Case Study on Ningbo FOTILE Kitchen Ware Co., Ltd.

advertisement

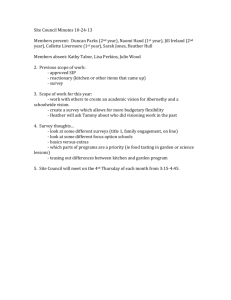

Strategic Selection Based on Industry Environment Analysis:Case Study on Ningbo FOTILE Kitchen Ware Co., Ltd. Shuang-shuang Shi College of Management, Zhejiang University, China, Hangzhou (ssslovesss@163.com) Abstract – As we all know, strategy comes into being for the aim of dealing with fervent competition successfully. Nowadays, as the competition within and between all trades is becoming incessantly fierce, it is a prerequisite for enterprises longing for success to make the right strategic selection to triumph over others in the competition. In the kitchenware market, Ningbo FOTILE Kitchen Ware Co., Ltd. has become the leading brand in range hood manufacturers over ten-year efforts. This essay aims to analyze how enterprise could become the champion of competition aided by strategic selection, through the analysis of the status quo of the kitchenware industry, the history of Ningbo FOTILE Kitchen Ware Co., Ltd., the industry environment analysis on kitchenware industry and the strategic selection of FOTILE. Key Words - Competition, FOTILE, Kitchenware, Strategy As is known to all, human beings cannot survive without four basic necessities of life, namely, food, clothing, shelter and transportation, among which food is given the primary priority. With the ever-improving material living standard, families tend to attach more attention to the living quality, which makes the improvement of living quality a hot topic. This attention catalyzes the rapid development of kitchenware market, as kitchenware is of great importance to deliver delicious cuisines. I. The Status Quo of Kitchenware Industry Kitchen industry has completed a qualitative change stage from rapid growth to gradually mature period since 1980s[1]. In recent years, China’s kitchenware market keeps a momentum of 35% increase, and its annual turnover reaches almost 10 billion RMB. The number of domestic kitchenware manufacturers has increased unprecedentedly to 1000[2]. On one hand, the kitchenware industry faces an idea opportunity for development, on the other hand, with the limitation of technology, production capability and brand influence of kitchenware industry, the industry sinks into a chaotic state due to the uneven distributions of quality among the different products (including range hood, hob, disinfection cabinet, dishwasher, microwave oven cupboard and so on), which inhibits the rapid and healthy development of the industry as a result. In 2006, the overall Chinese household electric appliances amount to 650 billion RMB, mobile phone (24.6%), IT (15.1%), color television (13.9%) duly ranking the top 3. The 4th is occupied by small household electric appliances with preponderance of kitchen appliances, which seizes 11.7% of the total, or 76 billion RMB[3]. Domestic kitchenware industry, especially the rang hood one, has a history of more than twenty years and has went through three phases, from modeling, R&D to maturity, types evolving from under-cabinet hoods, chimney hoods to Island hoods[2]. Different from largescale household electric appliances market, the kitchenware market is almost fully occupied by Chinese brands before 2002. At that time, available foreign brands are mainly oriented to the high-end market, rare and costly[2]. While at the year of 2002, as the purchasing willing of consumers in full set of kitchen appliances surges, the market margin expanses and its lucrative potential lures large international manufacturers such as Electrolux (Switzerland), Simens (Germany) and Panasonnic (Japan), stepping into the Chinese market. Meanwhile, domestic manufacturers such as Haier, Kelon and Midea follow suit, investing heavily on kitchenware industry. Besides, a number of emerging private smalland-medium-sized enterprises take an active part into this market, realizing the prosperous profits and the relatively low requirement for technique and cost of production. Therefore, the domestic kitchenware market is in chaos, with more than 400 manufacturers and nearly 300 brands. However, despite of the chaotic situation, it generates a group of spearheads in respective areas of kitchenware appliances, such as Sacon and Fotile in range hood, Vatti and Guangdong Micro in hobs, Gelanz in microwave oven. In this essay, the discussion is based on case study of FOTILE, to address how to obtain advantageous status and sustainable business development under such a fierce competition with nearly 1000 enterprises to share the kitchenware market margin. II. The History of FOTILE Mao Li-xiang, the funding father of Ningbo FOTILE Kitchen Ware Co., Ltd., embarked on his own business more than twenty years ago. In 1985, when township enterprises started to implement appointment system for factories directors in order to select capable candidates adept at management as chief in charge, a group of audacious township entrepreneurs full of marketpioneering spirit came to the fore. Mao commenced his first enterprise for Cixi wireless Electricity