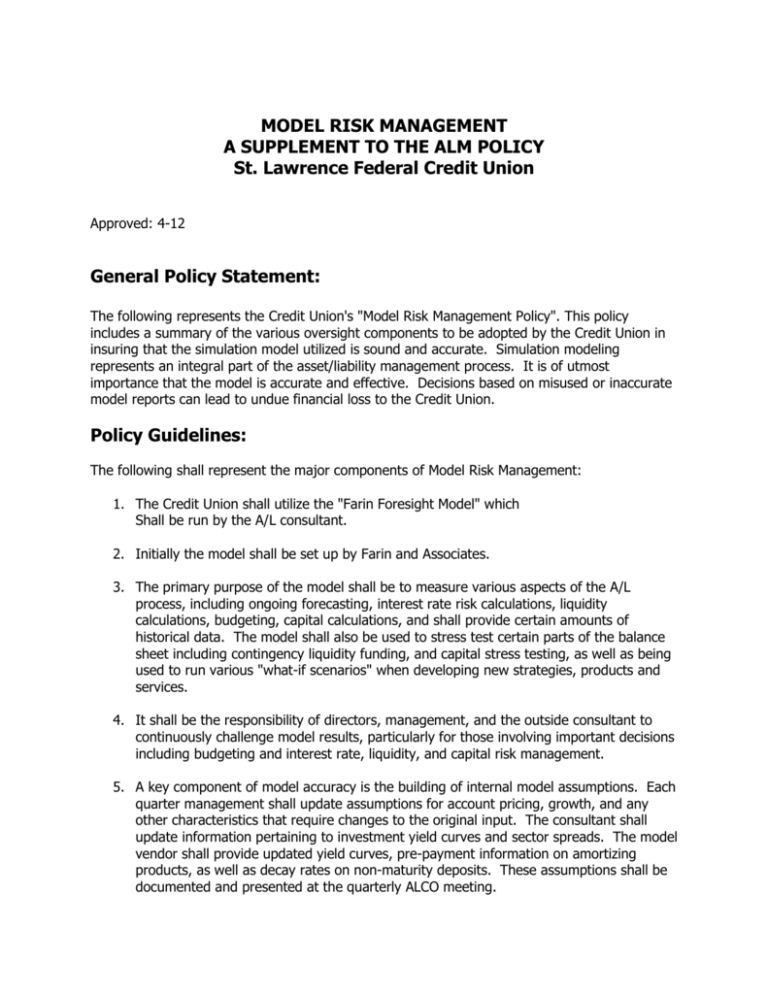

MODEL RISK MANAGEMENT A SUPPLEMENT TO THE ALM

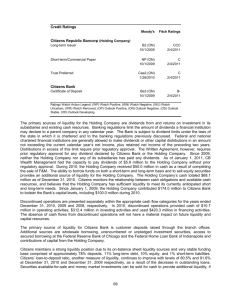

advertisement

MODEL RISK MANAGEMENT A SUPPLEMENT TO THE ALM POLICY St. Lawrence Federal Credit Union Approved: 4-12 General Policy Statement: The following represents the Credit Union's "Model Risk Management Policy". This policy includes a summary of the various oversight components to be adopted by the Credit Union in insuring that the simulation model utilized is sound and accurate. Simulation modeling represents an integral part of the asset/liability management process. It is of utmost importance that the model is accurate and effective. Decisions based on misused or inaccurate model reports can lead to undue financial loss to the Credit Union. Policy Guidelines: The following shall represent the major components of Model Risk Management: 1. The Credit Union shall utilize the "Farin Foresight Model" which Shall be run by the A/L consultant. 2. Initially the model shall be set up by Farin and Associates. 3. The primary purpose of the model shall be to measure various aspects of the A/L process, including ongoing forecasting, interest rate risk calculations, liquidity calculations, budgeting, capital calculations, and shall provide certain amounts of historical data. The model shall also be used to stress test certain parts of the balance sheet including contingency liquidity funding, and capital stress testing, as well as being used to run various "what-if scenarios" when developing new strategies, products and services. 4. It shall be the responsibility of directors, management, and the outside consultant to continuously challenge model results, particularly for those involving important decisions including budgeting and interest rate, liquidity, and capital risk management. 5. A key component of model accuracy is the building of internal model assumptions. Each quarter management shall update assumptions for account pricing, growth, and any other characteristics that require changes to the original input. The consultant shall update information pertaining to investment yield curves and sector spreads. The model vendor shall provide updated yield curves, pre-payment information on amortizing products, as well as decay rates on non-maturity deposits. These assumptions shall be documented and presented at the quarterly ALCO meeting. 6. Each quarter a "Back-Test" Report shall be part of the ALCO agenda, and shall include reviewing actual results over the prior twelve months, compared to initial forecasts, using the net interest income as the primary yardstick. Also on a quarterly basis several specific accounts shall be back-tested to supplement the NIM results. This shall assist management in determining the accuracy of initial model input, particularly as it relates to account assumptions, and shall serve as a tool to assist management in developing more accurate assumptions in future simulation runs. 7. A comprehensive "Model Validation" process shall be established to include various processes intended to verify that the model is performing as expected. Model components to be validated shall include inputs, processing, outputs, and reports. As stated above directors, management, and consultants shall be self-reviewers and shall challenge these aspects to the extent possible, but there shall also be a level of outside review as well. Specifically the model validation process shall include a periodic "Statement of Model Certification" from the vendor, an annual review by the internal audit department, and/or an independent outside company, testing for accuracy and reasonableness, an annual report by management to the board summarizing management's degree of confidence in the accuracy and soundness of the model, and an ongoing system of back-testing as described in # 6 above. Any additional uses of the model above and beyond those defined above shall be reported to the board.