Grading, Assignments, and Exams - Stevens Institute of Technology

advertisement

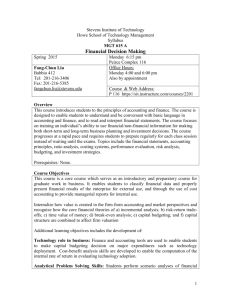

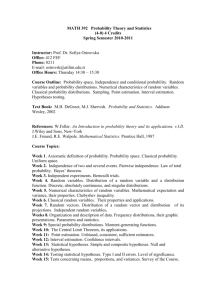

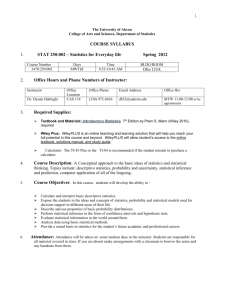

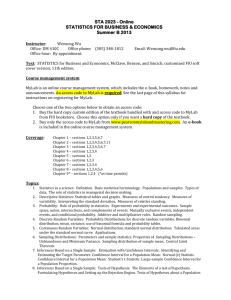

Stevens Institute of Technology Howe School of Technology Management Syllabus MGT 615 Financial Decision Making Spring 2014 Prof. Fang-Chun Liu Babbio 412 Fangchun.liu@stevens.edu 201 216 3406 Office Hours: 4:00pm~6:00pm Appointment every Wednesday by Course Description This course introduces students to the principles of accounting and finance. It focuses on the use of accounting and financial data to enhance an individual’s financial decisionmaking ability. The course is designed to enable students to understand and be conversant with basic language in accounting and finance, and to read and interpret financial statements. The course focuses on how managers may use financial and non-financial information in making both short-term and long-term planning and investment decisions. The course progresses at a rapid pace and requires students to prepare regularly for each class session instead of waiting until the exams. Topics covered include the major financial statements, cost analysis, time value of money, stock valuation, and areas relating to investment decisions. Prerequisites: None. Course Objectives This course is a foundation core course in the MSM curriculum. It serves as an introductory course for graduate work in business and is targeted to non-business majors. It enables students to classify financial data and properly present financial results of the enterprise for external use, and through the use of cost accounting to provide managerial reports for internal use. Internalize how value is created in the firm from accounting and market perspectives and recognize how the core financial theories of a) incremental analysis; b) risk-return tradeoffs; c) time value of money; d) break-even analysis; e) capital budgeting; and f) capital structure are combined to affect firm valuation Additional learning objectives includes the development of: Technology role in business: Finance and accounting tools are used to enable students to make capital budgeting decision on major expenditures such as technology deployment. Cost-benefit analysis skills are developed to enable the computation of the internal rate of return in evaluating technology adoption. Analytical Problem Solving Skills: Students perform scenario analyses of financial information for investment and performance evaluation decisions. Ethics: Short cases on ethical issues are discussed and the impact on different stakeholders is examined The short and long term consequences of ethical decisionmaking are examined from the individual, corporate and market perspective. Global Awareness: Introductions on the differences between U.S. general accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS), and the valuations of diversified investment strategies through international investment portfolios. Course Outcomes After successfully completing this course, the student will be able to: Apply accounting and financial principles supplemented with financial ratio analysis techniques to analyze the operational results of a firm over time and relative to competitive and market benchmarks; Analyze cost behavior and evaluate operational outcomes reported by different costing systems; Use accounting information and apply financial principles to make better investment and resource allocation decisions; Appreciate how operating efficiency, investment effectiveness and financial structure increase firm value and maximize investment returns to shareholders. Pedagogy The course is organized into topical areas in accounting and finance disciplines. Each class will provide an introduction to the student with a fundamental understanding of the covered topics/theories) that will aid the student in understanding how these topics could be applied to daily business operations. In addition, financial tools that are applied for making appropriate capital investment, pricing/output planning and financial structure decisions will be reviewed. The actual classroom discussions will reiterate the accounting practices and financial theories, and provide the opportunities for in-class review of trial homework problems and/or optional application oriented cases. Lecture notes will be provided in advance and are designed to help clarify and emphasize key points covered in the class. There will be homework problems assigned to you for helping you understand the materials covered and preparing you for exams. You will need to use MyLab online system to finish assigned homework problems. See Homework Problems section below for more details. 