Department of Economics

advertisement

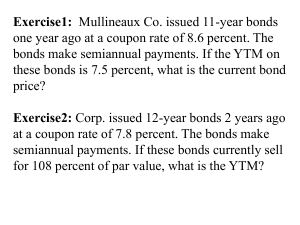

Department of Economics, SUFFOLK UNIVERSITY Jonathan Haughton Fall 2011 ECONOMICS 826: Financial Economics ASSIGNMENT 2 Answers to this assignment are due back by Thursday, September 22 Please feel free to work together on the assignment, in groups of not more than three, if you so wish. 1. A useful free source of information on bonds is http://finance.yahoo.com/bonds . You can find bonds for a company (e.g. Ford Motor) or state (e.g. Massachusetts) or city (e.g. Boston) in the “Bond Lookup” space on the left, and you will get a listing of applicable bonds. a. Construct a yield curve for Ford Motor bonds. Include at least 10 points. b. Construct a yield curve for Massachusetts general obligation (“GO”) bonds. You should be able to find five points to graph. c. Why is the yield curve for Ford Motor higher than that of Massachusetts? d. Here is the Morningstar site with information on General Electric bonds. Why is the yield curve so uneven? http://quicktake.morningstar.com/stocknet/bonds.aspx?symbol=ge 2. The Scribe Paper Company’s $1,000 bonds pay a coupon rate of 8% in a single annual payment, and mature in 20 years. The current market price is $1,050. Compute a. the yield to maturity, and b. current yield. [Note: you should try to program the computation of YTM in Excel, at least once! Excel also has a yield() function that should allow you to check your calculations!] 3. Compute the Macaulay duration of a bond that has a face value of $1,000, a 7% annual coupon rate, and a YTM of 10% for the cases where there are 2, 4, 6, 8, 10, 15, and 20 years to maturity. Graph the results (i.e. with duration on the vertical axis, and years to maturity on the horizontal axis). Also, calculate the modified duration for this bond if there are 4 years to maturity. 4. A year ago you bought a newly-issued 30-year U.S. Treasury bond; at the time the yield curve was flat at a rate of 4% per year. Today the yield curve is flat at a rate of 5% per year. What rate of return did you earn on your initial investment: a. if the bond was a 4% coupon bond? b. if the bond was a zero-coupon bond? 5. A life insurance company has to pay out $73,121.56 in 7 years. Show that this liability will be immunized with $40,000 of 9% coupon par value bonds with a 10 year maturity, even if the interest rates were to change immediately to (a) 8% (b) 10%, or (c) stay at 9%. [Suggestion: Set up the calculation on a spreadsheet. The immunization should be close – within $50 – even if it is not perfect.] 6. You recently bought a car and now have to make payments of $449 per month for the next 4 years. If the rate of interest is 6% p.a., what is the duration of the loan? Page 1 of 2 7. You are managing a portfolio of $30 million, and have a target duration of 12 years. You can choose from two zero-coupon bonds, one with 5 years to maturity, and the other with 20years to maturity. What percent of your portfolio should be allocated to each? Both bonds yield 10%. [Hint: You might find it useful to use the Excel Solver for this one.] 8. In the dividend discount model of stock valuation, when we assume a constant growth rate of 𝐷 dividends of g, and a risk-adjusted cost of capital of k, we asserted in class that 𝑃0 = 1 . Show how 𝑘−𝑔 this follows from our initial premise that 𝑃0 = 𝐷1 +𝑃1 1+𝑘 . 9. You observe the following prices for zero-coupon bonds that have no default risk: Maturity 1 year 2 years Price per $1 of par value 0.97 0.90 YTM 3.093% Given this information, a. What should be the price of a 2-year coupon bond that pays an 8% coupon rate (assuming that the coupon payments are made once a year starting one year from now)? b. Fill in the missing entry in the table. c. What should be the YTM of the 2-year coupon bond in a.? d. Why are the answers to parts b. and c. of this question different? 10. What is the current yield on a five-year 6% coupon bond priced to yield 8%? Assuming annual compounding. 11. You would like to create a two-year synthetic zero-coupon bond. Assume the following: 1-year zerocoupon bonds are trading for $0.93 per dollar of face value, and 2-year 7% coupon bonds (annual payments) are selling at $985.30 (face value ($1,000). a. What are the two cash flows from the 2-year coupon bond? [This is simple!] b. Assume you can purchase the 2-year coupon bond and unbundle the two cash flows and sell them. i. How much will you receive from the sale of the first payment? ii. How much do you need to receive from the sale of the 2-year Treasury strip to break even? 12. The yield curve on dollar bonds free of default risk is flat at 6% per year. A 2-year 10% coupon bond (annual coupons, $1,000 face value) issued by SureFire Corporation is rated B, and is currently trading at a market price of $918. Other than the risk of default, the SureFire bond has no other financially significant features. How much should an investor be willing to pay for a guarantee against SureFire defaulting on this bond? 13. The yield curve on bonds that are free of default risk is flat at 5% per year. A 20-year default-free coupon bond (annual coupons, $1,000 face value, 5.5% coupon rate) becomes callable (at par) after 10 years of trading. a. What is the implied value of the call provision? b. A SureFire Corporation bond that is otherwise identical to the callable 5.5%-coupon bond described in a. is also convertible into 10 shares of SureFire stock at any time up to the bond’s maturity. If its yield to maturity is currently 3.5% per year, what is the implied value of the conversion feature? Page 2 of 2