Golden Spike - Edwards School of Business

advertisement

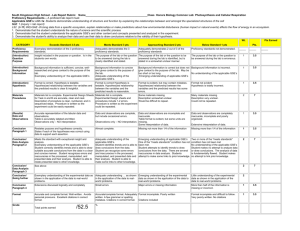

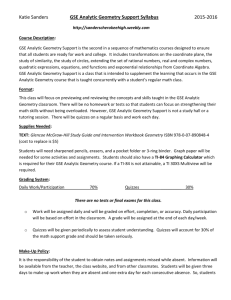

2014 Business Plan DECEMBER 05, 2014 PREPARED BY: SULMAN ALI SAIF & UMAR RAHEEL FOR: MARVIN J. PAINTER, COMM 447.3 Page 1 of 28 Golden Spike Exports – Business Plan Contents Executive Summary....................................................................................................................................... 3 Golden Spike ................................................................................................................................................. 4 Owners ...................................................................................................................................................... 4 Vision Statement ....................................................................................................................................... 5 Philosophy ................................................................................................................................................. 5 Core Values ............................................................................................................................................... 5 Goals and Objectives................................................................................................................................. 5 Short term goals.................................................................................................................................... 5 Long term Goals .................................................................................................................................... 5 Industry Overview ......................................................................................................................................... 6 Figure 2: Scrap Metal Import Data, State Bank of Pakistan ...................................................................... 6 Operations Plan............................................................................................................................................. 7 Organizational Structure ........................................................................................................................... 7 Figure 3: GSE Organizational Structure ................................................................................................. 7 Operations Cycle Flow .............................................................................................................................. 8 Figure 4: GSE Operations Cycle ............................................................................................................. 8 Logistics ..................................................................................................................................................... 9 International Shipping............................................................................................................................... 9 Figure 5: International Shipping Route (Searoute Finder, 2014) .......................................................... 9 Freight Delivery in Pakistan ...................................................................................................................... 9 Figure 6: National Highways of Pakistan ( National Trade & Transportation Facilitation Committee, 2012) ................................................................................................................................................... 10 Figure 7: National Highway N5 (Munir, 2010) .................................................................................... 10 Human Resources ....................................................................................................................................... 12 Number of Employees & Positions ......................................................................................................... 12 Job Descriptions ...................................................................................................................................... 12 Salaries: ................................................................................................................................................... 14 Benefits and Cost of Living Allowances (COLA): ................................................................................. 14 Marketing .................................................................................................................................................... 15 Competitor Analysis: ............................................................................................................................... 15 Customer Analysis:.................................................................................................................................. 15 Marketing Mix Summary ........................................................................................................................ 17 Page 2 of 28 Golden Spike Exports – Business Plan Product ................................................................................................................................................ 17 Price .................................................................................................................................................... 17 Promotions.......................................................................................................................................... 18 Place & Distribution ............................................................................................................................ 19 Capital Structure and Feasibility Analysis ................................................................................................... 20 Financial Structure & Decision-Making Power ....................................................................................... 