Procedural Guidelines

advertisement

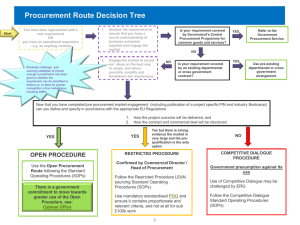

Revised 6/28/2010 RAPID RESPONSE TO CRISES AND EMERGENCIES: PROCEDURAL GUIDELINES INTRODUCTION 1. This note provides task teams with guidelines on streamlined procedures and processes applicable to emergency operations subject to OP/BP 8.00, covering the full project cycle of preparation, appraisal, approval and supervision. Since these guidelines are intended to support rapid Bank response to emergency situations, they should be applied uniformly across Regions and are, therefore, not subject to additional Region-specific requirements or guidelines. OPERATIONAL GUIDING PRINCIPLES 2. Speed, simplicity, and flexibility are key guiding principles for Bank engagement in emergency-related activities. Greater speed requires the Bank to apply higher levels of delegation and risk tolerance in the processing and initiation of emergency assistance operations than in standard Bank operations. To mitigate such risks, the Bank would need to intensify its supervision efforts through frequent missions and ex-post reviews and to address any performance issues identified. This should be accompanied by a systematic effort to assess and support the capacity of counterpart agencies. A. Initiation and Planning of Bank Emergency Assistance 3. Internal Communications. The Regional Vice President (RVP) communicates with the Managing Director (MD) of the affected Region regarding the nature and scope of the emergency. The Chief Financial Officer (CFO)1 and VP (OPCS) are also informed and, depending on the nature of the emergency, the Conflict Prevention and Reconstruction Unit (CPR), Fragile States Unit (OPCFC) and the Hazard Management Unit. In consultation with the affected Region(s), the MD may decide to declare a “corporate emergency” in situations where (a) the Bank’s response to the emergency will require exceptional resources—technical, financial, or institutional—that cannot easily be mobilized by country departments using regular procedures; and/or (b) the Bank’s potential role in the emergency involves a degree of reputational risk which argues for a corporate review/response. The MD’s decision is communicated to the relevant departments internally. 4. Establishment of a Rapid Response Committee (RRC). RRCs are not required in response to all emergencies. In the case of corporate emergencies, however, an RRC is immediately convened by the responsible MD. In the case of other emergencies, the Country Director (CD) of the country concerned consults with the RVP on the need for establishing the RRC. Depending on the nature of the emergency and/or the extent to which inter-departmental resource transfers are necessary, the RVP decides whether to convene an RRC and, if convened, whether it will be chaired by the RVP or CD. Examples of non-corporate emergencies in which convening an RRC has proven adequate include (i) natural disasters of national or regional dimensions, (ii) the first operation prepared in a complex post-conflict setting, (iii) operations in which cross-regional knowledge and expertise is required, and (iv) operations requiring exceptions to Bank policies. 1 In line with streamlined procedures, the country director consults early in the preparation process with the CFO’s office on the availability of adequate financial resources. 5. The role of the RRC, if convened, is to (a) ensure timely decisions on the Bank’s strategy and response to an emergency, including its involvement in any immediate damage/needs assessment and its role vis-à-vis other donors; (b) advise on the mix of instruments to be used; (c) ensure adequate institutional response from Bank teams/departments; and (d) resolve procedural bottlenecks that could cause delays in the preparation, appraisal, approval, and implementation of emergency operations. The RRC, if convened, may also assist in identifying staff with appropriate skills and experience to prepare and implement the Bank’s response and discuss the need for supplementing field-based staffing capacity through the rapid redeployment of sector/operational staff, including from the callable roster.2 Members of the RRC, if convened, are expected to participate in decision meetings for the review of emergency operations being processed under OP/BP 8.00 and in upstream Bankwide reviews by the Regional Operations Committee (ROC) of Interim Strategy Notes (ISNs) (where an RRC exists at the time of such review). 6. RRC Membership. The membership of the RRC would normally include representatives from the country management unit, the Regional vice presidency, a designated emergency lawyer, a designated emergency procurement specialist, a designated safeguards coordinator, and representatives from Human Resources (HR), LOA, Resources Management, OPCFC and/or the Hazard Management Team, and the Region’s Operations Quality staff. Depending on the nature of the emergency and the issues to be addressed, the RRC could also include as members other sector, Regional and/or corporate departments including TFO and FM. 7. Selection of Instruments. OP 8.00 offers Bank teams a number of possible options for responding to emergencies. These may include: (a) non-lending support such as provision of assistance for damage/needs assessment, convening donor meetings and technical assistance; and (b) lending/financial support through a combination of (a) new lending via an Emergency Recovery Loan (ERL) or credit (ERC); (b) restructuring, or reallocation within existing projects with or without additional financing; (c) supplemental development policy loans or credits;2 (d) in exceptional cases, transfers from the surplus; (e) mobilization of donor assistance including establishment of trust funds; and (f) accessing grants from the Bank’s programmatic post-conflict, LICUS and other trust funds.3 B. Processing and Approval of Emergency Operations4 8. Country teams should notify OPCS of their intention to apply the new policy to the processing of upcoming emergency operations. 