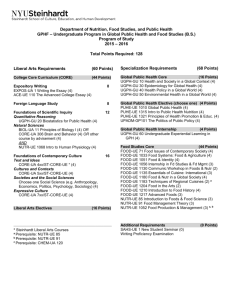

RMGI Program, Course Descriptions & Learning Outcomes 3

advertisement

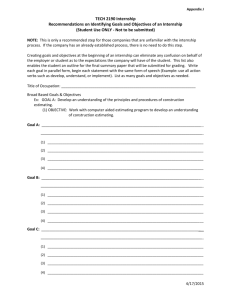

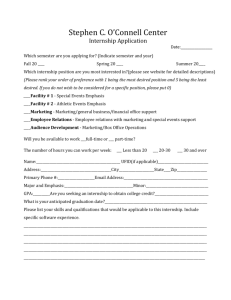

Davenport University BBA- MGMT RMGI Specialty Program Descriptions and Learning Outcomes The Risk Management and Insurance specialty program will prepare students for careers in positions that help individuals and businesses identify and manage risks and understand the relationship of appropriate insurance product and related service solutions. The insurance business is knowledge-driven and an integral part of modern societies and the global economy. This program develops and integrates, business management, marketing, financial and statistical analysis skills. It places an emphasis on developing high standards of professional ethics, especially in relationship to this industry. Students have the opportunity to complete a professional internship and prepare for national exams leading to professional designations. Graduates should be able to achieve professional designations, giving them a competitive edge in employment upon graduation. Course work emphasizes analytical and critical thinking, and the application of knowledge to case studies and simulations. 1. Apply knowledge of the fundamental concepts of risk and insurance, ownership and operational models, regulation of the insurance business and the different insurance products. 2. Demonstrate an understanding of the necessity of uberrimae fidei (utmost good faith) in the business of insurance, the responsible use of information, principled negotiating techniques, and appropriate response to ethical issues in the insurance business. 3. Assess industry-specific financial operations using analysis quantitative techniques in financial analysis of insurers and risk management decision-making. 4. Analyze business and entrepreneurial environments and apply the risk management process, risk control and financing techniques to various case scenarios Courses specific to this specialty: RMGI221 Principles of Risk Management and Insurance 3 CR This course introduces the subject of risk management and insurance. The student will learn the concept of risk and risk management, how insurance fits in the risk management process, how the insurance mechanism works including the core competencies, and how the insurance market is structured and regulated. Students will also examine the structure of insurance contracts, and an overview of property and liability loss exposures and common insurance policy provisions. This course will also help students prepare for the INS 21 national examination administered by the Insurance Institute of America. Recommended Co-requisite(s): MATH125, MGMT211. Upon completion of this course, the student should be able to: Explain the concepts of risk, loss, exposure, and insurance Describe the process of risk management; identify risk management techniques in addition to insurance Describe the insurance market structure, insurance regulation, and the significant operations and financial measurement of insurance companies Read an insurance policy, identify loss exposures, recognize common policy provisions Identify and analyze current issues and developments in this field Take the INS 21 national exam administered by the Insurance Institute of America RMGI Course Descriptions Page 1 of 4 3-29-2012 RMGI322 Personal Insurance 3 CR This course examines insurance contracts and programs for individuals, including property, liability, automobile, life, disability, healthcare and retirement. This course will also help students prepare for the INS 22 national examination administered by the Insurance Institute of America. Prerequisite(s): MATH125, RMGI221. Upon completion of this course, the student should be able to: Analyze provisions of homeowners and automobile insurance contracts, and apply them to loss situations Describe the coverages provided under other personal property, liability, life and health insurance contracts (dwelling, mobilehome, farm, flood, inland marine, watercraft, umbrella liability, term, whole life, basic and major medical) Apply the risk management process to personal exposures Identify and analyze current issues and developments in this field Take the INS 22 national exam administered by the Insurance Institute of America RMGI323 Commercial Insurance 3 CR This course examines insurance contracts and programs for businesses, including property, business income, crime, equipment breakdown, marine, general liability, automobile, workers compensation, farm, and others. This course will also help students prepare for the INS 23 national examination administered by the Insurance Institute of America. Prerequisite(s): MATH125, RMGI221. Upon completion of this course, the student should be able to: Analyze provisions of commercial property, including business income, and general liability insurance contracts and apply them to loss situations Describe the coverages provided under other commercial property and liability insurance contracts (crime, equipment breakdown, inland and ocean marine, auto, businessowners and workers compensation) Identify and analyze current issues and developments in this field Take the INS 23 national exam administered by the Insurance Institute of America RMGI410 Insurance Proposals and Negotiation 3 CR This course examines typical negotiation situations in risk management and insurance and application of principled negotiating techniques to those