1. Stock Market Crash

advertisement

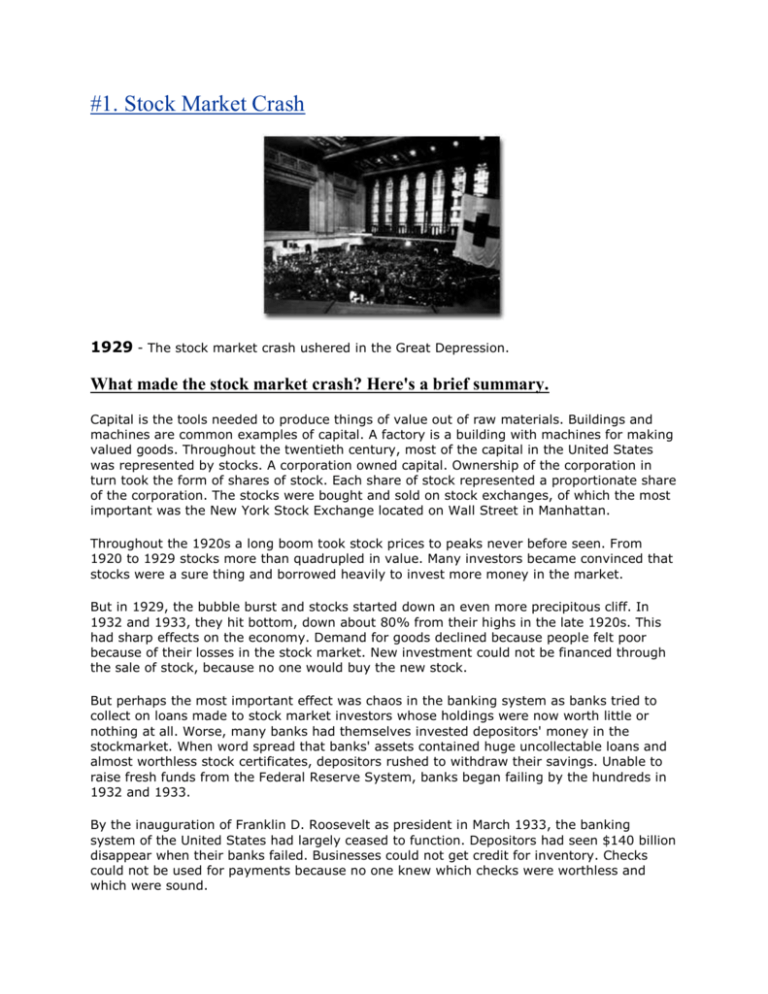

#1. Stock Market Crash 1929 - The stock market crash ushered in the Great Depression. What made the stock market crash? Here's a brief summary. Capital is the tools needed to produce things of value out of raw materials. Buildings and machines are common examples of capital. A factory is a building with machines for making valued goods. Throughout the twentieth century, most of the capital in the United States was represented by stocks. A corporation owned capital. Ownership of the corporation in turn took the form of shares of stock. Each share of stock represented a proportionate share of the corporation. The stocks were bought and sold on stock exchanges, of which the most important was the New York Stock Exchange located on Wall Street in Manhattan. Throughout the 1920s a long boom took stock prices to peaks never before seen. From 1920 to 1929 stocks more than quadrupled in value. Many investors became convinced that stocks were a sure thing and borrowed heavily to invest more money in the market. But in 1929, the bubble burst and stocks started down an even more precipitous cliff. In 1932 and 1933, they hit bottom, down about 80% from their highs in the late 1920s. This had sharp effects on the economy. Demand for goods declined because people felt poor because of their losses in the stock market. New investment could not be financed through the sale of stock, because no one would buy the new stock. But perhaps the most important effect was chaos in the banking system as banks tried to collect on loans made to stock market investors whose holdings were now worth little or nothing at all. Worse, many banks had themselves invested depositors' money in the stockmarket. When word spread that banks' assets contained huge uncollectable loans and almost worthless stock certificates, depositors rushed to withdraw their savings. Unable to raise fresh funds from the Federal Reserve System, banks began failing by the hundreds in 1932 and 1933. By the inauguration of Franklin D. Roosevelt as president in March 1933, the banking system of the United States had largely ceased to function. Depositors had seen $140 billion disappear when their banks failed. Businesses could not get credit for inventory. Checks could not be used for payments because no one knew which checks were worthless and which were sound. Roosevelt closed all the banks in the United States for three days - a "bank holiday." Some banks were then cautiously re-opened with strict limits on withdrawals. Eventually, confidence returned to the system and banks were able to perform their economic function again. To prevent similar disasters, the federal government set up the Federal Deposit Insurance Corporation, which eliminated the rationale for bank "runs" - to get one's money before the bank "runs out." Backed by the FDIC, the bank could fail and go out of business, but then the government would reimburse depositors. Another crucial mechanism insulated commercial banks from stock market panics by banning banks from investing depositors' money in stocks. #2. New River Media Interview with David Kennedy Professor of History, Stanford University Author of Freedom from Fear QUESTION: What are the most surprising things you find in studying the Great Depression? DAVID KENNEDY: One of the most surprising things that I discovered about the Depression was the degree of passivity or docility with which people greeted it. Several commentators at the time remarked on this - including Franklin Roosevelt, as a matter of fact - that here was the greatest crisis in American institutions since the Civil War, and yet there was no rioting in the streets, and the people seemed rather curiously, mysteriously submissive, at least in the early years of the Depression. I think this passivity is attributable to several things. First of all, for many people, the Depression was nothing new. The fabled prosperity of the 1920s did not extend to everybody. There were tens of millions of people