9. The policy on Rapid Response to Crises and Emergencies allows for accelerated preparation and processing of emergency operations. For simple new emergency recovery loans, 2 3 4 Development Policy Lending (DPL) provides quick access to fast-disbursing resources for countries that are approaching or are in a crisis with substantial structural and social dimensions, as well as post-conflict countries. The processing of DPLs is subject to OP/BP, Development Policy Lending. OP 8.00 also allows for the use of PPAs for start-up activities up to a maximum of US$ 5 million. PPAs may be used to finance urgently needed rehabilitation work and/or the procurement of essential goods and technical services, some of which may be necessary to enable the borrower to assume responsibility for implementation of follow-on emergency projects. Detailed processing steps and corresponding turnaround times are provided in the attached Annex F. 2 task teams should aim to have projects approved within a period of 10 weeks from initiation of project discussion with government. Unless recipient governments have complex and lengthy ratification requirements, emergency operations should be signed and become effective following Board approval, signing of the legal agreements and receipt by the Bank of a satisfactory legal opinion. 10. The rapid processing of emergency operations is accelerated through the following streamlined procedures: (a) reducing review requirements to a single decision review meeting which authorizes negotiations based on the submission of a complete negotiations package, eliminating the need for sequential clearances; (b) assisting borrowers in satisfying all requirements in the form of legal documentation for signature and first disbursements at the point of negotiations; (c) applying shortened turnaround standards; (d) using simplified documentation templates; and (e) applying simplified procedures for assessment of FM and procurement capacity of counterpart agencies, and designing the appropriate simplified arrangements and application of relevant risk mitigation measures. 11. Project restructuring/additional financing. Emergency response activities may be financed through the restructuring of ongoing projects, with or without additional financing. Any ongoing investment loan may be restructured to finance emergency response activities as provided in the OpMemo - Restructuring: New Procedures (Revised) of November 18, 2009, and in Processing Restructuring of Investment Projects: Guidelines for Staff of November, 2009, Revised in February, 2010. Additional Financing may be used to support emergency response activities under any ongoing investment loan as provided in OP/BP 13.20, Additional Financing, and Processing Additional Financing: Guidance to Staff of November 18, 2009, Revised June 2010. Attachment 3 of the Processing Additional Financing: Guidance to Staff describes required processing steps and accelerated ERL business standards. 1. Processing of new Emergency Loans:5 12. Identification and task team mobilization. Following consultations with the borrower, the TL obtains CD’s agreement on a proposed project outline and budget, and task team members are appropriately identified. Task teams would be supported by Regional designated emergency staff from Legal, FM, PR, LOA, and Safeguards and by designated staff from the anchor unit who would be copied on all project-related correspondence in case they need to provide additional policy, institutional, and technical back up.6 5 6 In certain situations, the country’s ISN may provide for all projects in the Bank’s portfolio to be subject to OP/BP 8.00. Otherwise OP/BP 8.00 would only apply to projects that are intended to deliver rapid assistance in response to a natural or man-made emergency or crisis, including projects financed through multidonor trust funds. Designated emergency staff are identified by Regional and anchor units based on staff knowledge of crosscountry and cross-regional precedents and past involvement. The Callable Roster will be managed by the Fragile States Unit in OPCS. 3 13. ISDS and PID. TL prepares ISDS and PID and these are approved by the CD and Safeguards Coordinator, respectively. 14. Risk Assessment. Starting July 1, 2010, documentation for all IL operations is required to include an Operational Risk Assessment Framework (ORAF). The purpose of the initial ORAF is to establish a framework for identifying and assessing risks through all stages of project processing, supervision and implementation completion review. Unlike other investment operations, however, emergency operations are always processed on a fast track whatever risk levels are identified in the ORAF. Appropriate measures are included in the project design and appropriate covenants in the legal agreements to address the risks identified. 15. Combined Identification-Preparation-Appraisal Mission. Based on the PID, the TT assists the borrower in preparing the new project. FM and PR specialists complete rapid assessments of procurement and financial management capacity of counterpart agency. 