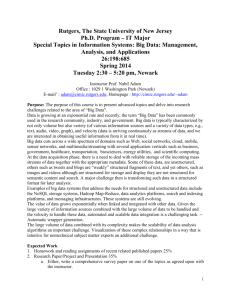

program policy statement template for graduate programs

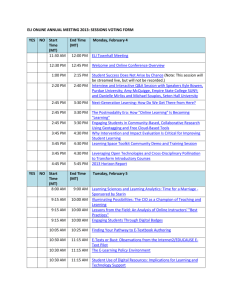

advertisement