Suggested Example Problems – Lecture 1

advertisement

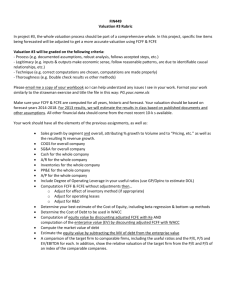

Suggested Example Problems Investment Valuation – Damodaran Lecture 5 – Final Steps in DCF Analysis Lecture 6 – Relative Valuation In Lectures 3 and 4, we discussed measurement and forecasting of earnings and cash flows. In Lecture 5, we will discuss the final steps in DCF valuation. Chapter 16 deals with final adjustments that must be made in order to estimate equity value per share. This discussion includes adjustments for holdings in other firms and for employee stock options. In Chapters 13 through 15, Damodaran provides numerous examples of valuations based on the dividend discount model, the FCFE model, and the FCFF model. While there is little new material here, the chapters and related problems should help to bring the whole valuation process together. Lecture 6 deals with relative valuation. We will start with a basic discussion of multiples and how to interpret them. This discussion is related to chapter 17 in the text and to the McKinsey article on the use of multiples. We will then describe specific multiples in more detail focusing on their definitions, their distributions, and the fundamental characteristics that drive variation in the multiple across firms. Earnings multiples, such as P/E ratios, PEG ratios, and Value/EBITDA ratios are described in chapter 18. Additional book value multiples and revenue multiples are covered in chapters 19 and 20, but we will not have time to cover these chapters. Homework (Turn In): Complete the homework problems on the attached pages and turn in your solutions by the assigned due date. Be prepared to discuss your solutions in class. Additional Suggested Problems (Do Not Turn In): The following suggested problems will give you a basic idea of the topics that I want to emphasize from the text. The solutions to these problems are available on the class web site. Chapter Topic Suggested Problems 16 From Firm Value to Equity Value per Share 1, 2, 6, 8 13 The Dividend Discount Model 1, 2, 3 14 The FCFE Model 1, 4, 7 15 The FCFF Model 1, 3 17 An Overview of Relative Valuation 1, 2, 3, 4 18 Earnings Multiples 6, 7 Homework Assignment - Lecture 5 1. Using a FCFF model based on consolidated financials, you estimate that the present value of operating cash flows for Conglomerate Inc. is $6.25 billion. The firm reports a 70% majority stake in a subsidiary called ABC, which has a market value of $2.5 billion. Conglomerate Inc. has no debt, but reports a liability of $375 million related to the minority interest in ABC. Conglomerate also has excess cash and short-term investments worth $600 million. If Conglomerate Inc. has 200 million shares outstanding, what is your estimate of the equity price per share? 2. The current stock price of Acme Corp. is $79.00 per share. Using a DCF model, you estimate that the total equity value for Acme Corp. is $110 billion. The firm has 1.4 billion shares outstanding. However, the firm also has 145 million outstanding employee stock options with an average exercise price of $62 per share (you can assume all options are vested and in-the-money). The options have a Black-Scholes value of $17.10 each and the firm’s marginal tax rate is 38%. a. What is the estimated equity price per share if you use the Treasury Stock method to incorporate employee stock options? b. What is the estimated equity price per share if you use the Black-Scholes method to incorporate employee stock options? Homework Assignment - Lecture 6 1. Starting from the Gordon Growth Model (the Dividend Discount Model with constant growth), show how the P/E ratio is related to the fundamentals of the firm. 2. Based on your answer to (1), estimate the expected P/E ratio for a firm that has long-term expected growth of 6%, an ROE of 13%, and a cost of equity of 8.5%. If the company has a current P/E ratio of 19.5, would your analysis suggest that the company is over- or under-valued?

![FORM 0-12 [See rule of Schedule III]](http://s2.studylib.net/store/data/016947431_1-7cec8d25909fd4c03ae79ab6cc412f8e-300x300.png)