Plant IX, lighting up his career with electric lighter [4] [5]. Mao conceived the idea of turning to another trade triggered by a crisis in 1994. At that year, Feixiang Group, the winner for sixth consecutive years in sales volume worldwide, even confronted by pernicious price war among electric lighter manufacturers, suffering a disastrous loss, Thinking of his talented son, he started his second enterprise together with him, Mao Zhong-qun, as the old Chinese saying going, “Fighting a tiger with dear brother and fighting a war with father increase your chance of triumph”. They cofounded FOTILE Group, the precursor of the FOTILE Kitchen Ware Co., Ltd. renamed in 1996, marching on the range hood industry. Although FOTILE is the last entrant when compared with Vatti and Sacon, it quickly occupies the second place in the market[6]. Since its foundation, FOTILE Kitchen Ware Co., Ltd. has been focused on the R & D and manufacturing into high-end built kitchen appliances and integrated kitchenware, devoting itself to providing people who are craving for superb living standard with kitchen electric appliances leading in design, humanistic in technology and excellent in quality. The high-end integrated kitchen brand “BIRCCI” and professional brand for household water heater system “MIBOI” are the epitomes of FOTILE’s products. Through fifteen years’ efforts, FOTILE has ascended to the No. 1 in domestic high-end kitchen electric appliances market, maintaining its status as No. 1 in the high-end market with the lion’s share (in terms of both the value and volume of its sales). At present, FOTILE has more than 7,000 staff nationwide in FOTILE, with excellent army of designers from home and abroad, those internationally renowned designers mastering the production facility and state-of-the-art technology for Germany and Italy imported high-end kitchen appliances. In 2008, FOTILE relocates itself to FOTILE Binhai Industrial Park (with an area of 400 mu), Hangzhou Bay Area, where FOTILE will continue to spare no effort for its highest mission of “the No. 1 brand in high-end built-in kitchen electric appliances in China”[3]. III. Industry Environment Analysis on Kitchenware Market and FOTILE’s Strategic Selection. Industry structure and competitive strategy are keys to profitability. As Michael Porter points out,the first step in structural analysis is an assessment of the competitive environment in which the company operates—the basic competitive forces and the strength of each in shaping [7] industry structure . So in this part, we will analysis FOTILE’s industry environment and strategic selection. The competitive intensity of an industry is Threat of New Entrants Bargaining Power of Customers Competitive Rivalry within an industry Bargaining Power of Suppliers Threat of Substitute Products Fig.1 Porter’s five forces analysis determined by five basic forces(As shown in figure 1), those forces cooperating with each other to determine the overall industry profitability with enormous influences on all the enterprises in the same industry[8-10]. In essence, the job of the strategist is to understand and cope with competition [11]. In order to deal with these competitive forces properly, strategic-decision makers must penetrate the sources of each force thoroughly. Industry profitability is generally determined by the most competitive force or several, each competitive differing in degree of importance. For instance, a leading enterprise in an industry is prone to be threatened by a competitive new entrant with declining revenue as a result, when there are no other products in higher quality and lower price. In that case, the first priority lies in how to take appropriate measures to address the competitive new entrant. A.Threat of New Entrants Potential entrants can reduce the existing enterprise’ s profit in two ways: First, Entrants will carve up the original market and then share some business; Second, entry minus market concentration so as to arouse competition between the existing enterprise and reduce their profit[12].As it is mentioned above, new entrants are engrossed by the booming kitchenware market need, the average lucrative profits and the relatively low requirement for the technique and cost of production, anticipating a stand and share in the attractive market to bring competitive resources for their sustainable development. Undoubtedly, their entrance will generate a new wave of production energy and accelerate competitiveness, which has the potential to threaten the “spearheads” within the industry. Hence, it is of significance for leading enterprises to avail themselves of their status to fortify the entrance barriers in the industry. FOTILE holds more than three hundred top patent technology with thirty patents for invention, and pays close attention to the accumulation and preservation of knowledge and patent over a long term through more than 5% of total revenue into R&D. According to the statistics provided by National Patent Bureau, FOTILE ranks No.1 in patent application in kitchenware industry, its application