All models include PE firm fixed effects, in addition to the country

advertisement

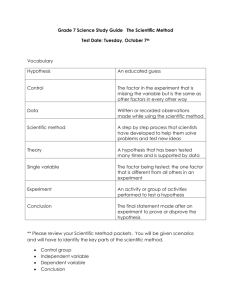

APPENDIX FOR STRATEGIC MANAGEMENT JOURNAL ARTICLE “UNBUNDLING THE EFFECTS OF INSTITUTIONS ON FIRM RESOURCES: THE CONTINGENT VALUE OF BEING LOCAL IN EMERGING ECONOMY PRIVATE EQUITY” (MARKUS TAUSSIG AND ANDREW DELIOS, NUS BUSINESS SCHOOL) Table 1: OLS Regressions on Firm Performance with Fixed Effects for Host country, Investment Year, and PE Firm Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Hypothesis 1b: PE firm local experience -0.002 0.024 -0.024 0.675** 0.020 0.025 (-0.014) (0.197) (-0.174) (2.066) (0.156) (0.199) Hypothesis 2a: Host country contract enforcement -0.035* -0.038* -0.023 -0.002 -0.034 -0.038** (-1.671) (-1.823) (-1.054) (-0.098) (-1.582) (-2.018) Hypothesis 3a: Host country stock market development 0.004 0.004 0.003 0.003 (1.451) (1.383) (0.987) (0.956) Hypothesis 3a: Host country credit market development -0.001 0.000 (-0.219) (-0.103) British common law origins 0.295 0.164 0.153 0.090 0.282 (0.839) (0.954) (0.626) (0.576) (0.311) (0.856) Host country PE industry size (Logged US fund deals) 0.071 0.092 0.079 0.063 0.089 0.094 (1.074) (1.539) (1.182) (1.008) (1.306) (1.499) Total investment (Logged) 0.057 0.062 0.055 0.059 0.056 0.062 (1.422) (1.563) (1.325) (1.554) (1.373) (1.567) Minority Stake (Dummy) 0.059 0.055 0.045 0.065 0.057 0.057 (0.573) (0.542) (0.436) (0.643) (0.561) (0.575) Hypothesis 2b: Local origins * contract enforcement -0.040 (-1.578) Hypothesis 2c: Local experience * contract enforcement -0.084** (-2.299) Hypothesis 3b: Local origins * stock market 0.006 (1.279) Hypothesis 3b: Local origins * credit market -0.001 (-0.107) Hypothesis 3c: Local experience * stock market Model 7 -0.037 (-0.232) -0.033 (-1.596) 0.004 (1.391) 0.263 (0.943) 0.069 (1.026) 0.058 (1.457) 0.055 (0.540) 327 0.061 327 0.049 327 0.065 327 0.084 327 0.066 327 0.049 0.000 (-0.182) 0.278 (0.775) 0.093 (1.550) 0.061 (1.533) 0.056 (0.550) 0.001 (0.580) Hypothesis 3c: Local experience * credit market Observations R-squared Model 8 0.038 (0.273) -0.038* (-1.821) 327 0.062 0.000 (-0.172) 327 0.049 *** p<0.01, ** p<0.05, * p<0.1; Z-scores in parentheses. Standard errors computed to correct for two-way clustering of errors by host country and PE firm. All models include PE firm fixed effects, in addition to the country fixed effects, investment year fixed effects, and variables for share of GSIC industry that were included in all models in the paper’s Table 2. Table 2: Robustness Tests Using Multiple Interactions and PE Firm Fixed Effects Model 1 Model 2 Model 3 Hypothesis 1a: PE firm local origins 0.336 -0.121 0.289 (1.186) (-1.246) (1.014) Hypothesis 1b: PE firm local experience 0.685** -0.008 0.690* (2.022) (-0.0499) (1.840) Hypothesis 2a: Host country contract enforcement 0.015 -0.034 0.012 (0.742) (-1.526) (0.586) Hypothesis 3a: Host country stock market development 0.002 0.004 0.002 (0.917) (1.255) (0.713) Hypothesis 3a: Host country credit market development British common law origins Host country PE industry size (Logged US fund deals) Total investment (Logged) Minority Stake (Dummy) Hypothesis 2b: Local origins * contract enforcement Hypothesis 2c: Local experience * contract enforcement -0.201 (-0.757) 0.076 (1.197) 0.056 (1.420) 0.046 (0.454) -0.051 (-1.630) -0.0896** (-2.331) Hypothesis 3b: Local origins * stock market -0.340 (-1.167) 0.084 (1.291) 0.053 (1.275) 0.058 (0.577) 0.502* (1.770) 0.084 (0.477) Hypothesis 3b: Local origins * credit market -0.227 (-0.775) 0.079 (1.259) 0.053 (1.344) 0.053 (0.527) -0.046 (-1.470) -0.0880** (-2.222) 0.346 (1.195) -0.023 (-0.125) Hypothesis 3c: Local experience * stock market Model 4 -0.231 (-0.551) 0.019 (0.142) -0.0339* (-1.712) 0.003 (0.983) 0.000 (-0.168) -0.247 (-0.939) 0.094 (1.372) 0.055 (1.346) 0.056 (0.561) 0.000 (0.010) -0.291 (-1.092) 0.0968* (1.647) 0.058 (1.459) 0.043 (0.432) 0.006 (1.435) 0.000 (-0.0159) Hypothesis 3c: Local experience * credit market Local origins * common law Local experience * common law Observations R-squared Model 5 -0.158 (-1.607) 0.041 (0.286) -0.033 (-1.511) 327 0.09 327 0.065 327 0.092 327 0.066 Model 6 0.114 (0.240) 0.760** (2.093) 0.016 (0.743) 0.001 (0.233) 0.000 (-0.0192) -0.245 (-0.966) 0.091 (1.399) 0.054 (1.372) 0.048 (0.494) -0.046 (-1.382) -0.0944** (-2.304) Model 7 0.337 (1.159) 0.651* (1.720) 0.014 (0.636) 0.002 (0.797) -0.001 (-0.348) -0.215 (-0.814) 0.077 (1.223) 0.056 (1.428) 0.044 (0.443) -0.052 (-1.633) -0.0885** (-2.292) Model 8 0.126 (0.257) 0.700* (1.843) 0.018 (0.813) 0.000 (0.038) 0.000 (-0.0389) -0.237 (-1.023) 0.093 (1.441) 0.055 (1.436) 0.041 (0.424) -0.048 (-1.440) -0.0932** (-2.294) 0.000 (0.111) 0.000 (0.095) 327 0.091 0.00781* (1.834) 0.000 (0.034) 0.001 (0.481) 0.000 (-0.00981) 327 0.099 0.00708* (1.659) 0.001 (0.080) 0.004 (1.289) -0.004 (-1.238) 327 0.053 327 0.097 *** p<0.01, ** p<0.05, * p<0.1; Z-scores in parentheses. Standard errors computed to correct for two-way clustering of errors by host country and PE firm. All models include PE firm fixed effects, in addition to the country fixed effects, investment year fixed effects, and variables for share of GSIC industry that were included in all models in the paper’s Table 2. Table 3: Interacting Contract Enforcement and Stock Market Development Sample Local Origins Local Experience Contract Enforcement Common Law Market Capitalization PE Industry Size Total Investment Minority Stake Contract Enforcement * Market Capitalization Observations R-squared Model 1 Model 2 Model 3 Model 4 Model 5 Full Sample No Local Experience Local Experience Foreign Origins Local Origins -0.059 -0.059 0.082 (-0.968) (-0.955) (0.764) 0.059 0.088 0.069 (1.189) (1.398) (0.835) -0.004 -0.012 0.017 -0.012 0.020 (-0.261) (-0.658) (0.883) (-0.969) (0.632) 0.098 0.073 -0.002 0.053 0.109 (1.584) (0.870) (-0.0221) (0.993) (1.186) 0.006** 0.002 0.017*** 0.003 0.009*** (2.016) (0.414) (6.402) (0.858) (2.753) 0.038 0.056* 0.041 0.049** 0.025 (1.312) (1.900) (0.842) (2.236) (0.557) 0.073*** 0.051* 0.112*** 0.052*** 0.072* (3.555) (1.725) (5.119) (2.804) (1.843) 0.244** 0.239* 0.458*** 0.284** 0.090 (2.328) (1.887) (3.197) (2.550) (0.298) -0.001*** 0.000 -0.002*** -0.001* -0.001*** (-2.856) (-0.824) (-9.446) (-1.722) (-3.038) 327 242 85 235 92 0.128 0.073 0.408 0.093 0.155 *** p<0.01, ** p<0.05, * p<0.1; Z-scores in parentheses. Standard errors computed to correct for two-way clustering of errors by host country and PE firm. All models include PE firm fixed effects, in addition to the country fixed effects, investment year fixed effects, and variables for share of GSIC industry that were included in all models in the paper’s Table 2. Table 4: Interacting Contract Enforcement and Credit Market Development Local Origins Local Experience Contract Enforcement Common Law Domestic Credit PE Industry Size Total Investment Minority Stake Contract Enforcement * Domestic Credit Observations R-squared Model 1 Model 2 Model 3 Model 4 Model 5 Full Sample No Local Experience Local Experience Foreign Origins Local Origins -0.052 -0.067 0.144 (-0.917) (-1.197) (1.341) 0.062 0.053 0.119* (1.113) (0.804) (1.743) -0.002 -0.008 0.005 -0.005 0.029 (-0.0895) (-0.264) (0.152) (-0.211) (0.620) 0.067 0.044 -0.126 0.015 0.114 (1.178) (0.543) (-0.955) (0.222) (1.079) 0.003 0.001 0.008** 0.002 0.006 (0.975) (0.381) (2.052) (0.597) (1.026) 0.036 0.0579* 0.061 0.045* 0.020 (1.212) (1.928) (1.307) (1.927) (0.435) 0.068*** 0.049* 0.114*** 0.043** 0.070* (3.326) (1.692) (5.465) (2.195) (1.837) 0.224** 0.232* 0.348** 0.241** 0.051 (2.206) (1.879) (2.531) (2.144) (0.178) -0.001 0.000 -0.001*** -0.001 -0.001 (-1.503) (-0.713) (-2.610) (-1.281) (-1.217) 327 242 85 235 92 0.116 0.068 0.348 0.086 0.118 *** p<0.01, ** p<0.05, * p<0.1; Z-scores in parentheses. Standard errors computed to correct for two-way clustering of errors by host country and PE firm. All models include PE firm fixed effects, in addition to the country fixed effects, investment year fixed effects, and variables for share of GSIC industry that were included in all models in the paper’s Table 2. Table 5: OLS Regressions on Firm Performance with IFC Share in Investing PE Fund and Host country and Investment Year Fixed Effects Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7 Model 8 Hypothesis 1a: PE firm local origins -0.031 -0.020 0.395* -0.053 -0.139** -0.280*** -0.039 -0.038 (-0.453) (-0.286) (1.958) (-0.820) (-2.438) (-3.243) (-0.637) (-0.641) Hypothesis 1b: PE firm local experience 0.058 0.059 0.024 0.434* 0.081 0.071 0.134 0.203** (1.028) (1.118) (0.383) (1.943) (1.348) (1.294) (1.579) (2.319) Hypothesis 2a: Host country contract enforcement -0.044** -0.046** -0.027 -0.028 -0.044** -0.047** -0.047** -0.044** (-2.175) (-2.185) (-1.370) (-1.306) (-2.261) (-2.235) (-2.268) (-2.113) Hypothesis 3a: Host country stock market development 0.005* 0.004* 0.004 0.003 0.005** (1.786) (1.726) (1.447) (1.226) (2.001) Hypothesis 3a: Host country credit market development 0.000 -0.002 0.002 (0.124) (-0.768) (0.744) British common law origins 0.225 0.247 0.256 0.206 0.246 0.263 0.220 0.222 (1.046) (1.031) (1.152) (0.958) (1.235) (1.232) (1.068) (0.952) Host country PE industry size (Logged US fund deals) 0.048 0.073 0.059 0.039 0.059 0.074 0.051 0.070 (0.708) (1.121) (0.884) (0.588) (0.861) (1.171) (0.753) (1.111) Total investment (Logged) 0.090*** 0.095*** 0.084** 0.095*** 0.090*** 0.093*** 0.091*** 0.092*** (2.793) (2.978) (2.570) (3.034) (2.752) (2.869) (2.788) (2.888) Minority Stake (Dummy) 0.173* 0.169* 0.141 0.169* 0.172* 0.135 0.183** 0.176* (1.861) (1.766) (1.462) (1.916) (1.798) (1.280) (2.013) (1.865) 0.050 0.061 0.050 0.058 0.031 0.052 0.044 0.056 IFC share of PE Fund (logged) (0.704) (0.835) (0.695) (0.816) (0.440) (0.713) (0.612) (0.775) Hypothesis 2b: Local origins * contract enforcement -0.054** (-2.245) Hypothesis 2c: Local experience * contract enforcement -0.048 (-1.639) Hypothesis 3b: Local origins * stock market 0.003*** (3.074) Hypothesis 3b: Local origins * credit market 0.004*** (2.882) Hypothesis 3c: Local experience * stock market -0.002* (-1.840) Hypothesis 3c: Local experience * credit market -0.003*** (-2.622) Observations 307 307 307 307 307 307 307 307 R-squared 0.130 0.115 0.141 0.139 0.143 0.133 0.135 0.122 *** p<0.01, ** p<0.05, * p<0.1; Z-scores in parentheses. Standard errors computed to correct for two-way clustering of errors by host country and PE firm. All models include PE firm fixed effects, in addition to the country fixed effects, investment year fixed effects, and variables for share of GSIC industry that were included in all models in the paper’s Table 2.