Econ 3010: Intermediate Price Theory (microeconomics)

Econ 3010: Intermediate Price Theory (microeconomics)

Professor David L. Dickinson

PROBLEM SET #3

GAME THEORY

1)

What is the basic conflict inherent in the Prisoners’ dilemma? Set up a 2x2 simultaneous move game matrix that analyzes the Cold War arms build up between the

U.S. and Russia as a Prisoners’ Dilemma. How about analyzing a duopoly competition game between Acme Inc and Gizmo & Co.?

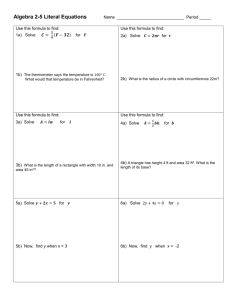

2) Consider the following simultaneous move game in baseball between a batter

(Player A) and a Pitcher (Player B). The Pitcher can throw either a fastball or a slower change-up, and either pitch can be thrown high or low. The batter does not have great reflexes and so must decide whether to swing hi, middle, or low prior to a pitch being thrown (i.e., can’t change his mind once the pitch is on the way). If the batter hits a fastball well, it’s a 500-foot home-run, but if he hits a change-up well, it’s a 340-ft homerun that barely makes it over the fence (still a homer, but not quite as satisfying for the batter). The payoffs matrix below describes the various outcomes possibilities in this game.

Player A

(Batter)

Hi

Middle

Hi Fastball

100 , -10

20 , 45

Player B (Pitcher)

Low Fastball

0 , 80

30 , 40

Hi Change-up Low Change-up

80 , 10

10 , 50

0 , 70

20 , 40 low 0 , 80 100 , -10 0 , 70 80 , 10

Does the Batter have a dominant strategy? Does the Batter have a dominated strategy?

What about the Pitcher? Is there a Nash equilibrium (in pure strategies, not mixed strategies) in this game? What does a mixed strategy equilibrium imply in this game context (you don’t have to try and find it, just describe it)?

3) Now consider the same Batter/Pitcher game as in question (2), but suppose the batter has worked on his reflexes (off-season training, I guess) such that he has time to decide what to do after the pitch is made, no matter what the pitch. Furthermore, the batter can now make his strategy choice to swing Hi, Middle, or Low, knowing exactly which pitch is coming.

Set up a sequential-move game tree for this new game, and analyze the likely outcome.

4) [A tough one] Consider the payoff matrix below that one could use to describe the final penalty kick during the shootout that determined the winner of the 1999

Women’s World Cup (the U.S. won, by the way).

U.S. Kicker

Kick to Goalie’s right Kick to Goalie’s left

Chinese Goalie Dive to the right

Dive to the left

0 , 0

-10 , 10

-10 , 10

0 , 0

1

There is apparently no Nash equilibrium in this game. However, we can show a Nash equilibrium in mixed strategies by examining probabilities with which each strategy might be played. Show that the mixed strategy equilibrium is one in which the U.S.

Kicker plays each of her strategies with a 50% probability, and the Chinese Goalie plays each of her strategies with a 50% probability. To do this, consider that the Goalies dives right with probability p and dives left with probability (1-p) . The U.S. Kicker kicks to the goalie’s right with probability q and kicks to the goalie’s left with probability

(1-q) .

(Hint: the goalie’s expected payoff of diving right is now q *0 + ( 1-q )*(-10), and the expected payoff of diving left is now q *(-10) + ( 1-q )*0. Think now of the best action to play given the probability choice of the counterpart, and try to think of how the players will react ).

5) Consider the following game, the so-called “Battle of the sexes”. A husband and wife are planning a night out, and they have two options: go see the opera, or go to a wrestling match. The guy would rather see the wrestling match than opera, but he would rather see the opera with his wife than go by himself to see wrestling. She feels similarly—she prefers opera to wrestling, but would rather be together with her husband at wrestling than by herself at the opera. The game is depicted below (yes, it assumes they are deciding without any discussion….a simultaneous-move game).

