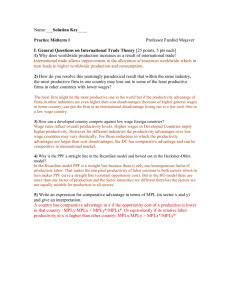

IV. International trade and Income distribution [10 points]

advertisement

![IV. International trade and Income distribution [10 points]](http://s3.studylib.net/store/data/006950604_1-0da0029a4568f4c95395b670b1f10025-768x994.png)

Name:___Solution Key____ SSII 2011, 160A Midterm Professor Farshid Mojaver I. General Questions on International Trade Theory [3 points each, 15 points total] 1) How can international trade improve producer efficiency? International trade allows countries to increase production because of better allocation of resources. Better allocation of resources is the source of producer efficiency in IT. 2) How can a developed country compete against low foreign wage countries? While it is true that in developed economies wage rates are higher but labor requirement is lower due to higher overall productivity in those economies. In the sectors in which the productivity advantage outweighs the wage disadvantage the high wage economy can complete against a low wage economy. 3) Make an argument to show that a domestic firm may lose out in international competition even if it is the most productive producer in the world. A domestic firm that has the highest productivity in the world may lose out in international trade because there might be firms with even higher productivity in that country that drive the average wages higher (i.e, US might have the most productive apparel industry in the world but even higher productivity in wheat production drives the wages high so that it is not cost effective produce apparel in US). 4) Write an expression for comparative advantage in terms of MPL (in sector x and y) and give an interpretation. A country has comparative advantage in x if the opportunity cost of x production is lower in that country MPLy/MPLx < MPLy*/MPLx*. Or equivalently if its relative labor productivity in x is higher than other country: MPLx/MPLy > MPLx*/MPLy* 5) Discuss the short run effect of an increase in the price of import goods on factor prices (who gains and who loses). In the short run the return to the specific factors employed in the import-competing sector increases and that of export sector decreases. The change in the real return to the mobile factor can increase or decrease depending on the mix of workers’ consumption basket. II-The Ricardian Model of Trade [27 points, parts 3 pts each] The United States has 200 units of labor, while there are 1600 units of labor in India. When they produce, they have the following unit labor requirements. U.S. India ULR (hr/unit of output) Clothing Machines____Labor Endowment 2 1 200 5 10 1600 1) Which country has absolute advantage in the production of clothing and why? What about machines? U.S has absolute advantage in both machines and clothing because its labor productivities are larger than India in both sectors. 2) In absence of trade, what is the opportunity cost of clothing (in terms of machines) in US and what does it measure? What is the opportunity cost of clothing in India? U.S India OC of Clothing (in terms of machines) aLC/aLM bLC/bLM 2/1 = 2 5/10 = 0.5 OC of clothing in US is 2 machines that is, US has to give up tw machine for each unit of clothing production. 3) What is the comparative advantage of India and why? India has Comparative Advantage in Clothing production because her opportunity cost of clothing is lower than that in United States 4) What is the relative price of clothing in each country before trade? Autarky PC/PM in U.S = 2 Autarky PC/PM in China = 0.5 5) Draw a graph showing production possibility frontier of U.S. and India. Have Clothing production of the horizontal axis and machines on the Vertical axis. QM QM Unites States LM /aLC = 200/1= 200 India bLC/bLM = 0.5 aLC/aLM = 2 160 100 QC LCh /bLC = 1600/5= 320 QC 6) Use hypothetical indifference curves to show pre-trade equilibrium in each country. Show home production and consumption at this point.. QM QM Unites States India 200 160 Consumption before trade QC 100 320 QC 7) Now suppose that trade opens up and the world relative price of clothing is 1. What would be the home production of clothing and machines in the short run if labor is immobile between sectors? QM B A IAut C IFT P=1 QC 8) Now suppose labor is totally mobile between sectors. Use a hypothetical indifference curve in a graph showing gains from trade for each country (when international PC/PM =1). Which country would produce each? QM QM Unites States India 200 Consumption after trade 160 PC/PM = 1 Consumption before trade PC/PM= 1 100 QC 320 QC 9) In the graph above show the trade Triangles in the United States and India. Who produces what and how much? India produces 1600/5 = 320 units of Clothing and exports its excess supply. U.S. produces 200/1 = 200 and exports its excess supply. III-Hecksche-Ohlin Theory [26 pts total] 1. State