7 The results of the appraisal are summarized in an Emergency Project Paper (EPP), which includes an ORAF, following the EPP template and in a Simplified six-month Procurement Plan (SPP).8 16. Draft Negotiations Package. Based on the EPP, the lawyer drafts the legal agreement. This is shared with FM, PR, and LOA for their respective inputs and a draft negotiations package is put together consisting of the following documentation: (a) a draft EPP, (b) a draft legal agreement; (c) a draft disbursement letter; (d) an SPP and, (e) an updated ISDS. 17. The Decision Meeting. The negotiations package is submitted through the CD for a decision meeting which is held within 3 working days from the distribution of the package. The decision meeting is chaired by the RVP or his/her designee and includes as members representatives from the country management unit, Regional designated emergency staff (Legal, FM, PR, LOA, ILRT and Safeguards), OPCFC and/or the Hazard Management Team, and the Region’s Operations Quality staff. If an RRC is in existence, its members will also take part in the decision meeting, if they are not already included. The minutes of the decision meeting are recorded confirming completion of appraisal and authorizing negotiations. The minutes of the decision meeting would include a record of comments/clearances and, as appropriate, conditions for concluding negotiations. 18. When the negotiations package is finalized taking into account any recorded conditions, it is submitted to the borrower with an invitation to negotiate. SECBO is informed in writing of the schedule of negotiations. Cleared PID and ISDS are sent to the InfoShop. 19. Negotiations. Negotiations are held and minutes of negotiations are prepared and approved by the borrower. During negotiations, the Bank tries to (a) obtain from the borrower the Authorized 7 8 Financial Management and Procurement Assessments. The requirement for speed in emergency settings necessitates the Bank to undertake financial management and procurement assessments and project design actions in a streamlined fashion focusing on identifying weaknesses and risks and establishing the appropriate mitigation measures. In situations where designated FM and procurement staff are not able to take part in project appraisal, full-fledged financial management and procurement assessments should be replaced with rapid review of capacity using simplified questionnaires. In these situations, task teams are provided with adequate support from the center through close advice and adequate tool kits to facilitate their function. Simplified Procurement Plans (SPPs). For emergency projects, initial procurement plans should be developed for a maximum of 6 months. The information reflected in these plans should be limited to the following: object of the contract; estimated cost; procurement method; estimated date of bid submission; and Bank review (prior or post). 4 Signature Letter; (b) arrange for signature of Statutory Committee Report/Recommendation; and (c) discuss with the borrower the disbursement letter and the format of the legal opinion. 20. Board approval. The Board package is shared with the team members for consistency and it is submitted by the TL through the RVP to SECBO for streamlined circulation to the Executive Directors for Board approval.9 21. Signing and effectiveness. Once approved, a notification of approval is prepared by the TL and sent to the borrower and arrangements are made for signature of the legal documents. Following early receipt of a satisfactory legal opinion, and unless there are additional conditions of effectiveness, including those of the borrower such as for parliamentary approval or ratification, the Legal Agreement is declared effective immediately following its signature.10 C. Disbursement, Implementation, and Supervision 22. The timely delivery of emergency assistance, once projects have been approved, is facilitated through (a) reduced turnaround times for processing of Withdrawal Applications; (b) flexible Designated Account provisions; (c) higher prior review thresholds for procurement actions; (d) higher delegated authority to designated PR staff for clearing exceptions to standard thresholds for direct payments, bidding times, single source etc; and (e) reducing turnaround time standards for no objection letters, replenishments, and other Bank actions. Input and turnaround standards for the establishment and activation of trust funds are also significantly reduced. 1. Financial management 23. Bank staff should follow the “Financial Management Practices in World Bank-Financed Investment Operations,” for detailed guidance on FM matters.11 2. Disbursement 24. OP/BP 12.00, Disbursement,12 provides the flexibility to provide advances to Designated Accounts based on the needs of a project with no arbitrary fixed ceiling (in the past advances were normally limited to a maximum of 10 percent of the Bank’s financing). The TL, in consultation with LOA, will establish the ceiling or limit of the Designated Account taking into consideration the planned program expenditures, potential delays or difficulties in banking transfers in emergency situations, communication difficulties in working in remote or inaccessible areas and other factors in order to ensure that sufficient liquidity is secured at all times to enable smooth project implementation.13 9 10 11 12 13 Projects financed under multidonor trust funds and which do no require Board approval are approved at the level of the RVP. The notification of effectiveness is prepared by the TTL and cleared by the lawyer for transmission through the Country Office. See the manual Financial Management Practices in World Bank-Financed Investment Operations, November 3, 2005, Washington, DC: World Bank, Financial Management Sector Board. Staff should refer to Disbursement Guidelines and Letter for guidance on revised disbursement procedures. When preparing emergency operations, TLs are advised to involve designated Legal, FM, PR, Safeguards and LOA specialists at the early stage of project design since this will help resolve many of the issues as they arise, avoiding delays in later stages of project development. 