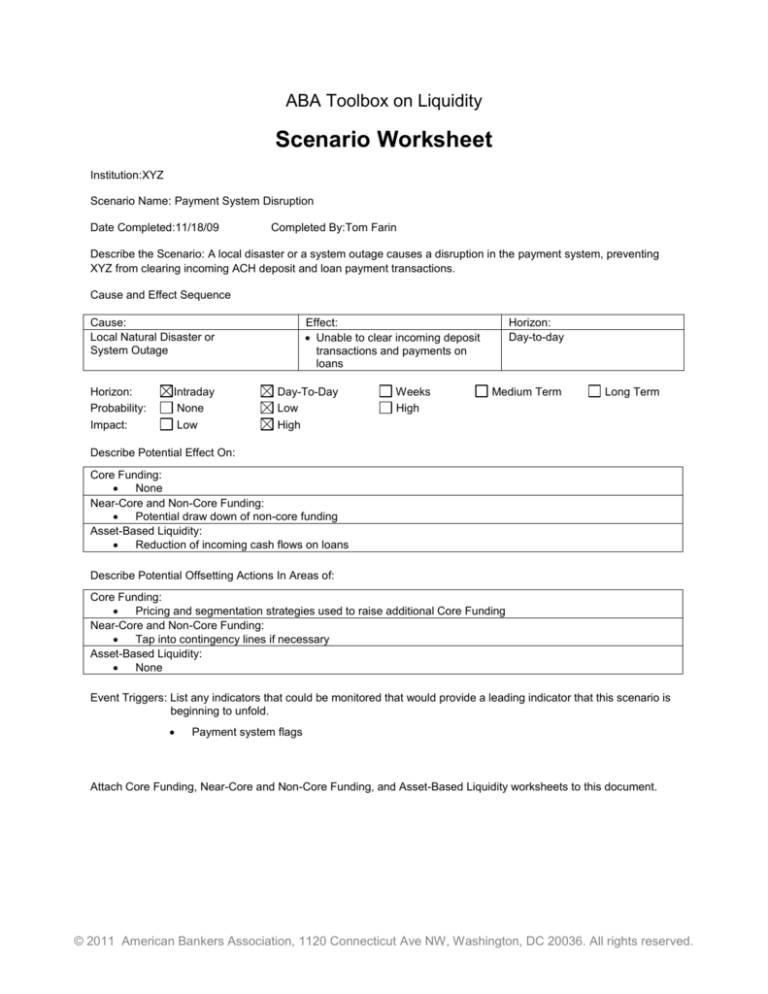

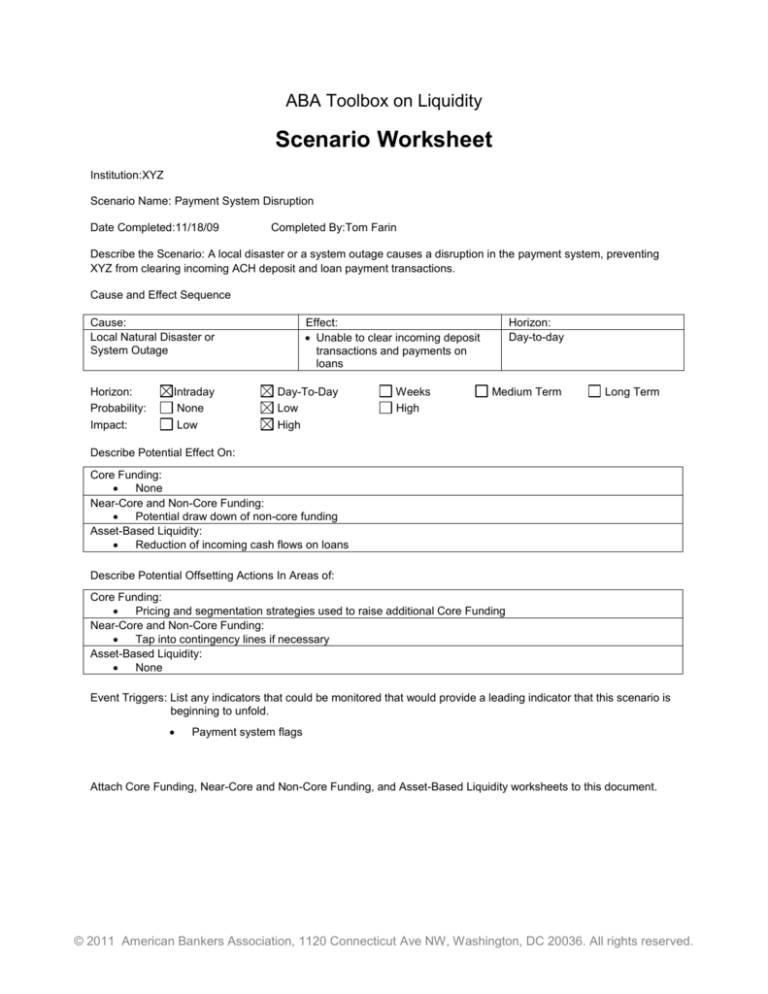

ABA Toolbox on Liquidity

Scenario Worksheet

Institution:XYZ

Scenario Name: Payment System Disruption

Date Completed:11/18/09

Completed By:Tom Farin

Describe the Scenario: A local disaster or a system outage causes a disruption in the payment system, preventing

XYZ from clearing incoming ACH deposit and loan payment transactions.

Cause and Effect Sequence

Cause:

Local Natural Disaster or

System Outage

Horizon:

Probability:

Impact:

Intraday

None

Low

Effect:

Unable to clear incoming deposit

transactions and payments on

loans

Day-To-Day

Low

High

Weeks

High

Horizon:

Day-to-day

Medium Term

Long Term

Describe Potential Effect On:

Core Funding:

None

Near-Core and Non-Core Funding:

Potential draw down of non-core funding

Asset-Based Liquidity:

Reduction of incoming cash flows on loans

Describe Potential Offsetting Actions In Areas of:

Core Funding:

Pricing and segmentation strategies used to raise additional Core Funding

Near-Core and Non-Core Funding:

Tap into contingency lines if necessary

Asset-Based Liquidity:

None

Event Triggers: List any indicators that could be monitored that would provide a leading indicator that this scenario is

beginning to unfold.

Payment system flags

Attach Core Funding, Near-Core and Non-Core Funding, and Asset-Based Liquidity worksheets to this document.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

ABA Toolbox on Liquidity

Scenario Worksheet

Institution:XYZ

Scenario Name:Market Dislocations Scenario

Date Completed:11/18/09

Completed By:Tom Farin

Describe the Scenario:This scenario is a short-term disruption caused by a market dislocation or widening credit

default spreads in the securitization markets. The effect is that XYZ is forced to hold mortgages originated for sale in

