Lesson 2 Student Handout 2.3—Stock Market Crash

advertisement

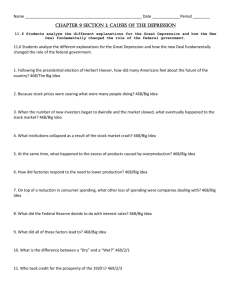

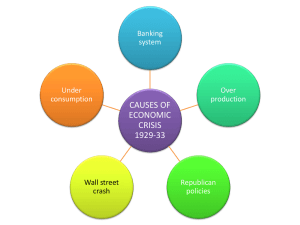

World History for Us All Big Era 8 Landscape 3 Lesson 2 Student Handout 2.3—Stock Market Crash It is 1933 and the Great Depression is at its worst. As wise and articulate experts on global conditions, you and your colleagues have been selected as delegates to represent your country at the World Economic Conference in London, England. The Conference is a concerted effort on the part of besieged nations around the world to find an international solution to the crisis. The first item on the agenda is determining what actually caused the Great Depression. Bewildered by unfolding events, politicians everywhere insist that developments outside their own countries are responsible for the collapse. No one is prepared to take (or even share) responsibility for the economic downswing. Yet the main cause of the Great Depression needs to be correctly identified if multilateral efforts to find a solution are to prove successful. Your group’s assignment is to persuade the Conference that the stock market crash was the most important cause of the Great Depression. Other countries have enlisted their finest minds to argue alternative viewpoints, so you need to make an effective presentation. The future of your nation depends on it! Here is what your group should do: 1. 2. 3. 4. 5. 6. Choose a fictitious name for your country. Review the information provided below. Have all members conduct research to learn more about your cause. Review the research together to make sure everyone understands the material. Highlight the key reasons why the stock market crash was so important Decide how to present the information in a clear, accessible way so that the audience easily grasps the concepts. 7. Make sure everyone in the group has a role in the presentation. 8. Create props or visual aids to supplement your efforts. Stock Market Crash Most people associate the Great Depression with the Wall Street stock market crash of 1929. One scholar described the start of the crash on October 24 as “the most devastating day in the history of the New York stock market.” Throughout the 1920s a long boom took stock prices to peaks never before seen. From 1920 to 1929, stocks more than quadrupled in value. Many investors became convinced that stocks were a sure thing and borrowed heavily to invest more money in the market. This was called “buying on the margin” and was very risky financially. It was possible to make nine dollars for every dollar invested, but it was also possible to lose nine dollars for every dollar invested. Still Americans remained confident that they could become rich from “playing the market.” The collapse began on October 24, now known as “Black Thursday.” Prices plummeted when people realized that the stock market boom was over. With no one buying stocks, millionaires became bankrupt almost overnight. In just three days, stocks lost $5 billion in value. The banking system fell into chaos as banks tried to collect on loans made to stock market investors whose holdings were now worth little or nothing. Worse, many banks had themselves invested depositors’ money in the stock market. When word spread that banks’ assets contained huge loans and almost worthless stock certificates, depositors rushed to withdraw their savings. Unable to raise fresh funds, banks began failing by the hundreds. When American loans to other countries dried up, the fragile world economy felt the full impact of the crash. http://worldhistoryforusall.sdsu.edu/ Page 21