Report of Corporate Asset Manager

advertisement

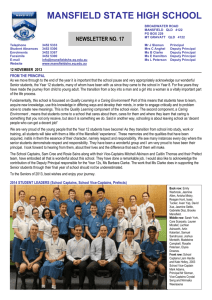

MANSFIELD DISTRICT COUNCIL Report of Corporate Asset Manager to the Portfolio Holder for Resources For a DELEGATED EXECUTIVE DECISION On 19th October 2015 Property Transaction Land at Millennium Business Park, Mansfield – Plot 10A Disposal of Long Leasehold Interest 1. SUMMARY 1.1. This report seeks approval to a property transaction to dispose of Plot 10A Millennium Business Park, Mansfield. 1.2. This is deemed to be a Key Decision by virtue of the amount of capital receipt. 2. RECOMMENDATIONS To be resolved by the Portfolio Holder for Resources 2.1. That approval be granted to dispose of the Plot 10A Millennium Business Park, Mansfield (shown edged red on the attached plan) to SuKe Property Limited, on the terms set out in this report. 3. BACKGROUND 3.1. The District Council owns the freehold of the land shown edged red on the attached plan. The area amounts to approximately 1.55 Ha (3.83 acres) and enjoys direct access to the highway at Enterprise Road. The site originally formed part of Plot 10 having been leased to Future Products Ltd, but was surrendered back to the Council in October 2013 due to non-development by the company. 3.2. Whilst the site has not been actively marketed a number of enquiries have been pursued including a possible expansion with a local company and internal discussions with Regeneration Team on projects to bring this site forward. However a recent direct property enquiry from JKS Boyles Limited. The company is currently located in Alfreton Derbyshire and is a leading supplier to the drilling industry, from drilling rigs and wireline drilling systems MANSFIELD DISTRICT COUNCIL to drill rods and diamond core bits. The company intends to purchase the site through their pension fund, SuKe Property Limited, on behalf of JKS Boyles Ltd. 3.3. Following a meeting with the company director Heads of Terms have now been agreed as follows: Landlord: Mansfield District Council, Civic Centre, Chesterfield Road South, Mansfield, Notts. NG19 7BH Tenant: SuKe Property Limited, 14 High Leys Drive, Ravenshead, Nottingham. NG15 9HQ. (Company No. 08817529). Demise: All that area of land known as Plot 10A, Enterprise Way, Millennium Business Park, Mansfield, Notts. NG19 7JX, extending to circa 3.83 acres (edged red on the attached plan for identification purposes only). Use: Not to use the demised premises for any use other than a use falling within Class B1, B2 and B8 of the Schedule to the Town and Country Planning (Use Classes) Order 1987. Lease: A term of 999 years. Premium: A premium of £450,000, and a peppercorn per annum thereafter. Service Charge: To pay to the Landlord a proportionate part of all reasonable costs, expenses and outgoings incurred by the Landlord in providing services at Millennium Business Park. Development Clause: The Tenant is to complete the development of the demised premises in accordance with the approved plans and in accordance will all necessary permissions, licences, permits, regulations and consents within 18 months of the date of the Lease. Fencing Responsibility: The Tenant will be responsible for maintaining the Northern and Western boundaries of the site, together with any fencing and gating required to the Enterprise Road entrance. Legal and Surveyors Fees: Each party to bear their own costs in the transaction. 3.4. The land proposed to be sold is held within the General Fund account and a disposal will raise a capital receipt already identified in funding the Council’s Capital Programme. 3.5. Millennium Business Park was developed with financial assistance through East Midlands Development Agency, now part of the Homes & Communities Agency (HCA). As part of the original funding agreement a proportion of any capital receipt has to be repaid to the HCA within 1 month of completion. The share due to HCA is 42.33% less Council costs. Therefore the share due to the HCA is approximately £185,000. 4. ALTERNATIVE OPTIONS AVAILABLE 4.1. The are 2 options available: - MANSFIELD DISTRICT COUNCIL 4.2. Option A – Dispose the property to SuKe Property Limited. The Council would benefit from the receipt of a capital sum £265,000 after allowing for a repayment of £185,000 to HCA as part of the funding agreement, together with attracting inward investment of a new company into the District creating new employment. 4.3. Option B – Formally market the site. The Council could formally market the site through external agents, but would incur costs in doing so and the likely capital receipt would be as the agreed terms set out in the report. If this option were chosen this would delay the timing of a capital receipt. 5. RISK AND OPPORTUNITY ASSESSMENT OF RECOMMENDATIONS AND OPTIONS Risk Risk Assessment Financial Risk Failure to secure a capital receipt. Risk Level Medium Risk Management Property Services have been provided evidence that the company is in funds to proceed with the purchase. 6. ALIGNMENT TO COUNCIL PRIORITIES 6.1 Revitalising our district, town centres and neighbourhoods encouraging inward investment and creating a climate for job creation and growth. 6.2 In accordance with the Asset Management Plan, the Council has to ensure its land and property assets are used effectively for the delivery of services either directly in the case of operational properties or indirectly with non-operational properties (e.g. investment properties). The capital receipt will contribute to the Council’s capital programme. 7. IMPLICATIONS (a) Relevant Legislation –The Council has a duty under Section 123 of the Local Government Act 1972 to obtain best consideration in the disposals of its assets. In my opinion the agreed sale price represents market value and satisfies best consideration under the Act. (b) Human Rights - The Human Rights Act 1998 is not engaged as an individual is not directly affected by the recommendation. MANSFIELD DISTRICT COUNCIL (c) Equality and Diversity – It is considered that the proposed actions are fair and equitable in their content and are not discriminative on the grounds of equality and human rights. (d) Climate change and environmental sustainability – No implications on the Council. (e) Crime and Disorder – No implications on the Council. (f) Budget /Resource - There is presently no rental income to the General Fund from this vacant site. However a net £265,000 capital receipt will be generated from the proposed disposal which has been previously identified in the Asset Realisation programme and accounted for in the funding of the capital programme. 8. COMMENT OF STATUTORY OFFICERS Head of Paid Service – No specific comments. Section151 Officer – The financial implications of the recommendation have been set out within the body of this report. VAT implications - This site has been opted to tax and thus VAT will be charged on the disposal. Monitoring Officer – No specific comments. 9. CONSULTATION 9.1 Nil 10. BACKGROUND PAPERS Heads of Terms letter 7th September 2015 Report Author Designation Telephone E-mail - Philip Colledge - Principal General Practice Surveyor & Corporate Asset Manager - 01623 463231 - pcolledge@mansfield.gov.uk MANSFIELD DISTRICT COUNCIL Site Plan - For illustration purposes only