Answers to the Learning Objectives` recommended problems exam 2

advertisement

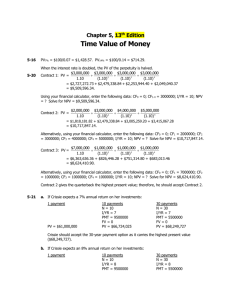

FIN303 Answers to the recommended problems Chapter 5 5-1 0 10% 1 | | PV = 10,000 2 | 3 | 4 | 5 | FV5 = ? FV5 = $10,000(1.10)5 = $10,000(1.61051) = $16,105.10. Alternatively, with a financial calculator enter the following: N = 5, I/YR = 10, PV = -10000, and PMT = 0. Solve for FV = $16,105.10. 5-2 0 7% | PV = ? 5 | 10 | 15 | 20 | FV20 = 5,000 With a financial calculator enter the following: N = 20, I/YR = 7, PMT = 0, and FV = 5000. Solve for PV = $1,292.10. 5-3 0 | I/YR = ? PV = 250,000 18 | FV18 = 1,000,000 With a financial calculator enter the following: N = 18, PV = -250000, PMT = 0, and FV = 1000000. Solve for I/YR = 8.01% ≈ 8%. 5-4 0 6.5% | PV = 1 N=? | FVN = 2 $2 = $1(1.065)N. With a financial calculator enter the following: I/YR = 6.5, PV = -1, PMT = 0, and FV = 2. Solve for N = 11.01 ≈ 11 years. 5-5 0 1 | 12% | PV = 42,180.535,000 2 | 5,000 N–2 | 5,000 N–1 | 5,000 N | FV = 250,000 Using your financial calculator, enter the following data: I/YR = 12; PV = -42180.53; PMT = -5000; FV = 250000; N = ? Solve for N = 11. It will take 11 years to accumulate $250,000. 5-6 Ordinary annuity: 0 | 7% 1 | 300 2 | 300 3 | 300 4 5 | | 300 300 FVA5 = ? With a financial calculator enter the following: N = 5, I/YR = 7, PV = 0, and PMT = 300. Solve for FV = $1,725.22. Annuity due: 0 7% 1 | | 300 300 2 | 300 3 | 300 4 | 300 5 | With a financial calculator, switch to “BEG” and enter the following: N = 5, I/YR = 7, PV = 0, and PMT = 300. Solve for FV = $1,845.99. Don’t forget to switch back to “END” mode. 5-7 0 | 8% 1 | 100 2 | 100 3 | 100 4 | 200 5 | 300 6 | 500 FV = ? PV = ? Using a financial calculator, enter the following: CF0 = 0; CF1 = 100; Nj = 3; CF4 = 200 (Note calculator will show CF2 on screen.); CF5 = 300 (Note calculator will show CF3 on screen.); CF6 = 500 (Note calculator will show CF4 on screen.); and I/YR = 8. Solve for NPV = $923.98. To solve for the FV of the cash flow stream with a calculator that doesn’t have the NFV key, do the following: Enter N = 6, I/YR = 8, PV = -923.98, and PMT = 0. Solve for FV = $1,466.24. You can check this as follows: 0 | 8% 1 | 100 2 | 100 3 | 100 4 | 200 5 | 300 (1.08)2 (1.08)3 (1.08)4 (1.08)5 5-8 6 | 500 (1.08) 324.00 233.28 125.97 136.05 146.93 $1,466.23 Using a financial calculator, enter the following: N = 60, I/YR = 1, PV = -20000, and FV = 0. Solve for PMT = $444.89. EAR = 1 M I NOM – 1.0 M = (1.01)12 – 1.0 = 12.68%. Alternatively, using a financial calculator, enter the following: NOM% = 12 and P/YR = 12. Solve for EFF% = 12.6825%. Remember to change back to P/YR = 1 on your calculator. 5-9 a. 0 6% | -500 1 | $500(1.06) = $530.00. FV = ? Using a financial calculator, enter N = 1, I/YR = 6, PV = -500, PMT = 0, and FV = ? Solve for FV = $530.00. b. 0 6% | -500 1 | 2 | $500(1.06)2 = $561.80. FV = ? Using a financial calculator, enter N = 2, I/YR = 6, PV = -500, PMT = 0, and FV = ? Solve for FV = $561.80. c. 0 6% | PV = ? 