5 25. Withdrawal applications. In order to expedite disbursements for emergency operations, the Bank will give priority to the processing of Withdrawal Applications (WAs) for designated emergency operations. The revised turnaround standards applicable to emergency operations reduce the processing time on WAs from the standard 5 working days to one working day. The submission through country offices of faxed/scanned WAs is also mainstreamed as a standard in emergency situations.14 In order to avoid delays in the processing of WAs, and where borrower capacity is weak, field-based Bank staff should assist in the review of WAs to confirm accuracy of information submitted.15 As relevant, Bank teams could also provide assistance to borrowers in utilizing systems available for direct electronic submissions. 26. Disbursement methods. The disbursement methods used should be the most appropriate for the implementation arrangements selected. This could include (a) advances to Designated Accounts (b) Direct Payments to suppliers or contractors (c) reimbursement to the government for expenditures that they have made from their own resources, including expenditures allowed for retroactive financing, and (d) Special Commitments. In emergency situations the thresholds for Direct Payments and Special Commitments may be set at lower levels than for regular projects. This may be particularly relevant in situations where vendors do not have confidence in the ability of the borrower to pay. Where UN Agencies are the implementing agency for emergency operations, there are special disbursement procedures which allow for a “Blanket Withdrawal Application” procedure.16 27. Financing eligibility17. OP/BP 8.00 support task teams in taking full advantage of the Bank’s eligibility policy to finance cash and food benefits, in the context of transitional safety net activities, when these are necessary for meeting the development objectives of an emergency operation. Additional flexibilities introduced in OP/BP 8.00 include the following: • Emergency operations could finance up to 100 percent of the expenditures needed to meet the development objectives of such operations, including recurrent expenditures, local costs, and taxes. • Emergency operations could finance retroactive expenditures up to 40 percent of the loan amount for payments made by the borrower not more than 12 months prior to the expected dates of signing the legal documents. 3. Procurement procedures 28. In emergency situations, procurement actions need to be facilitated through higher levels of delegation to the borrower and, within the Bank, through the delegation by RPMs of higher levels of approval authority to Bank Procurement Specialists on task teams to allow for the use of direct contracting, shopping, and simpler procurement methods for the delivery of urgently needed services 14 15 16 17 LOA accepts faxed copies only upon confirmation from a field-based Bank staff member that the faxed copies are identical to the original WA received. It is, therefore, the responsibility of the TL to ensure that a fieldbased staff is designated and trained to receive and log WAs, review them for any inconsistencies, fax them and ensure that originals are subsequently submitted through pouch. A checklist is available for the use of field-based staff to review WAs to ensure completion and accuracy of information submitted. Details of the “Blanket Withdrawal Application” procedure are available from LOA. Bank teams should refer to OP/BP 6.00, Bank Financing, which defines the expenditure eligibility framework for Bank projects. 6 and goods. Following are examples of procurement actions that are essential for facilitating the Bank’s immediate and rapid response to emergencies and for which Procurement Specialists working on emergency projects would be delegated higher approval authority:18 • using rapid procurement methods (direct contracting or simple shopping) for the procurement of services of qualified UN agencies/programs and/or suppliers (for goods) and civil works contractors already mobilized and working in emergency areas (for works); • using single sourcing or Consultant’s Qualification Selection (CQS) for contracting firms already working in the area and which have a proven track record for the provision of technical assistance; • extending contracts issued under existing projects for similar activities by increasing their corresponding contract amounts; • where alternative arrangements are not available, using Force Account for delivery of services directly related to the emergency; • using NCB, accelerated bidding and streamlined procedures and applying Bank provisions on elimination, as necessary, of bid securities. 