Wife

Husband Go see Wrestling

Go see Wrestling

2 , 1

Go to the Opera

0 , 0

Go to the Opera 0 , 0 1 , 2

Is there more than one Nash equilibrium in this game? If so, can you identify them?

How might the wife and husband choose among multiple equilibria in this game?

UNCERTAINTY

1) Suppose that there are four possible payoff outcomes to the risky situation confronting Betty. The outcomes are payoffs of $100, $150, $250, and $400. The respective probabilities of each outcome are .4, .3, .2, and .1. Calculate Betty’s expected value of this lottery? What is the variance of the lottery Betty must consider?

2) Consider Betty again. Sketch the probability distribution of the lottery facing

Betty. Also, if you were to give Betty a certain amount of money with certainty, what amount would make here indifferent between the certain amount versus playing the lottery described above? Calculate this assuming Betty has U (x)= x . What if Betty has

U (x)=x

2

? Finally, what if Betty has utility function U (x)=x? What kind of risk preferences does Betty have for each of these different utility functions?

3) Consider a risk-averse individual. What element of the utility function picture indicates a more versus less risk-averse person? What about for risk-loving individuals?

4) Consider Betty one last time? Suppose that she has utility function U (x)= x , but that the lottery is not [$100,$150,$250,$400] with respective probabilities [.4,.3,.2,.1], but

2

rather it is [$25,$150,$200,$325] with probabilities [.25,.25,.25,.25]. What is the expected value of this lottery, and what is its variance? With the utility function U (x)= x , how much would you have to now give Betty with certainty in order that she be indifferent between the lottery and the certain $ amount?

5) Consider the following insurance scenario. You are risk-averse with U (w)= w , you currently have wealth=w of $100,000, but a loss of $10,000 might occur with a 20% probability. Acme insurance offers you a full insurance policy that would pay you

$10,000 in the event that the loss occurs. The price of the insurance policy is $1,400.

Will you buy this policy? Why or why not?

6) Management and the Union are about to undergo labor negotiations on the companies total wages to all union employees. Should negotiations fail, the case will be submitted to arbitration. There is uncertainty as to what the arbitrator would decide and the Union’s current lead negotiator, Nichole, feels that the likely outcomes from arbitration are a total wage package of either $2,000,000 or $1,000,000, and she estimates the probability of each outcome at 50%.

If Nichole is risk-neutral and has utility function U (w)=w, where w is the total wage package, what is the lowest amount that the Union (i.e., Nichole) would accept in negotiations with management?

(this last part of question could be saved until the Behavioral Economics section).

Suppose that is Nichole is replaced as the Union’s lead negotiator by Guido. Guido is risk-averse, with utility function U (w)= w . However, Guido is also more optimistic about the likely arbitration outcomes (because he has bribed several of the possible arbitrators in the past). He feels that an arbitrator would render a wage settlement of

$2,000,000 with probability of 75%, and settlement of $1,000,000 with probability of only 25%. What is Guido’s lowest acceptable negotiated settlement for the Union?

Show this on a Graph of Guido’s utility function. What lesson can you take from comparing Nichole and Guido?

GENERAL EQUILIBRIUM

1) Consider the market for two goods and two consumers. Draw an Edgeworth Box diagram assuming that there are a total of 10 units of x

1

available to the economy, and 5 units of x

2

. Redraw the Edgeworth Box if there were instead 5 units of x

1

and 10 units of x

2

available. (notice, we do not know preferences for this questions, and so we are only drawing the dimensions of the boxes and getting the labeling correct).

2) Draw an Edgeworth Box for an economy where there are 20 units of x

1

and 10 units of x

2

available. Highlight the initial endowment point where Bob (person 1) has x

1B

=6 and x

2B

=8. What must the endowment be for Jamie (person 2)? Draw a couple of indifference curves into the Edgeworth Box for both Bob and Jamie, assuming that each has nice convex indifference curves.

