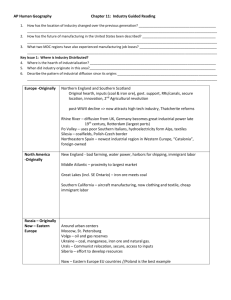

chapter n0-5 indian textile

advertisement