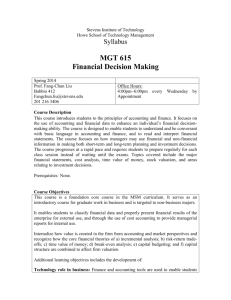

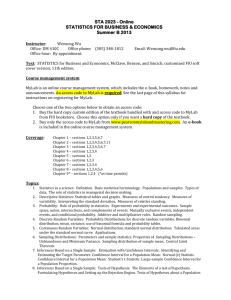

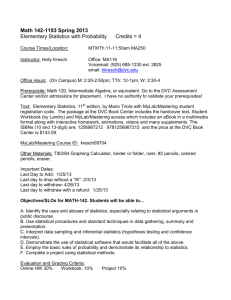

Course Schedule - Stevens Institute of Technology

advertisement

Stevens Institute of Technology Howe School of Technology Management Syllabus MGT 615 A Financial Decision Making Spring 2015 Fang-Chun Liu Babbio 412 Tel: 201-216-3406 Fax: 201-216-5385 fangchun.liu@stevens.edu Monday 6:15 pm Peirce Complex 116 Office Hours: Monday 4:00 and 6:00 pm Also by appointment Course & Web Address: P 116 https://sit.instructure.com/courses/2201 Overview This course introduces students to the principles of accounting and finance. The course is designed to enable students to understand and be conversant with basic language in accounting and finance, and to read and interpret financial statements. The course focuses on training an individual’s ability to use financial/non-financial information for making both short-term and long-term business planning and investment decisions. The course progresses at a rapid pace and requires students to prepare regularly for each class session instead of waiting until the exams. Topics include the financial statements, accounting principles, ratio analysis, costing systems, performance evaluation, risk analysis, budgeting, and investment strategies. Prerequisites: None. Course Objectives This course is a core course which serves as an introductory and preparatory course for graduate work in business. It enables students to classify financial data and properly present financial results of the enterprise for external use, and through the use of cost accounting to provide managerial reports for internal use. Internalize how value is created in the firm from accounting and market perspectives and recognize how the core financial theories of a) incremental analysis; b) risk-return tradeoffs; c) time value of money; d) break-even analysis; e) capital budgeting; and f) capital structure are combined to affect firm valuation Additional learning objectives includes the development of: Technology role in business: Finance and accounting tools are used to enable students to make capital budgeting decision on major expenditures such as technology deployment. Cost-benefit analysis skills are developed to enable the computation of the internal rate of return in evaluating technology adoption. Analytical Problem Solving Skills: Students perform scenario analyses of financial 1 information for investment and performance evaluation decisions. Ethics: Short cases on ethical issues are discussed and the impact on different stakeholders is examined The short and long term consequences of ethical decisionmaking are examined from the individual, corporate and market perspective. Global Awareness: Introductions on the differences between U.S. general accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS), and the valuations of diversified investment strategies through international investment portfolios. Course Outcomes After completing this course, students will be able to: Understand the accounting principles to classify financial data and properly present financial results of the enterprise for external use, and through the use of cost accounting to provide managerial reports for internal use; Use financial ratio analysis techniques to analyze the operational results of the firm over time and relative to competitive and market benchmarks; Identify cost behavior and evaluate operational outcome reported by different cost accounting systems; Internalize how value is created in the firm from accounting and market perspectives and recognize how the core financial theories of a) incremental analysis; b) risk-return trade-offs; c) time value of money; d) break-even analysis; e) capital budgeting; and f) capital structure are combined to affect firm valuation; Utilize accounting information and apply financial principles to make better investment and capital budgeting decisions; Appreciate how operating efficiency, investment effectiveness and financial structure maximize returns to shareholders. Pedagogy The course is organized into topical areas in accounting and finance disciplines. Each class will provide an introduction to the student with a fundamental understanding of the covered topics/theories) that will aid the student in understanding how these topics could be applied to daily business operations. In addition, financial tools that are applied for making appropriate capital investment, pricing/output planning and financial structure decisions will be reviewed. The actual classroom discussions will reiterate the accounting practices and financial theories, and provide the opportunities for in-class review of trial homework problems and/or optional application oriented cases. Lecture notes will be provided in advance and are designed to help clarify and emphasize key points covered in the class. There will be homework problems assigned to you for helping you understand the materials covered and preparing you for exams. You will need to use MyLab online system to finish assigned homework problems. See Homework assignments section below for more details. 