Chapter 15

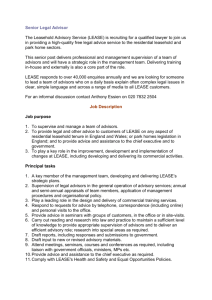

advertisement

Leases Chapter 15 Leases LEARNING OBJECTIVES After studying this chapter, you should be able to: LO15-1 Identify and describe the operational, financial, and tax objectives that motivate leasing. LO15-2 Explain why some leases constitute rental agreements and some represent purchases/sales accompanied by debt financing. LO15-3 Explain the basis for each of the criteria and conditions used to classify leases LO15-4 Record all transactions associated with operating leases by both the lessor and lessee. LO15-5 Describe and demonstrate how both the lessee and lessor account for a capital lease. LO15-6 Describe and demonstrate how the lessor accounts for a sales-type lease. LO15-7 Describe the way a bargain purchase option affects lease accounting. LO15-8 Explain how lease accounting is affected by the residual value of a leased asset. LO15-9 Explain the impact on lease accounting of executor costs, the discount rate, initial direct costs, and contingent rentals. LO15-10 Explain sale-leaseback agreements and other special leasing arrangements and their accounting treatment. LO15-11 Explain sale-leaseback agreements and their accounting treatment. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-1 Leases CHAPTER HIGHLIGHTS PART A: ACCOUNTING BY THE LESSOR AND LESSEE For accounting purposes, we classify leases as follows: LESSEE 1. Operating lease 2. Capital lease LESSOR 1. Operating lease 2. a. Direct financing lease b. Sales-type lease Advantages of Leasing Companies use leasing for a variety of business reasons. These include using leases as a means of “off-balance-sheet financing” as well as to achieve various operational and tax objectives. Lease Classification Consistent with the concept of substance over form we account for a lease as either a rental agreement or a purchase/sale accompanied by debt financing. The objective is to “see through” the legal form of the agreement to determine its economic substance and account for it that way. Lessee A lessee classifies a lease transaction as a capital lease if it is noncancelable and if one or more of four classification criteria is met. Otherwise, it is an operating lease. The criteria are: 1. The agreement specifies that ownership of the asset transfers to the lessee. 2. The agreement contains a bargain purchase option. 3. The noncancelable lease term is equal to 75% or more of the expected economic life of the asset. 4. The present value of the minimum lease payments is equal to or greater than 90% of the fair value of the asset. Lessor A lessor records a lease as either a direct financing lease or a sales-type lease if one of the four classification criteria is met as well as two additional conditions relating to revenue realization: 1. The collectibility of the lease payments must be reasonably predictable. 2. If any costs to the lessor have yet to be incurred, they are reasonably predictable. (i.e., performance by the lessor is substantially complete.) Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-2 Leases Operating Lease In an operating lease, the lessor does not record a “sale”; the lessee does not record a “purchase.” Rather, both parties to the transaction simply record the periodic rental payments as rent: rent revenue by the lessor, rent expense by the lessee. The assumption is that the fundamental rights and responsibilities of ownership are not transferred but retained by the lessor. The lessee is only using the asset temporarily. Most advance payments are considered prepayments of rent that are deferred and allocated to rent over the lease term. An exception is a refundable security deposit, which is recorded as a long-term receivable (by the lessee) and liability (by the lessor) unless it is not expected to be returned. Another exception is the prepayment of the last period’s rent, which is recorded as prepaid rent and allocated to rent expense/rent revenue during the last period of the lease term. The cost of a leasehold improvement is depreciated (or amortized) over its useful life to the lessee. Illustration On January 1, 2013, Cardinal Brands, Inc. leased a computer from Ace Business Equipment. The lease agreement specifies eight quarterly payments of $4,000 beginning March 1, 2013. The useful life of the computer is estimated to be four years. The agreement also specified an advance payment of $8,000 at the inception of the lease. With the permission of Ace, Cardinal Brands purchased and permanently installed additional random access memory to the computer at a cost of $2,000. January 1, 2013 Prepaid rent (advance payment) ...................................................... Cash ....................................................................................... Leasehold improvement ............................................................ Cash ....................................................................................... March 1, 2013 Rent expense (quarterly rent payment) ............................................. Cash ....................................................................................... 8,000 8,000 2,000 2,000 4,000 4,000 Rent expense (advance payment allocation) ...................................... Prepaid rent ($8,000 ÷ 8)........................................................... 1,000 Depreciation expense (advance payment allocation) ......................... Accumulated depreciation ($2,000 ÷ 8) .................................... 250 Student Study Guide 1,000 250 © The McGraw-Hill Companies, Inc., 2013 15-3 Leases Capital Lease – Lessee A capital lease is recorded by the lessee as a capital lease. In a capital lease the lessee records both an asset and a liability as if an asset were being purchased and paid for with periodic installment payments. Both a leased asset and a lease liability are recorded at the present value of the minimum lease payments. The discount rate used in the present value computation is the lower of (a) the lessee's incremental borrowing rate and (b) the implicit rate used by the lessor (if known by the lessee) in determining the amount of the periodic payments. Each lease payment after the inception of the lease includes (a) interest on the lease obligation and (b) a partial reduction of the obligation. As with any other liability, interest expense is recorded at the effective interest rate. Because the lessee is presumed to have purchased the asset, the lessee normally depreciates the leased asset over the lease term. However, if ownership transfers or a bargain purchase option is present (ownership is expected to transfer) the lessee normally depreciates the leased asset over the asset's useful life. Either way, it’s the useful life to the lessee. Direct Financing Lease – Lessor A capital lease is recorded by the lessor as a direct financing lease or sales-type lease, depending on whether the lease provides the lessor a dealer’s profit (sales-type lease). In a direct financing lease, the lessor should debit a receivable for the present value of the payments to be made. The asset‘s carrying value is removed from the books. The present value of the lease payments and the carrying value of the asset are the same; otherwise, the lease is a sales-type lease. Interest accrues to the lessor at the effective interest rate in a direct financing lease as interest revenue from financing the "purchase" of the asset by the lessee. Illustration Lessor Company leased equipment to Lessee Company on January 1, 2013. Terms of the lease agreement were as follows: Lease term: 6 years; 6 annual rent payments, payable at the beginning of each year. Equipment’s fair value: $143,724. No residual value. Lessor's required rate of return: 10% Lessee's incremental borrowing rate: 10% Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-4 Leases Lessor Company would compute the lease payments as $30,000: $143,724 ÷ 4.79079** lessor’s cost = $30,000 lease payments ** Present value of an annuity due