File

advertisement

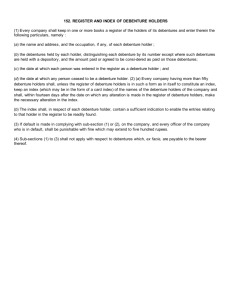

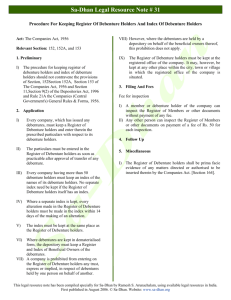

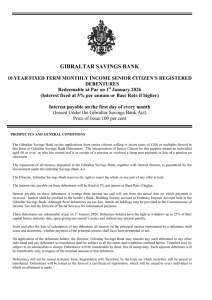

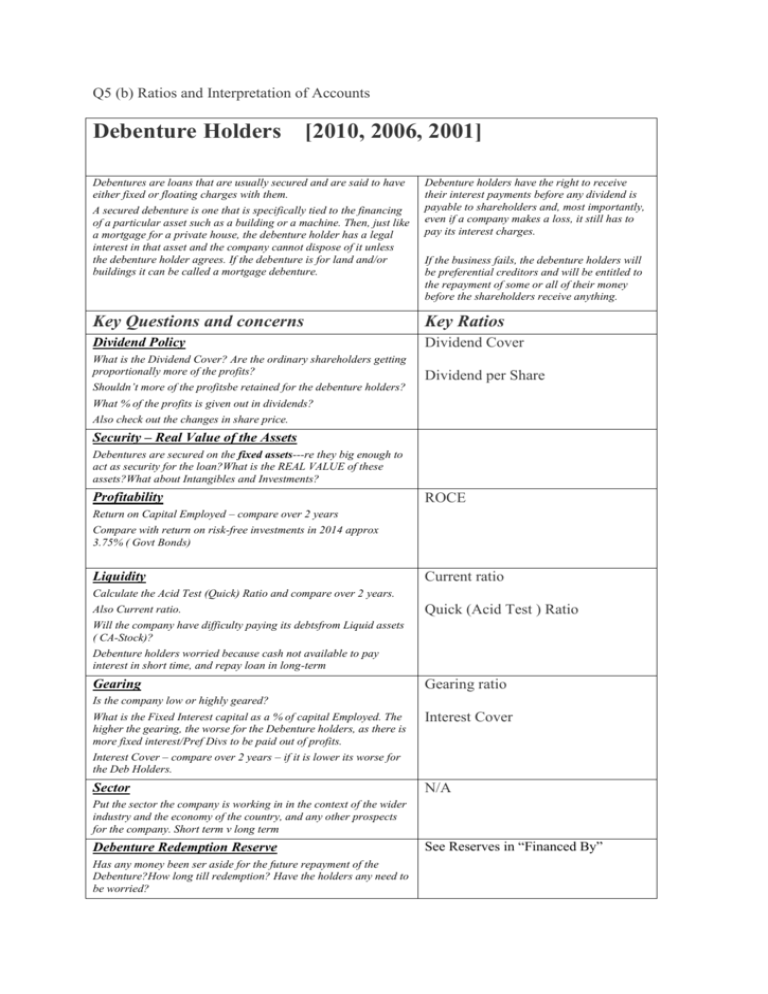

Q5 (b) Ratios and Interpretation of Accounts Debenture Holders [2010, 2006, 2001] Debentures are loans that are usually secured and are said to have either fixed or floating charges with them. A secured debenture is one that is specifically tied to the financing of a particular asset such as a building or a machine. Then, just like a mortgage for a private house, the debenture holder has a legal interest in that asset and the company cannot dispose of it unless the debenture holder agrees. If the debenture is for land and/or buildings it can be called a mortgage debenture. Debenture holders have the right to receive their interest payments before any dividend is payable to shareholders and, most importantly, even if a company makes a loss, it still has to pay its interest charges. If the business fails, the debenture holders will be preferential creditors and will be entitled to the repayment of some or all of their money before the shareholders receive anything. Key Questions and concerns Key Ratios Dividend Policy Dividend Cover What is the Dividend Cover? Are the ordinary shareholders getting proportionally more of the profits? Shouldn’t more of the profitsbe retained for the debenture holders? Dividend per Share What % of the profits is given out in dividends? Also check out the changes in share price. Security – Real Value of the Assets Debentures are secured on the fixed assets---re they big enough to act as security for the loan?What is the REAL VALUE of these assets?What about Intangibles and Investments? Profitability ROCE Return on Capital Employed – compare over 2 years Compare with return on risk-free investments in 2014 approx 3.75% ( Govt Bonds) Liquidity Current ratio Calculate the Acid Test (Quick) Ratio and compare over 2 years. Also Current ratio. Quick (Acid Test ) Ratio Will the company have difficulty paying its debtsfrom Liquid assets ( CA-Stock)? Debenture holders worried because cash not available to pay interest in short time, and repay loan in long-term Gearing Gearing ratio Is the company low or highly geared? What is the Fixed Interest capital as a % of capital Employed. The higher the gearing, the worse for the Debenture holders, as there is more fixed interest/Pref Divs to be paid out of profits. Interest Cover – compare over 2 years – if it is lower its worse for the Deb Holders. Interest Cover Sector N/A Put the sector the company is working in in the context of the wider industry and the economy of the country, and any other prospects for the company. Short term v long term Debenture Redemption Reserve Has any money been ser aside for the future repayment of the Debenture?How long till redemption? Have the holders any need to be worried? See Reserves in “Financed By” Q5 (b) Ratios and Interpretation of Accounts Shareholders [2012, 2009, 2008, 2007, 2005] Key Questions and concerns Key Ratios Dividend Policy Dividend Cover What is the Dividend Cover? Are the ordinary shareholders getting proportionally more of the profits? Shouldn’t more of the profitsbe retained for the debenture holders? What % of the profits is given out in dividends? Also check out the changes in share price. Dividend per Share Security – Real Value of the Assets Debentures are secured on the fixed assets---re they big enough to act as security for the loan?What is the REAL VALUE of these assets?What about Intangibles and Investments? Profitability ROCE Return on Capital Employed – compare over 2 years Compare with return on risk-free investments in 2014 approx 3.75% ( Govt Bonds) Liquidity Current ratio Calculate the Acid Test (Quick) Ratio and compare over 2 years. Also Current ratio. Will the company have difficulty paying its debtsfrom Liquid assets ( CA-Stock)? Quick (Acid Test ) Ratio Debenture holders worried because cash not available to pay interest in short time, and repay loan in long-term Gearing Gearing ratio Is the company low or highly geared? What is the Fixed Interest capital as a % of capital Employed. The higher the gearing, the worse for the Debenture holders, as there is more fixed interest/Pref Divs to be paid out of profits. Interest Cover Interest Cover – compare over 2 years – if it is lower its worse for the Deb Holders. Sector N/A Put the sector the company is working in in the context of the wider industry and the economy of the country, and any other prospects for the company. Short term v long term Debenture