20 Capital Budget ......................................................................................................................................... 21 Financial Projections ............................................................................................................................... 22 Critical Variables ..................................................................................................................................... 22 Required Return on Investment (ROI) .................................................................................................... 22 Internal Rate of Return (IRR)................................................................................................................... 23 Financial Projections Based on Critical Variables ................................................................................... 23 1. Analysis Based on Number of Containers per Year .................................................................... 24 2. Increase or Decrease in Cost of Goods Sold ............................................................................... 24 3. Financial structure of the business (debt/equity ratio) .............................................................. 24 Risk Management ....................................................................................................................................... 25 Conclusion ................................................................................................................................................... 25 Appendix ..................................................................................................................................................... 26 Bibliography ................................................................................................................................................ 27 Page 3 of 28 Golden Spike Exports – Business Plan Executive Summary Golden Spike Exports (GSE) is a scrap metal exporter who believes strongly in the 3P model of People, Profit and Planet and will be shipping scrap metal from Canada to Pakistan. GSE will be sending the scrap metal from Vancouver Port, B.C. to Bin Qasim Port, Karachi, Pakistan via the Pacific Ocean route after which the metal will be further distributed to buyers in two other major cities, namely Lahore and Islamabad. Pakistan is an emerging economy with the 6th largest population in the world. The country is in a phase of political stability and has undertaken several infrastructure developmental projects including a major railway expansion throughout the country. Initiatives like these have rapidly increased the metal imports in Pakistan and they do not seem to be slowing down anytime soon. By acquiring this metal at cheaper price in Canada, GSE believes that it can fulfill the scrap metal demands in Pakistan by supplying it to vendors in Pakistan. Golden Spike will be managed by two owners, Sulman Ali Saif and Umar Raheel who will be looking over the operations and logistics of the company in executive positions. Ali’s father is the former General Secretary of Pakistan’s Chamber of Commerce and will be leveraging his contacts to secure key business people for investing and acquiring contracts for GSE’s success and Umar’s father who works for the Pakistani government will assist the company in matters related to it. GSE’s capital structure will consist of a 46% Debt & 54% Equity at a total value of $650,000. Based on the projections GSE will produce an average five year net income of $276,662 and it will raise its gross margin per container from 35% in year one to 47% by year five. This will be achieved by locking-in forward contracts with suppliers and reducing variable expenses over time. GSE will also deliver a return of 40% to its investor which is above the required industry average of 28.9%. Based on all these factors we believe that GSE is a feasible venture because it will be managed by a group of people who have the international experience and the connections to make these projections into reality. Page 4 of 28 Golden Spike Exports – Business Plan Golden Spike Golden Spike Exports (GSE) is an incorporated scrap metal exporting venture that ships scrap metal from Canada to the emerging market of Pakistan. The company will have a satellite office in Vancouver, B.C. where the primary owners would negotiate contracts with the scrap metal vendors and will be shipping it off via the Pacific Ocean route to the port city of Karachi, Pakistan. The shipped metal will be sold to steel and iron mills in Pakistan who will be working with the government on expanding the current railway tracks and other infrastructure in Pakistan. Owners The company will be managed by two active owners Sulman Ali Saif and Umar Raheel, who are both final year Management students at Edwards School of Business in Saskatoon, SK. Ali brings to the table the connections of his father in the Pakistani commerce world and Umar brings connections of his father who works for the Pakistani government and is well aware of the governmental railway expansion and infrastructure development initiatives. Ali has a versatile work experience where he has been working in a variety of industries ranging from service to logistics and exporting to handling accounting duties at the multinational company of Cargill. In addition, he coaches and competes in martial arts and works with special needs children. Umar has a diverse background from having being born in Hong Kong and having lived all over the world from the Middle East to Brazil. Besides English, he speaks five languages fluently such as Portuguese, Spanish, French, Arabic and Urdu. He received a full scholarship at the University of Saskatchewan and also worked throughout the last three summers at ExxonMobil’s Imperial Oil in Calgary. Ali’s father, Mr. Saif-ul-Malook was the former General Secretary of Pakistan’s Chamber of Commerce and has deep rooted connections with the elite business class of Pakistan. His established relationships will help