29. In emergency situations, Bank teams should also actively support counterpart agencies at various stages of procurement, including in their preparation of Terms of Reference, Requests for Proposals, bidding documents, and drafting of shortlists. The Bank could also provide borrowers with a long list of pre-qualified international procurement agents. 30. As in other areas of project implementation, issuance of no-objection letters for emergencyrelated procurement actions would be subject to corporate-wide shorter turnaround time standards. 31. The simplification and delegation included in the design of emergency operations aimed at speeding-up implementation may represent additional risks, which require additional Bank supervision efforts. Therefore, Bank field supervision and procurement post-review missions should take place every 6 or 4 months of project implementation, depending on the level of risk assessed. In situations where Bank staff may face difficulties accessing projects, Bank supervision could be supported with the hiring of Monitoring Agents using simplified procurement methods. 32. Outsourcing. In situations where the capacity of the government is very weak, Bank teams should be able to assist the borrower in outsourcing procurement actions to UN agencies, private procurement agents, NGOs and/or consulting firms. In considering these options, Bank staff should take into account the importance of having in place arrangements for transferring knowledge and expertise to local counterpart agencies. 33. Procurement and project management agents. The Bank (OPCPR) will maintain a list of pre-qualified procurement and project management agents with the ability to rapidly deploy to 18 Approval of simplified procurement methods would be limited to the immediate aftermath of an emergency and until such time that it is possible to use regular procurement procedures without compromising the timely delivery of assistance. 7 emergency areas. Borrowers with weak capacity may access companies from this list under appropriate authorized single source arrangements.19 D. Safeguards 34. Ensuring due diligence in managing potential risks while recognizing the emergency nature of the proposed emergency operations and the need for providing immediate assistance will remain the primary objective of the Bank’s approach to managing environmental and social safeguards in emergencies. In line with this objective and in order to facilitate a rapid response, task teams would be expected to adopt, as with procurement, principles of greater delegation, speed, simplicity and flexibility in applying relevant safeguard policies. The following guidelines should enable task teams to strike the appropriate balance between speed and risks with regards to safeguards: • Bank safeguard specialists should be involved in the preparation and implementation of emergency projects and assist task teams in identifying all safeguard risks—including both the risks of action as well as the risks of inaction.20 • Bank teams should define upfront the approach and principles to be followed to ensure duediligence in managing potential adverse environmental and social impacts and risks. • Bank teams should develop an Environmental and Social Screening and Assessment Framework (ESSAF) for the proposed operation. The ESSAF would provide guidance on the approach to be taken during implementation for the selection and design of subprojects/proposed investments and the planning of mitigation measures, including consultation and disclosure requirements, to ensure due diligence and facilitate consistent treatment of environmental and social issues by all participating development partners. • Task teams should adopt a sequenced approach that would consist of the following: (a) during the initial 2-4 months of the response period, the Bank would support emergency actions to assist affected persons while the government prepares the environmental and social assessment and designs a strategy to reduce possible environment and social impacts; (b) at the second stage (possibly up to one year), transitional safeguards measures would be adopted if necessary to achieve the project objectives; and (c) finally, after one year, the regular safeguard procedures would be implemented, but only after the emergency needs are fully addressed. Such an approach would allow low-risk activities to move ahead while necessary assessments and actions are undertaken to address high-risk environmental and social safeguards issues. • If any waivers or exemptions from OP/BP 8.00 requirements are needed for successful and timely implementation of the proposed due diligence approach, the TL should seek the approval of the decision meeting prior to negotiations.21 19 20 In certain situations, if the reputational risk to the Bank from delays in implementation is too high, the Bank may insist that the Borrower use a project management agent. This should include an upstream involvement in the earliest development of the project concept so that the TL can complete the draft ISDS accurately and concisely. 