the secondary markets in its portfolio, causing unexpected asset growth. Either management action or return of

market stability should prevent this event from cascading into other events.

Cause and Effect Sequence

Cause:

Widening Credit Default spreads on

mortgages

Horizon:

Probability:

Impact:

Intraday

None

Low

Effect:

Unexpected asset growth

Day-To-Day

Low

High

Weeks

High

Horizon:

Days to weeks

Medium Term

Long Term

Describe Potential Effect On:

Core Funding:

None

Near-Core and Non-Core Funding:

Could cause an increase in the use of Non-Core Funding to fund the unexpected growth

Asset-Based Liquidity:

Could cause a reduction in asset-based liquidity to fund the growth

Describe Potential Offsetting Actions In Areas of:

Core Funding:

Pricing and segmentation strategies used to raise additional Core Funding

Near-Core and Non-Core Funding:

Additional contingent funding sources drawn on as limits reached in primary funding sources

Asset-Based Liquidity:

Sale of loans and securities that would normally be held.

Lending curtailed

Shrink wrapping of customer credit lines around current outstandings

Event Triggers: List any indicators that could be monitored that would provide a leading indicator that this scenario is

beginning to unfold.

Widening credit default spreads

Increasing delinquency levels

News stories about financial health of counterparties

Attach Core Funding, Near-Core and Non-Core Funding, and Asset-Based Liquidity worksheets to this document.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

ABA Toolbox on Liquidity

Scenario Worksheet

Institution:XYZ

Scenario Name:Catastrophic Capital Compliance Event

Date Completed:11/18/09

Completed By:Tom Farin

Describe the Scenario:This cascading event scenario focuses on an economic downturn leading to asset quality

problems resulting in XYZ falling below risk-based capital minimums. The liquidity crisis worsens throughout the

scenario.