of $1: n=6, i=10% Lessee Company would compute the cost of the equipment as $143,724: $30,000 x 4.79079** lease payments = $143,724 present value ** Present value of an annuity due of $1: n=6, i=10% The journal entries at the inception of the lease are: Lessor Company Lease receivable 143,724 Asset 143,724 Leased asset Lease liability Cash Lease receivable Lease liability Cash 30,000 30,000 Lessee Company 143,724 143,724 30,000 30,000 Note: The first lease payment includes no interest because no time has passed. The journal entries for the second lease payment are: Lessor Company Cash 30,000 Lease receivable 18,628 Interest revenue 11,372* Lessee Company Lease liability (difference) 18,628 Interest expense 11,372* Cash 30,000 * 10% x ($143,724 - 30,000) Depreciation expense ($143,724 ÷ 6) Leased property Student Study Guide 23,954 23,954 © The McGraw-Hill Companies, Inc., 2013 15-5 Leases Each period the interest is 10% of the outstanding balance. An amortization schedule reflecting effective interest can help track the changing amounts: Payment Cash Effective interest effective rate x balance Change in Balance Outstanding Balance 30,000 18,628 20,490 143,724 113,724 95,096 74,606 22,539 24,793 27,274 52,067 27,274 0 10% 1 2 3 30,000 30,000 30,000 .10 (113,724) = .10 (95,096) = 4 5 6 30,000 30,000 30,000 .10 (74,606) = .10 (52,067) = .10 (27,274) = 180,000 0 11,372 9,510 7,461 5,207 2,726* 36,276 143,724 * rounded Sales-Type Lease – Lessor A sales-type lease is different from a direct financing lease in only one respect. In a sales-type lease, the lessor receives a manufacturer’s or dealer's profit on the “sale” of the asset in addition to the interest revenue earned over the lease term from financing the asset. The additional profit exists when the present value of the lease payments (the "sales price") exceeds the cost or carrying value of the asset "sold." A sales-type lease often occurs when a manufacturer or dealer uses leasing as a means of "selling" its product, rather than a leasing company serving as a lessor to finance the purchase of an asset by the lessee. Accounting for a sales-type lease is precisely the same as for a direct financing lease except for recognizing the manufacturer's or dealer's profit at the inception of the sales-type lease. The profit is recorded, not as a single amount, but by recording both the sales revenue (the "sales price") and cost of goods sold (cost, that is, carrying value). Gross profit is the difference between sales revenue and cost of goods sold. We can modify the previous illustration to assume Lessee Company leased the equipment directly from the manufacturer. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-6 Leases Illustration Manufacturing Company leased equipment to Lessee Company on January 1, 2013. Terms of the lease agreement were as follows: Lease term: 6 years; 6 annual rent payments, payable at the beginning of each year. Equipment’s fair value: $143,724. No residual value. Lessor's required rate of return: 10% Lessee's incremental borrowing rate: 10% Manufacturing Company’s cost to produce the equipment: $100,000. Sales-type lease? "Selling price" Lessor's cost Lessor's profit $143,724 –100,000 $ 43,724 Yes Manufacturing Company’s journal entries at the inception of the lease are: Lease receivable (present value of payments: $30,000 x 4.79079)........................ Cost of goods sold (cost to lessor) ................................................................. Sales revenue (present value of payments: $30,000 x 4.79079)........................ Asset (cost to lessor) ................................................................................ 143,724 100,000 Cash ........................................................................................................... Lease receivable .................................................................................... 30,000 143,724 100,000 30,000 All entries other than the entry at the inception of the lease are the same for a sales-type lease and a direct financing lease. The amortization schedule is unaffected. The lessee’s accounting is not affected by how the lessor classifies the lease. All lessee entries are precisely the same as in the previous illustration of a direct financing lease. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-7 Leases PART B: RESIDUAL VALUE AND BARGAIN PURCHASE OPTIONS Residual Value A residual value for leased property is an estimate of what the asset’s commercial value will be at the end of the lease term. If the lessee obtains title, the lessor’s computation of rental payments is unaffected by any residual value. On the other hand, if the lessor retains title, the amount to be recovered through periodic lease payments is reduced by the present value of the residual amount. For instance, if a leased asset has an estimated residual value of $50,000 at the end of a four-year lease, the lessor’s cost (investment in the lease) is reduced by the present value of $50,000 to determine the amount that must be recovered from the lessee through periodic lease payments. If the asset’s cost were $400,000, a lessor requiring a 10% rate of return on assets it finances would calculate annual lease payments due at the beginning of the year as follows: $400,000 (34,150) $365,850 ÷ 3.48685 $104,923 Lessor’s investment to be recovered Residual value ($50,000 x .68301 [PV of $1, n=4, i=10%] ) Amount to be recovered through periodic lease payments Present value of a $1 annuity due, n=4, i=10% Annual lease payments Sometimes a lease agreement includes a guarantee by the lessee that the asset will have a specified residual value when custody of the asset reverts back to the lessor at the end of the lease term. A lessee-guaranteed residual value is considered by the lessee to be equivalent to an additional payment and thus is included in the calculation of the cost of the asset. In the example above, the lessee would calculate the amount to record as a leased asset and lease liability as: $104,923 x 3.48685 $365,850 34,150 $400,000 Annual lease payments Present value of a $1 annuity due, n=4, i=10% Present value of periodic lease payments Present value of residual value ($50,000 x .68301 [PV of $1, n=4, i=10%] ) Leased asset and lease liability On the other hand, if the lessee does not guarantee the residual value, the lessee’s cost would simply be $365,850, the present value of periodic lease payments. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-8 Leases Bargain Purchase Option A bargain purchase option (BPO) is included as a component of minimum lease payments for both the lessor and the lessee. Therefore, it’s included in the calculations of both parties in precisely the same way as a lessee-guaranteed residual value. The lease term effectively ends when the BPO is exercisable. PART C: OTHER LEASE ACCOUNTING ISSUES Executory Costs A responsibility of ownership that is transferred to the lessee in a capital lease is the responsibility to pay for maintenance, insurance, taxes, and any other costs usually associated with ownership. These costs are referred to as executory costs. The lessee simply expenses executory costs as incurred. As an expediency, sometimes a lease contract will specify that the lessor pays executory costs, but that the lessee will reimburse the lessor through higher rental payments. When rental payments are inflated for this reason, any portion of rental payments that represents executory costs is not considered part of minimum lease payments. They still are expensed by the lessee, even though paid through the lessor. Initial Direct Costs Any costs incurred by the lessor that are associated directly with originating a lease and are essential to acquire that lease are called initial direct costs. These costs include legal fees, commissions, evaluating the prospective lessee's financial condition, and preparing and processing lease documents. The method of accounting for initial direct costs depends on the nature of the lease. For operating leases, initial direct costs are recorded as assets and amortized over the term of the lease. For direct financing leases, interest revenue is earned over the lease term, so initial direct costs are matched with the interest revenues they help generate. For sales-type leases, initial direct costs are expensed at the inception of the lease. Lease Disclosures Financial statement disclosures in connection with leases include (a) a “general description” of the leasing arrangement as well as (b) minimum future payments, in the aggregate, and for each of the five succeeding fiscal years. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-9 Leases Decision-Makers’ Perspective: Financial Statement Impact Lease liabilities can affect the debt equity ratio as well as the rate of return on assets. Operating leases, too, represent long-term commitments that can become a problem if business declines and cash inflows drop off. The net income difference between treating a lease as a capital lease as opposed to an operating lease ordinarily is not significant, but the impact on the balance sheet between capital leases and operating leases is significant. Lease payments (operating or capital) are reported on a statement of cash flows as financing activities by the lessee and investing activities by the lessor. The primary difference between operating and capital leases is that the lease at its inception would be reported as a non-cash investing/financing activity if treated as capital, but not reported at all if treated as an operating lease. PART D: SPECIAL LEASING ARRANGEMENTS Sale-Leaseback Arrangement In a sale-leaseback transaction the owner of an asset sells it and immediately leases it back from the new owner. A gain on the sale of an asset in a sale-leaseback arrangement is deferred and amortized over the lease term (or asset life if title is expected to transfer to the lessee). The lease portion of the transaction is evaluated and accounted for like any lease. Real Estate Leases Real estate leases involve land. Because land has an unlimited life only the first (title transfers) and second (BPO) classification criteria apply in a land lease. If the leased property includes both land and a building, neither of the first two criteria is met, and the fair value of the land is 25% or more of the combined fair value, then both the lessee and the lessor treat the land as an operating lease and the building as any other lease. The usual lease accounting treatment applies to leases that involve only part of a building even though some extra effort may be needed to arrive at reasonable estimates of cost and fair value. Leveraged Leases A leveraged lease involves significant long-term, nonrecourse financing by a third party creditor. The lessee accounts for a leveraged lease the same way as a nonleveraged lease. However, the lessor records its investment (receivable) net of the nonrecourse debt and reports income from the lease only in those years when the receivable exceeds the liability. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-10 Leases International Financial Reporting Standards Lease accounting under U.S. GAAP and IFRS provides a good general comparison of “rules-based accounting” as U.S. GAAP often is described and “principles-based accounting” which often is the description assigned to IFRS. Four classification criteria are used under U.S. GAAP to determine whether a lease is a capital lease. However, using IFRS, no such bright-line rules exist. Instead, a lease is deemed a capital lease (called a finance lease under IFRS), if substantially all risks and rewards of ownership are judged to have been transferred. Professional judgment relies on a number of “indicators” including some similar to the specific criteria of U.S. GAAP. Using IFRS, both parties to a lease generally use the rate implicit in the lease to discount minimum lease payments. Under U.S. GAAP, lessors use the implicit rate, and lessees use the incremental borrowing rate unless the implicit rate is known and is the lower rate. In a sale-leaseback transaction, when the leaseback is an operating lease (as long as the lease payments and sales price are at fair value), under IFRS, any gain on the sale is recognized immediately but is amortized over the lease term using U.S. GAAP. Under IFRS, land and buildings elements in a lease transaction are considered separately unless the land element is not material. This often results in classification of the land component as an operating lease. Under U.S. GAAP, land and building elements generally are accounted for as a single unit, unless land represents more than 25% of the total fair value of the leased property. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-11 Leases ADDENDUM: WHERE WE’RE HEADED Right-of-Use Model The right to use leased property can be a significant asset. Likewise, the obligation to make the lease payments can be a significant liability. Under the new Accounting Standards Update (ASU) the lessee reports both the right-of-use asset and the corresponding liability in the balance sheet. The concept of operating leases is eliminated. On the other side of the transaction, the lessor reports a receivable for the lease payments it will receive and removes from its records (derecognizes) the asset (or portion thereof) for which it has given up the right of use. We no longer employ the concept of direct financing and sales-type leases. Illustration Lessor buys a machine from its manufacturer at its fair value of $100,000 and leases it to Lessee for lease payments whose present value is $10,000. Lessee Right-of-use asset (present value of lease payments) ..... Lease liability (present value of lease payments) . Lessor Lease receivable (present value of lease payments) ...... Asset (carrying amount of asset being leased) ......... 10,000 100,000 10,000 100,000 Residual Asset If the lease receivable represents only a portion of the total fair value of the asset, the lessor also records a “residual asset” for the portion related to the right of use not transferred to the lessee: Illustration LeaseCo buys a machine from its manufacturer at its fair value of $10,000 and leases it to UserCorp for lease payments whose present value is $3,000. Lessee Right-of-use asset (present value of lease payments) ..... Lease liability (present value of lease payments) . Student Study Guide 3,000 3,000 © The McGraw-Hill Companies, Inc., 2013 15-12 Leases Only a portion of the right to use the asset is transferred. So, a portion is being retained. The portion transferred is: $3,000 / $10,000 x $10,000 = $3,000. Thus, the portion retained (residual asset) is the remainder: $10,000 – 3,000 = $7,000. Lessor Lease receivable (present value of lease payments) ...... Residual asset (carrying amount of portion retained) ....... Asset (carrying amount of asset being leased) ......... 3,000 7,000 10,000 When the Lessor Earns a Profit from the Lease The lessor earns an immediate profit from the lease transaction in addition to the interest revenue earned over the term of the lease if the present value of the lease payments exceeds the carrying amount of the asset transferred. Usually, the lessor in this type of transaction is a manufacturer or a merchandiser that is using the lease as a means of “selling” its product. Illustration Maker manufactures a machine at a cost of $6,000 with a retail selling price (fair value) $10,000. Maker leases the machine to Lessee under an agreement in which the present value of the lease payments is $10,000. So, just like selling the asset for $10,000 cash, Maker generates a profit of $4,000: Lessor Lease receivable (PV of lease payments) .................... Asset (carrying amount of asset being leased) ....... Profit (difference1 between the PV of lease payments and the carrying amount of asset) ...................... 