2032 Scenario 1 Summary: Focus on Economic Recovery

advertisement

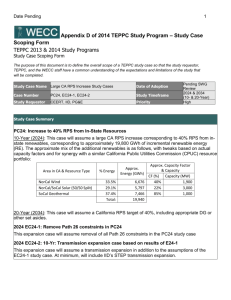

Summary—Scenario One: Focus on Economic Recovery Basic Description: Wide-spread Economic Growth in WECC Region with Increasing Standards of Living and Evolutionary Changes in Electric Supply and Distribution Technology Policy Theme: No overriding policy theme; focus on growth Summary: This is a world in which an initially slow uptick out of recession is followed by rising economic growth in the WECC region. Happening in concert with a steady pace of incremental rather than breakthrough technology improvements in the power sector this growth supports the emergence of the next generation power system for the region—one which is more efficient, flexible, responsive to customers, and takes full advantage of a spreading smart grid. After a period of international financial instability, the U.S. economy with more growth is back on a more solid fiscal foundation with the restructuring of the national debt leading to the implementation of new tax and fiscal policies. The U.S., with its growing population, entrepreneurial culture, and ability to develop advanced technologies, helps to bring the global economy back into balance. A steadily improving economy drives increasing electricity demands from consumers and expanding businesses and industries—both large and small. In the early years, natural gas meets this demand as increasing supplies keeps domestic prices low. As the last decade unfolds however, there is a major shift towards renewables driven by a robust regional electricity market facilitating the integration of renewables, and increasing environmental concerns about land and water use and air quality. Continued concern about climate change leads to efforts to reduce CO2 emissions and culminates in a federal energy policy, which includes a national carbon tax. These changes contribute to economic growth as they trigger innovation, revitalize markets and drive new investment. Even without game-changing breakthroughs, the energy sector is a primary beneficiary of the prowess of the U.S. in both technology development and entrepreneurial vigor and provides a solid basis for overall economic growth for the nation. The WECC region, home to some of the nation’s best educational and financial management institutions, leads the long-term positive evolution of the nation’s economy. Page 1 of 5 March, 2013 Scenario One Summary Key Scenario Metrics in 2032: Natural Gas Price $10.00 Cost of Carbon 2032 Reference Case value: $37.11 Policy Adjusted Peak Load Growth Rate1 1.9% (2032 Ref Case = 1.5%) Policy Adjusted Demand Growth Rate2 1.6% (2032 Ref Case = 1.2%) Scenario One - Overview by Key Driver Key Driver Scenario Summary The evolution of electricity demand in WECC region The economy begins a slow but steady recovery, and coupled with continued population growth drives a return to electricity demand growth. High fuel prices drive incremental electric vehicle adoption. The evolution of electricity supply in the WECC region Renewables struggle to grow in early years, but new investment and coal plant retirements trigger a resurgence of development, renewable generation takes off in last decade with increased deployment of on-site generation and storage. Innovation in electricity supply technology & distribution systems Slow and incremental technology innovation in the sector is mirrored in new generation development and operational and communications improvements. Renewables innovations pick up in the later years. Increased technology innovation in gasfired turbines continues to drive natural gas for new generation. The course of regional economic growth in the WECC region Growth in the early years remains slow, and leads the WECC states and provinces to enact legislation to support economic development. The economy picks up in the middle years, followed by growth in the later years. Changes in the regulation of electric power systems in the WECC region States and provinces continue to drive energy policy in early years. The WECC region begins to manage the power industry with better optimization of generation and transmission across the Western Interconnection. Changes in federal regulation affecting electric power industry The U.S. and Canada establish federal national energy policies to drive toward energy independence. A national energy policy is enacted, including a carbon tax. 1 2 Adjusted for known electrification, DSM and energy efficiency policies included in the modeling results Adjusted for known electrification, DSM and energy efficiency policies included in the modeling results Page 2 of 5 Scenario One Summary Key Driver Scenario Summary Changes in social values related to energy issues Consumer demand for customer-centric energy independence drives demands for energy-efficiency products, onsite generation and storage, etc. The public and investors begin to implement local community grids with clean generation. Changes in society’s preferences for environmental & natural resources Impacts of natural gas extraction cause states to look at increasing RPS standards. Centrist policies support reasonable energy infrastructure development leaning more towards renewables in the later years. Shifts in national & global financial markets Stabilization of financial markets following changes in deficit spending in the U.S. and other nations. Global financial markets return to normal credit patterns. Shifts in the availability & prices of commodity fuels used in the electricity sector Natural gas remains a clear choice for new dispatchable and replacement of coal fired generation in the early years. Page 3 of 5 Scenario One Summary Scenario One – Overview of Modeling Parameters Units 2032 Reference Value Scenario 1 Natural Gas $/MMBtu $6.58 $10.00 Coal $/MMBtu $1.62 $1.62 $/ton $37.11 $37.11 Geothermal % below 2012 cost 0% 0% IGCC w/ CCS % below 2012 cost 0% 0% Solar PV % below 2012 cost 31% 31% Solar Thermal % below 2012 cost 25% 25% Wind % below 2012 cost 8% 0% Load GWh 1,163,526 1,210,159 Policy-Driven Load Reductions GWh 0 0 Policy-Driven Electrification GWh 0 0 WECC Net Energy for Load GWh 1,163,526 1,210,159 Implied Growth Rate, Unadjusted Load %/yr 1.5% 1.9% Implied Growth Rate, Adjusted Load %/yr 1.5% 1.9% Input Parameters Fuel & Carbon Costs Carbon Capital Cost Reductions Net Energy for Load Page 4 of 5 Scenario One Summary Units 2032 Reference Value Scenario 1 Load MW 198,715 206,685 Policy-Driven Load Reductions MW -4952 -4,952 Policy-Driven Electrification MW 0 0 WECC Coincident Peak MW 193,763 201,733 Implied Growth Rate, Unadjusted Load %/yr 1.4% 1.8% Implied Growth Rate, Adjusted Load %/yr 1.2% 1.6% Input Parameters Coincident Peak Demand LOAD NUMBERS SHOWN ARE DRAFT AND NEED TO BE REVIEWED ONCE INPUTS ARE FINALIZED Renewable Goals State RPS % of Load Energy Current state policies Current state policies Federal RPS % of Load Energy none none In-state RPS Requirement % of RPS requirement Page 5 of 5 Current in-state preferences applied to RPS requirements Current in-state preferences applied to RPS requirements