1 | 500 $500(1/1.06) = $471.70. Using a financial calculator, enter N = 1, I/YR = 6, PMT = 0, and FV = 500, and PV = ? Solve for PV = $471.70. d. 0 | 6% PV = ? 1 | 2 | $500(1/1.06)2 = $445.00. 500 Using a financial calculator, enter N = 2, I/YR = 6, PMT = 0, FV = 500, and PV = ? Solve for PV = $445.00. 5-10 a. 0 1 | 6% | $895.42. -500 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | $500(1.06)10 = FV = ? Using a financial calculator, enter N = 10, I/YR = 6, PV = -500, PMT = 0, and FV = ? Solve for FV = $895.42. b. 0 12% 1 | | $1,552.92. -500 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | $500(1.12)10 = FV = ? Using a financial calculator, enter N = 10, I/YR = 12, PV = -500, PMT = 0, and FV = ? Solve for FV = $1,552.92. c. 0 6% 1 | | $279.20. PV = ? 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | $500/(1.06)10 = 500 Using a financial calculator, enter N = 10, I/YR = 6, PMT = 0, FV = 500, and PV = ? Solve for PV = $279.20. d. 0 12% 1 | | PV = ? 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 1,552.90 $1,552.90/(1.12)10 = $499.99. Using a financial calculator, enter N = 10, I/YR = 12, PMT = 0, FV = 1552.90, and PV = ? Solve for PV = $499.99. $1,552.90/(1.06)10 = $867.13. Using a financial calculator, enter N = 10, I/YR = 6, PMT = 0, FV = 1552.90, and PV = ? Solve for PV = $867.13. e. The present value is the value today of a sum of money to be received in the future. For example, the value today of $1,552.90 to be received 10 years in the future is about $500 at an interest rate of 12%, but it is approximately $867 if the interest rate is 6%. Therefore, if you had $500 today and invested it at 12%, you would end up with $1,552.90 in 10 years. The present value depends on the interest rate because the interest rate determines the amount of interest you forgo by not having the money today. 5-11 a. 2005 | -6 ? 2006 | 2007 | 2008 | 2009 | 2010 | 12 (in millions) With a calculator, enter N = 5, PV = -6, PMT = 0, FV = 12, and then solve for I/YR = 14.87%. b. The calculation described in the quotation fails to consider the compounding effect of interest. It can be demonstrated to be incorrect as follows: $6,000,000(1.20)5 = $6,000,000(2.48832) = $14,929,920, which is greater than $12 million. Thus, the annual growth rate is less than 20%; in fact, it is about 15%, as shown in Part a. 5-12 These problems can all be solved using a financial calculator by entering the known values shown on the time lines and then pressing the I/YR button. a. 0 | +700 I/YR = ? 1 | -749 With a financial calculator, enter: N = 1, PV = 700, PMT = 0, and FV = -749. I/YR = 7%. b. 0 I/YR = ? 1 | -700 | +749 With a financial calculator, enter: N = 1, PV = -700, PMT = 0, and FV = 749. I/YR = 7%. c. 0 I/YR = ? | +85,000 10 | -201,229 With a financial calculator, enter: N = 10, PV = 85000, PMT = 0, and FV = 201229. I/YR = 9%. d. 0 I/YR = ? 1 2 3 4 5 | | | | | | +9,000 -2,684.80 -2,684.80 -2,684.80 -2,684.80 -2,684.80 With a financial calculator, enter: N = 5, PV = 9000, PMT = -2684.80, and FV = 0. I/YR = 15%. 