GSE to penetrate the inner elite circle and acquire key business people for GSE’s vision to become a reality in form of potential investors and clients. Umar’s father Mr. Raheel Aslam has been working for the Ministry of Foreign Affairs of Pakistan for over 25 years and is well-known amongst government officials. He, like Ali’s father has deep-rooted relationships with government officials in different ministries. He has already referred Umar and Ali to one of his contacts, Mr. Shamoon Khan who exports iron flat-roll sheets from Germany to Pakistan. Mr. Aslam’s contacts can serve extremely useful for GSE who can utilize them as mentors and advisors. Page 5 of 28 Golden Spike Exports – Business Plan Vision Statement “Golden Spike envisions a 21st century business model of 3P’s by creating a circular economy that generates profits for investors while empowering people and sustaining the planet.” Figure 1: Circular Economy (Green Jeanne, 2013) Philosophy The concept of GSE was born due to need of an emerging market like Pakistan requiring scrap metal for its railway development and infrastructure expansion initiatives. GSE owners believe that by taking advantage of an international market opportunity like this, they can create a profitable business, provide a prosperous livelihood for the lower class and educated youngsters of Pakistan and also help the planet by reutilizing scrap metal waste into the circular economy. Core Values As an international exporting company that will be conducting operations in Canada and Pakistan, GSE will embody itself with the following core values to help the company operate and direct itself in the future: GSE will thrive to provide its business partners with exceptional service in terms of quality of the material and overall business integrity. GSE will always seek for the best model to payback its equity holders without jeopardizing the company’s principles and integrity. GSE will provide a platform which will provide reasonable and safe working environment for its workers. GSE business practices will respect the protocol of greener global initiative. Goals and Objectives Short term goals GSE will establish a strong relationship among the scrap metal suppliers and buyers in Canada and Pakistan by the end of first business year. The GSE enterprise would aim to achieve 1.5x its sales by the second year Long term Goals GSE would achieve to become one of the largest scrap metal providing vendor in Pakistan. The company would expect to lock in better price rate for metal, shipping and other variable expenses. GSE would strive to enter in an agreement with the Government of Pakistan as their primary supplier for their developmental initiative projects. Page 6 of 28 Golden Spike Exports – Business Plan After successfully proving the concept in Pakistan, GSE would aim to expand its operations in other countries like: USA, India, Bangladesh and Afghanistan. Industry Overview The scrap metal industry is an industry that generally does not get as much attention because it is not considered a very “glamourous” industry. However, the facts about this industry tell a different story. The scrap metal industry is a multi-billion dollar industry that contributes to the concept of circular economy as it reuses the recyclables and reintegrates it into the manufacturing industry. Alone in the U.S., the scrap metal industry contributed to the economy over $90.6 billion in 2011 which was more than the revenues generated from forestry and fisheries industries combined (Greene, 2013). Historically, the scrap metal industry was very localized with minimal international reach, therefore it did not emerge as rapidly as other industries internationally over time because the supporting technological growth has been slow for this industry to catch on. The Pakistani scrap metal industry has been experiencing a sharp growth in recent years. According to the State Bank of Pakistan’s latest data on trade, the scrap metal industry has experienced growth from $423.08 million of revenues in 2012 to $602.28 million in 2014, representing a growth of 142% in a span of three years. This growth does not seem to be slowing down anytime soon as it is projected to go over $800 million in 2015. (Subohi, 2014) Figure 2: Scrap Metal Import Data, State Bank of Pakistan $ in millions Scrap Metal Imports (Pakistan) $900.00 $800.00 $700.00 $600.00 $500.00 $400.00 $300.00 $200.00 $100.00 $0.00 $800.00 $602.28 $499.14 $423.08 2012 2013 2014 2015 Year After researching and analyzing the current scrap metal recycling industry in North America and Pakistan, GSE has identified an opportunity that can be capitalized by creating a business in this booming sector. Page 7 of 28 Golden Spike Exports – Business Plan Operations Plan Organizational Structure Golden Spike Exports PAKISTAN CANADA Business Supplier Relations Sales Business Relations Administration & Accounts Figure 3: GSE Organizational Structure As an organization GSE will have an international structure as it will be conducting business operations in Canada and Pakistan. In Canada, GSE will have a satellite office out of the owner’s residence in Vancouver City as the only operations it will be conducting are purchasing scrap metal from scrap yards in Vancouver and surrounding areas. The Canadian operations will consist of negotiating material prices with the vendors, inspecting the goods and arranging the Canadian side of shipping and logistics to Pakistan. Umar and Ali will be conducting the sales themselves and will strive to build healthy supplier relations with the vendors in BC, Canada. The bulk of the operations will take place in Pakistan’s three major cities of Karachi, Lahore and Islamabad and among these cities Karachi’s office will serve as the regional headquarters of GSE and the storage yard for the scrap metal. The main office in Karachi will keep record of all the sales, administer the operations flow and logistic status of freight delivery within Pakistan. Delivery Logistics Page 8 of 28 Golden Spike