Unemployment rates – the number of unemployed workers as a

advertisement

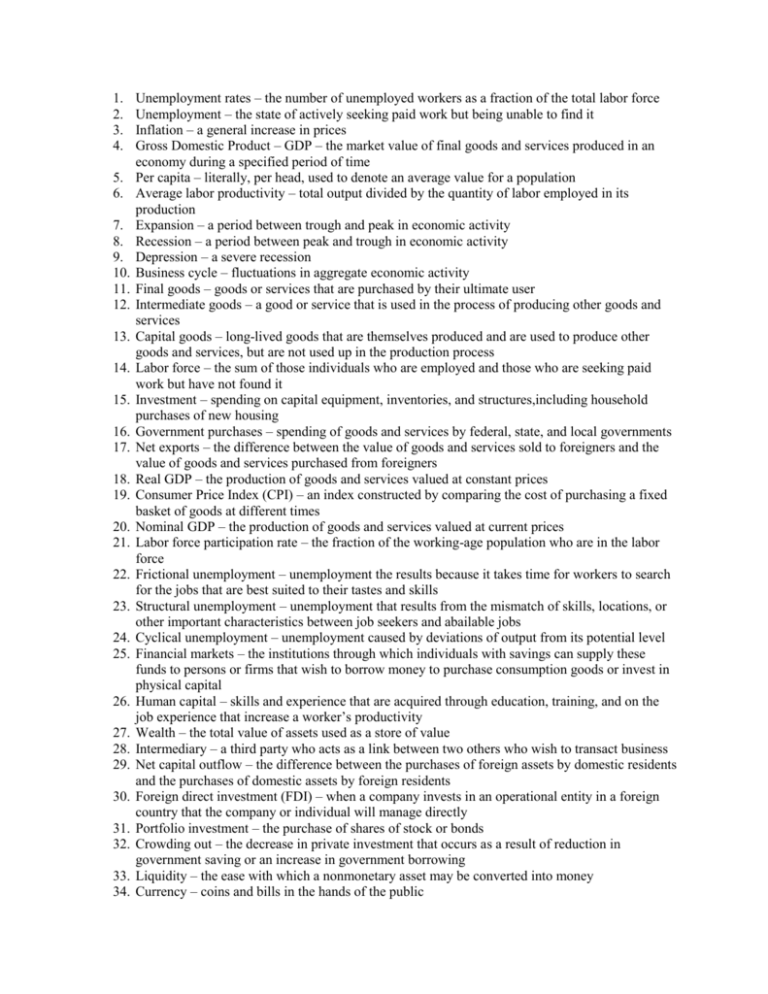

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. Unemployment rates – the number of unemployed workers as a fraction of the total labor force Unemployment – the state of actively seeking paid work but being unable to find it Inflation – a general increase in prices Gross Domestic Product – GDP – the market value of final goods and services produced in an economy during a specified period of time Per capita – literally, per head, used to denote an average value for a population Average labor productivity – total output divided by the quantity of labor employed in its production Expansion – a period between trough and peak in economic activity Recession – a period between peak and trough in economic activity Depression – a severe recession Business cycle – fluctuations in aggregate economic activity Final goods – goods or services that are purchased by their ultimate user Intermediate goods – a good or service that is used in the process of producing other goods and services Capital goods – long-lived goods that are themselves produced and are used to produce other goods and services, but are not used up in the production process Labor force – the sum of those individuals who are employed and those who are seeking paid work but have not found it Investment – spending on capital equipment, inventories, and structures,including household purchases of new housing Government purchases – spending of goods and services by federal, state, and local governments Net exports – the difference between the value of goods and services sold to foreigners and the value of goods and services purchased from foreigners Real GDP – the production of goods and services valued at constant prices Consumer Price Index (CPI) – an index constructed by comparing the cost of purchasing a fixed basket of goods at different times Nominal GDP – the production of goods and services valued at current prices Labor force participation rate – the fraction of the working-age population who are in the labor force Frictional unemployment – unemployment the results because it takes time for workers to search for the jobs that are best suited to their tastes and skills Structural unemployment – unemployment that results from the mismatch of skills, locations, or other important characteristics between job seekers and abailable jobs Cyclical unemployment – unemployment caused by deviations of output from its potential level Financial markets – the institutions through which individuals with savings can supply these funds to persons or firms that wish to borrow money to purchase consumption goods or invest in physical capital Human capital – skills and experience that are acquired through education, training, and on the job experience that increase a worker’s productivity Wealth – the total value of assets used as a store of value Intermediary – a third party who acts as a link between two others who wish to transact business Net capital outflow – the difference between the purchases of foreign assets by domestic residents and the purchases of domestic assets by foreign residents Foreign direct investment (FDI) – when a company invests in an operational entity in a foreign country that the company or individual will manage directly Portfolio investment – the purchase of shares of stock or bonds Crowding out – the decrease in private investment that occurs as a result of reduction in government saving or an increase in government borrowing Liquidity – the ease with which a nonmonetary asset may be converted into money Currency – coins and bills in the hands of the public 35. Money supply the quantity of money available to the economy 36. Monetary policy – the use of the supply of money in the economy by the Federal Reserve to influence the level of aggregate demand 37. Open market operations – a tool used by the Federal Reserve to adjust the money supply by buying or selling US government bonds in the financial market 38. Reserves – the fraction of deposit liabilities that banks hold to meet depositor withdrawels 39. Money multiplyer – the ratio of the money supply in the monetary base 40. Monetary base – the quantity of currency plus bank reserves 41. Reserve requirements – the amount of reserves that the Federal Reserve requires banks to hold 42. Discount rate – the interest rate that the Federal Reserve charges banks when they must borrow reserves from it 43. Federal funds rate – the rate that banks charge other banks when they lend reserves 44. Bank run – a sudden rush of depositors seeking to withdraw funds from the banking system 45. Neutrality of money – the proportion that in the long run, changes in the quantity of money affect the the price level but do not affect any real quantities 46. Velocity of money – the ratio of nominal GDP to the money supply; in effect, the average number of transactions supported by each dollar of the money supply 47. Potential output – the quantity of output that would be produced by an economy if all of its resources were being employed at normal rates 48. Output gap – the difference between actual output and potential output 49. Natural rate of unemployment – the level of unemployment that would exist if the economy were producing at its potential output 50. Okun’s Law – the relationship identified by Arthur Okun between the output gap and the level of cyclical unemployment