5-13 a. 7% | -200 ? | 400 With a financial calculator, enter I/YR = 7, PV = -200, PMT = 0, and FV = 400. Then press the N key to find N = 10.24. Override I/YR with the other values to find N = 7.27, 4.19, and 1.00. b. 10% | -200 c. 18% | -200 d. | 100% ? | 400 Enter: I/YR = 10, PV = -200, PMT = 0, and FV = 400. N = 7.27. ? | 400 Enter: I/YR = 18, PV = -200, PMT = 0, and FV = 400. N = 4.19. ? | Enter: I/YR = 100, PV = -200, PMT = 0, and FV = 400. -200 5-14 a. 0 | 10% 400 1 | 400 2 | 400 N = 1.00. 3 | 400 4 | 400 5 | 400 6 | 400 7 | 400 8 | 400 9 | 400 10 | 400 FV = ? With a financial calculator, enter N = 10, I/YR = 10, PV = 0, and PMT = -400. Then press the FV key to find FV = $6,374.97. b. 0 | 5% 1 | 200 2 | 200 3 | 200 4 | 200 5 | 200 FV = ? With a financial calculator, enter N = 5, I/YR = 5, PV = 0, and PMT = -200. Then press the FV key to find FV = $1,105.13. c. 0 | 1 | 400 2 | 400 0% 3 | 400 4 | 400 5 | 400 FV = ? With a financial calculator, enter N = 5, I/YR = 0, PV = 0, and PMT = -400. Then press the FV key to find FV = $2,000. d. To solve Part d using a financial calculator, repeat the procedures discussed in Parts a, b, and c, but first switch the calculator to “BEG” mode. Make sure you switch the calculator back to “END” mode after working the problem. 1. 0 10% 1 | | 400 400 2 | 400 3 | 400 4 | 400 5 | 400 6 | 400 7 | 400 8 | 400 9 10 | | 400 FV = ? With a financial calculator on BEG, enter: N = 10, I/YR = 10, PV = 0, and PMT = -400. FV = $7,012.47. 2. 0 5% 1 | | 200 200 2 | 200 3 | 200 4 5 | | 200 FV = ? With a financial calculator on BEG, enter: N = 5, I/YR = 5, PV = 0, and PMT = -200. FV = $1,160.38. 3. 0 0% 1 | | 400 400 2 | 400 3 | 400 4 5 | | 400 FV = ? With a financial calculator on BEG, enter: N = 5, I/YR = 0, PV = 0, and PMT = -400. FV = $2,000. 5-15 a. 0 10% 1 | | PV = ? 400 2 | 400 3 | 400 4 | 400 5 | 400 6 | 400 7 | 400 8 | 400 9 | 400 10 | 400 With a financial calculator, simply enter the known values and then press the key for the unknown. Enter: N = 10, I/YR = 10, PMT = -400, and FV = 0. PV = $2,457.83. b. 0 5% 1 | | PV = ? 200 2 | 200 3 | 200 4 | 200 5 | 200 With a financial calculator, enter: N = 5, I/YR = 5, PMT = -200, and FV = 0. PV = $865.90. c. 0 | 0% 1 | 2 | 3 | 4 | 5 | PV = ? 400 400 400 400 400 With a financial calculator, enter: N = 5, I/YR = 0, PMT = -400, and FV = 0. PV = $2,000.00. d. 1. 0 1 | 10% | 400 400 PV = ? 2 | 400 3 | 400 4 | 400 5 | 400 6 | 400 7 | 400 8 | 400 9 | 400 With a financial calculator on BEG, enter: N = 10, I/YR = 10, PMT = 400, and FV = 0. PV = $2,703.61. 2. 0 1 | 5% | 200 200 PV = ? 2 | 200 3 | 200 4 | 200 5 | With a financial calculator on BEG, enter: N = 5, I/YR = 5, PMT = -200, and FV = 0. PV = $909.19. 3. 0 0% 1 | | 400 400 PV = ? 2 | 400 3 | 400 4 | 400 5 | With a financial calculator on BEG, enter: N = 5, I/YR = 0, PMT = -400, and FV = 0. PV = $2,000.00. 5-16 PV7% = $100/0.07 = $1,428.57. PV14% = $100/0.14 = $714.29. When the interest rate is doubled, the PV of the perpetuity is halved. 