8 E. Establishment of New Trust Funds/Activation of Child Trust Funds 35. Trust funds established to finance emergency operations would be tagged to enable their management through streamlined procedures and reduced turnaround time standards, as described in the attached Annex. The main principle applied to setting up and activating these trust funds is that of parallel, as opposed to sequential, review/clearance actions, while continuing to adhere to requisite Bank controls. At the same time, the relevant Task Leaders (TLs) for such trust funds would be expected to be proactive in consulting early and often with key staff, who can provide guidance on the Bank’s corporate requirements.22 36. Donor-financed trust funds: If the trust fund will be funded in whole, or in part, from donor funds, the TL needs to concurrently: • Prepare an Initiating Brief for a Trust Fund (IBTF)23 and complete the associated risk assessment matrix. o The IBTF is prepared based on an authorization of project preparation through the Regional management and confirmation of donor interest in providing funding. An AIS/SAP project/TF definition code is set up which is to be reflected in the IBTF. The VPU’s TF Coordinator helps TLs develop any proposal for a trust fund and address the issues raised on the IBTF form. The TF Coordinator clears and sends the draft IBTF and risk matrix to TFO’s Policy Team for corporate clearance. o TFO coordinates clearance of the IBTF by relevant departments including ACTTF, LEG, CSRRM, and LOA.24 At this stage, ACTTF assigns the TF account number of the main nondisbursing account. Upon TFO clearance, the IBTF is approved by the Country Director, and, when deemed necessary, by the Vice President concerned. • Request Legal to prepare a draft Administration Agreement between the Bank and the donor(s), setting out the terms under which their funds would be accepted. It is essential that this draft reflect the terms of the IBTF, since the latter (once cleared) represents the Bank’s corporate view of the arrangements being put in place. • Once LEG has prepared the draft Administration Agreement, the TL submits the Administration Agreement to ACTTF’s Trust Fund Accounting Clearance Team (TACT) for their clearance. TACT clearance would be provided within 2 working days from the date of receipt of the draft. 21 22 23 24 Previous good practice examples where countrywide frameworks were developed, at the very beginning of the emergency response effort with help from the safeguards team, should be considered for potential value in streamlining the project-specific processes and reducing transaction costs on each project. TLs are advised to prepare IBTFs in close consultation with VPU Trust Fund Coordinator (TFC) and staff in Trust Fund Operations Department (TFO) and ACTTF. A simplified IBTF template will be developed to be used for rapid establishment of trust funds intended for financing emergency operations. To ensure rapid clearance of the IBTF, TFO would convene a review meeting of the IBTF among TFO, ACTTF, LEG, LOA, and CSRRM from which the consolidated set of written comments would be prepared. The task team would make itself available for such a meeting so that issues that emerge can be appropriately addressed in a timely fashion. On this basis, TFO could clear the IBTF within 4 business days. 9 37. In emergency situations, Grant Agreements may be signed for the full trust fund amount even prior to the actual receipt by the Bank of all committed donor contributions. In these situations, the Grant Agreement will include a clause that the Bank would only disburse against the grant proceeds to the extent that an amount adequate to cover such disbursements has been paid into the trust fund. 38. If trust funds are to be financed in whole, or in part, from the Bank’s Net Income or Surplus, the Executive Directors must recommend and the Board of Governors must subsequently approve the use of such funds. In these situations, the Board package would be subject to the same review process as other Bank-financed emergency operations and the clearance by the ACTTF would be obtained at the decision review meeting. The TL/CMU coordinate with the Financial Reporting and Analysis (ACTFA), Corporate Finance (SFRCF), and Treasury (TRE) departments to ensure that early preparations are made to have the funds transferred from Surplus/Net Income to the trust fund once Board approval is given. 39. Activation of trust fund accounts and allocations of funds to Child Trust Funds: In order for ACTTF to activate a new Trust Fund, IBRD or the donor’s, funds must be available. This is accomplished through the deposit of one or more donor contributions, or the transfer of IBRD funds, into the main TF account. Procedures for the transfer of funds from donors and/or Treasury are detailed in the attached Annex. 40. In order to charge expenditures to a trust fund, disbursing accounts (currently called “child accounts”) will need to be set up under the overall main account. To set up such accounts, the TL needs to concurrently (a) submit to TACT a request to create a disbursing fund, and (b) arrange for the draft legal agreement to be submitted to TACT and LOA for clearance. The activation by TACT of the main and child account(s) is done based on a receipt of the signed Administration Agreement(s) and Grant Agreement(s),25 respectively, as well as any and all Attachments/Annexes referred to in those Agreements, including copies of any relevant Board of Governors and/or Executive Directors approved Resolutions (certified by Secretary's). The transfer of funds from the main trust fund to each individual disbursing child trust fund under the main trust fund is processed through a request from the TL to the Program Accountant.26 To ensure rapid availability of funds, the TL should simultaneously submit the signed agreements and the request for transfer. E. HR Policies and