guidelines in developing economics report

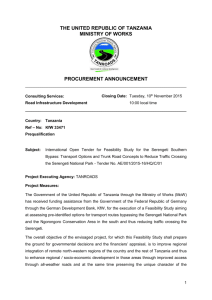

advertisement

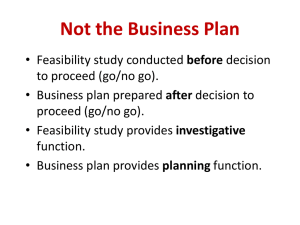

GUIDELINES OF COMPILING THE ECONOMICS REPORT FOR THE AGRIBEE FUND APPLICATION 1. INTRODUCTION In order to compile any economics report it is important to conduct feasibility study of a particular project or business. 1.1 FEASIBILITY STUDY Project feasibility looks at whether the project idea will work or not It knows beforehand whether there exists a market for the proposed product/service What would the investment requirements and where would you get the funding Technical knowhow to convert the idea into a tangible product In other words feasibility study examines operations (infrastructure), financial, HR and marketing aspects of a business on ex ante (before the venture enter into existence) basis. 1.2 MARKET ANALYSIS A market whether a place or not, is the interaction among buyers and sellers From a seller’s point of view, market analysis is primarily concerned with the aggregate demand of the proposed product/service in future and the market share (the percentage of market’s total sales that is earned by a particular company over a specific period of time. It is calculated by taking the company’s sales over the period and dividing it by the total sales of the industry over the same period. This metric is used to give a general idea of the size of a company to its market and its competitors; Market share is the percentage of a market (defined in terms of either units or revenue) accounted for by a specific entity) expected to be captured. Success of the proposed project clearly hinges on the continuation of the customers Identifying a market can be difficult because the whole universe cannot be your market Segmenting market accord to some criteria such as geographic scope, demographic and psychological profile of the potential customers etc. It is study of knowing who all comprise your customers, for this you require information on: Consumption trends Past and present supply position Production possibilities and constraints Imports and exports Competition Cost structure Elasticity of demand Consumer behavior, intentions, motivations, attitudes, preferences and requirements Distribution channels and marketing policies in use Administrative, technical and legal constraints impinging on the marketing of the product 1.3 FINANCIAL ANALYSIS Financial analysis (also referred to as financial statement analysis or accounting analysis or analysis of finance) refers to an assessment of the viability, stability and profitability of a business, sub-business or project. The objective of financial analysis is to ascertain whether the proposed project will be financially viable in the sense of being able to meet the burden of servicing debt and whether the proposed project will satisfy the return expectations of those who provide the capital. While conducting a financial appraisal certain aspects has to be looked into like: Investment outlay and cost of a project Means of financing Projected profitability Break-even point (In economics & business, specifically cost accounting, the break-even point (BEP) is the point at which cost or expenses and revenue are equal: there is no net loss or gain, and one has "broken even"). Cash flows of the project Investment worthiness judged in terms of various criteria of merit Projected financial position 1.3.1 Financial analysts often assess the following elements of a project: Profitability - its ability to earn income and sustain growth in both the short- and longterm. A project's degree of profitability is usually based on the income statement, which reports on the company's results of operations; Solvency - its ability to pay its obligation to creditors and other third parties in the longterm; Liquidity - its ability to maintain positive cash flow, while satisfying immediate obligations; Both solvency and liquidity are based on the project's balance sheet, which indicates the financial condition of a business as of a given point in time. Stability - the project's ability to remain in business in the long run, without having to sustain significant losses in the conduct of its business. Assessing a company's stability requires the use of the income statement and the balance sheet, as well as other financial and non-financial indicators. 