amount at more than 100% year-on-year increase. For new entrants, the scale economy generated by the technology, R & D capability and the incessant financial investment is beyond compare. Over a long time, brand-oriented FOTILE has been putting its unique perception of Chinese kitchen and Chinese kitchen culture into its design and R & D, and combining marginal science such as human engineering and aesthetics with technology to create the most suitable kitchen appliance tailored to China’s current kitchenware market. Brand awareness, brand loyalty, and pre-purchase rate all come out first. This high degree of brand recognition erects a high barrier for new entrants to break down at a high cost as entrance fee. Even those entrants with abundant reserves, they are unable to build their brand loyalty in a day. Persisting in independent development, FOTILE is willing to conduct open cooperation, and has been cooperated with first-class enterprises worldwide such as SASAFU, Schott Glaswerke, Microsoft and UFIDA Software. The establishment and management of logistics and distribution system bring huge benefits to sales. Through years of improvement and revolution in management, FOTILE obtains and maintains distinguished competitive advantages, and consolidates further achievement in core competitiveness. From the analysis above, despite the easy access to kitchenware industry and the lowered barriers by low requirements on technology and production cost, FOTILE builds a higher access barrier different from the average of the industry through its competitive advantages by rare, valuable and inimitable strategic resources such as scale economy, brand and reputation, and sales channel. B.Demanding Consumers and Suppliers For members inside an industry, suppliers can improve bargaining power through raising price or lowering purchase volume and service quality, while consumers can beat down the price, demanding higher product and service quality [8]. Generally speaking, enterprises can improve their strategic situation from suppliers or customers who post the minimal impact on them. Most commonly, enterprise has a say for the target of products, that is, for choosing customers. For FOTILE, covering a wide rang of customers with different background, age, cultures, habits and occupations such as gourmet, businessman, scholar, doctor, lawyer, and artist to name a few, all its customers have one thing in common that they have a demanding for superlative life and are perfectionists who love live fervently and think independently. Like its customers, FOTILE advocates Thatcher-way of success: at work, they are supreme leaders; off work, they are people who appreciate the art of cuisine. All these people manage their family life exactly the way they manage their career, as they firmly believe that the true successor must be a master at the balance between work and life. So far, FOTILE focuses itself on high-end kitchen electric appliances, adheres to the idea of first-rate, superb quality and uniqueness in product development with more than 5% of total revenue into prospective R & D, and keeps upgrading products to satisfy the ever-changing customer needs. When confronting demanding customers and lower price by fierce competition, FOTILE’s CEO, Mao Zhongqun, always comments, “The market has its inherent product positioning and price positioning since the very beginning, dividing customers into several corresponding groups. We position FOTILE at the highend; therefore lowering the price equals lowering product positioning.” While encountering international household magnate Simens’ entrance, headed by Sacon, ROMAM and Vatti, most domestic brands choose to lower their price as the countermeasure to drag their customers back. In the short term, this measure could maintain or increase market share a little, while in the long term, it will encroach enterprise’s own profit margin, meanwhile crippling product class and comprehensive competition strength. Through efforts from technology, quality and service improvement, FOTILE preserves and even increases sales price to some degree, and succeeds in maintaining its market share[13]. It is what FOTILE has chosen as strategic selection makes what it is now. Today,although being much more expensive than foreign brands in price, FOTILE still exceeds them in sales; this best testifies FOTILE’s strategic selection. C. Substitute Products Substitute Products or Services (addresses as “Product” below) refers to alternatives through improvement in quality and price to replace their predecessors. They will influence current products and services more or less. Substitute Products usually plunge into the market with a wave of lower price or improved function, when there is aggravated competition impelled by development. FOTILES is quite an expert in this aspect. By conducting elaborate market research and cooperating with Zhejiang University Industrial Design Department, FOTILE succeeds in designing and developing the kitchenware appliance in accordance with Chinese market reality. The first