Exports – Business Plan Operations Cycle Flow Golden Spike Exports Step 1 Canadian Purchasing Operations Pakistan Selling Operations Step 2 Step 3 Step 4 Scrap Metal Purchases from Suppliers Scrap Metal Sales to the Clients Step 5 Step 6 Revenues Figure 4: GSE Operations Cycle The operations cycle flow is broken down into the following steps: Step 1: GSE seeks scrap metal vendors for its Canadian purchasing and supplying operations to Pakistan. Step 2: GSE closes the purchases with selected vendors and arranges the shipment of cargo. Step 3: GSE ships the cargo with a preferred shipping company from Vancouver, BC to Bin Qasim Port in Karachi, Pakistan via the Pacific Ocean route. Step 4: GSE logistics receives the shipment in Karachi and handle the customs and shipping duties, after which the goods are delivered by long haul trucks to the purchasing clients in all the major cities. Step 5: GSE collects all the outstanding sales and transfers the revenues back to Canada. Step 6: Upon the completion of revenues transformation in Step 5, GSE retriggers the operations cycle flow from step 2. Page 9 of 28 Golden Spike Exports – Business Plan Logistics As an international exporting business, GSE understands the value of having an efficient logistic system for its product to be delivered on time and in good condition. The logistics can be divided into two sections: i) ii) International Shipping of the cargo from Canada to Pakistan. Long haul trucks delivery of the shipment within Pakistan. International Shipping This process will include the packing of shipment into containers from the scrap yard and then delivering them on the shipping yards before the departure date of cargo. Once the containers are loaded onto the cargo ship, the preferred ocean route to Pakistan is via the Pacific Ocean. It will take approximately 25 days for the shipment to reach Bin Qasim Port in Karachi, Pakistan. Figure 5: International Shipping Route (Searoute Finder, 2014) Freight Delivery in Pakistan Once the shipment is received at Bin Qasim Port (Karachi), the goods will be delivered using the company long haul trucks to GSE storage yard located in the Landhi industrial area of Karachi. From there the shipments will be delivered to clients within Karachi and the cities of Lahore and Islamabad via national highway N5. Please refer to the figures below for an overview of national highways of Pakistan. Page 10 of 28 Golden Spike Exports – Business Plan Figure 6: National Highways of Pakistan ( National Trade & Transportation Facilitation Committee, 2012) Figure 7: National Highway N5 (Munir, 2010) Page 11 of 28 Golden Spike Exports – Business Plan Figure 8: GSE Trucking Routes (Google Maps, 2014) The distance from Karachi to Lahore via highway route N5 is 1,228km and it will take a shipment approximately 14 hours to be delivered to the clients in Lahore. Islamabad’s distance via same national highway N5 is 1,476km and a shipment will take approximately 16 hours to be delivered to the clients in Islamabad. Please refer to the figure above for visual representation of the transportation route, where A represents Karachi, B represents Lahore and C represents Islamabad. Page 12 of 28 Golden Spike Exports – Business Plan Human Resources Number of Employees & Positions Titles Chief Operations Manager (COM) Chief Relations Manager (CRM) Account Managers Sales Person Delivery Drivers Total Number of positions 1 1 3 6 5 16 Note: The number of delivery drivers is expected to grow over the period of next five years contingent on business growth. Please refer to the financial schedules of operating expenses to review the expected number of truckers that will be hired. Job Descriptions 1. Chief Operations Manager (COM): Umar Raheel will serve as the COM of GSE. The COM will be responsible for ensuring the efficiency of overall operations of GSE. He will be responsible for the following duties: In Canada his responsibilities will be inspecting the raw material and its quality and supervising the loading of goods to the shipping yard and sealing the containers at Vancouver Port. The COM will co-ordinate with the head office team in Karachi regarding the shipment arrival, its delivery and storage. The COM will visit the operations facility in Pakistan last month of every quarter to physically oversee the operations. Planning by prioritizing customer, employee and organizational requirement and demands. Maintaining staffing levels at an optimum and monitoring performance measures like profitability, annual growth and market share for GSE. 2. Chief Relations Manager (CRM): Sulman Ali Saif will perform the responsibilities required for this position. The CRM will be responsible for strengthening GSE’s relations network with its suppliers and clients. The CRM duties will include the following tasks: Page 13 of 28 Golden Spike Exports – Business Plan In Canada, the CRM will procure various scrap metal suppliers within the Vancouver area and sign exclusive deals for supplying of scrap metal for GSE’s operations in Pakistan. In Pakistan, the CRM will use the leads provided by Mr. Malook and Mr. Aslam to secure contracts with metal developers of Pakistan and Government of Pakistan. Over the course of time the CRM will work on strengthening its position with clients and suppliers to become their preferred business partner. Organizing conventions in Pakistan to appreciate current clientele and attract new clients, also arranging shareholder and board meetings. The CRM is responsible for maintaining an exceptional communication with GSE’s suppliers in Canada and clients in Pakistan. The CRM will visit Pakistan every 2nd month of the quarter to establish rapport with clients and return to Canada before the arrival of COM to resume his duties in Canada. Note: Both the COM and CRM will not be exclusive to the duties mentioned above as they will take on additional tasks that are required for keeping GSE operations stable. 