What is a Recession?

advertisement

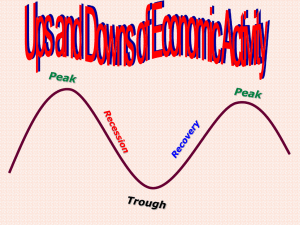

What is a Recession? Use the next three paragraphs to complete the following ON LINED PAPER IN YOUR NOTES SECTION under the heading “What is a Recession?”: 1. What is a recession? What factors does it include? Answer in a complete sentence. 2. How is a depression different from a recession? Complete sentence. 3. Use paragraph two to create a chart that shows how a recession can occur AND become a cycle (this could take a number of different forms and the second part might take some thought). Start with a good economy and go from there. A recession is a period of time when economic activity slows down [economy: production, distribution, and consumption of a community’s resources]. It’s similar to a depression which is a particularly long or severe recession. During a recession, people spend less, businesses make less money, unemployment goes up, and the stock market slows down. The reason all this happens at once is because each of these factors is dependent on the others. To find out why, let's take a look at how the economy works. Suppose everything is going well. People are feeling good about the future and buying a great deal. Maybe they're buying too much, and they go into debt. Or maybe companies are selling so much that they make too many products—more than they can sell. So the companies start losing money. People hear about this and lose confidence. They buy less. This hurts companies even more, so they start cutting jobs. Unemployment goes up, and people have less money to spend. As companies weaken, people become nervous and less willing to invest in them by buying their stock. Get the picture? In a recession, everything is connected—and that can be good news. You may have noticed that a lot of stores have been having big sales. That's because they're trying to get more business from customers who have been nervous about spending their money. Companies hope that lower prices will lead to more sales. This higher demand will lead to more production, which means that there will be more jobs. That's how recessions end. Did The Great Recession Bring Back The 1930s? by MARILYN GEEWAX July 11, 2012 The long economic downturn that began in late 2007 came to be known at the Great Recession –- the worst period since the Great Depression of the 1930s. Even though both events were momentous enough to earn the word "great" as a modifier, they really are not comparable, according to recent research by economist Mark Vaughan, a fellow at the Weidenbaum Center on the Economy at Washington University in St. Louis. EnlargeAP Thousands of unemployed people wait outside the State Labor Bureau in New York City to register for federal relief jobs in 1933. "It's now clear the Great Recession was the worst downturn of our lifetime — the worst since the Great Depression," Vaughan said. "But in terms of human suffering, it pales in magnitude" with the 1930s. The Great Depression was painful in ways we can scarcely imagine now because we have grown so accustomed to having a government-funded safety net, he said. For example, the unemployment rate hit a peak of 10 percent in October 2009, but Congress provided those laid-off workers with extended unemployment benefits. As a result, jobless Americans were able to collect up to 99 weeks of government checks to help ride out tough times. In contrast, the jobless rate shot to 25 percent in the Great Depression and stayed in the double digits for a decade. When the job market first collapsed in 1930, workers could not rely upon unemployment insurance, food stamps, Social Security or other forms of government help, Vaughan noted. After 1933, "the New Deal started to introduce safety-net programs, but they weren't there in the early 1930s and they weren't on the same scale as today," he said. So why do so many people today feel the Great Recession was miserable enough to be in the same ballpark as the Great Depression? In November 2008, for example, TIME magazine's cover inserted Barack Obama's face into a famous photo of Depression-era President Franklin D. Roosevelt. Spencer Platt/Getty Images Job seekers wait to attend a job fair in the Brooklyn borough of New York City in 2010. Vaughan says people may feel the Great Recession was so bad because the recovery has been so slow paced. Today, the unemployment rate remains high at 8.2 percent, economic growth is weak around 2 percent, foreclosures are still going forward, and both consumers and business owners remain very worried about looming problems, such as a financial crisis tied to European debt troubles. Vaughan says this has been the most painful economic period Americans under 80 can remember. For those who lost both jobs and homes — all while carrying heavy consumer and student debt — this has indeed felt like a depression, which actually has no official definition. But generally, economists say a depression is an event that lasts at least two years and involves a sustained decline of about 10 percent of gross domestic product. Vaughan has compiled lots of statistics to measure the magnitude of the two great downturns of the past century. He did find some interesting parallels between the Great Depression and the Great Recession…But the differences are huge because the Great Depression was much worse. The chart below makes the comparisons. Great Depression Great Recession Length Of Contraction (Economy Is Shrinking, Not Growing) 43 months (August 1929 to March 1933) 18 months (December 2007 to June 2009) Drop In Industrial Production 51.7 percent 14.9 percent Rise In Unemployment 19.3 percentage points 5.7 percentage points Change In Consumer Prices Down 27.2 percent Up 1.5 percent Number Of Bank Failures (Bank Runs Out of Money) 9,000 443 Drop In The Dow Jones Industrial Average (Stock Market Value) 89.2 percent 53.8 percent Credit: Angela Wong / NPR; Source: Mark Vaughan – Weidenbaum Center fellow Here are some similarities: Both were preceded by good economic times. - 1921-29: Annual real economic growth was 4.4 percent - 1982-2007: Annual real economic growth was 3.2 percent Both were preceded by the movement of banks into new business lines. - 1920s: Banks ramped up real estate lending/investment banking - 1990s-2000s: Banks ramped up real estate lending/securitization of mortgages Both were preceded by innovations in consumer finance. - 1920s: Installment consumer credit (e.g., monthly payments for autos) - 2000s: Banks ramped up real estate lending/securitization of mortgages Both were preceded by asset bubbles. - 1920s: Florida real estate boom and the stock market - 1990s-2000s: Residential real estate and the tech-stock boom Both followed an era in which the Federal Reserve was highly regarded. Recession vs. Depression graphic: http://www.paydayloan.co.uk/images/infographics/payday-recession-depression975.png