deal with check to see if you are a good risk Two most commonly used credit scores is the: FICO (Fair Isaac Corp.) which ranges from 300 – 850. Vantage (Experian) scores go from 501 - 990. Credit scores are used by mortgage lenders, and companies that sell auto, homeowners and health insurance policies. What doesn’t Count in a Score. The scoring model doesn't look at: • • • • • • • • • • • age race sex income education marital status job or length of employment at your job whether you've been turned down for credit length of time at your current address whether you own a home or rent information not contained in your credit report Why is a Credit Score Important? A poor credit score can affect a person’s ability to: Obtain credit cards, car loans and mortgages Receive favorable interest rates and preferred credit limits on cars and credit cards Qualify for utility and cell phone services with no down payment or substantial security deposit Rent or lease a house or apartment Obtain government sponsored student loans Obtain private student loans with low rates It might also affect: Your car insurance rate Life insurance rates Health insurance premium Possible job offers Distribution of FICO Fair Isaac reports that the American public's credit scores break out along these lines: Credit score Percentage 499 and below 2 percent 500-549 5 percent 550-599 8 percent 600-649 12 percent 650-699 15 percent 700-749 18 percent 750-799 27 percent 800 and above 13 percent TWO DIFFERENT BORROWERS Alex has a FICO score of 680 and: Blanca has a FICO score of 780 and: Has six credit accounts, including several active credit cards, an active auto loan, a mortgage, and a student loan Has ten credit accounts, including several active credit cards, an active auto loan, a mortgage and a student loan An eight-year credit history A fifteen-year credit history Moderate utilization on his credit card accounts (his balances are 40-50% of his limits) Low utilization on her credit card accounts (her balances are 15-25% of her limits) Two reported delinquencies: a 90-day delinquency two years ago on a credit card account, and an isolated 30day delinquency on his auto loan a year ago Never has missed a payment on any credit obligation Has no accounts in collections and no adverse public records on file Has no adverse public records on file How Much Will Their FICO Scores Drop? Current FICO Score Alex Blanca 680 780 Score after one of these is added to the credit report One inquiry for a new credit card 675 (5) 775 (5) A new charge card (additional hit) 665 (15) 760 (20) Maxing out credit card 660 (20) 745 (35) A 30-day delinquency 610 (70) 680 (100) Settling a debt 625 (55) 665 (115) Foreclosure 585 (95) 630 (150) Bankruptcy 540 (140) 550 (230) What Rate Will Your Score Get You? FICO Score 30-year fixed-rate mortgage 36-month new auto loan 15-year home equity loan Credit Card APR 740 5.0% 6.4% 8.1% 7.3% 720 5.2% 6.4% 8.4% 10.0% 700 5.2% 7.9% 8.9% 15.0% 680 5.4% 9.9% 9.7% 15.0% 660 5.6% 9.9% 11.2% 18.0% What is APR? APR is the Annual Percentage Rate on a loan or a credit card. It is interest rate that will determine how much you pay in interest each year. How much will you pay? A home theater system for $1,000, when purchased on credit card and each month you pay minimum payment will actually cost FICO Score Credit Card APR You will pay off the balance in about 740 7.3% 680 15.0% 660 18.0% 5 years $196 7 years $580 8 years $863 You will end up paying an interest of You will end up paying an estimated total of $1,196 $1,580 $1,863 Credit Scores and Interest Rates 2015 Ford Focus 5 yrs. 5% 4% 3% 0% 4 yrs. 3 yrs. $377.42 $22,645 $460.59 $599.42 $21,579 $368.33 $22,100 $451.58 $359.37 $21,562 $442.69 $333.34 $20,000 $417.66 $22,108 $21,676 $21,249 $20,000 590.48 $21,257 $581.62 $20,938 $556.00 $20,000 Credit Score Mistakes 1. Paying bills late 2. Closing old credit cards 3. Maxing out . Watch the “Utilization Rate” (35%) 4. Using cash over credit 5. Applying for extra cards 6. Not shopping around for lower rates 7. Not checking your credit reports.