living in poverty even before the great crash of 1929. So for them, there was nothing remarkable about this, and it wasn't particularly dramatic change in their circumstance. Second, I think, is that we see here , you might say, the flip side of the famous American value of individualism, that if we congratulate ourselves for our success and give ourselves a pat on the back for boot-strapping ourselves up the ladder of social mobility, it follows naturally that if we don't do that or slip down that ladder, we have nobody but ourselves to blame. So their natural psychological reflexes seemed to be, for lots of people, in the early Depression, to blame themselves, to feel guilty and ashamed at their circumstance. QUESTION: Before the 1929 crash, what was the mood of America? DAVID KENNEDY: When we think of the 1920s and think about what the mood of the country was, much of our popular understanding of that is informed by famous old books like Frederick Lewis Allen's Only Yesterday, and we have this image of the 1920s as a decade that was slap-happy on bathtub gin and flappers and so on and so forth. But in fact, for large portions of the country, the 1920s was a depressed decade. There had been an agricultural depression that, by 1929, was already nearly a decade old. Farm prices were way below what they'd been before the First World War, and even further below what they had been in wartime. Nearly half the American people still live in the countryside in the 1920s, and they lived in the grip of a chronic depression. If you were black, if you were a farmer, or if you were a recent immigrant living in America in the 1920s, you did not share, generally speaking, in that so-called 1920s prosperity. If, on the other hand, you were a reasonably skilled urban worker, you probably were making out pretty well. There was real prosperity in certain pockets of the economy in the 1920s. QUESTION: And what else of that economic volatility prior to the crash? How does it compare to today? DAVID KENNEDY: The story of the American economy before the Great Depression or, more precisely, before the New Deal is a story of chronic volatility. From the onset of the American industrial revolution in the early nineteenth century right down to the 1930s, the American economy was essentially on a roller coaster ride, where they'd have these periodic boom and bust cycles - depressions in the 1830s, the 1850s, the 1870s, the 1890s; right after World War I was another one - on a scale that we have not seen for the last half century. So the New Deal really marks a substantial divide in American economic history, which takes a lot of volatility out of the system. QUESTION: In 1929, the crash occurs. Do we know why it occurred and why at that moment? DAVID KENNEDY: The basic reason the crash of 1929 occurred is because of excessive speculation, but that's too easy an answer. Most economic historians can't agree precisely, beyond that rather unhelpful generalization, why the great crash occurred. Insofar as there is a consensus, it seems to be that the First World War so destabilized the major industrial economies and so disrupted the international system of trade and finance that it left in its wake a highly vulnerable system that finally succumbed a decade after the war's conclusion, in 1929 or 1930, to all the liabilities that had been put into it, you might say, as a result of the disruptions of the First World War. Further, I don't believe the great crash of 1929 caused the Great Depression. It may have been a contributory factor in sustaining the kind of doubt and fear and instability, particularly in the financial markets, in the credit and banking system, that persisted through the decade of the 1930s. But to call it the cause of the Depression, I think, is a fundamental mistake, not least of all because - and just a moment's reflection instructs us that the Great Depression was a worldwide phenomenon. It was not just an American phenomenon. It hit every advanced industrialized country at just about the same moment in 1930, 1931.