FOTILE artificial intelligent range hood, the first FOTILE automatic gas water heater and the first FOTILE disinfection cabinet combining high ozone technology with high ultraviolet technology are all specified to the features of Chinese kitchen[3]. Therefore, one of the survival strategies in kitchenware industry is product innovation. Making a breakthrough from the current and obsolete products, an enterprise should penetrate new market based on consumer needs, and then rely on product innovation with technology innovation as the core so as to achieve the tremendous transition from manufacturing to creation. Only by the accomplishment of such a transition can an enterprise be able to satisfy the various customer needs through new products and reduce the threat brought by substitutes to the minimum. D.Competitive Rivalry within an industry As above-mentioned, kitchenware market is in such chaos with more than 400 manufactures and nearly 300 brands. The intensity of competitiveness is obvious to all. As we know, the competition to seize advantageous position among current rivalries will compel enterprises take strategies like price competition, new product, and advertising war. Compared with domestic household names such as Vatti and Sacon, FOTILE is the latest entrant in kitchenware market. With Ms. FOTILE’s frequent appearance on the screen, FOTILE’s rang hoods enter into thousands upon thousands families. Relying on product innovation, technology innovation, marketing innovation, management innovation, brand innovation and culture innovation, FOTILE stands out among competitors; on humanized professional kitchen technology, fashionable design, excellent quality and improved service system, it becomes the spokesman of Chinese kitchen culture, advocator of new life style and kitchen expert among consumers. IV. Conclusion This paper takes Ningbo FOTILE Kitchen Ware Co.,Ltd. as an example, introduce the kitchen industry’s industry environment analysis and FOTILE’s strategic choice for the enterprise, in order to analyze how to be big winners in the industry by the strategic choice . In fact, not kitchenware industry alone but all trades have to deal with above-mentioned competitive forces, as they are components of Industrial Organizational economics. The strategic decision makers should design the action plan after taking all these influential competitive forces into serious evaluation, including: positioning the enterprise properly to optimize all the available resources and talents, anticipating the changes in the elements inside all the competitive forces, and making the appropriate strategic action plan, and so on. All in all, if an enterprise wants to establish a foothold in an industry out of cutthroat competition, it has to make it through various ways, neither being easily shattered by the current or new rivalries’ frontal attack, nor being crippled by demanding suppliers, buyers or substitutes[8]. REFERENCES [1]Xiaobing Wang. Small industry move big market: household kitchen forward in adversity (Periodical style). Fujian Quality Management, 2007, 10(15):44-49.(Chinese) [2]Juan Zi. China kitchen industry will be shuffle again (Periodical style). Small and medium-sized enterprise technology, 2005(5): 44-45. (Chinese) [3]Guangyan Zhao. The key to venture successfullyinnovation- Fotile’s way to success (Periodical style). Science and technology information, 2009: 167169. (Chinese) [4]Qiqiang Zhang. “Fotile” always be the kitchen master——the general manager of Fotile Kitchen Ware Co., Ltd., Zhongqun Mao (Periodical style). China Quality, 2003, 10(22): 28-29. (Chinese) [5]ling Chen, Xinchun Li, Chu Xiaoping. The social role of Chinese family business——past, now and future (Book style). Zhejiang University Press, 2011(1): 86- 91.(Chinese) [6]Yuhong Wu, Shisong Li. The war in the kitchen——three kingdoms in the kitchenware market (Periodical style). Advantage, 2005(1):50-51.(Chinese) [7]Porter, Michael E. Industry structure and competitive strategy: keys to profitability (Periodical style). Financial Analysts Journal,1980, 36(4):30-41. [8]Porter,Michael E. How competitive forces shape strategy (Periodical style). Harvard Business Review, 1979, 57(2): 137-145. [9]Porter,Michael E. Competition strategy (Book style). Beijing: Huaxia press, 1997. [10]Jun Miu. The theoretical reflection of five competitive forces model (Periodical style). Business Culture, 2007, 8(30): 228.(Chinese) [11]Porter, Michael E. The five competitive forces that shape strategy (Periodical style). Harvard Business Review,2008(1):2-16. [12]Qingsong Yang, Mingsheng Li. Porter’s five competitive forces model and its added. Journal of changsha railway institute, 2005,6(4): 9596.(Chinese) [13]Ning Cai. Kitchenware: Fotile VS Siemens (Periodical style). China private technology and economy, 2008(5):54-56.(Chinese) [14]Porter, Michael E. What is Strategy (Periodical style)? Harvard Business Review, 1996, 74(6): 61-78. [15]Porter, Michael E. From competitive advantage to corporate strategy (Periodical style). Harvard Business Review, 1987, 65(3):43-59.