10,000 6,000 4,000 1 In the rare instance that this is a debit difference, we would have a loss rather than profit. Companies might choose to separate this profit into its two components: Sales revenue and cost of goods sold, which is the gross method demonstrated for “sales-type” leases in the main chapter. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-13 Leases When the Lessor Earns a Profit and Retains a Residual Asset Sometimes the lessee retains a “residual asset” and at the same time earns a profit on the lease: Illustration Maker manufactures a machine at a cost of $6,000 with a retail selling price (fair value) of $10,000. Maker leases the machine to Lessee under an agreement in which the present value of the lease payments is $8,000. Because Maker is not receiving the full value of the machine, only a portion of the right to use the asset is being transferred. The portion transferred is: $8,000 / $10,000 x $6,000 = $4,800. And, the portion retained (residual asset) is the remainder: $6,000 – 4,800 = $1,200. Lease receivable (PV of lease payments)....................... Residual asset (carrying amount of portion retained) ......... Asset (carrying amount of asset being leased) ....... Profit ($8,000 – 4,800) ...................................... 8,000 1,200 6,000 3,200 Amortization of the Right-of-Use Asset (Lessee) The lessee amortizes its right-of-use asset the lease term. As with other long-term assets, its cost is allocated to the periods it benefits. Amortization expense (PV of payments ÷ yrs of lease term) Right-of-use asset.................................................... xxx xxx Accretion of the Residual Asset (Lessor) The residual asset represents the present value of the underlying asset not transferred to the lessee. We “accrete” the residual asset from its initial balance to the fair value we expect it to have at the end of the lease term. The process of increasing the asset’s balance is called accretion. At the end of each year of the lease term, the lessor records accretion of the residual asset using the interest rate implicit in the agreement. Because the asset increases with the passage of time, the lessor records Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-14 Leases revenue from accretion. Residual asset ............................................................... Revenue from accretion (interest rate x outstanding balance) xxx xxx The lessor recovers its investment from two sources: (a) payments for the portion of the carrying value transferred and (b) obtaining the residual asset at the end of the lease term. Its revenue is (a) the interest revenue from financing the portion transferred and (b) the revenue from accretion of its residual asset not transferred, both at the interest rate implicit in the lease. Thus, the lessor earns the same rate of return on both the portion of its asset transferred and the portion retained as a residual asset. If there is profit at the commencement of the lease in addition to a residual asset, the present value of the underlying asset not transferred to the lessee is higher than its carrying value on the books of the lessor. We still “accrete” the residual asset from its initial balance (present value) to the fair value we expect it to have at the end of the lease term. But in addition, we also record the profit on the portion of the asset not transferred. Residual asset ............................................................... xxx Deferred profit (PV of the asset not transferred minus its carrying value) xxx That amount is deferred during the lease term and included in earnings only when the asset is sold or re-leased. Initial Direct Costs Costs associated directly with originating a lease and that would not have been incurred had the lease agreement not occurred are called initial direct costs. They include legal fees, commissions, evaluating the prospective lessee’s financial condition, and preparing and processing lease documents. Initial direct costs are simply added to the carrying amount of the right-of-use asset if incurred by the lessee or to the lease receivable if incurred by the lessor. What if the Lease Term is Uncertain? Sometimes the lease term be renewed at the option of the lessee or maybe either party can terminate the lease after a certain number of years. The lease term for both the lessee and the lessor is the contractual lease term modified by any renewal or termination options for which there is a “significant economic incentive” to exercise the options. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-15 Leases What if the Lease Payments are Uncertain? Sometimes lease payments are to be increased (or decreased) at some future time during the lease term, depending on whether or not some specified event occurs. If future lease payments are uncertain, we consider them as part of the lease payments only if they are “reasonably assured.” Guaranteed Residual Value Sometimes a lease agreement includes a guarantee by the lessee that the lessor will recover a specified residual value when custody of the asset reverts back to the lessor at the end of the lease term. This not only reduces the lessor’s risk but also provides incentive for the lessee to exercise a higher degree of care in maintaining the leased asset to preserve the residual value. The lessee promises to return not only the property but also sufficient cash to provide the lessor with a minimum combined value. A cash payment predicted under a lessee-guaranteed residual value is treated the same as a lease payment. That is, the present value of that payment is added to the present value of the lease payments the lessee records as both a right-of-use asset and a lease liability. Similarly, it also adds to the amount that the lessor records as a lease receivable. Purchase Options A purchase option gives the lessee the option of purchasing the leased property during, or at the end of, the lease term at a specified exercise price. We consider the exercise price to be an additional cash payment (just like a cash payment predicted under a lessee-guaranteed residual value), which will increase both the lessee’s lease payable and the lessor’s lease receivable, if the lessee has a "significant economic incentive" to exercise the purchase option. Short-Term Leases – A Short-Cut Method A lease that has a maximum possible lease term (including any options to renew or extend) of twelve months or less is considered a “short-term lease.” In a short-term lease, the lessee and lessor can elect not to record the lease at its commencement and instead simply record lease payments as expense and revenue. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-16 Leases SELF-STUDY QUESTIONS AND EXERCISES Concept Review 1. leases are agreements that are formulated outwardly as leases, but that are in reality installment purchases. 2. Periodic interest expense is calculated by the lessee as the interest rate times the amount of the outstanding lease liability during the period. The approach is the same regardless of the specific form of the debt – that is, whether in the form of notes, bonds, leases, pensions, or other debt instruments. 3. Conceptually, leases and 4. One criterion for a lease to classify as a capital lease is that the agreement specifies that of the asset transfers to the lessee. 5. One criterion for a lease to classify as a capital lease is that the agreement contains a option. 6. One criterion for a lease to classify as a capital lease is that the lease term is equal to or more of the expected economic life of the asset. 7. One criterion for a lease to classify as a capital lease is that the present value of the minimum lease payments is equal to or greater than of the fair value of the leased asset. 8. A bargain purchase option is a provision in the lease contract that gives the lessee the option of purchasing the leased property at a bargain price, defined as price sufficiently lower than the ________________ of the property when the option becomes exercisable that the exercise of the option appears reasonably assured. 