2 Required Textbook MGT615 Financial Decision Making, Pearson Custom Library; ISBN: 1269697277 This custom textbook is specifically designed for this course. The book can be purchased from the campus bookstore. The e-book is available for purchase from the bookstore or the Pearson MyLab (see below “Homework Assignments” section for registration details). and you should obtain a textbook as soon as possible. This textbook is a combination of selected chapters from three different textbooks. You'll notice slight differences in the presentation and problem materials between the three textbooks. Canvas: Canvase will be used as a course management tool. You should be automatically enrolled in Canvas if you have registered on time. Class announcements, lecture notes and relevant course materials will be posted in advance for class preparation. Class Etiquette Please be in class on time and ready to participate. In the unusual case that you are late, please enter with the minimum amount of disruption. If you need to leave early, please try to let me know before the class begins. Turn off your cell phone. No private conversations during class. If at any time during lectures you do not understand something, I want you to interrupt me with questions (or follow up later in person or via email). Grading, Assignments, and Exams Class Preparation: Preparation of materials assigned for each class before the session is very important since exams will be based mostly on the class lectures and in-class discussions. You are expected to review the assigned materials. Grading: The scale for grades is: A >92; A- 92~90; B+ 89~85; B 84~80; B- 79~75; C+ 74~70; C 69~65; C- 64~60; F<60 Midterm Exam (1@120 points) 30% Final Exam (1@120 points) 30% Homework (10@12 points each) 30% Class participation (40 points) 10% Maximum Possible (400 points) 100% Exams: There will be a midterm exam scheduled during regular class time on March 23, 2015 and a final examination on May 11, 2015. Exams consist mostly of short multiple-choice questions, including questions on concepts and computational problems. The exams focus on the material discussed in the class sessions and homework problems. All exams are closed books and closed notes. The final grade will be based on your total score and reflect performance standards expected of Stevens students. Bring a regular calculator for exams – you will not be allowed to use the calculator in your cell phone, tablet or other devices. Make-up Exams will be given only for documented medical or family emergencies, at instructor’s discretion. You have to provide documentation for emergencies. If you have 3 no documentation, you will not get a make-up exam/quiz. A grade of 0 will be assigned for unexcused absences. If you have a medical/family emergency, let me know before the exam/quiz – no excuses will be accepted after the scheduled exam time. Homework Assignments: We will use MyLab for homework problems. MyLab is a supplemental online resource for students. It makes submitting homework easy and you get immediate feedback and assistance while completing the assignments. The assignments will be graded automatically. You will have the chances to practice the assigned problems before submitting your answers. Late submissions will be subject to a 25% deduction. Early submission of homework is strongly encouraged. Register MyLab at http://www.pearsonmylabandmastering.com/northamerica/. Use the following course code to locate the course on MyLab: liu98792. Once you register the course, you will have 14 days of temporary access to MyLab. You need to have an access code to complete the registration process. If you purchase a hard copy of the book, an access code is included in the package. If you decide to get the digital option, you need to purchase the access code via MyLab/or bookstore. Class Participation: Your score will be determined at the discretion of the instructor based on a subjective evaluation of the quality (not necessarily, the quantity) of your participation in the class discussions, and overall contribution to class learning. Regular attendance is a very important part of class participation score and excused absence is limited to two times. Throughout the semester, you are required to take the same seat that you choose on the first day of class (if possible). Ethical Conduct The following statement is printed in the Stevens Graduate Catalog and applies to all students taking Stevens courses, on and off campus. “Cheating during in-class tests or take-home examinations or homework is, of course, illegal and immoral. A Graduate Academic Evaluation Board exists to investigate academic improprieties, conduct hearings, and determine any necessary actions. The term ‘academic impropriety’ is meant to include, but is not limited to, cheating on homework, during in-class or take home examinations and plagiarism.“ Consequences of academic impropriety are severe, ranging from receiving an “F” in a course, to a warning from the Dean of the Graduate School, which becomes a part of the permanent student record, to expulsion. Reference: The Graduate Student Handbook, Academic Year 2003-2004 Stevens Institute of Technology, page 10. Consistent with the above statements, all homework exercises, tests and exams that are designated as individual assignments MUST contain the following signed statement before they can be accepted for grading. 4 ____________________________________________________________________ I pledge on my honor that I have not given or received any unauthorized assistance on this assignment/examination. I further pledge that I have not copied any material from a book, article, the Internet or any other source except where I have expressly cited the source. Signature _________________________ Date: _____________ Please note that assignments in this class may be submitted to www.turnitin.com, a webbased anti-plagiarism system, for an evaluation of their originality. Course Schedule Session Date 1 1/26 2 2/2 3 2/9 4 2/17(Tue) 5 2/23 6 3/2 7 3/9 8 9 10 11 3/16 3/23 3/30 4/6 12 4/13 13 14 4/20 4/27 15 5/4 16 5/11 Topic Ch1: Financial Statements Ch 2: Accrual Accounting & Income Ch 3: Financial Statement Analysis Ch 4: Cost Behavior Ch 5: Cost-Volume-Profit Analysis Ch 6: Job Costing Ch 7: Activity-Based Costing Midterm Exam Review SPRING BREAK-NO CLASS Midterm Exam Ch8: Relevant Costs for Short-Term Decisions Ch 9: The Master Budget Ch 10: Time Value of Money Ch 11: Risk and Return Ch 12: Capital Budgeting Techniques Ch 13: Interest Rates and Bond Valuation Ch 14: Stock Valuation Final Exam Review Final Exam Homework due 1 2 3 4 5 6 7 8 9 10 5