situations, assembly of information to support positions and proposals, the responsible use and presentation of data, use of spreadsheets and presentation software to create professional documents and presentations to support positions and proposals, such as the development of a new product or the sale of a new insurance coverage to a risk manager or a new exposure to an insurance/reinsurance underwriter. The course includes a major group project to develop a written proposal and oral presentation. Prerequisite(s): BITS211, COMM120, ENGL311, RMGI323. Upon completion of this course, the student should be able to: Use principled negotiating techniques in the business of risk management and insurance Create persuasive risk management and insurance proposals including written documents and illustrations, and oral presentations Evaluate risk management and insurance information and communicate it responsibly, and detect the misleading use of data Collaborate effectively on group projects Communicate at a professional level in the business of risk management and insurance RMGI Course Descriptions Page 2 of 4 3-29-2012 RMGI420 Insurance Company Operations 3 CR This course examines the core competencies of an insurance company and the interdependencies of those functions, including actuarial, claims, finance, reinsurance, and underwriting. Other topics include insurance regulation, the global insurance market, and the strategic management of an insurance company. This course will incorporate the use of an insurance company simulation “game” exercise. This course will incorporate the online Ethics 311 Ethical Guidelines for Insurance Professionals module administered by the Insurance Institute of America, and help students prepare for the CPCU 520 national examination administered by the American Institute for Chartered Property Casualty Underwriters. Prerequisite(s): FINC211, STAT220, RMGI221 Upon completion of this course, the student should be able to: Understand the strategic management process of insurance companies Analyze the financial performance of property and liability insurance companies Explain the core operations of property and liability insurance companies, and the interdependencies of those operations Identify and analyze current issues and developments in this field Complete the online Ethics 311 Ethical Guidelines for Insurance Professionals module administered by the Insurance Institute of America Take the CPCU 520 national exam administered by the American Institute for CPCUs RMGI454 Risk Management 3 CR This course examines the process of risk management, including the identification and analysis of loss exposures; examination of alternatives to traditional insurance; the use of loss forecasting and cash flow analysis to make a decision. An overview of the evolution of an international exposure will also be examined. This course will incorporate the use of case studies and a risk management simulation “game” exercise. This course will also help students prepare for the ARM 54 national examination administered by the Insurance Institute of America. Prerequisite(s): FINC211, STAT220, RMGI221 (RMGI420 Recommended) Upon completion of this course, the student should be able to: Identify and analyze the loss exposures of organizations, including multi-nationals Evaluate and choose the appropriate risk management technique(s) to address loss exposures Formulate a spreadsheet for loss forecasting and cash flow analysis, and use it to make a risk management decision Identify and analyze current issues and developments in this field Take the ARM 54 national exam administered by the Insurance Institute of America RMGI490 Risk Management and Insurance Internship 3 CR Contact Career Services at least one semester prior to enrolling. This bachelor-level risk management and insurance internship is the integration of previous classroom instruction with new learning acquired through on-the-job work experience. The employment experience should be related as closely as possible to the student’s major field and individual interest. In general, 150–200 hours of career-related work time shall be required at the employment site and evidenced by weekly reports filed by the student. Students will be given information concerning placement site possibilities; however, responsibility for selection by the internship employer rests with the student. The internship may be either paid or unpaid. An appropriate faculty member and the placement site supervisor will evaluate the student’s performance. Note: A criminal background check and drug screening may be required by the RMGI Course Descriptions Page 3 of 4 3-29-2012 internship site. Prerequisite(s): Junior status; “Foundations of Business” courses completed; minimum 2.7 GPA in the major and 2.7 GPA cumulative, RMGI221 Upon completion of the RMI internship, the student should be able to: Use risk management and/or insurance terminology appropriately Apply concepts from classroom to a professional work setting Manage time by prioritizing work and meeting deadlines Use a professional approach to one’s work and others in the work place (appearance, communication, ethical behavior, networking skills), meet or exceed professional standards in work performed, and demonstrate an understanding of professional work place customs and practices Interpret information, apply knowledge to a task, use technology appropriately, negotiate and arrive at a decision in a timely and professional fashion RMGI Course Descriptions Page 4 of 4 3-29-2012