9. A lessor’s cost. notes are accounted for in precisely the same way. lease exists when the present value of the minimum lease payments exceeds the 10. The minimum lease payments for the lessee should exclude any by the lessee. not guaranteed 11. The minimum lease payments of the includes any residual value not guaranteed by the lessee but guaranteed by a third-party guarantor. 12. Even when minimum lease payments are the same, their present values will differ if the lessee uses a discount rate different from the lessor’s . 13. The way a is included in determining minimum lease payments is precisely the same way that a lessee-guaranteed residual value is included. 14. are costs usually associated with ownership of an asset such as maintenance, insurance, and taxes. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-17 Leases 15. When 16. the lessor’s rate. implicit rate is unknown, the lessee should use its own rentals are not included in minimum lease payments but are reported in disclosure notes by both the lessor and lessee. 17. The costs of negotiating and consummating a completed lease transaction incurred by the lessor that are associated directly with originating a lease and are essential to acquire that lease are referred to as . These include legal fees, evaluating the prospective lessee's financial condition, commissions, and preparing and processing lease documents. 18. In an lease initial direct costs are recorded as prepaid expenses (assets) and amortized as an operating expense (usually straight-line) over the lease term. 19. In a lease initial direct costs are amortized over the lease term, accomplished by offsetting lease receivable by the initial direct costs. 20. In a initial direct costs are expensed in the period of “sale” – that is, at the inception of the lease. 21. In a the gain on the sale of the asset is not immediately recognized, but deferred and recognized over the term of the lease. 22. The FASB specifies exceptions to the general classification criteria for leases that involve ______________ because of its unlimited useful life and the inexhaustibility of its inherent value through use. 23. A creditor. lease involves significant long-term, nonrecourse financing by a third party Addendum Respond to these questions with the presumption that the guidance provided by the new Accounting Standards Update is being applied 24. The right to use a leased asset can provide the lessee with a significant benefit. The lessee reports this benefit as a __________ asset in the balance sheet. 25. If the present value of the lease payments is less than the fair value of the asset being leased, the lessor divides the carrying amount of the asset into two parts, (1) the portion transferred and thus derecognized and (2) the portion retained and thus reclassified as a _____________. 26. Sometimes, the lessor earns an immediate profit from the lease transaction in addition to the interest revenue earned over the term of the lease. This happens when the present value of the lease payments exceeds the __________________ of the asset transferred to the lessee. 27. Sometimes the actual term of a lease is not obvious. We adjust the contractual lease term to include a renewal option if the lessee has a ___________ __________ __________ to exercise the option. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-18 Leases 28. If the amounts of future lease payments are uncertain due to contingencies or otherwise, we consider them as part of the lease payments only if they are ___________ _____________. Answers: 1. Capital 2. effective 3. installment 4. ownership 5. bargain purchase 6. 75% 7. 90% 8. expected fair value 9. sales-type 10. residual value 11. lessor 12. implicit rate 13. BPO 14. Executory costs 15. incremental borrowing 16. Contingent 17. initial direct costs 18. operating 19. direct financing 20. sales-type lease 21. sale-leaseback 22. land 23. leveraged 24. right-of-use 25. residual asset 26. cost or carrying value 27. significant economic incentive 28. reasonably assured Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-19 Leases REVIEW EXERCISES Exercise 1 Electronic Leasing leases business equipment to consumers. On September 30, 2013, the company leased a computer to Transfer Services. The lease agreement specified quarterly payments of $400 beginning September 30, 2013, the inception of the lease, and each quarter (December 31, March 31, and June 30) through June 30, 2015 (two-year lease term). The estimated economic life of the computer is 21/2 years. Electronic Leasing’s quarterly interest rate for determining payments was 3% (approximately 12% annually). Electronic Leasing paid $2,892 for the computer. Required: 1. Calculate the cost of the computer to Transfer Services. [Be careful to note that, although payments occur on the last calendar day of each quarter, since the first payment was at the inception of the lease, payments represent an annuity due.] Round to nearest dollar. Show calculations. 2. Prepare the appropriate entries for Transfer Services on September 30, 2013. Round to nearest dollar. Show calculations. 3. Prepare the appropriate entries for Transfer Services on December 31, 2013. Round to nearest dollar. Show calculations. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-20 Leases Solution: Cost: Present value of quarterly rental payments ($400 x 7.23028**) $2,892 ** Present value of an annuity due of $1: n=8, i=3% (from Table 6) September 30, 2013 Leased asset (present value determined above) ........................................ Lease payable (lessor’s cost) ............................................................. Lease payable (lease payment) ................................................................. Cash (lease payment) ........................................................................ December 31, 2013 Interest expense (3% x [$2,892 - 400]) .................................................... Lease payable (difference) ....................................................................... Cash (lease payment) ........................................................................ Depreciation expense ($2,892 ÷ 8) ........................................................... Accumulated depreciation ................................................................. 2,892 2,892 400 400 75 325 400 362 362 Exercise 2 Refer to the situation described in Exercise 1. 1. Show how Electronic Leasing determined the $400 lease payments. 2. Prepare the appropriate entries for Electronic Leasing on September 30, 2013. Round to nearest dollar. Show calculations. 3. Prepare the appropriate entries for Electronic Leasing on December 31, 2013. Round to nearest dollar. Show calculations. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-21 Leases Solution: Quarterly rental payments : $2,892 ÷ 7.23028** = $400 ** Present value of an annuity due of $1: n=8, i=3% (from Table 6) September 30, 2013 Lease receivable (present value determined above) ................................. Inventory of equipment (lessor’s cost) .............................................. Cash (lease payment)................................................................................ Lease receivable ................................................................................ December 31, 2013 Cash (lease payment)................................................................................ Lease receivable ................................................................................ Interest revenue (3% x [$2,892 - 400]) ............................................. 3,200 2,892 400 400 400 325 75 Exercise 3 Refer to the situation described in Exercise 1. Assume Transfer Services leased the computer directly from CCR Computer Company, which manufactured the computer at a cost of $2,000. 1. Calculate the dealer’s profit to CCR Computer Company. 2. Prepare the appropriate entries for CCR Computer Company on September 30, 2013. Round to nearest dollar. Show calculations. 