3. Account Manager: GSE will have three account managers for each city that overlook the operations in their respective cities in Pakistan and will serve as the primary point of contact for owners and clients. Some of their additional duties will include the following tasks: Ensuring successful pick-up and delivery of the shipment. Communicate the monthly progress of operations with the COM. Monitoring forecast and tracking key business accounts and consulting COM and CRM for each step. Responsible for delegating the assigned sales person to GSE’s clients and assisting the sales persons with necessary tools to complete the sale. Addressing GSE’s major client’s complaints and forwarding them to the COM and CRM for solution. 4. Sales Person: GSE will have two sales people for each city and they will work under the supervision of their account manager. The sales people will be responsible for the following duties: Close assigned sales with the clients and fill out the order for client. Submit the paperwork to the account manager and assist him with admin duties. Coordinate with the delivery drivers regarding their schedule and attend the shipment delivery for the client. Page 14 of 28 Golden Spike Exports – Business Plan 5. Delivery Drivers: GSE will begin its operations with five drivers in the first year and will gradually increase the number of drivers contingent on expected business growth. They will have following duties: Loading and securing the shipment into the trucks from Bin Qasim Port and bringing it to the warehouse in Landhi, Karachi. Picking up assigned delivery routes and coordinating their arrival time with sales person of that city. Upon completion of the delivery, reporting and submitting the delivery report to the Account Manager of the city. Salaries: As GSE stands for 21st century business model of 3P’s, GSE would payout its overseas employees a salary that is above the average salary for these positions in Pakistan. (Glassdoor, 2014) GSE believes that it will empower its employees and help them live out a prosperous life. The officials and employees will get paid the following figures in salaries: Titles Salaries Chief Operations Manager (COM) Both executives will take a flat salary of $30,000 increased every year @ Canadian inflation rate of 2.5% and contingent on & Chief Relations Manager (CRM) expected growth the salaries will increase to $45,000 in the 4th and 5th year. Beside their salaries, each will receive 25% of the total dividend payout, when GSE is in the position to payout dividends. The individuals working at this position will receive a monthly Account Managers salary of $400/ month, which is about 40,000 PKR. Their salary will increase @ Pakistani inflation rate of 7.7%. Sales person will receive a salary of $300/month equalling to Sales Person about 30,000 PKR. They will experience the growth in salary at Pakistan’s inflation rate mentioned above. Truckers would make $200/month, sums up to about 20,000 Delivery Drivers PKR and increase at same inflation rate as above. (Al-Jazeera, 2012) Benefits and Cost of Living Allowances (COLA): In Pakistan cost of living allowance is a premium that an employer has to deduct equating to 100 PKR/month = $1/month for every employee in the company, which they pay them on vacation or leave. GSE will pay a higher COLA of 1000 PKR/month = $10/month for each of our employees ( WageIndicator Foundation, 2014). GSE will provide a benefits package equal to 10% of the employee salaries for health allowance every year per employee. Page 15 of 28 Golden Spike Exports – Business Plan Marketing GSE’s marketing strategy would be a lot different than a mainstream brand marketing strategy. Because GSE deals with the commodities market, it believes that a bigger portion of its marketing budget would go towards the inner circle of its business to organize conventions for its clients in Pakistan and meetings with suppliers for the scrap metal goods. GSE will have to consider the following: Competitor Analysis: GSE competes in a competitive market with few but well established businesses. A lot of the businesses do not specialize in one type of scrap exporting. GSE will be competing directly with scrap metal sector importers in Pakistan on the merits of lower prices and quality of the raw material. Currently there are numerous small and large metal brokers and developers that are serving the emerging demands for scrap metal product. Such companies include: Competitor’s Name Business Size & Description Metal import and export company located in Los Angeles, CA and Karachi, Khan Metals Pakistan. Khan metals has been exporting scrap metal for the last 30 years worldwide. http://www.jztrading.com/ Metal export company that specializes in processing and exporting of recycled ShredMet International Metal scrap metal to refineries and foundries in countries such as India, Pakistan, Bangladesh and China. They are located in Birmingham, United Kingdom. Exports http://www.shredmet.com/ Auscon International Export International export company with over 25 years of experience that specializes in sending scrap metals to South East Asian destinations and also counties like Pakistan, India and Bangladesh. Auscon is based in Perth, Western Australia. http://www.ausmetals.com.au/ Figure 9: Competitor Analysis Customer Analysis: Canada’s scrap export market has not reached its complete potential for exporting scrap to emerging economies like Pakistan as the total exports for metal and steel from Canada to Pakistan only accounts for 17.71% (Asia Pacific Foundation of Canada, 2014). This is where GSE believes it has an opportunity that it can capitalize on. Due to the high availability of well-sorted scrap in Canada, specifically British Columbia and Ontario where landfill sites are approaching capacity, GSE aims to offer its clients quality scrap metal at competitive prices. Landfills account for about 38% of total Canadian methane emissions and recycling waste glass, paper and metal can reduce carbon dioxide emissions by Page 16 of 28 Golden Spike Exports – Business Plan 400 kg a year. (Recycling Council of British