5-17 0 1 2 3 4 | I/YR = ? | | | | 85,000 -8,273.59 -8,273.59 -8,273.59 -8,273.59 30 | -8,273.59 With a calculator, enter N = 30, PV = 85000, PMT = -8273.59, FV = 0, and then solve for I/YR = 9%. 5-18 a. Cash Stream A 0 8% 1 2 3 4 5 | | | | | | PV = ? 100 400 400 400 300 Cash Stream B 0 8% 1 2 3 4 5 | | | | | | PV = ? 300 400 400 400 100 With a financial calculator, simply enter the cash flows (be sure to enter CF0 = 0), enter I/YR = 8, and press the NPV key to find NPV = PV = $1,251.25 for the first problem. Override I/YR = 8 with I/YR = 0 to find the next PV for Cash Stream A. Repeat for Cash Stream B to get NPV = PV = $1,300.32. b. PVA = $100 + $400 + $400 + $400 + $300 = $1,600. 10 | 5-19 PVB = $300 + $400 + $400 + $400 + $100 = $1,600. a. Begin with a time line: 40 41 64 65 | 9% | | | 5,000 5,000 5,000 Using a financial calculator input the following: N = 25, I/YR = 9, PV = 0, PMT = 5000, and solve for FV = $423,504.48. b. 40 9% | 41 | 5,000 69 | 5,000 70 | 5,000 FV = ? Using a financial calculator input the following: N = 30, I/YR = 9, PV = 0, PMT = 5000, and solve for FV = $681,537.69. c. 1. 65 9% | 423,504.48 66 | PMT 67 | PMT 84 | PMT 85 | PMT Using a financial calculator, input the following: N = 20, I/YR = 9, PV = -423504.48, FV = 0, and solve for PMT = $46,393.42. 2. 70 9% | 681,537.69 71 | PMT 72 | PMT 84 | PMT 85 | PMT Using a financial calculator, input the following: N = 15, I/YR = 9, PV = -681537.69, FV = 0, and solve for PMT = $84,550.80. 5-22 a. This can be done with a calculator by specifying an interest rate of 5% per period for 20 periods with 1 payment per period. N = 10 2 = 20, I/YR = 10/2 = 5, PV = -10000, FV = 0. Solve for PMT = $802.43. b. Set up an amortization table: Period 1 2 Beginning Balance $10,000.00 9,697.57 Payment $802.43 802.43 Interest $500.00 484.88 $984.88 Payment of Principal $302.43 317.55 Ending Balance $9,697.57 9,380.02 Because the mortgage balance declines with each payment, the portion of the payment that is applied to interest declines, while the portion of the payment that is applied to principal increases. The total payment remains constant over the life of the mortgage. c. Jan must report interest of $984.88 on Schedule B for the first year. Her interest income will decline in each successive year for the reason explained in Part b. d. Interest is calculated on the beginning balance for each period, as this is the amount the lender has loaned and the borrower has borrowed. As the loan is amortized (paid off), the beginning balance, hence the interest charge, declines and the repayment of principal increases. 5-23 a. 0 12% 1 | | -500 2 | 3 | 4 | 5 | FV = ? With a financial calculator, enter N = 5, I/YR = 12, PV = -500, and PMT = 0, and then press FV to obtain FV = $881.17. b. 0 6% 1 | | -500 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | FV = ? With a financial calculator, enter N = 10, I/YR = 6, PV = -500, and PMT = 0, and then press FV to obtain FV = $895.42. I = PV 1 NOM M Alternatively, FVN NM 0.12 = $500 1 2 5(2) = $500(1.06)10 = $895.42. c. 0 3% 4 | | -500 8 | 12 | 16 | 20 | FV = ? With a financial calculator, enter N = 20, I/YR = 3, PV = -500, and PMT = 0, and then press FV to obtain FV = $903.06. 