3. Prepare the appropriate entries for CCR Computer Company on December 31, 2013. Round to nearest dollar. Show calculations. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-22 Leases Solution: Present value of quarterly rental payments ($400 x 7.23028**) $2,892 ** Present value of an annuity due of $1: n=8, i=3% (from Table 6) “Selling price” minus Computer’s cost equals Dealer’s profit $2,892 (2,000) $ 892 September 30, 2013 Lease receivable (calculated above) ......................................................... Cost of goods sold (lessor’s cost) ............................................................. Sales revenue (calculated above) ...................................................... Inventory of equipment (lessor’s cost) .............................................. Cash (lease payment)................................................................................ Lease receivable ................................................................................ December 31, 2013 Cash (lease payment)................................................................................ Lease receivable ................................................................................ Interest revenue (3% x [$2,892 - 400]) ............................................. 2,892 2,000 2,892 2,000 400 400 400 325 75 Exercise 4 Refer to the situation described in Exercises 1 and 2. Assume the computer has a residual value of $500 at the end of the two-year lease, but is not guaranteed by Transfer Services. 1. Calculate the lease payments that will allow Electronic Leasing to recover its $2,892 investment and achieve its desired rate of return. 2. Calculate the cost of the computer to Transfer Services. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-23 Leases Solution: 1. Quarterly rental payments : $2,892 - ($500 x .78941*) $2,497 ÷ = $2,497 * Present value of $1: n=8, i=3% (from Table 6) 7.23028** = $345 ** Present value of an annuity due of $1: n=8, i=3% (from Table 6) 2. Cost: Present value of quarterly rental payments ($345 x 7.23028**) $2,497 ** Present value of an annuity due of $1: n=8, i=3% (from Table 6) Note: Because Transfer Services did not guarantee the residual value, the residual value is not considered a ninth payment in the calculation. Addendum Respond to these questions with the presumption that the guidance provided by the new Accounting Standards Update is being applied Exercise 5 Electronic Leasing leases business equipment to consumers. On September 30, 2013, the company leased a computer to Transfer Services. The lease agreement specified quarterly payments of $400 beginning September 30, 2013, the inception of the lease, and each quarter (December 31, March 31, and June 30) through June 30, 2015 (two-year lease term). The estimated economic life of the computer is 5 years. The estimated residual value of the asset at the end of the two-year lease term is $4,102. Electronic Leasing’s quarterly interest rate for determining payments was 3% (approximately 12% annually). Electronic Leasing paid $6,130 for the computer. Required: 1. Calculate the cost of the computer to Transfer Services. [Be careful to note that, although payments occur on the last calendar day of each quarter, since the first payment was at the inception of the lease, payments represent an annuity due.] Round to nearest dollar. Show calculations. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-24 Leases 2. Prepare the appropriate entries for Transfer Services on September 30, 2013. Round to nearest dollar. Show calculations. 3. Prepare the appropriate entries for Transfer Services on December 31, 2013. Round to nearest dollar. Show calculations. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-25 Leases Solution: Cost: Present value of quarterly rental payments ($400 x 7.23028**) $2,892 ** Present value of an annuity due of $1: n=8, i=3% (from Table 6) September 30, 2013 Right-of-use asset (present value determined above) ............................... Lease payable (present value determined above) .............................. Lease payable (lease payment) ................................................................. Cash (lease payment) ........................................................................ December 31, 2013 Interest expense (3% x [$2,892 - 400]) .................................................... Lease payable (difference) ....................................................................... Cash (lease payment) ........................................................................ Amortization expense ($2,892 ÷ 8) .......................................................... Right-of-use asset .............................................................................. 2,892 2,892 400 400 75 325 400 362 362 Exercise 6 Refer to the situation described in Exercise 5. 1. Show how Electronic Leasing determined the $400 lease payments. 2. Prepare the appropriate entries for Electronic Leasing on September 30, 2013. Round to nearest dollar. Show calculations. 3. Prepare the appropriate entries for Electronic Leasing on December 31, 2013. Round to nearest dollar. Show calculations. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-26 Leases Solution: Quarterly rental payments : Investment in asset Less: Present value of the residual value ($4,102 x .78941*) To be recovered through periodic lease payments (present value) Lease payments at the beginning of each of the next 4 years * present value of $1: n=8, i=3% ** present value of an annuity due of $1: n=8, i=3% $2,892 ÷ 7.23028** = $6,130 (3,238) $2,892 ÷ 7.23028** $ 400 $400 September 30, 2013 Lease receivable (present value determined above) ................................. Residual asset (portion not transferred: $6,130 – [$2,892/$6,130 x $6,130]) .... Inventory of equipment (lessor’s cost) .............................................. Cash (lease payment)................................................................................ Lease receivable ................................................................................ December 31, 2013 Cash (lease payment)................................................................................ Lease receivable ................................................................................ Interest revenue (3% x [$2,892 – 400]) ............................................. Residual asset ........................................................................................... Revenue from accretion (3% x $3,238)............................................. 2,892 3,238 6,130 400 400 400 325 75 97 97 MULTIPLE CHOICE Enter the letter corresponding to the response that best completes each of the following statements or questions. 1. Which of the following leases would least likely be classified as an operating lease by the lessee? a. The lease term is 5 years and the economic life of the leased asset is 8 years. b. Ownership of the leased asset reverts to the lessor at the end of the lease term. c. The agreement permits the lessee to buy the leased asset for one dollar at the end of the lease term. d. The fair value of the leased asset is $20 million and the present value of the lease payments is $13 million. 2. Which of the following is not a sufficient criterion for a lessee to classify a lease as a capital lease? a. The lease transfers ownership of the leased asset to the lessee at the end of the lease term. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-27 Leases b. c. d. The lessee has the option of acquiring the asset during or at the end of the lease term at a bargain price. The lease term is greater than two-thirds of the economic life of the asset. The present value of the minimum lease payments is at least 90% of the fair value of the leased asset. 