Columbia, 2014) GSE believes that it can help the Canadian environment reduce emissions by moving scrap metal from Canada to Pakistan where it be re-utilized to manufacture goods and trigger a circular economy model. Considering the environmental concerns and rising demand of scrap metal, GSE believes that it will be able to acquire companies as customers who are keen on helping the planet and people in it without paying additional costs than they currently incur in their operations. This will be applicable to GSE as they will be selling the material at price lesser then the current market price. The customers GSE is expecting to acquire are as follows: Figure 10: Customer Analysis Business Name Asif Traders HVACR Solutions Mughal Steel Al-Tuwairqi Steel Mills Limited (TSML) Services and Distribution Channels Located in the suburb of Raiwand, Lahore. Asif Traders is a major supplier using recycled metal to manufacture commercial heating and cooling systems for Pakistan Army, Lahore General Hospital, Marriott Hotels, and Nestle. http://asiftraders.com/about.html One of the leaders of the steel and iron sector of Pakistan, established for over 50 years that specializes in the manufacturing of beams, girders, springs and stainless steel bars. Mughal steel is the premier supplier of metal in Pakistan and their raw materials are used in every industry ranging from residential construction to infrastructure development projects. http://www.mughalsteel.com/pindex.php State-of-the art, environmentally friendly steel manufacturing project located over 2220 acres at Port Qasim, Karachi. Al Tuwairqi is a leading private sector steel producer in Saudi Arabia now expanding their operations to Pakistan. AlTuwairqi is projecting to supply more than half of Pakistan’s 8.4 million tonnes of annual demand for steel. http://tuwairqi.com.pk/new/ Figure 11: Al-Tuwairqi Steel Mills Projection of Pakistan’s Steel Supply & Demand Page 17 of 28 Golden Spike Exports – Business Plan Marketing Mix Summary Product GSE will be delivering both ferrous and non-ferrous metal scrap, the majority of which will be: Steel Aluminium Copper Brass Each product will be delivered in a 40ft container carrying 20 tonnes of raw material of the metal types stated above. Initially, the container will only contain one type of compressed metal blocks but eventually GSE will be looking into sending crushed material of these scrap metals as they are easier to process for the manufacturer. (Trimiss Recycling, 2014) (Popular Mechanics, 2014) The manufacturer would use the shipped goods to prepare metal products for the respective industries they do business with. Price Scrap metal market prices fluctuate on daily basis and getting a better product without spending a significant amount is a concern among the Pakistani manufacturers. GSE believes that it will be able to deliver good quality scrap metal to its client at a very reasonable cost. The current cost for scrap metal per ton in Pakistan based on rate provided in AliBaba.com stands at an average of $350/ton, which would equal to a cost of about $7000 per 40ft/20 tons Page 18 of 28 Golden Spike Exports – Business Plan container. This is only the cost of acquiring raw scrap metal and this figure excludes, shipping, customs and insurance charges. The table below will explain the cost breakdown for GSE per 40ft/20ton container. Charges 20 tons of raw scrap @ $166/ton (Scrap Metal Prices and Auctions, 2014) Shipping charges (World Freight Rates, 2014) Insurance (World Freight Rates, 2014) Custom Charges Pakistan (1% of buying price) (Pakistan Customs, 2014) Delivery expense Pakistan Total Amount $3320 $2000 $850 $33.20 $280 $ 6,483.20 or $ 6550.00 approx. Based on these numbers, GSE will be selling its container at a price of $10,000 in Pakistan. The logic for this pricing is founded on the fact that competitors buy their scrap for a much higher price of $7,000 per container and after factoring in all the shipping, customs, insurance charges and business margin they would be selling a 40ft container for at least $11,000. Therefore, GSE’s difference in price of $1,000 will make them a logical choice for their clients. At the selling price of $10,000 per container, GSE’s profit margin will be $3,450 or 34.5%. Promotions Due to the nature of international business, GSE will adapt its promotion strategies based on the general business norms in Pakistan. GSE will be mindful of the cultural differences and the COM and CRM will lead the promotional activities themselves as they are well-versed in the Pakistani business culture. GSE believes that it will be spending the majority of its marketing budget on expenses like organizing conventions and entertaining its guests i.e. clients from the private sector and government officials to establish and strengthen business relations with them. The CRM will organize conventions in each city at its respective Chamber of Commerce. The conventions will take place in the following order: Year 1: Two mid-size conventions in Karachi and Lahore. Year 2: Two mid-size conventions in Islamabad, Lahore and one large-scale convention held at Avari Beach Luxury Hotel in Karachi. Year 3: Three large-sized conventions in Karachi, Lahore and Islamabad. Note: Contingent upon the expected growth, year 3’s number of conventions will become an ongoing tradition for GSE. In addition, GSE will have a website built and managed by an outsourced Information Technology company in Pakistan. The website would cater to both the Canadian and Pakistani market where potential clients can see what GSE does and how they can contact GSE for Page 19 of 28 Golden Spike Exports – Business Plan business. The website will also contain upcoming auction results for GSE’s bid for scrap metals and press releases from the COM and CRM. Specifically in Pakistan, the general public is still very reliant on print media, therefore GSE will be utilizing newspapers and other print media outlets as a part of their advertising campaign in Pakistan. For a detailed breakdown of