0.12 4 0 1% 12 | | -500 48 | d. 5( 4 ) Alternatively, FVN = $500 1 + 24 | 36 | = $500(1.03)20 = $903.06. 60 | FV = ? With a financial calculator, enter N = 60, I/YR = 1, PV = -500, and PMT = 0, and then press FV to obtain FV = $908.35. Alternatively, FVN = $500 1 + e. 0 365 | 0.0329% | -500 5 (12) 0.12 12 = $500(1.01)60 = $908.35. 1,825 | FV = ? With a financial calculator, enter N = 1825, I/YR = 12/365 = 0.032877, PV = 500, and PMT = 0, and then press FV to obtain FV = $910.97. f. The FVs increase because as the compounding periods increase, interest is earned on interest more frequently. 5-24 a. 0 6% 2 | | PV = ? 4 | 6 | 8 | 10 | 500 With a financial calculator, enter N = 10, I/YR = 6, PMT = 0, and FV = 500, and then press PV to obtain PV = $279.20. 1 1 + INOM/M 0 3% 4 | | PV = ? 1 1 + 0 . 12 /2 8 | 5(2) = $500 10 1 1.06 = $500 b. NM = FVN Alternatively, PV 12 | = $279.20. 16 | 20 | 500 With a financial calculator, enter N = 20, I/YR = 3, PMT = 0, and FV = 500, and then press PV to obtain PV = $276.84. 1 1 + 0.12 /4 4 (5) Alternatively, PV = $500 c. 0 1% 1 | | PV = ? 2 | 20 1 1.03 = $500 = $276.84. 12 | 500 With a financial calculator, enter N = 12, I/YR = 1, PMT = 0, and FV = 500, and then press PV to obtain PV = $443.72. 12(1) 1 1 + 0 . 12 /12 Alternatively, PV = $500 12 1 = $443.72. 1.01 = $500 d. The PVs for Parts a and b decline as periods/year increases. This occurs because, with more frequent compounding, a smaller initial amount (PV) is required to get to $500 after 5 years. For Part c, even though there are 12 periods/year, compounding occurs over only 1 year, so the PV is larger. Chapter 6 6-2 Short-term interest rates are more volatile because (1) the Fed operates mainly in the short-term sector, hence Federal Reserve intervention has its major effect here, and (2) long-term interest rates reflect the average expected inflation rate over the next 20 to 30 years, and this average does not change as radically as year-to-year expectations. 6-3 Interest rates will fall as the recession takes hold because (1) business borrowings will decrease and (2) the Fed will increase the money supply to stimulate the economy. Thus, it would be better to borrow short-term now, and then to convert to long-term when rates have reached a cyclical low. Note, though, that this answer requires interest rate forecasting, which is extremely difficult to do with better than 50% accuracy. T-bill rate = r* + IP 5.5% = r* + 3.25% r* = 2.25%. 6-2 6-3 r* = 3%; I1 = 2%; I2 = 4%; I3 = 4%; MRP = 0; rT2 = ?; rT3 = ? r = r* + IP + DRP + LP + MRP. Since these are Treasury securities, DRP = LP = 0. rT2 = r* + IP2. IP2 = (2% + 4%)/2 = 3%. rT2 = 3% + 3% = 6%. rT3 = r* + IP3. IP3 = (2% + 4% + 4%)/3 = 3.33%. rT3 = 3% + 3.33% = 6.33%. 