3) Consider the situation from (2) where there are 20 units of x

1

and 10 units of x

2 available to the economy, and the initial endowment point is where Bob (person 1) has x

1B

=6 and x

2B

=8 (and Jamie is person 2).

3

Suppose Bob has utility function U

B

=x

1

+2x

2

, while Jamie has utility function

U

J

=min{x

1

,2x

2

}. Draw the indifference curve that goes through the endowment for both

Bob and Jamie, and highlight the region of outcomes that are mutually preferred to the endowment by both Bob and Jamie (i.e., the Pareto Improving Region). Are all points in the Pareto improving region Pareto efficient? (Hint: remember that Pareto efficient means that we’ve exhausted all possible gains from trade).

4) Assume an economy with 10 units of both x

1

and x

2

available. Person A has utility function U

A

=min{2x

1

,x

2

} and Person B has U

B

=x

1

+x

2

. Highlight the contract curve for this economy.

5) Suppose an economy has two individuals, each of which with Cobb-Douglas utility function U =x

1

1/2 x

2

1/2

. There are 10 units of each good available in the economy and the initial endowment is where Person A has 2 units of x

1

and 8 units of x

2

. The price of x

1

is p

1

=$2, and the price of x

2

is p

2

=$4. Find the competitive equilibrium in this economy, and graph it in the Edgeworth Box diagram.

Here’s how you can approach this

: start by using p

1

and p

2

to figure out the real

“income” of each consumer, which is just the value of the endowment that the consumer has. Then use what you know about Cobb-Douglas preferences to find the optimal demand for both goods for both people. You should find excess demand for x

1

. Now start increasing the price of x

1

by $1 and recalculating optimal demands until you have equilibrium (you should only have to do this about 3 times).

6) Describe how inputs can be used more efficiently than they currently are at point

Z in the production Edgeworth Box below (be specific) x

1B

FirmB

Z x

2B x

2A

Q

B

Q

A

Firm A x

1A

7) Suppose an economy is described by its production and preferences over Cars and

Butter (put “Cars” on the vertical axis). The economy is currently producing on its production possibilities frontier at a point where the Marginal Rate of Transformation is greater than the Marginal Rate of Substitution of consumers between these two goods.

Draw such a point and explain in detail if the economy is operating efficiently and, if not, how can it increase efficiently (again describe in detail to show your understanding of the intuition).

BEHAVIORAL AND EXPERIMENTAL ECONOMICS

1) Describe the main distinction between experimental and behavioral economics

4

2) Consider the ultimatum game. Player A proposes a division of $10 between

Players A and B. Player B (the responder) can either accept or reject the offer. If Player

B accepts, then each player receives the payoff Player A proposed, but if Player B rejects the offer, both players receive nothing. A player B who cares only about money should accept anything, and a Player A should therefore offer the minimal amount. Do you think this is what the data show? How can behavioral considerations help explain results from this Ultimatum game?

3)

Consider the “Guessing Game”. A group of players is presented the following task:

“Please select a number between 0 and 100. Other players are also selection a number between 0 and 100. The “winner” of this game is the person whose chosen number is closest to ½ times the average number selected”

This game has been used extensively in lab experiments. What is the perfectly (and infinitely) rational Nash equilibrium (don’t try to set up a game matrix, just think through best responses). A behavioral consideration in this game is that players are not infinitely rational, but rather have a limit to their rationality. How would such limits affect the likely outcomes in this game?

4) What are the 5 key biases identified by behavioral economists regarding how behavior departs from homo economicus predictions? Discuss how retail outlets (like at the Blowing Rock Outlets) are taking advantage of behavioral biases when they seem to

ALWAYS have 50% off sales going on.

5) What is the key trade-off faced when considering to conduct a laboratory versus field experiment?

5