Redemption Reserve Has any money been ser aside for the future repayment of the Debenture?How long till redemption? Have the holders any need to be worried? See Reserves in “Financed By” Q5 (b) Ratios and Interpretation of Accounts Bank Loan Application [2011, 2007] A bank will essentially be looking for the following : What is the loan for? Can the interest be repaid annually? Can the loan itself be repaid over the term agreed? Key Questions and concerns Key Ratios Dividend Policy Dividend Cover What is the Dividend Cover? Are the ordinary shareholders getting proportionally more of the profits? Wouldn’t more of the profits have to be retained for the payment of loans and interest? What % of the profits is given out in dividends? Would the repayment of the loan be jeopardized by the dividend policy? Also check out the changes in share price. Dividend per Share Security – Real Value of the Assets Debentures are secured on the fixed assets---re they adequate / big enough to act as security for the loan? Are any of the Fixed Assets already secured on the Debentures?What is the REAL VALUE of these assets?What about Intangibles and Investments?The bank manager would have to question these valuations Profitability/ ROCE ROCE Is the company profitable? Compare the current ROCE with the rate of interest on the loan – if ROCE<Rate of Interest then questionable. Liquidity Current ratio Calculate the Acid Test (Quick) Ratio and compare over 2 years. Also Current ratio. Will the company have difficulty paying its debts including extra interest from Liquid assets ( CA-Stock)? Bank Manager may be concerned because cash may not available to pay interest in short time, and repay loan in long-term. Remember Debentures have to be repaid in 4 years, so cash will also have to be found for this.There is no Debenture Redemption Reserve Quick (Acid Test ) Ratio Gearing Gearing ratio Is the company low or highly geared? What is the Fixed Interest capital as a % of capital Employed. The higher the gearing, the worse for the bank, as there is more fixed interest/Pref Divs to be paid out of profits.Will the new loan make the company highly geared? - YES Interest Cover – compare over 2 years – if it is lower its worse for the bank – loan will make it worse again. Interest Cover Sector N/A Put the sector the company is working in in the context of the wider industry and the economy of the country, and any other prospects for the company. Short term v long term – its all about whetehr the loan can be serviced and repaid, probably in 5 years time. Purpose of loan Why is loan required ? future expansion – exactly what??Can this expansion generate enough income to service loan? Where is the Business Plan?? Relate to “Sector” Q5 (b) Ratios and Interpretation of Accounts Prospective Shareholders [2013, 2004, 2003] Key Questions and concerns Key Ratios Dividend Policy Dividend Cover What is the Dividend Cover? Are the ordinary shareholders getting proportionally more of the profits? Shouldn’t more of the profitsbe retained for the debenture holders? What % of the profits is given out in dividends? Also check out the changes in share price. Dividend per Share Security – Real Value of the Assets Debentures are secured on the fixed assets---re they big enough to act as security for the loan?What is the REAL VALUE of these assets?What about Intangibles and Investments? Profitability ROCE Return on Capital Employed – compare over 2 years Compare with return on risk-free investments in 2014 approx 3.75% ( Govt Bonds) Liquidity Current ratio Calculate the Acid Test (Quick) Ratio and compare over 2 years. Also Current ratio. Will the company have difficulty paying its debtsfrom Liquid assets ( CA-Stock)? Quick (Acid Test ) Ratio Debenture holders worried because cash not available to pay interest in short time, and repay loan in long-term Gearing Gearing ratio Is the company low or highly geared? What is the Fixed Interest capital as a % of capital Employed. The higher the gearing, the worse for the Debenture holders, as there is more fixed interest/Pref Divs to be paid out of profits. Interest Cover Interest Cover – compare over 2 years – if it is lower its worse for the Deb Holders. Sector N/A Put the sector the company is working in in the context of the wider industry and the economy of the country, and any other prospects for the company. Short term v long term Debenture Redemption Reserve Has any money been ser aside for the future repayment of the Debenture?How long till redemption? Have the holders any need to be worried? See Reserves in “Financed By”