6-4 rT10 = 6%; rC10 = 8%; LP = 0.5%; DRP = ? r = r* + IP + DRP + LP + MRP. rT10 = 6% = r* + IP10 + MRP10; DRP = LP = 0. rC10 = 8% = r* + IP10 + DRP + 0.5% + MRP10. Because both bonds are 10-year bonds the inflation premium and maturity risk premium on both bonds are equal. The only difference between them is the liquidity and default risk premiums. rC10 = 8% = r* + IP10 + MRP10 + 0.5% + DRP. But we know from above that r* + IP10 + MRP10 = 6%; therefore, rC10 = 8% = 6% + 0.5% + DRP 1.5% = DRP. 6-5 r* = 3%; IP2 = 3%; rT2 = 6.2%; MRP2 = ? rT2 = r* + IP2 + MRP2 = 6.2% rT2 = 3% + 3% + MRP2 = 6.2% MRP2 = 0.2%. 6-6 r* = 5%; IP4 = 16%; MRP = DRP = LP = 0; rRF4 = ? rRF4= (1 + r*)(1 + IP4) – 1 = (1.05)(1.16) – 1 = 0.218 = 21.8%. Chapter 7 7-1 With your financial calculator, enter the following: N = 10; I/YR = YTM = 9%; PMT = 0.08 1,000 = 80; FV = 1000; PV = VB = ? PV = $935.82. 7-2 VB = $985; M = $1,000; Int = 0.07 $1,000 = $70. a. N = 10; PV = -985; PMT = 70; FV = 1000; YTM = ? Solve for I/YR = YTM = 7.2157% 7.22%. b. N = 7; I/YR = 7.2157; PMT = 70; FV = 1000; PV = ? Solve for VB = PV = $988.46. 7-3 The problem asks you to find the price of a bond, given the following facts: N = 2 8 = 16; I/YR = 8.5/2 = 4.25; PMT = (0.09/2) × 1,000 = 45; FV = 1000. With a financial calculator, solve for PV = $1,028.60. 7-4 With your financial calculator, enter the following to find YTM: N = 10 2 = 20; PV = -1100; PMT = 0.08/2 1,000 = 40; FV = 1000; I/YR = YTM =? YTM = 3.31% 2 = 6.62%. With your financial calculator, enter the following to find YTC: N = 5 2 = 10; PV = -1100; PMT = 0.08/2 1,000 = 40; FV = 1050; I/YR = YTC = ? YTC = 3.24% 2 = 6.49%. Since the YTC is less than the YTM, investors would expect the bonds to be called and to earn the YTC. 7-5 a. 1. 5%: Bond L: Bond S: 2. 8%: Bond L: Bond S: 3. 12%: Bond L: Bond S: Input N = 15, I/YR = 5, PMT = 100, FV = 1000, PV = ?, PV = $1,518.98. Change N = 1, PV = ? PV = $1,047.62. From Bond S inputs, change N = 15 and I/YR = 8, PV = ?, PV = $1,171.19. Change N = 1, PV = ? PV = $1,018.52. From Bond S inputs, change N = 15 and I/YR = 12, PV = ?, PV = $863.78. Change N = 1, PV = ? PV = $982.14. 7-8 b. Think about a bond that matures in one month. Its present value is influenced primarily by the maturity value, which will be received in only one month. Even if interest rates double, the price of the bond will still be close to $1,000. A 1year bond’s value would fluctuate more than the one-month bond’s value because of the difference in the timing of receipts. However, its value would still be fairly close to $1,000 even if interest rates doubled. A long-term bond paying semiannual coupons, on the other hand, will be dominated by distant receipts, receipts that are multiplied by 1/(1 + rd/2)t, and if rd increases, these multipliers will decrease significantly. Another way to view this problem is from an opportunity point of view. A 1-month bond can be reinvested at the new rate very quickly, and hence the opportunity to invest at this new rate is not lost; however, the long-term bond locks in subnormal returns for a long period of time. The rate of return is approximately 15.03%, found with a calculator using the following inputs: N = 