2 Required Textbook We will use a custom textbook in this course. It is available ONLY from the campus bookstore and you should obtain a textbook as soon as possible. This textbook is a combination of selected chapters from three different textbooks. You'll notice slight differences in the presentation and problem materials between the three textbooks. The course designers believe that this presents the optimal learning opportunity for introductory master degree students. MGT 615 Pearson Custom Business Resources, including MyAccounting Lab ISBN 1269447432 Moodle: Moodle will be used as a course management tool. You should be automatically enrolled in Moodle if you have registered on time. Lecture notes and relevant course materials will be posted in advance for class preparation. Class announcements will be posted on Moodle as well. Class Etiquette All of us are expected to be in class on time and ready to participate. In the unusual case that you are late, please enter with the minimum amount of disruption. We have many important tasks to accomplish and late arrivals are disruptive and inconsiderate. If you need to leave early, please try to let me know before the class begins. Unless there is a medical reason or an emergency, none of us is allowed to leave for reasons such as to get a drink of water or to take a break. Food and beverages are permitted in class only as long as the room is kept clean. Good manners and politeness require that we listen to and respect each other’s' questions and ideas. Private conversations are distracting and not permitted. Grading, Assignments, and Exams Class Preparation Preparation of materials assigned for each class before the session is very important since exams will be based mostly on the class lectures and in-class discussions. You are expected to review the assigned materials. Grading The scale for grades is: A >92; A- 92~90; B+ 89~85; B 84~80; B- 79~75; C+ 74~70; C 69~65; C- 64~60; F<60 Assignment Midterm exam (1 @ 120 points) Final exam (1 @ 120 points) Homework (10 @ 12 points each) Class participation (40 points) Maximum Possible (400 points) Grade % 30% 30% 30% 10% 100% Exams There will be a midterm exam scheduled during regular class time on March 19, 2014 3 and a final examination on May 7, 2014. Exams consist mostly of short problems and multiple choice questions and occasionally of short essays. The exams will focus on the materials that are discussed in the class sessions. Both exams are closed book and closed notes. The final grade will be based on your total score and reflect performance standards expected of Stevens students. Make-up exams will not be given. If you are excused from an exam, a special final exam will be required. It will cover the missed material. Generally, no excuses will be accepted after the scheduled exam time. A grade of 0 will be assigned for unexcused absences. Homework Assignments We will use MyLab for homework problems. MyLab is a supplemental online resource for students. It makes submitting homework easy and you get immediate feedback and assistance while completing the assignments. The assignments will be graded automatically. You will have the chances to practice the assigned problems before submitting your answers. Late submissions will be subject to a 25% deduction. Early submission of homework assignments is strongly encouraged. Register MyLab at http://www.pearsonmylabandmastering.com/northamerica/. Use the following course code to locate the course on MyLab: liu91675. An access code will come with the custom textbook and you should use that code to finish the course registration on MyLab. Class Participation Your score will be determined at the discretion of the instructor based on a subjective evaluation of the quality (not necessarily, the quantity) of your participation in the class discussions, and overall contribution to class learning. Regular attendance is a very important part of class participation score and excused absence is limited to two times. Throughout the semester, you are required to take the same seat that you choose on the first day of class (if possible). Ethical Conduct The following statement is printed in the Stevens Graduate Catalog and applies to all students taking Stevens courses, on and off campus. “Cheating during in-class tests or take-home examinations or homework is, of course, illegal and immoral. A Graduate Academic Evaluation Board exists to investigate academic improprieties, conduct hearings, and determine any necessary actions. The term ‘academic impropriety’ is meant to include, but is not limited to, cheating on homework, during in-class or take home examinations and plagiarism.“ Consequences of academic impropriety are severe, ranging from receiving an “F” in a course, to a warning from the Dean of the Graduate School, which becomes a part of the permanent student record, to expulsion. 4 Reference: The Graduate Student Handbook, Academic Year 2003-2004 Stevens Institute of Technology, page 10. Consistent with the above statements, all homework exercises, tests and exams that are designated as individual assignments MUST contain the following signed statement before they can be accepted for grading. ____________________________________________________________________ I pledge on my honor that I have not given or received any unauthorized assistance on this assignment/examination. I further pledge that I have not copied any material from a book, article, the Internet or any other source except where I have expressly cited the source. Signature ________________ Date: _____________ Please note that assignments in this class may be submitted to www.turnitin.com, a webbased anti-plagiarism system, for an evaluation of their originality. 5 Course Schedule Week Date Topic Homework due 1 1/15 Ch1: Financial Statements 2 1/22 Monday Class Schedule-NO CLASS 3 1/29 Ch 2: Accrual Accounting & Income 1 4 2/5 Ch 3: Financial Statement Analysis 2 5 2/12 Ch 4: Cost Behavior 3 6 2/19 Ch 5: Cost-Volume-Profit Analysis 4 7 2/26 Ch 6: Job Costing 5 8 3/5 9 3/12 Spring Break-NO CLASS 10 3/19 Midterm Exam 11 3/26 Ch 8: The Master Budget 12 4/2 Ch 9: Time Value of Money 7 13 4/9 Ch 10: Risk and Return 8 14 4/16 Ch 11: Capital Budgeting Techniques 9 15 4/23 Ch 12: Interest Rates and Bond Valuation 10 16 4/30 17 5/7 Ch 7: Activity-Based Costing Midterm Exam Review 6 Ch 13: Stock Valuation Final Exam Review Final Exam 6