1.4 TECHNICAL ANALYSIS This issue involved in the assessments of technical analysis of the proposed project may be classified into those pertaining to inputs, throughputs and outputs Input analysis: It is mainly concerned with the identification, quantification and evaluation of project inputs, that is, machinery and materials. Making sure that the right kind and quality of inputs would be available at the right time and cost throughout the life of a project. You have to enter into a long term contracts with the potential suppliers; in many cases you have to cultivate your supplier sources; e.g. when MacDonald entered India, they developed sustainable sources of supply of potatoes, lettuce and other ingredients for the burger. The activities involved in developing and retaining supply sources are referred to as supply chain management. Throughput analysis: It refers to the production/operations that you would perform on the inputs to add value. Usually, the inputs received would undergo a process of transformation in several stages of manufacture. Where to locate the facility, what would be the sequence, what would be the layout, what would be the quality control measures, etc. are the issues that you would learn in greater details in subsequent lessons. Output analysis: this involves product specification in terms of physical features-colour, weight, length, breadth, height; functional features; chemical-material properties; as well as standards to be complied with such as BIS, ISI, and ISO etc. 2. ECONOMIC ANALYSIS Economics is the study of costs-and-benefits. In regard to the feasibility of the study the entrepreneur is concerned whether the capital cost as well as the cost of the product is justifiable vis-à-vis the price at which it will sell at the market place e.g. technically, silver can be extracted from silver bromide, (a chemical used for processing the X-ray and photo films); but, the cost of extraction is so high that it would not be economically feasible to do so. Likewise, until recently cost of harnessing solar power was prohibitively high. This cost-benefit analyses goes into financial calculations for profitability analysis that we discussed under financial analysis. At this stage it is also useful to distinguish between economic and commercial feasibility; whereas economic feasibility leads one to the unit cost of the product, commercial feasibility informs whether enough units would sell. Overall Assessment of the Project To do so, the criteria normally used in Evaluations can be helpful: efficiency, effectiveness, impact, sustainability and relevance. Criteria Questions Relevant to Economical and Financial Analysis: Is the project using a minimum of resources and are resources used efficiently? Are the returns of the project adequate (only for projects with tangible benefits)? What is the extent to which the project reaches its purpose? Do the main stakeholders face solvency problems during the implementation of the project? Can the main stakeholders meet the recurrent costs after the end of the project? Is the project competitive (hence viable) internationally? What are the effects of the project on the national economy (economic growth, government budget, foreign exchange, and income distribution)? Does the project address the real needs of the intended beneficiaries? How well does the project fit with national priorities and reforms undertaken by the government? 2.1 LOCATION ANALYSIS This is carried out with a view to determine the best location for the business in terms of nearness to high traffic roads, nearness to infrastructure, ease of transportation of raw materials and finished products, cost of land acquisition and so on. 2.3 MANPOWER ANALYSIS This part of a feasibility study deals with the process of estimating the level of skill, professionalism and number of employees to be hired by the business. The salary scale, incentives and pay package are also estimated at this point. 2 . 4 S E NS IT IVIT Y AND RIS K A NAL Y S IS This is the last part of a feasibility study and probably the most important. After all other factors have been analyzed and proven viable, sensitivity and risk analysis can come in. Building a business without properly conducting a risk analysis is like flying a plane without regards to weather condition. Before any business idea is taken to the marketplace, its risk to reward ratio should be analyzed, the sensitivity to competition should be determined and the liquidation rate of companies in the industry of your proposed business venture should be calculated. With results obtained from sensitivity and risk analysis, growth and survival strategies can be developed for your proposed business. Carrying out feasibility study on your business idea will help you forge a competitive advantage for your business and increase your chance of success. Sensitivity analyses must be made on each of the key risk factors to assess their possible effects on the expected benefits - A sensitivity analysis consists of changing the value of key factors such as length of project, costs and discount rate, to assess their impact on benefits. There should be, at least, an 'optimistic', an 'average' and a 'pessimistic' scenario. Overall, knowing what assumptions a project is based on, and their possible effects on the planned results, will greatly facilitate its appraisal and implementation.