the marketing budget, please refer to the table below. Figure 12: Marketing Budget Place & Distribution For the details on international shipping, logistics, distribution and placement, please refer to the Operations section above. Page 20 of 28 Golden Spike Exports – Business Plan Capital Structure and Feasibility Analysis Financial Structure & Decision-Making Power GSE will receive its initial financing through an equity investor, Zafar Bakhtawri, who will lend GSE $500,000. Mr. Bakhtawri is an old business partner of Mr. Malook and he will be financing this project at the guarantee of Mr. Malook. $300,000 of the fund provided will be a loan to GSE at 11% which is above the average Pakistani market interest rate and the loan will be paid back within a period of 10 years. The remaining $200,000 will be Mr. Bakhtawri’s equity stake in the company. Mr. Malook will also be providing office buildings in Lahore and Islamabad worth $150,000 for GSE’s operations, as his equity stake in the business. Figure 13: GSE Capital Structure Although Umar and Ali are not investing financially into the business, their time and effort will be considered as an equal share to the monetary financial contribution by Mr. Malook and Mr. Bakhtawri. However Umar and Ali will own 50% plus 1 share more than Mr. Malook and Mr. Bakhtawri and therefore will be the majority owners of the company. Page 21 of 28 Golden Spike Exports – Business Plan GSE’s Board of Directors will consist of Umar, Ali, Mr. Malook, Mr. Aslam and Mr. Bakhtawri as they will be discussing the company’s future direction and challenges in the board meetings, however, Umar and Ali as being the majority owners of the company will have the decision making rights over Mr. Malook, Mr. Aslam and Mr. Bakhtawri. Capital Budget As for starting the operations, GSE expects to spend $295,000 for its capital acquisitions which will consist of the following items: Buildings – As explained before, these are Mr. Malook’s equity contribution which will be going straight towards the company’s fixed assets. Equipment – This is computer and printers for the three offices of GSE in Pakistan. The equipment will be bought in Pakistan as it is much more affordable. Vehicles – These are two cars, each for $10,000 for the Canadian operations. Trucks – These are 5 long-haul trucks to be bought for $16,000 each in the first year as GSE’s fleet. Contingent on the expected business growth, the company will be an additional 4 trucks in Year 3. These trucks will be bought from Olx.com Furniture and Fixtures - $1,000 will be spent on furniture and fixtures for each of the offices in Pakistan. Note: The total capital expenditure for all these items except the buildings will be $145,000 and after adding the value of the office buildings worth $150,000, the total will come to $295,000 as stated in the capital budget above. Page 22 of 28 Golden Spike Exports – Business Plan Financial Projections Presented below are the figures that are GSE’s expected projections during the course of its initial five years. In 2015, GSE will be sending 75 containers per year, then it expects to grow that number by 50% in the next two years and 35% and 25% in year 4 and 5 respectively. The revenues will grow steadily due to the increase in the number of containers. In year 1, net income will be negative and GSE will break-even in year 2. The reason for increase in net income for the following years will be due to higher number of containers shipped and GSE managing its expenses. GSE will provide dividends to its investors starting from year 4 as the company believe it will have enough residual income to do so. Based on the projections, GSE is projecting a healthy cash flow that will increase steadily over the course of time. This is in part due to the fact that GSE does not release dividends till year 4. Therefore, they will have enough cash build-up to face and deal with an unexpected event. Critical Variables Due to the risky nature of the commodities market, a business like GSE would have some critical factors, out of which GSE believes the following are the most critical for GSE’s success or failure: 1. Number of containers sent every year 2. Increase or decrease in Cost of Goods Sold 3. The financial structure of the business (debt/equity ratio) GSE performed a sensitivity analysis using each of these critical variables to analyze the best and worst case scenarios for the company’s future. Required Return on Investment (ROI) Because GSE will be an extension of the manufacturing industry as it will be providing raw goods to the metal developers of Pakistan, it is likely due to the risky nature of business that that an investor would look for an above average return on their investment. Page 23 of 28 Golden Spike Exports – Business Plan Based on research, the average market return on investment is 28.9% as shown in the exhibit below (Tata Consultancy Services, 2012). Therefore, GSE will be looking for an ROI of 32% slightly above the industry average. Figure 14: Mean Expected ROI on Big Data by Industry Internal Rate of Return (IRR) GSE will be evaluating all the critical factors based on the figures and percentage they produce for the average 5 year income, net payback and the internal rate of return (IRR). In order for a scenario to be feasible, the IRR has to be higher than the required ROI for the business. However, in some cases even if the IRR is higher, GSE will take into account other factors and will choose against it. Financial Projections Based on Critical Variables The results are displayed in a table format for each scenario. Red are scenarios GSE will try to avoid as they produce undesirable results. Yellow represents the base case results. Green stands for exceptional and idealistic results. Page 24 of 28 Golden Spike Exports – Business Plan 1. Analysis Based on Number of Containers per Year As stated above in the critical variables analysis, GSE believes that the number of containers sent per year would be the most vital factor in terms of revenues