3. For a lessor to consider a leasing arrangement to be a capital lease, collectibility of the lease payments must be reasonably assured and: a. There must be no bargain purchase option. b. The lessee must be responsible for all executory costs over the term of the lease. c. The lease term must be 75% or more of the economic life of the asset. d. Any costs to the lessor yet to be incurred must be reasonably predictable. 4. In an operating lease in which the asset’s economic life and lease term are different: a. The lessee depreciates the leased asset over the term of the lease. b. The lessor depreciates the leased asset over its economic life. c. The lessee should record a leased asset and a related obligation at the present value of the lease payments. d. The lessee depreciates the asset over its economic life. 5. If a capital lease contains a bargain purchase option, the lessee should depreciate the leased asset: a. Over the term of the lease. b. Without reference to the economic life of the asset. c. Over the economic life of the asset. d. Without reference to the term of the lease. 6. A necessary condition for a sales-type lease is: a. Legal title to the asset transfers to the lessee. b. The present value of minimum lease payments exceeds the lessor’s cost. c. The lessor earns interest revenue instead of dealer's profit. d. The lessor earns dealer's profit instead of interest revenue. 7. The inception of a six-year capital lease is December 31, 2013. The agreement specifies equal annual lease payments on December 31 of each year. For the lessee, the first payment on December 31, 2013, includes: a. b. c. d. Student Study Guide Interest Expense No Yes Yes No Reduction of the Lease Liability Yes No Yes No © The McGraw-Hill Companies, Inc., 2013 15-28 Leases 8. Universal Leasing Corp. leases farm equipment to its customers under direct-financing leases. Typically the equipment has no residual value at the end of leases and the contracts call for payments at the beginning of each year. Universal’s target rate of return is 10%. On a five-year lease of equipment with a fair value of $485,100, Universal will earn interest revenue over the life of the lease of: a. $ 96,575 b. $114,900 c. $121,275 d. $194,040 9. In a ten-year capital lease, the portion of the annual lease payment in the lease’s third year that represents interest is: a. The same as in the fourth year. b. The same as in the first year. c. Less than in the second year. d More than in the second year. 10. On January 1, 2013, Walter Scott Co. leased machinery under a 6-year lease. The machinery has a 9-year economic life. The present value of the monthly lease payments is determined to be 85% of the machinery's fair value. The lease contract includes neither a transfer of title to Scott nor a bargain purchase option. What amount should Scott report in its 2013 income statement? a. Depreciation expense equal to one-ninth of the equipment's fair value. b. Depreciation expense equal to one-sixth of the machinery‘s fair value. c. Rent expense equal to the 2013 lease payments. d. Rent expense equal to the 2013 lease payments minus interest. 11. Pyramid Properties entered a lease that contains a bargain purchase option. When calculating the amount to capitalize as a leased asset at the inception of the lease term, the payment called for by the bargain purchase option should be: a. Subtracted at its exercise price. b. Subtracted at its present value. c. Added at its present value. d. Excluded from the calculation. 12. Tucson Fruits leased farm equipment from Barr Machinery on July 1, 2013. The lease was recorded as a sales-type lease. The present value of the lease payments discounted at 10% was $40.5 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning July 1, 2013. Barr had purchased the equipment for $33 million. What amount of interest revenue from the lease should Barr report in its 2013 income statement? a. $2,025,000 b. $1,725,000 c. $1,650,000 d. $0 Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-29 Leases 13. On January 1, 2013, Jackson Properties leased a warehouse to Jensen Distributors. The operating lease provided for a nonrefundable bonus paid by Jensen. Jackson should recognize the bonus in earnings: a. At the inception of the lease. b. When the bonus is received. c. Over the life of the lease. d. At the expiration of the lease. 14. Grant Industries leased exercise equipment to Silver Gyms on July 1, 2013. Grant recorded the lease as a sales-type lease at $810,000, the present value of minimum lease payments discounted at 10%. The lease called for ten annual lease payments of $120,000 due at the beginning of each year. The first payment was received on July 1, 2013. Grant had manufactured the equipment at a cost of $750,000. The total increase in earnings (pretax) on Grant’s 2013 income statement would be: a. $0 b. $93,000 c. $94,500 d. $100,500 15. Brown Properties entered into a sale-leaseback transaction. Brown retains the right to substantially all of the remaining use of the property. A gain resulting from the sale should be: a. Reported as part of the asset’s cost. b. Offset against losses from similar transactions. c. Deferred at the time of the sale-leaseback and subsequently amortized. d. Recognized in earnings at the time of the sale-leaseback. 16. A lease is a capital lease (called a finance lease under IFRS) if substantially all risks and rewards of ownership are transferred whether using US GAAP or IFRS. When making this determination, less judgment, more specificity is applied using a. U.S. GAAP. b. IFRS. c. Either U.S. GAAP or IFRS. d. Neither U.S. GAAP nor IFRS. 17. When the leaseback in a sale-leaseback transaction is an operating lease, a company that prepares its financial statements using IFRS: a. immediately recognizes the gain on the sale. b. amortizes the gain over the lease term. c. recognizes the gain on the sale immediately only if the asset leased is land. d. does not record the gain. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-30 Leases 18. When recording a capital lease (called a finance lease under IFRS) Blue Company is aware that the implicit interest rate used by the Gray Company, the lessor, to calculate lease payments is 7%. Blue’s incremental borrowing rate is 6%. Blue should record the leased asset and lease liability at the present value of the lease payments discounted at: a. 7% if using IFRS. b. 6% if using IFRS. c. 6% if using either U.S. GAAP or IFRS. d. 7% if using U.S. GAAP. Addendum Respond to these questions with the presumption that the guidance provided by the new Accounting Standards Update is being applied 19. Which of the following would a lessee not record in connection with a lease? a. Accretion revenue. b. Amortization expense. c. Interest expense. d. Right-of-use asset. 20. Which of the following would a lessor not record in connection with a lease? a. Accretion revenue. b. Residual asset. c. Interest revenue. d. Right-of-use asset. 21. If a lease contains a purchase option, the exercise price is considered to be an additional cash payment if: a. the lessee has a "significant economic incentive" to exercise the option. b. the exercise the option is “reasonably assured.” c. the exercise price is reasonably determinable. d. the exercise price never is considered to be an additional cash payment. 22. The commencement of a five-year capital lease is December 31, 2013. The agreement specifies equal annual lease payments on December 31 of each year. For the lessee, the first payment on December 31, 2013, includes: a. b. c. d. Student Study Guide Interest Expense No Yes Yes No Reduction of the Lease Liability Yes No Yes No © The McGraw-Hill Companies, Inc., 2013 15-31 Leases 23. Adonis Co. recorded a right-of-use asset of $400,000 in a ten-year lease under which no profit was recorded at commencement by the lessor. The interest rate charged the lessee was 10%. The balance in the right-of-use asset after two years will be: a. $324,000. b. $320,000. c. $440,000. d. $484,000. 24. Simpson Co. recorded a residual asset of $400,000 in a ten-year lease under which no profit was recorded at commencement by the lessor. The interest rate charged the lessee was 10%. The balance in the residual asset after two years will be: a. $320,000. b. $360,000. c. $440,000. d. $484,000. 