Procedures 41. Rapid and efficient Bank response to emergency situations is often contingent on the experience of task teams and their knowledge of Bank policies and procedures. It is, therefore, critical for the Bank to ensure adequate staffing support to emergency operations. This will be achieved through the timely redeployment to Bank teams of experienced staff, 27 the involvement in project preparation and implementation of experienced designated emergency staff, and drawing on 25 26 27 TACT accepts scanned copies of signed documents. The name of the Program Accountant for any given fund can be found in the contacts section under that trust fund in the web-based My Trust Funds system or in the SAP Master Data for the trust fund under the “Contacts” tab For “corporate emergencies,” the OC will ensure timely redeployments of experienced staff providing adequate backfill for sending departments. 10 expertise available through the callable roster.28 In emergency situations, HR related transactions and processes will be facilitated through the following: • Callable roster. Redeployments from the callable roster, and appropriate backfill arrangements, are agreed and recorded at the RRC meetings. • Recruitment and redeployment of consultants/staff. Contracts related to emergency operations will be flagged for priority processing, reduced from 5 to 2 working days. The waiting period between SAP approval and actual beginning of work is also reduced from 5 to 2 working days. Contracts of consultants working on emergency projects could also be processed through the end of fiscal year freeze. • Salary Scales. In emergency situations where local pay salaries may become obsolete, the Bank would apply flexibility in adopting adjusted salary scales based on available market information and until such time that the local market stabilizes and HRSCM issues a revised schedule. • Exceptional STC extensions. In emergency situations that may occur during the window in the fiscal year when consultants start maxing out on the 150 days, and when all other reasonable alternatives have been exhausted, STC contacts could be extended on a caseto-case basis to exceed the 150-day limit. Trust fund bridge financing. An interim budget and reimbursement agreement may be set up to allow for bridge financing for the hiring of consultants until trust funds are set up and activated. 28 Task Teams should refer to the Board Paper entitled Strengthening the World Bank’s Rapid Response and Long-Term Engagement in Fragile States (SecM2007-0018), January 19, 2007, for details on the three-tier approach for strengthening the Bank’s staffing and organizational support to improve Bank response to emergency situations. 11 ANNEX PROCESSING STEPS FOR EMERGENCY OPERATIONS Note: The processing steps in this annex apply not only to emergency operations financed through grants and loans, but also to those financed in part or in full through trust funds. For self-standing trust funds, EPPs would be prepared as the basis for completing the IBTF and subsequent Administrative and Grant Agreements and, as relevant, the Decision Review Meeting would serve as an opportunity for Bank teams to obtain agreement on parameters of the trust fund. Board approval for operations financed through Trust Funds would only apply when the operation is financed in part or in full through IDA/IBRD or surplus/net income. Unless borrower actions are required for completion of transactions, service standards are here provided for final clearance, including resolution of any outstanding issues with the task teams. In the vast majority of cases, these targets should be adhered to and not be subject to Regional variations. A. Emergency Recovery Loan—Identification to Effectiveness Step Guidelines Primary Responsibility Identification/ approval of proposal TL obtains the agreement of the country director (CD) on the project’s outline and budget and informs OPCS of the team’s intention to launch a new emergency operation. At the same time, the TL alerts Regional designated emergency staff (FM, PR, Legal, LOA and Safeguards).1i1 TL prepares a draft Project Information Document (PID) and a draft Integrated Safeguards Data Sheet (ISDS), both of which are updated throughout the process. During a combined preparation-appraisal mission, the task team (TT) assists the borrower in preparing the new project. The TT prepares the EPP with the relevant annexes on procurement (including a SPP), financial management, and safeguards.3 3 CD/TL The TL provides the designated Lawyer with a copy of the EPP for drafting the Legal Agreement and the safeguards coordinator with a copy of the ISDS for confirming EA category and clearance authority. The TL shares a copy of the EPP and the draft Legal Agreement with assigned staff from PR, FM, and LOA for their inputs and preparation of necessary documentation including the Lawyer Safeguards Coordinator 2 PR FM LOA 2 PID, ISDS Combined preparation/ appraisal mission Drafting of Emergency Project Paper (EPP) and Simplified Procurement Plan (SPP)22 Drafting of Legal Agreement Review by safeguards coordinator Review of draft Legal Agreement and EPP by PR, FM and LOA. 1 2 3 Turnaround Time (working days) TL TL/TT TL/TT Regional and designated emergency staff from the anchor units will be copied on all project-related correspondence and documentation A simplified emergency procurement plan template will be used covering the first six months of operation and will be replaced with a full procurement