generated by GSE. A sensitivity analysis was performed using this factor. The results are displayed in the table below: 2. Increase or Decrease in Cost of Goods Sold The second most impactful scenario towards GSE’s operations and revenues would be the price per container shipped. As GSE will be actively seeking to lock-in contracts with suppliers and reducing variable costs to secure in a price that resembles or is close to the projected prices per container in the Cost of Goods Sold Schedule for every year. Therefore, GSE has performed a sensitivity analysis in the range of 5-10% increase or decrease in cost of goods per container as shown below: 3. Financial structure of the business (debt/equity ratio) The final critical variable that GSE analyzed was the effect of shifts in the capital structure which impacted the IRR, Net Payback and Average 5-year Net Income. In this particular scenario the base case below is displayed in green as GSE believes it represents the best financial structure. Page 25 of 28 Golden Spike Exports – Business Plan Risk Management Even though GSE believes that based on its research, this venture is feasible, however, since the commodities market fluctuates regularly that makes the business environment very risky. GSE will ensure that it hedges these risks by: Locking-in future contracts with metal suppliers, shipping companies and potential buyers in Pakistan. Converting all the revenues from Pakistan into Canadian currency as the Pakistani rupee is very volatile. In a least desirable scenario, if the GSE is not on track to fulfill its targets and reach its expected potential, GSE will revaluate its operations and will cut down the least profitable streams to stay in business and provide return to its investors. If this strategy does not go as expected as well, then GSE will discontinue its operations and salvage all of its acquired assets to pay back its loan and its investors. Conclusion In conclusion, GSE believes that by year 5, based on their base case scenario, it will deliver a return on investment of 40% that is above the industry average of 28.9%. Even though, GSE will face a loss in its first year, the average net income for 5 years will be $276,662. This is due to having exponential growth in income through year 3 to year 5. Throughout the five years of business, GSE will have positive cash flows. GSE will release dividends to its investors in year 4 and 5. This is due to having enough cash accumulated for the first three years. GSE also understands its critical factors and how they affect the business and it will manage them by establishing a strong business relations with its partners by signing future contracts. Page 26 of 28 Golden Spike Exports – Business Plan Appendix As a supplement to the business plan, please refer to the attached excel file to view the financial projections of GSE. Page 27 of 28 Golden Spike Exports – Business Plan Bibliography National Trade & Transportation Facilitation Committee. (2012). National Highways of Pakistan. Retrieved from NTTFC: http://www.nttfc.org/maps/map-national-highways.jpg WageIndicator Foundation. (2014). Pay and Minimum Wage in Pakistan. Retrieved from Paycheck.pk: http://www.paycheck.pk/main/salary/minimum-wages/pay-and-minimum-pay/pay-and-wagein-pakistan Al-Jazeera. (2012, 02 15). Pakistani truckers' perilous journey. Retrieved from Al-Jazeera: http://www.aljazeera.com/programmes/riskingitall/2011/05/20115414525333804.html Asia Pacific Foundation of Canada. (2014). Canada's Merchandise Trade with Pakistan. Retrieved from Asia Pacific Foundation of Canada: http://www.asiapacific.ca/statistics/trade/bilateral-tradeasia-product/canadas-merchandise-trade-pakistan Glassdoor. (2014). Al-Fateh Ceramics Accounts Manager Salaries in Pakistan. Retrieved from Glassdoor: http://www.glassdoor.com/Salary/AL-Fateh-Ceramics-Salaries-E699824.htm Glassdoor. (2014). Drinkmore Plus Sales Manager Salaries in Pakistan. Retrieved from Glassdoor: http://www.glassdoor.com/Salary/Drinkmore-Plus-Salaries-E678128.htm Google Maps. (2014). Retrieved from Google Maps: https://www.google.ca/maps/dir/Karachi,+Pakistan/Lahore,+Pakistan/Islamabad,+Pakistan/@2 8.979738,61.2044826,5z/data=!3m1!4b1!4m20!4m19!1m5!1m1!1s0x3eb33e06651d4bbf:0x9cf 92f44555a0c23!2m2!1d67.0099388!2d24.8614622!1m5!1m1!1s0x39190483e58107d9:0xc23ab e6ccc7 Green Jeanne. (2013). Jeanne's Support for the 3 Ps: People, Planet and Profit. Retrieved from http://www.greenjeanne.com/people-planet-profit.html Greene, I. (2013, August 02). Piecing Together the Scrap Metal Industry. Retrieved from Huffington Post: http://www.huffingtonpost.com/ilana-greene/piecing-together-the-scrap_b_3686062.html Munir, I. (2010, 09 23). Pakistan’s Motorway, World’s First Motorway. Retrieved from http://irfanmunir.wordpress.com/2010/09/24/pakistans-motorway-worlds-first-motorway/ Pakistan Customs. (2014). Pakistan Customs and Tariffs Report 2014-15. Islamabad. Popular Mechanics. (2014). Car Crush Pile. Retrieved from http://media.popularmechanics.com/images/car-crush-pile-0407.jpg Recycling Council of British Columbia. (2014). Recycling Fact Sheets. Retrieved from Recycling Council of British Columbia: http://www.rcbc.ca/resources/additional-resources-links/recycling-factsheets Scrap Metal Prices and Auctions. (2014, 11). Retrieved from http://scrapmetalpricesandauctions.com/ Searoute Finder. (2014). Retrieved from http://www.searoutefinder.com/: http://www.searoutefinder.com/ Subohi, A. (2014, 10 13). Surge in metal scrap imports. Retrieved from Dawn News: http://www.dawn.com/news/1137563 Page 28 of 28 Golden Spike Exports – Business Plan Tata Consultancy Services. (2012). Return on Investment – Expectation by Industries. Retrieved from Tata Consultancy Services: http://sites.tcs.com/big-data-study/return-on-investment-in-big-data/ Trimiss Recycling. (2014). Types of scrap. Retrieved from Trimiss Recycling: http://trimiss.com/images/Aluminum,%20cast%20aluminum,%20copper.png World Freight Rates. (2014). Retrieved from http://worldfreightrates.com/freight