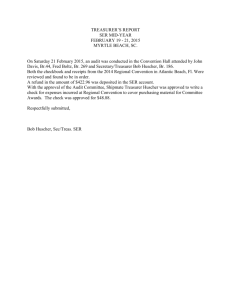

Final Decision

advertisement