Exam #2 Answers for 004 Section

advertisement

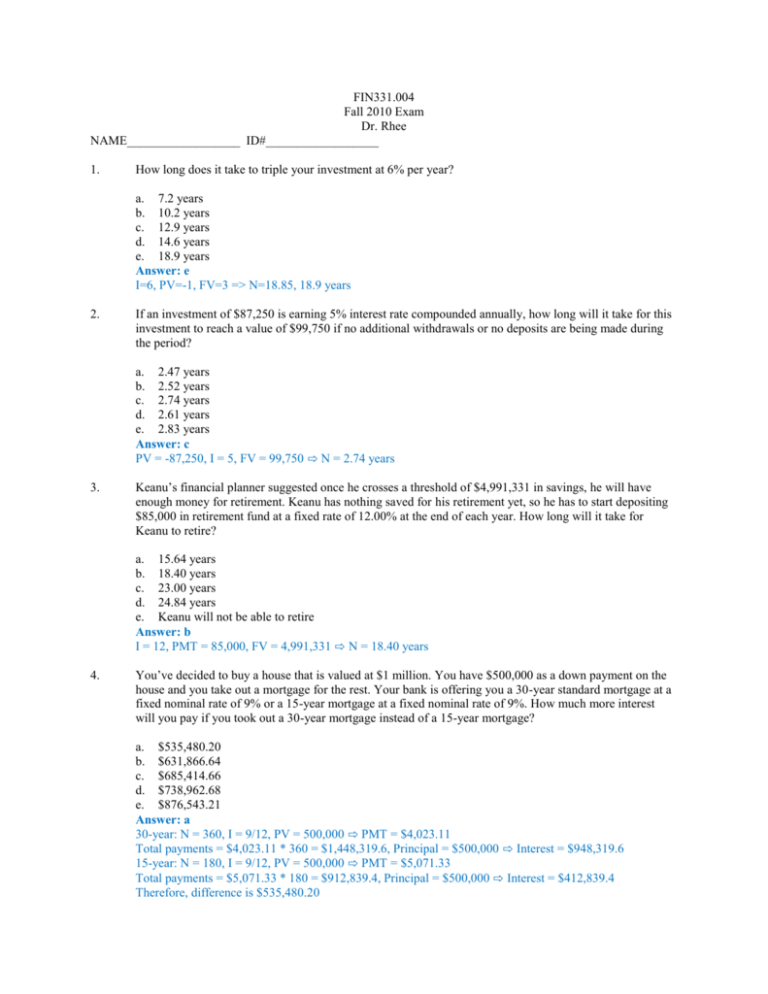

FIN331.004 Fall 2010 Exam Dr. Rhee NAME__________________ ID#__________________ 1. How long does it take to triple your investment at 6% per year? a. 7.2 years b. 10.2 years c. 12.9 years d. 14.6 years e. 18.9 years Answer: e I=6, PV=-1, FV=3 => N=18.85, 18.9 years 2. If an investment of $87,250 is earning 5% interest rate compounded annually, how long will it take for this investment to reach a value of $99,750 if no additional withdrawals or no deposits are being made during the period? a. 2.47 years b. 2.52 years c. 2.74 years d. 2.61 years e. 2.83 years Answer: c PV = -87,250, I = 5, FV = 99,750 ⇨ N = 2.74 years 3. Keanu’s financial planner suggested once he crosses a threshold of $4,991,331 in savings, he will have enough money for retirement. Keanu has nothing saved for his retirement yet, so he has to start depositing $85,000 in retirement fund at a fixed rate of 12.00% at the end of each year. How long will it take for Keanu to retire? a. 15.64 years b. 18.40 years c. 23.00 years d. 24.84 years e. Keanu will not be able to retire Answer: b I = 12, PMT = 85,000, FV = 4,991,331 ⇨ N = 18.40 years 4. You’ve decided to buy a house that is valued at $1 million. You have $500,000 as a down payment on the house and you take out a mortgage for the rest. Your bank is offering you a 30-year standard mortgage at a fixed nominal rate of 9% or a 15-year mortgage at a fixed nominal rate of 9%. How much more interest will you pay if you took out a 30-year mortgage instead of a 15-year mortgage? a. $535,480.20 b. $631,866.64 c. $685,414.66 d. $738,962.68 e. $876,543.21 Answer: a 30-year: N = 360, I = 9/12, PV = 500,000 ⇨ PMT = $4,023.11 Total payments = $4,023.11 * 360 = $1,448,319.6, Principal = $500,000 ⇨ Interest = $948,319.6 15-year: N = 180, I = 9/12, PV = 500,000 ⇨ PMT = $5,071.33 Total payments = $5,071.33 * 180 = $912,839.4, Principal = $500,000 ⇨ Interest = $412,839.4 Therefore, difference is $535,480.20 5. Which of the following investments would have the highest future value at the end of 10 years? Assume that the effective annual rate for all investments is the same and is greater than zero. a. b. Investment A pays $250 at the beginning of every year for the next 10 years (a total of 10 payments). Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments). c. Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments). d. Investment D pays $2,500 at the end of 10 years (just one payment). e. Investment E pays $250 at the end of every year for the next 10 years (a total of 10 payments). Answer: a A dominates B because it provides the same total amount, but it comes faster, hence it can earn more interest over the 10 years. A also dominates C and E for the same reason, and it dominates D because with D no interest whatever is earned. We could also do these calculations to answer the question: A B C D E 6. $4,382.79 $4,081.59 $4,280.81 $2,500.00 $3,984.36 Largest EFF% 10.00% NOM% 9.76% 10 250 125 125 2500 250 Which of the following statements is CORRECT? a. b. c. d. The