6; PV = -1000; PMT = 140; FV = 1090; I/YR = ? Solve for I/YR = 15.03%. Despite a 15% return on the bonds, investors are not likely to be happy that they were called. Because if the bonds have been called, this indicates that interest rates have fallen sufficiently that the YTC is less than the YTM. (Since they were originally sold at par, the YTM at issuance= 14%.) Rates are sufficiently low to justify the call. Now investors must reinvest their funds in a much lower interest rate environment. N 7-9 a. VB = (1INT r ) t 1 t d M (1 rd ) N M = $1,000. PMT = 0.09($1,000) = $90. 1. VB = $829: Input N = 4, PV = -829, PMT = 90, FV = 1000, YTM = I/YR = ? I/YR = 14.99%. 2. VB = $1,104: Change PV = -1104, YTM = I/YR = ? I/YR = 6.00%. b. Yes. At a price of $829, the yield to maturity, 15%, is greater than your required rate of return of 12%. If your required rate of return were 12%, you should be willing to buy the bond at any price below $908.88. 7-10 a. Solving for YTM: N = 9, PV = -901.40, PMT = 80, FV = 1000 I/YR = YTM = 9.6911%. b. The current yield is defined as the annual coupon payment divided by the current price. CY = $80/$901.40 = 8.875%. Expected capital gains yield can be found as the difference between YTM and the current yield. CGY = YTM – CY = 9.691% – 8.875% = 0.816%. Alternatively, you can solve for the capital gains yield by first finding the expected price next year. N = 8, I/YR = 9.6911, PMT = 80, FV = 1000 PV = -$908.76. VB = $908.76. Hence, the capital gains yield is the percentage price appreciation over the next year. CGY = (P1 – P0)/P0 = ($908.76 – $901.40)/$901.40 = 0.816%. c. As rates change they will cause the end-of-year price to change and thus the realized capital gains yield to change. As a result, the realized return to investors will differ from the YTM. 7-16 Before you can solve for the price, we must find the appropriate semiannual rate at which to evaluate this bond. EAR = (1 + INOM/2)2 – 1 0.0816 = (1 + INOM/2)2 – 1 INOM = 0.08. Semiannual interest rate = 0.08/2 = 0.04 = 4%. Solving for price: 7-18 N = 2 10 = 20, I/YR = 4, PMT = 0.09/2 1,000 = 45, FV = 1000 PV = -$1,067.95. VB = $1,067.95. a. According to Table 7.5, the yield to maturities for Goldman Sachs’ and GE’s bonds are 5.463% and 4.949%, respectively. So, Goldman Sachs would need to set a coupon of 5.46% to sell its bonds at par, while GE would need to set a coupon of 4.95%. b. Current investments in Goldman Sachs and GE would be expected to earn returns equal to their expected present yields. The return is safer for GE. Looking at the table, we see that the Goldman Sachs bonds are rated A, while the GE bonds have a rating of AA+. Chapter 8 8-4 Yes, if the portfolio’s beta is equal to zero. In practice, however, it may be impossible to find individual stocks that have a nonpositive beta. In this case it would also be impossible to have a stock portfolio with a zero beta. Even if such a portfolio could be constructed, investors would probably be better off just purchasing Treasury bills, or other zero beta investments. 