Document

advertisement

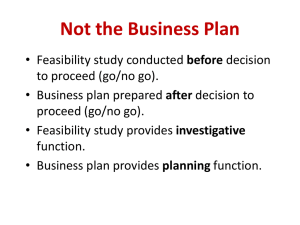

1 THEME 4: EVALUATION AND SELECTION OF STRATEGIC ALTERNATIVES Success criteria: suitability, acceptability & feasibility (viability). But first, an example: http://www.youtube.com/watch?v=e8Lw76 5qzH0 http://www.youtube.com/watch?v=ibYucMl yM9k © Alfonso VARGAS SÁNCHEZ 2 DEFINITIONS • Suitability is concerned with whether an alternative addresses the key issues relating to the strategic position of the company. • Acceptability is concerned with the expected performance outcomes of a strategic option. • Feasibility is concerned with whether a company has the resources and capabilities to deliver a strategy; in other words, if it could work in practice. 3 Implementation YES FEASIBILITY YES NO ACCEPTABILITY YES Strategic Option Rejected NO SUITABILITY Rejected NO Rejected 4 SUITABILITY • Factors to be considered: Environment - Capabilities - Expectations. • Techniques: PESTEL, 5-Forces, Strategic Groups, Value Chain, Core Competences, Stakeholder Mapping, Cultural Web. • Relative suitability: SWOT analysis, ranking, decision trees, scenarios. 5 Ranking: example 6 Decision tree: example 7 ACCEPTABILITY. Criteria • Return: – Profitability. – Cost-Benefit. – Real Options-Strategic Flexibility (redefinition of industry attractiveness & analysis of resources and capabilities). Example: hotel industry. – Shareholder Value Analysis (Total Shareholder Return & Economic Value Added). • Risk: – Financial Ratios Projections (http://www.netmba.com/finance/financial/ratios/). – Sensitivity Analysis. • Stakeholder reactions. 8 ACCEPTABILITY. Criteria 9 Profitability: Return Of Capital Employed (ROCE) 10 Profitability: Payback Period 11 Profitability: Discounted Cash Flow 12 Shareholder Value Analysis 13 Sensitivity Analysis 14 FEASIBILITY • Financial feasibility: – Funds Flow Forecasting. – Break-Even Analysis. • Resource deployment, for staying in business and for competing successfully. • Video: http://www.youtube.com/watch?v=b_YiHy NcIE8 15