cash flows for an ordinary annuity all occur at the beginning of the periods. If a series of unequal cash flows occurs at regular intervals, then the series is an annuity. The cash flows for an annuity due must all occur at the ends of the periods. The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month. e. If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity. Answer: d 7. Charles Townsend Agency issues 15-year, AA-rated bonds. What is the yield on these bonds? Disregard cross-product terms, i.e., if average is necessary, use the arithmetic average. Relationship between bond ratings and DRP Rating Default Risk Premium U.S. Treasury AAA 0.60% AA 0.80% A 1.05% BBB 1.45% Real risk-free rate (r*) = 2.8% (expected to remain constant) Inflation rate = 5%/yr for each of next five years, 4% thereafter MRP = 0.1*(t – 1)%, t is the security’s maturity, LP = 0.55% a. 5.55% b. 8.48% c. 9.33% d. 9.88% e. 10.12% Answer: d IP15 = [(5 * 5%) + (10 * 4%)]/15 = 4.33% MRP15 = 0.1 * (t – 1)% = 0.1 * (15 – 1)% = 1.40% rk = r* + IP + DRP+ LP + MRP = 2.8% + 4.33% + 0.80% + 0.55% + 1.40% = 9.88% 8. There are three factors that can affect the shape of the Treasury yield curve (r*, IP t, and MRPt) and five factors that can affect the shape of corporate yield curve (r*, IPt, and MRPt, DRPt, and LPt). Suppose the real risk-free rate and inflation rate are expected to remain at their current level throughout the foreseeable future. Consider all factors that affect the yield curve. Which of following U.S. Treasury yield curve can take? a. Inverted yield curve b. Upward-sloping yield curve c. Humped yield curve d. Downward-sloping yield curve e. None of above Answer: b If the real risk-free rate and inflation rate are expected to be constant, upward-sloping yield curve or flat yield curve are likely to happen. 9. The yield on a one-year Treasury security is 5.84%, and two-year Treasury security has a 7.88% yield. Suppose the securities do not have a maturity risk premium, what is the market’s estimate of the one-year Treasury rate one year from now? a. 8.118% b. 9.55% c. 9.92% d. 11.354% e. 12.129% Answer: b From (1 + 0Rn)n = (1 + 0R1) * (1 + 1R2) * (1 + 2R3) * … * (1 + nRn-1) * [1 + E(n-1Rn)], (1 + 0R2 – MRP)2 = (1 + 0R1) * [1 + E(1R2)] ⇨ (1 + 0.0788 – 0.002)2 = (1.0584) * [1 + E(1R2)] ⇨ E(1R2) = (1.0768)2 / (1.0584) – 1 = 9.55% 10. Koy Corporation's 5-year bonds yield 12.50%, and 5-year T-bonds yield 5.15%. The real risk-free rate is r* = 3.0%, the inflation premium for 5-year bonds is IP = 1.75%, the liquidity premium for Koy's bonds is LP = 0.75% versus zero for T-bonds, and the maturity risk premium for all bonds is found with the formula MRP = (t – 1) × 0.1%, where t = number of years to maturity. What is the default risk premium (DRP) on Koy's bonds? a. 5.94% b. 6.60% c. 7.26% d. 7.99% e. 8.78% Answer: b Basic equation: r = r* + IP + MRP + DRP + LP Years to maturity r* In both bonds, so not needed in this problem MRP In both bonds, so not needed in this problem IP In both bonds, so not needed in this problem rKoy rT-bond LP Included in corp. only DRP = rKoy – rT-bond – LP 5 3.00% 0.40% 1.75% 12.50% 5.15% 0.75% 6.60% 11. Assume that interest rates on 20-year Treasury and corporate bonds are as follows: T-bond = 7.72% AAA = 8.72% A = 9.64% BBB = 10.18% The differences in these rates were probably caused primarily by: a. Tax effects b. Default risk differences c. Maturity risk differences d. Inflation differences e. Real risk-free rate differences Answer: b 12. In July 2009, Hungary successfully issued 1 billion euros in bonds. The transaction was managed by Citigroup. Who is the issuer and what is the category of bonds issued? a. Citigroup, b. The bank of Budapest, c. The Hungarian government, d. The New York Citibank, e. The Hungarian government, Answer: c Corporate bonds Municipal bonds Foreign government bonds Sinking bonds T-bonds 13. Roen is planning to invest in five-year 15% annual coupon bonds with a face value of $1,000 each. Calculate number to fill the blanks in the table and identify which one is the premium bond if the market is at equilibrium. Bond Discount Rate Bond Value Current Yield Bond A (1) $1,189.54 12.61% Bond B 15.00% (2) 15.00% Bond C 16.40% $954.58 (3) a. 9.00%, $988.76, 14.47%, bond A b. 10.00%, $1,000.00, 15.71%, bond A c. 11.00%, $1,100.00, 15.92%, bond B d. 12.24%, $1,000.00, 16.00%, bond B e. 10.00%, $1,250.00, 16.12%, bond C Answer: b (1) N = 5, PV = -1,189.54, PMT = 150, FV = 1,000 ⇨ I = 10.00% (2) Discount rate = coupon rate. Therefore bond value = $1,000 (3) CY = Annual Coupon PMT / Price of a Bond = $150 / $954.58 = 15.71% Premium bond = bond A 14. Assume that a $1 million par value, semiannual coupon U.S. Treasury note with five years to maturity has a coupon rate of 6%. The YTM of the bond is 11.00%. What is the value of the T-note? a. $511,282.39 b. $689,825.45 c. $973,871.22 d. $811,559.35 e. $987,654.32 Answer: d N = 10, I = 11.00/2, PMT = 1million * 6% / 2, FV = 1 million ⇨ PV = -811,559.35 15. The following bond list is from the business section of a newspaper on January 1, 2005 (all are semi-annual bonds). Prices are stated relative to the par value of $100. Calculate what number should be in the blank and indicate which bond is not trading at discount. Company Coupon Maturity Last Price Last Yield EST Spread UST (Years) EST Volume (1000s) 01-01Schubert, Inc. 8.125% $82.25 11.11% 6.20 2015 Chapman, 01-019.625% $80.48 12.05% 7.15 Inc. 2035 01-01Rust, Inc. 4.500% 5.62% 1.37 2010 Murphy & 01-015.375% $101.02 5.14% 0.89 Co. 2010 01-01Pickman, Inc. 7.750% $93.11 8.80% 3.89 2015 Last Price & Last Yield: bond’s price and YTM at the end of trading. EST Spread: bond’s spread above the relevant U.S. Treasury benchmark (percentage). UST: relevant maturity of U.S. Treasury benchmark for each bond. EST Volume: # of bonds traded during the day. 10 72,070 30 65,275 5 59,277 5 57,465 10 56,305 a. $88.27, Rust, Inc. b. $95.23, Murhpy & Co. c. $95.18, Murhpy & Co. d. $100.40, Pickman, Inc. e. $102.80, Schubert, Inc. Answer: c N = 10, I = 2.81, PMT = 2.25, FV = 100 ⇨ PV = -95.18 16. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? a. The bond’s expected capital gains yield is zero. b. The bond’s yield to maturity is above 9%. c. The bond’s current yield is above 9%. d. If the bond’s yield to maturity declines, the bond will sell at a discount. e. The bond’s current yield is less than its expected capital gains yield. Answer: a 17. McCue Inc.'s bonds currently sell for $1,250. They pay a $90 annual coupon, have a 25-year maturity, and a $1,000 par value, but they can be called in 5 years at $1,050. What is the difference between this bond's YTM and its YTC? a. 2.62% b. 2.88% c. 3.17% d. 3.48% e. 3.83% Answer: a If held to maturity: N = Maturity Price = PV PMT FV = Par I/YR = YTM Difference: YTM – YTC = 18. 25 $1,250 $90 $1,000 6.88% 2.62% Warren holds a small portfolio of 4 stocks as below. If called in 5 years: N = Call PV PMT FV = Call Price I/YR = YTC 5 $1,250 $90 $1,050 4.26% Stock Artemis, Inc. Babish & Co. Cornell Industries Danforth Motors Percentage of Portfolio 20% 30% 35% 15% Expected Return 8% 14% 12% 3% Standard Deviation 23% 27% 30% 32% What is expected return of the portfolio? a. 7.84% b. 8.11% c. 9.68% d. 10.45% e. 15.68% Answer: d E(rp) = sum(wi * ri) = (0.2 * 0.08) + (0.3 * 0.14) + (0.35 * 0.12) + (0.15 * 0.03) = 0.1045 or 10.45% 19. Below is investment amount, beta, and standard deviation that Jane holds in her portfolio. Stock Rouster Corp. McLoving Corp. Burger Queen, Inc. The Big Three, Inc. rf = 6%, RPM = 8% Portfolio Weight 30% 15% 20% 35% Beta 0.40 1.12 1.60 0.80 Standard Deviation 24.00% 16.00% 11.20% 12.00% Choose the company (1) contributing the least risk to the portfolio, (2) with the least stand-alone risk if all the stocks in the portfolio are equally weighted. And calculate (3) required return of the portfolio. a. Rouster Corp., b. McLoving Corp. c. Burger Queen, Inc., d. The Big Three, Inc., e. No such company, Answer: a Burger Queen, Inc., The Big Three, Inc., Rouster Corp., McLoving Corp, No such company, 13.10% 14.40% 15.28% 16.72% 18.69% The least risk to the portfolio = the least beta = Rouster Corp. The least stand-alone risk = the least standard deviation = Burger Queen, Inc. rp = rf + RPM*βp Stock Investment Beta Standard Deviation Weight Wi * Beta i Rouster Corp. $ 2,250 0.40 24.00% 0.30 0.12 McLoving Corp. $ 1,125 1.12 16.00% 0.15 0.168 Burger Queen, Inc. $ 1,500 1.60 11.20% 0.20 0.32 The Big Three, Inc. $ 2,625 0.80 12.00% 0.35 0.28 Total Investment $ 7,500 Sum = Portfolio Beta 0.888 𝛽𝑝 = ∑(𝑤𝑖 ∗ 𝛽𝑖 ) = 0.888 rp = rf + RPM*βp = 6% + (8% * 0.888) = 13.10% 20. Data for Dana Industries is shown below. Now Dana acquires some risky assets that cause its beta to increase by 30%. What is the stock's new required rate of return? Initial beta Risk free rate (rs) 1.00 6.20% Market risk premium, RPM 6.00% a. 14.00% b. 14.70% c. 15.44% d. 16.21% e. 17.02% Answer: a Old beta: Old rs = rRF + b(RPM) RPM Percentage increase in beta: Increase in IP: Find new beta after increase = Find old rRF: Old rs = rRF+ b(RPM): 10.2% = rRF + 1.0(6.0%): rRF = 10.2% − 6.0% = Find new rRF: Old rRF + increase in IP = Find new rs = new rRF + new beta(RPM) 1.00 10.20% 6.00% 30.00% 2.00% 1.30 4.20% 6.20% 14.00%