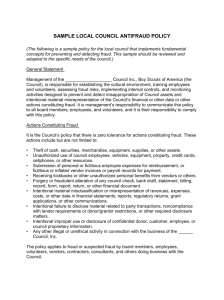

notes

advertisement

Auditor’s Responsibility for Fraud Detection Journal of Accountancy, January 2003 Michael Ramos Briefly, very briefly, without looking at the article, what does this article discuss? What is the first topic addressed in the article? AU 316 does define Professional Skepticism ---- Hint What NEW REQUIREMENT does SAS 99 introduce? Who has read AU 316 AU 316 specifies one individual who must participate in the “brainstorming” meeting. Who is that individual? The auditor with final responsibility for the audit When we discuss the audit client’s control environment, we talk about the “tone at the top.” SAS 99 discusses “tone at the top” in a different context. How does SAS 99 discuss “tone at the top?” What is the primary objective of the “brainstorming” session? When is this “brainstorming” session or sessions required to occur? When might an additional “brainstorming” session be held? What are the 3 elements of the “fraud triangle?” Is it necessary for all 3 elements to be present in order for fraud to occur? SAS 99 states auditors should obtain information to identify the risks of fraud form Management and others within the organization. Discuss 2 groups of people who might fall under “others within the organization.” The section is titled OBTAIN INFORMATION TO IDENTIFY THE RISKS OF FRAUD. Discuss the difference between obtaining information to identify the risks of fraud and the assessment of the Risk of Material Misstatement due to fraud. If you are making inquiries of someone in operations who has little of no knowledge of accounting, what is the nature of the information you are seeking? How does asking the same, or similar, question of different people provide evidence? What is a Fraud Risk Factor? Does the presence of a “fraud risk factor” indicate there is a fraud? The following section headings are from AU 316 1. OBTAINING THE INFORMATION NEEDED TO IDENTIFY RISKS OF MATERIAL MISSTATEMENT DUE TO FRAUD. 2. IDENTIFYING RISKS THAT MAY RESULT IN A MATERIAL MISSTATEMENT DUE TO FRAUD. 3. ASSESSING THE IDENTIFIED RISKS AFTER TAKING INTO ACCOUNT AN EVALUATION OF THE ENTITY’S PROGRAMS AND CONTROLS. With regard to the 2nd and 3rd bullets, how does the article suggest we think of “assessment.” Because the nature of fraud is very different than the nature of unintentional misstatements, the author suggest we must think of assessment differently. Back in our auditing class, how did we use “assessment” when evaluating the effectiveness of internal controls due to errors? What does the author suggest the goal of assessment should be when discussing fraud? Your goal is to “assess” or synthesize the identified risks to determine where the entity is most vulnerable to material misstatement due to fraud, the types of frauds that are most likely to occur and how those material misstatements are likely to be concealed. SAS 99 requires auditors to assess the Risk of Material Misstatement (RoMM) due to fraud at three levels. What are those three levels. For what type of fraudulent financial reporting scheme does SAS 99 presume there a risk of fraud? What does it imply about a company if they do not have programs and controls in place to assess and mitigate the risk of fraud. Discuss how management’s selection and application of accounting principles might be a factor in your identification of risks. Discuss nonstandard journal entries. What is the goal of Retrospectively Reviewing Accounting Estimates? What are Significant Unusual Transactions? Very late in the audit you become aware that the controller or CFO has fraudulently overstated travel expenses for reimbursement. The amount is totally insignificant to the financial statements. What effect will this have on your audit? Documentation, documentation, documentation