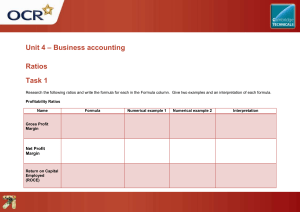

Lecture 7: Analysis and Interpretation of Financial Statements Reading Chapter 28: Review of Financial Ratio Analysis Chapter 29: Analysis of Published Financial Statements Objectives Explain the role of accounting ratios in the analysis and interpretation of the information provided in financial statements; Define each of the most commonly-used accounting ratios; Perform a ratio analysis of a set of financial statements; Explain the limitations of financial ratios analysis Introduction to ratio analysis The objective of financial statements is to provide users with useful information. Users need to analyze the financial statements and draw conclusions with regard to the company's financial performance and financial position. Ratio analysis is a technique for the analysis of financial statements. Accounting ratios can be used to compare one period with another and one company with another. Accounting Ratios Profitability ratios Liquidity ratios Efficiency ratios Investment ratios Analytical and Interpretative Approach Needs of the users of financial statements - All these user groups are interested in financial performance, financial position and cash flow, but some users are mainly interested in performance and profitability, while others may be more interested in liquidity and gearing or other matters. You must make a choice: Choose those relevant to the situation Choose those relevant to the party in the question Make use of any additional information given in the question to help your choice. Still in doubt that you have anything to say? There are some points which should serve as a useful checklist: - What does the ratio literally mean? - What does a change in the ratio mean? From the information given, what is likely to have led to the changes in the ratio? Your analysis should use the information in the scenario to produce the reason for movements in performance and position. Your knowledge of the business will be limited to that provided within the question, so the reasons for the movement in ratios should be linked back to this at all times. Profitability Ratios Gross Profit Margin and Net Profit Margin Return on capital employed (ROCE) Return on equity (ROE) Return on capital employed (ROCE) Example - ROCE The following information has been extracted from the financial statements of two companies for the year to 31 December 2019. the companies are of similar size and operate in the same sector of industry. Required: Calculate ROCE for each company and analyse each company’s ROCE figure into its component parts. Example – Profitability Ratios Archer Co is a retailer and trades through its stores on the high street, selling high quality goods. The company has recently been suffering from rising costs, that it has been unable to pass on to its customers. In response to the number of people shopping via the Internet, Archer Co has implemented a cost cutting strategy in the prior year, and in the current year asked shareholders for funds to help reduce it debt burden. The following financial information for the current year is available: Suggested Solution: The revenue has fallen by 6.7% due to more customers shopping using the Internet. If the company does not do more to address the decline then it will run the risk of continued falling sales in future periods. It might be a future strategy to sell its goods via the Internet as well as from its high street stores. Gross margin has fallen due to rising costs of production that have been unable to be passed on directly to its customers. This will have been done in order to maintain competitiveness with the online market, but if margins are to improve then Archer Co will need to either increase the selling prices or look to source the same products at more competitive prices. Operating margin has increased because Archer Co has implemented a cost cutting exercise that will have reduced staff numbers, and/or closed down stores that were under-performing. This will have resulted in large costs of redundancy in the prior year that are not present in the current year costs, and lower wages/rent in the current year. Finance costs have reduced as the funds received from the shareholders has been used to reduce the borrowing and lower the interest costs. Liquidity Ratios Current ratio Quick assets ratio ("acid test") Efficiency Ratios Inventory holding/turnover period Receivables collection period Payables payment period Example – Liquidity & Working Capital Ratios Comment on profitability Key factors: Revenue has increased by 50%; Gross profit margin significantly decreased, maybe due to lowering of selling price in order to increase market share and sales revenue Operating profit margin has decreased in line with gross profit margin; ROCE has increased, which must be due to the improvement in asset turnover. Comment on liquidity: Overall the liquidity of the company would appear to be in some doubt: Both the current ratio and quick ratio appear very low although they have improved since the precious year; We do not know anything about the type of business, so it is difficult to comment on these absolute levels of liquidity; Inventory holding period indicates that inventory is held for a considerable time and that this period is increasing; Accounts receivable collection period has deteriorated rapidly although given the increase in revenue this may be due to a conscious policy of offering extended credit terms in order to attract new customers; Clearly the business is heavily dependent upon its overdraft. Investment Ratios Capital gearing ratio = Capital gearing is expressed as a percentage. Interest cover: Interest cover is expressed as a ratio. Earnings per share: This ratio is usually expressed in pence. EPS is the subject of IAS 33 Price earnings (P/E) ratio: P/E is expressed as a ratio. Higher P/E ratios are generally viewed more favorably than lower P/E ratios. Dividend cover: Dividend cover is expressed as a ratio. Dividend yield: Dividend yield is expressed as a percentage. Example – Investor’s Ratios Solution: Limitations of Ratio Analysis Historical cost accounts Lack of standard definitions Figures taken from SOFP may be unrepresentative Accounting policies may differ Misinterpretation is possible Other issues