8-7 The risk premium on a high-beta stock would increase more than that on a lowbeta stock. RPj = Risk Premium for Stock j = (rM – rRF)bj. If risk aversion increases, the slope of the SML will increase, and so will the market risk premium (rM – rRF). The product (rM – rRF)bj is the risk premium of the jth stock. If bj is low (say, 0.5), then the product will be small; RPj will increase by only half the increase in RPM. However, if bj is large (say, 2.0), then its risk premium will rise by twice the increase in RPM. 8-8 8-1 According to the Security Market Line (SML) equation, an increase in beta will increase a company’s expected return by an amount equal to the market risk premium times the change in beta. For example, assume that the risk-free rate is 6%, and the market risk premium is 5%. If the company’s beta doubles from 0.8 to 1.6 its expected return increases from 10% to 14%. Therefore, in general, a company’s expected return will not double when its beta doubles. r̂ = (0.1)(-50%) + (0.2)(-5%) + (0.4)(16%) + (0.2)(25%) + (0.1)(60%) = 11.40%. 2 = (-50% – 11.40%)2(0.1) + (-5% – 11.40%)2(0.2) + (16% – 11.40%)2(0.4) + (25% – 11.40%)2(0.2) + (60% – 11.40%)2(0.1) 2 = 712.44; = 26.69%. CV = 8-2 26.69% 11.40% = 2.34. Investment $35,000 40,000 Total $75,000 Beta 0.8 1.4 bp = ($35,000/$75,000)(0.8) + ($40,000/$75,000)(1.4) = 1.12. 8-3 rRF = 6%; rM = 13%; b = 0.7; r = ? r = rRF + (rM – rRF)b = 6% + (13% – 6%)0.7 = 10.9%. 8-4 rRF = 5%; RPM = 6%; rM = ? rM = 5% + (6%)1 = 11%. r when b = 1.2 = ? r = 5% + 6%(1.2) = 12.2%. 8-5 a. r = 11%; rRF = 7%; RPM = 4%. r 11% 4% b = rRF + (rM – rRF)b = 7% + 4%b = 4%b = 1. b. rRF = 7%; RPM = 6%; b = 1. r = rRF + (rM – rRF)b = 7% + (6%)1 = 13%. N 8-6 a. r̂ Piri . i 1 r̂Y = 0.1(-35%) + 0.2(0%) + 0.4(20%) + 0.2(25%) + 0.1(45%) = 14% versus 12% for X. N (r b. = i r̂ ) 2 Pi . i1 σ 2X = (-10% – 12%)2(0.1) + (2% – 12%)2(0.2) + (12% – 12%)2(0.4) + (20% – 12%)2(0.2) + (38% – 12%)2(0.1) = 148.8. X = 12.20% versus 20.35% for Y. CVX = X/ r̂ X = 12.20%/12% = 1.02, while CVY = 20.35%/14% = 1.45. If Stock Y is less highly correlated with the market than X, then it might have a lower beta than Stock X, and hence be less risky in a portfolio sense. 8-7 Portfolio beta = $400,000 $600,000 $1,000,000 (1.50) + (-0.50) + (1.25) + $4,000,000 $4,000,000 $4,000,000 $2,000,000 (0.75) $4,000,000 bp = (0.1)(1.5) + (0.15)(-0.50) + (0.25)(1.25) + (0.5)(0.75) = 0.15 – 0.075 + 0.3125 + 0.375 = 0.7625. rp = rRF + (rM – rRF)(bp) = 6% + (14% – 6%)(0.7625) = 12.1%. Alternative solution: First, calculate the return for each stock using the CAPM equation [rRF + (rM – rRF)b], and then calculate the weighted average of these returns. rRF = 6% and (rM – rRF) = 8%. Stock A Investment $ 400,000 Beta 1.50 r = rRF + (rM – rRF)b Weight 18% 0.10 B C D Total 600,000 1,000,000 2,000,000 $4,000,000 (0.50) 1.25 0.75 2 16 12 rp = 18%(0.10) + 2%(0.15) + 16%(0.25) + 12%(0.50) = 12.1%. 8-8 In equilibrium: rJ = r̂J = 12.5%. rJ = rRF + (rM – rRF)b 12.5% = 4.5% + (10.5% – 4.5%)b b = 1.33. 0.15 0.25 0.50 1.00