and prove H-O Theorem? [10 points] Under H-O assumptions each country will export the good that uses its abundant factor intensively. For example is if consider two factors of labor and capital assume and two goods of computer (capital intensive) and shoes (labor intensive) and if we assume Home is relatively capital abundant K/L > K*/L* then the theory predicts that Home will export Computer and Foreign will export shoes. L/K < L*/K* This is illustrated in the graph bellow. Post-Trade: Production and Consumption of Home and Foreign Country QS Slope = (PC/PS)W Slope = (PC/PS)W Q*S B* • C • B A* U2 C* U2* U A (a) Home Country QC (b) Foreign Country Q*C At (PC/PS) < (PC/PS)W < P*C/P*S capital abundant Home exports capital intensive computer and Labor abundant Foreign exports Labor intensive shoes. 2. Under H-O what is the impact of free trade on the existing international wage gaps? [3 pts] (just provide a verbal argument, no proof or is required here) [3 pts] The wage gaps will be eliminated, which is the Factor-Price Equalization Theorem. Under HO assumption international trade leads to equalization of factor prices across countries. 3. Has this prediction come true to any degree? Why international wage rates are still so different? (just provide a verbal argument, no proof or is required here) [3 pts] No, because the productivity is different across countries. 4. Imagine a two good H-O economy which imports automobiles and exports wheat. Suppose the production of these two goods use only capital and labor. If the government raises a tariff on the import of automobiles it will raise the domestic price of autos. Suppose the price of wheat remains constant. Explain as a result of this tariff who in the economy will gain and who will lose in real terms? [10 pts] Answer: With an increase in price of Auto relative demand shifts in favor of Auto production and hence relative demand for Capital goes up (relative demand for labor goes down). This will lead to a increase in L-K ratio employed in the two sectors which lowers MPL and thus real Wage rates and increases MPK and thus real rentals. Tariff on Auto imports PAut↑ >0 and so does the cost of production. Since Auto is capital intensive domestic QAut ↑ demand for K↑ (relative demand for L↓)=> L/K↓ in both sectors MPKAut↑=R↑/PAut & MPKW↑=R↑/PW Rent earners win L/K↓ in both sectors MPLAut↓=W/PAut ↓& MPLW↓=W↓/PW Wage earners lose IV. International trade and Income distribution [10 points] Suppose two countries, Canada and Mexico, produce two goods, timber and televisions. Assume that land is specific to timber, capital is specific to televisions, and labor is free to move between the two industries. When Canada and Mexico engage in free trade, the relative price of televisions falls in Canada and the relative price of timber falls in Mexico. a. Using a graph show the effect of a fall in the price of televisions, holding constant the price of timber on real wages in Canada b. What is the impact of opening trade on the real rentals on capital and land in Canada? Answer: a) As shown in figure below, real wage falls in terms of timber but it rises in terms of TV because the percentage fall in wage is less than the percentage fall in TV prices. b) Because capital is specific to the television sector, the drop in the relative price of television will lead to a fall in employment in TV sector and thus an increase in K/L which would reduce MPK↓=↓Rk/Ptv. With Canada exporting timber, rental on land will rise because land is specific to the timber industry. Real return to Land increases because of higher labor employment and thus higher MPT in Timber . III- Offshoring [16 points] 1- Use Offshoring model to explain the observed increase in the relative wage of skilled labor in US and many other countries around the world in the last two decades. 2- Using a simplified Offshoring model to show that both countries can gain from trade in intermediate goods (say components and R&D products). Clearly state your assumptions. 1) Assume Foreign wages (both Low-skilled and High-skilled) are less than those at Home: • W *L < WL and W *H < WH. And W *L/W *H < WL/WH. Assume a reduction in cost of doing business in Foreign. This will increase relative demand for high-skilled labor in both countries leading to an increase in relative wage rates of skilled labor 2)Assume There are only two activities: Components production QC, and Research and Development (R&D), QR; There are two factor inputs low-skilled labor L, High-skilled labor H used to produce the two intermediate goods QC is an low-skilled-labor intensive (i.e., making parts and components) and QR is a high-skilled-labor-intensive non-production input (such as R&D, marketing and after-sale services). A final good Y. Then can see that Home exports R&D and imports Comp which enables the country to produce more final good Y