plan within the shortest time practicable EPP template—follows the structure of APP/PP. 12 ANNEX Finalization of review package Submission of review package to CD Decision Meeting Circulation of minutes of meeting Finalization of negotiations package Submission of PID and ISDS to Infoshop Invitation to negotiate Negotiations 4 5 disbursement letter and procurement provisions of Legal Agreement.4 The lawyer finalizes the package based on inputs from PR, FM, and LOA. When TL determines that the information reflected in project documents (draft EPP, draft Legal Agreement, SPP, and draft Disbursement Letter) forms a sufficient basis to enter into negotiations, the TL submits the entire package to the CD for a formal Decision Meeting. The RVP or his/her designee convenes a decision meeting to review the package. Unless the meeting concludes that the project is not ready for further processing, the decision meeting authorizes the TL to proceed with negotiations with the borrower. Minutes of the meeting record clearances provided by FM, PR and LOA and any conditions for agreement with borrower.5 TL clears with the chair and circulates minutes of meeting on a no objection basis. Lawyer 1 TL CD Within 3 days of circulation of documents TL Objections submitted within 1day Within 3 days from meeting, unless additional work with borrower is required Based on the Decision Meeting’s recommendations, the TL works closely with the lawyer, Finance Officer and fiduciary staff to finalize the negotiations package, including a revised EPP, draft legal documents and the disbursement letter, ISDS, and PID. TL submits PID and ISDS to Infoshop TT and lawyer TL sends the negotiations package to the borrower with an invitation to negotiate and informs SECBO in writing of the schedule Draft Legal Agreements are agreed and minutes of negotiations are signed. TL TL At negotiations, the TL also tries to (a) obtain from the borrower the authorization of signature, (b) arrange for signature of Statutory Committee TL If designated emergency lawyer and procurement and financial specialists are not taking part in the appraisal, they would be closely consulted on the content of the documentation prepared. For emergency operations, project-specific conditions of effectiveness should be avoided 13 ANNEX Finalize Board package Board approval Notification of approval Signing Notification of effectiveness TL and lawyer finalize the Board package based on minutes of negotiations. RVP (or CD, where delegated) submits Board package to SECBO for Board approval on a streamlined basis. TL requests ACTTF to generate information on status of borrower’s services payments. TL prepares a notification of approval and sends it to the borrower. TL arranges for CD/borrower signature of legal documents, including the legal opinion. If there are no additional conditions of effectiveness, a notice of effectiveness is prepared and signed by the CD. If there are additional conditions for effectiveness, the TL monitors progress toward them and submits to the designated lawyer the effectiveness package including evidence of compliance with conditions. Once the lawyer clears the effectiveness package, the TL prepares for the CD’s signature a letter confirming acceptance of the required evidence of compliance and declares the Legal Agreement effective. The notice is copied to the FM. 14 Report/Recomm endation; and (c) discuss with the borrower the format of the legal opinion. TL also obtains from borrower information about the Designated Account information. TL/lawyer 2 RVP’s (or CD’s) office Documents are sent to SECBO 10 days before Board TL 1 day after Board date 1 Same day as signature of legal docs TL/CD CD’s office Lawyer TL/CD Lawyer Clearance of compliance evidence given within 2 days of submission by TL. ANNEX Note: Unless borrower actions are required for completion of transactions, service standards are here provided for final clearance, including resolution of any outstanding issues with the task teams. In the vast majority of cases, these targets should be adhered to and not be subject to Regional variations. C. Emergency Operations—Disbursement, Implementation, and Supervision Action Primary Responsibility Loans/Grants Clearance of Grant Agreements Processing of withdrawal applications Procurement No-objection Letters Trust Funds6 Clearance of draft IBTF Clearance of Administrative Agreement with donor418 Creation of Child Trust Fund/Comment on Grant Agreement Activation of trust fund Funds reflected in Loan Accounting System Human Resources Issuance of contracts Waiting period between SAP and contract signing 6 7 8 9 Turnaround Time (working days) LOA LOA 1 1 PAS/RVP 1-3 TFO407 ACTTF ACTTF 4 2 2 days from receipt of document + request to create Child Trust Fund form 29 1 ACTTF ACTTF 2 2 Assuming there are no exceptional issues that would require special attention, the whole process of establishing and activating trust funds should be accomplished within 12-14 business days. Through a single meeting with ACTTF, LEG, CSRRM and LOA. This assumes that there would be no issues of donor conditionality for providing funds. This is important because resolution of any issues of donor conditionality is likely to significantly delay clearance process. This assumes that the TL of the main trust fund will forward to TACT copies of the fully cleared and signed legal agreements and all attachments, and will request the activation and authorize the program account to allocate funds simultaneously. 15