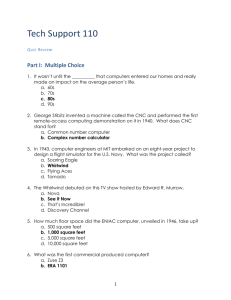

Preparation Of Case Study

advertisement