Cause and Effect Sequence

Cause:

Economic Downturn & Lax Underwriting

Asset-Quality Problem

Loss of Well-Capitalized Status

Adverse Press

Effect:

Asset Quality Problems

Increased Line Utilization

Market Dislocations

Net Operating Losses

Adverse Press

PCA and CAMELS Downgrades

Increased FHLB Haircuts

Loss of Access to Brokered CDs

Adverse Press

PCA and CAMELS Downgrades

Rating Agency Downgrades

Limits on Deposit Offering Rates

Loss of Large Depositors

Loss of Core Funding

Increased Line Utilization

Inability to Raise New Deposit

Funding

Horizon:

6 Months

3 Months

3 Months

3 Months

Horizon:

Probability:

Impact:

Intraday

None

Low

Day-To-Day

Low

High

Weeks

High

Medium Term

Long Term

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

Describe Potential Effect On:

Core Funding:

Some erosion of Core Funding as press makes public aware of financial condition

Limits on deposit rates

Reduced success in raising new funding and renewing existing funding

Near-Core and Non-Core Funding:

Loss of access to brokered CD markets and possibly CDARS

Loss of or increased cost of FHLB advances and other potential forms of collateralized funding

Asset-Based Liquidity:

Market dislocations reduce value of securities and loans pledged as collateral

Prepayments on mortgages and securities slow as customers feel effects of financial stress

Customers increase line utilization to balance cash flow and as a result of concerns over "whether the

money will be available when we need it."

Describe Potential Offsetting Actions In Areas of:

Core Funding:

Pricing and segmentation strategies used to raise additional Core Funding

Near-Core and Non-Core Funding:

Reciprocal deposits used to deliver insurance protection for large CD customers

Asset-Based Liquidity:

Sale of loans and securities that wold normally be held

Lending curtailed

Shrink-wrapping of customer credit lines around current outstandings

Event Triggers: List any indicators that could be monitored that would provide a leading indicator that this scenario is

beginning to unfold.

Negative growth in GDP

Increasing credit default spreads

Increase in delinquencies

Declines in property values

Reduction of target Fed funds rate

Attach Core Funding, Near-Core and Non-Core Funding, and Asset-Based Liquidity worksheets to this document.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

ABA Toolbox on Liquidity

Scenario Worksheet

Institution:XYZ

Scenario Name:Recovery Scenario

Date Completed:11/18/09

Completed By:Tom Farin

Describe the Scenario: This cascading event scenario focuses on an economic recovery, leading to unexpected

asset growth combined with an inability to grow core funding, which could lead to falling below well-capitalized

minimums. While this scenario displays a cause and event sequence, event triggers and management actions can

easily prevent this event from reaching later stages.

Cause and Effect Sequence

Cause:

Economic Recovery

Unexpected asset growth

Capital grows more slowly than loans

XYZ falls below well capitalized

minimums

Adverse Press

Horizon:

Probability:

Impact:

Intraday

None

Low

Effect:

Unexpected asset growth

Inability to raise additional core

funding

Capital grows more slowly than

loans

Loan growth exceeds Core

Funding growth

XYZ falls below well-capitalized

minimums

Increased FHLB haircuts

Loss of access to brokered CDs

Loss of CDARS

Adverse Press

PCA and CAMELS downgrades

Rating agency downgrades

Limits on deposit offering rates

Loss of large depositors

Loss of Core Funding

Increased line utilization

Day-To-Day

Low

High

Weeks

High

Horizon:

6 Months

3 Months

3 Months

3 Months

3 Months

Medium Term

Long Term

Describe Potential Effect On:

Core Funding:

Some erosion of Core Funding as press makes public aware of financial condition

Limits on deposit rates

Reduced success in raising new funding and renewing existing funding

Near-Core and Non-Core Funding:

Loss of access to brokered CD markets and possibly CDARS

Loss of or increased cost of FHLB advances and other potential forms of collateralized funding

Asset-Based Liquidity:

Market dislocations reduce value of securities and loans pledged as collateral

Prepayments on mortgages and securities slow as customers feel effects of financial stress

Customers increase line utilization to balance cash flow and as a result of concerns over "whether the

money will be available when we need it."

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.

Describe Potential Offsetting Actions In Areas of:

Core Funding:

Pricing and segmentation strategies used to raise additional Core Funding

CDARS used to deliver access to deposit insurance for large CD customers

Near-Core and Non-Core Funding:

Additional contingent funding sources drawn on as primary funding sources disappear or become restricted

Asset-Based Liquidity:

Sale of loans and securities that wold normally be held

Lending curtailed

Shrink-wrapping of customer credit lines around current outstandings

Event Triggers: List any indicators that could be monitored that would provide a leading indicator that this scenario is

beginning to unfold.

Rapid increase in GDP

Increase in loan applications

Increase in loan pipeline

Negative core deposit growth

Increases in target fed funds rate

Attach Core Funding, Near-Core and Non-Core Funding, and Asset-Based Liquidity worksheets to this document.

© 2011 American Bankers Association, 1120 Connecticut Ave NW, Washington, DC 20036. All rights reserved.