25. Farrakhan Fruits leased farm equipment from Hall Machinery on January 1, 2013. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2013. Hall had constructed the equipment recently for $33 million and its retail fair value was $50 million. What amount of interest revenue from the lease should Hall report in its 2013 income statement? a. $4,000,000. b. $3,750,000. c. $3,400,000. d. $0. 26. Farrakhan Fruits leased farm equipment from Hall Machinery on January 1, 2013. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2013. Hall had constructed the equipment recently for $33 million and its retail fair value was $50 million. What amount did Hall record as a residual asset? a. $2,640,000. b. $3,200,000. c. $6,600,000. d. $7,000,000. 27. Farrakhan Fruits leased farm equipment from Hall Machinery on January 1, 2013. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2013. Hall had constructed the equipment recently for $33 million and its retail fair value was $50 million. Its estimated useful life was 15 years. What amount of profit did Hall record at the commencement of the lease? a. $ 7,000,000. b. $10,000,000. c. $13,600,000. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-32 Leases d. $17,000,000. 28. Farrakhan Fruits leased farm equipment from Hall Machinery on January 1, 2013. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2013. Hall had constructed the equipment recently for $33 million and its retail fair value was $50 million. Its estimated useful life was 15 years. The total increase in earnings (pretax) in Hall’s 2013 income statement would be: a. $13,600,000. b. $16,560,000. c. $17,000,000. d. $18,000,000. 29. Farrakhan Fruits leased farm equipment from Hall Machinery on January 1, 2013. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2013. Hall had constructed the equipment recently for $33 million and its retail fair value was $50 million. Its estimated useful life was 15 years. The total decrease in earnings (pretax) in Farrakhan’s 2013 income statement would be: a. $3,400,000. b. $4,000,000. c. $4,440,000. d. $6,066,667. 30. Barton Industries leased exercise equipment to Witherspoon Gyms on July 1, 2013. Grant recorded the lease receivable at $810,000, the present value of lease payments discounted at 10% and fair value of the equipment. The lease called for ten annual lease payments of $120,000 due at the beginning of each year. The first payment was received on July 1, 2013. Barton had manufactured the equipment at a cost of $750,000. The total increase in earnings (pretax) on Barton’s 2013 income statement would be: a. $ 81,000. b. $ 94,500. c. $100,500. d. $120,000. Answers: 1. c. 2. c. 3. d. 4. b. 5. c. 6. 7. 8. 9. 10. Student Study Guide b. a. a. c. c. 11. 12. 13. 14. 15. c. b. c. c. c. 16. 17. 18. 19. 20. a a a a d 21. 22. 23. 24. 25. a a b d c 26. 27. 28. 29. 30. c c d d b © The McGraw-Hill Companies, Inc., 2013 15-33 Leases CPA Exam Questions 1. b. The four-year lease term is greater than 75% of the asset's five-year life, making this a capital lease. 2. b. $111,500 Present value at 1/1/2013 Payment made 12/30/2013 Interest portion for 2013 (8% x $112,500) Portion applied to the liability Capital lease liability 12/31/2013 $112,500 $10,000 (9,000) (1,000) $111,500 3. a. The key point is to first calculate the annual payments required by the lease. Use the basic present value formula: Annual Payments x Present Value Factor = Present Value of Future Payments. Therefore: Annual Payments x 4.313 = $323,400; Annual payments = $323,400 ÷ 4.313; Annual payments = $75,000. Then multiply the customer's $75,000 annual payment by five years for a total of $375,000. This figure represents Glade Co.'s gross lease receivable. The difference between the gross lease receivable and the present value of the future payments is the total amount of interest revenue that will be earned over the life of the lease ($375,000 – 323,400 = $51,600). 4. c. The profit on the sale is the difference between the cash selling price and the book value, $3,520,000 – 2,800,000 = $720,000. The interest is computed as follows: Present value of minimum lease payments and lease obligation, 7/1/2013 $3,520,000 Initial payment made 7/1/2013 (600,000) Liability balance $2,920,000 Interest rate 10% = For one-half year = $292,000 $146,000 5. a. In a capital lease with a bargain purchase option, the lessee will control the asset for its total useful life. Therefore, the depreciation should be allocated over the eight-year life of the asset. $240,000 cost – 20,000 salvage value = $220,000 ÷ 8 years = $27,500 per year. 6. a. The guaranteed residual value is a promise made by the lessee that the lessor can sell the leased asset at the end of the lease for a guaranteed amount. Since this promise is a potential future payment, it must be included in the calculation of the present value of the lessee's future lease payments. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-34 Leases 7. a. The capitalized lease liability should be the annual lease payments less the executory cost (real estate taxes) times the present value factor for an ordinary annuity of 1 for nine years at 9%. The calculation would be: ($52,000 – 2,000) x 6.0 = $300,000. The real estate taxes are a period cost and should be charged to expense. 8. a. Since the machine is being leased back for a minor part (present value of rentals is less than 10% of the value of the property at the date of the saleleaseback), the sale and the lease are viewed separately and the entire $30,000 profit is recognized. 9. b. In making the distinction between an operating lease and a capital/finance lease, more judgment, less specificity is applied using IFRS. 10. d. When recording a capital lease (usually called a finance lease under IFRS) a lessee using U.S. GAAP uses the lower of the implicit rate and its own incremental borrowing rate. Under IFRS, if the lessee is aware of the implicit interest rate used by the lessor to calculate lease payments, that’s the rate it uses. 11. b. When a sale-leaseback transaction occurs, if the leaseback is considered to be an operating lease, and the lease payments and sales price are at fair value, any gain on the sale is recognized immediately by a company using IFRS. CMA Exam Questions 1. d. For both sales-type and direct-financing leases, the lessor’s gross investment in the lease is the amount of the minimum lease payments (which include periodic payments plus guaranteed residual value) plus any amounts of unguaranteed residual value. The net investment in the lease is equal to the gross investment, plus any unamortized initial direct costs, minus unearned income. The unguaranteed residual value is the expected value of the leased asset in excess of the guaranteed residual value at the end of the lease term. 2. d. A lessee records a lease as a capital lease if it meets any one of four criteria. Existence of a bargain purchase option is one of these criteria. If a lease involving land and a building contains a bargain purchase option or if the lease transfers ownership to the lessee at the end of its term, the lessee separately capitalizes the land and the building. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-35 Leases 3. b. Initial direct costs have two components: (1) the lessor’s external costs to originate a lease incurred in dealings with independent third parties and (2) the internal costs directly related to specified activities performed by the lessor for that lease. In a sales-type lease, the cost, or carrying amount if different, plus any initial direct costs, minus the present value of any unguaranteed residual value, is charged against income in the same period that the present value of the minimum lease payments is credited to sales. The result is the recognition of a net profit or loss on the sales-type lease. Student Study Guide © The McGraw-Hill Companies, Inc., 2013 15-36