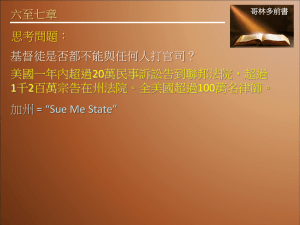

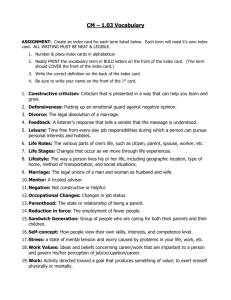

Family Law Table of Contents: Key Topics & Cases

advertisement