Docx 61kB - Commonwealth Grants Commission

advertisement

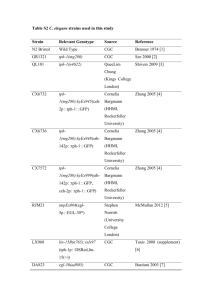

Supplementary Response to the New Issues for the 2013 Update 2011 Census – Indigenous population estimates Issue States 1 have been asked to comment on the Commonwealth Grants Commission’s (CGC’s) Indigenous population estimates proposal. The CGC’s intention in its 2013 Update New Issues Staff Discussion Paper CGC 2012-02-S was to use the 2011 Indigenous State Estimated Resident Population (ERP) with the 2006 based Indigenous ERP at sub-State geography. The sub-state geography is not yet available for 2011, and will not be released until next year. Given how inconsistent the 2006 and 2011 estimates are, the CGC is considering whether it is appropriate to use a mixture of 2006 and 2011 Indigenous estimates in the 2013 Update. An option is to use 2006 data for all purposes in the 2013 Update and to defer the use of the 2011 Census data until the 2014 Update. ACT Position The ACT’s view is that the CGC should use the 2011 Aboriginal and Torres Strait Islander (ATSI) Census data as it provides the most reliable basis for the estimation of the population for each of the States and local government areas. According to the ABS, in order to achieve the most accurate count of ATSI peoples in the Census, the 2011 Census Indigenous Enumeration Strategy incorporated a range of improvements to the enumeration of ATSI people living in urban areas, as well as those living in remote ATSI communities. At a broad level, the improvements for the 2011 Census included: earlier and ongoing engagement; a reduction in the overall enumeration period for Aboriginal and Torres Strait Islander communities; an increase in the number of field staff recruited; and a greater level of support to Aboriginal and Torres Strait Islander people requiring assistance in completing their form, in both urban and remote areas. 2 The ATSI 2011 data: 1 The word ‘States’ refers to the ‘States and Territories’ unless otherwise specified. Census of Population and Housing - Counts of Aboriginal and Torres Strait Islander Australians, 2011, Cat, no. 2075.0, released 21 June 2012, Explanatory notes. 2 Page | 1 meets the data use guidelines, and importantly, the revised guidelines agreed to by the Data Working Party which places a primary focus on the fit-for-purpose criterion; has a consequential GST redistribution which is material; and is consistent with reflecting the latest circumstances of the States in the 2013 Update. Comparability of State Natural Disaster Relief Expenses Issue In the 2012 Update the CGC became aware that some States did not have private natural disaster insurance arrangements for public assets, raising the issue that an actual per capita (APC) assessment could be compromised. The CGC noted it would rule on the appropriateness of an APC assessment in the 2013 Update after a review of State insurance arrangements undertaken by the Commonwealth Department of Finance and Deregulation (DoFD), and Emergency Management Australia has been reported. The March 2012 report was insufficient to allow firm conclusions to be drawn regarding adequate capacities to fund liabilities or infrastructure losses such as through insurance / reinsurance and State department premium contributions, other than for the ACT. DoFD sought further information from some States with respect to the availability and cost-benefit of insurance cover for currently uninsured assets. CGC staff recommended in the 2013 Update New Issues submission that the CGC await DoFD’s final report that was expected in September 2012 before considering the appropriateness of the current natural disaster relief assessment and then consult States. Non-road assets In regard to non-road assets, the DoFD report has now found that appropriate insurance arrangements are in place for all States other than Tasmania and the Northern Territory. The insurance arrangements for these two States were not considered appropriate because they had no insurance. Both have since been asked to seek market quotations and to perform cost-benefit analysis to demonstrate what appropriate insurance arrangements would be. Regardless, the CGC considers that conceptually, for an APC assessment to be continued under the NDRRA 2011 Determination, adjustments should be made to Tasmania’s and the NT’s natural disaster expenses. For future years no adjustments would be required if these two States are found to have implemented appropriate arrangements. For 2010-11, therefore, the CGC has determined that it could add notional annual insurance premiums and net off a notional insurance payout for each State: an imputation of insurance premiums could be based on the average insurance arrangements across the other States. However, this would not recognise the Page | 2 different risk profiles of these States and could be seen as unreliable. Any estimates, either average per capita or based on the size of their non-road stock, would be borderline material, using the $3 per capita materiality threshold for a data adjustment; and neither State would have been likely to receive a payout in 2010-11. Tasmania spent $9.1 million on restoration/replacement but would have been unlikely to receive a payout, given the insurance excess that would apply and the fact that roads would have formed part of the assets affected. The NT did not undertake any restoration or replacement of public assets in 2010-11. The CGC notes the result would increase the GST shares of these two States. CGC staff consider it better not to attempt to estimate premiums or payouts and make no adjustments to the expenses of these two States. ACT Position Non-road assets The CGC has noted that “It is It is important that State expenses are comparable and do not reflect different State policies because our assessment of natural disaster expense needs is an actual per capita (APC) assessment of State expenses.” The ACT agrees that it is a requirement for a reliable APC assessment to have net natural disaster expense (NNDE) needs that are free from policy influences. It is also fundamental, given the formula adopted by the CGC to derive NNDE needs, that States are undertaking similar overarching insurance policy approaches that place a cap on the escalation of natural disaster expenses to ensure that the GST outcome is not influenced. The ACT’s understanding of how the formula works is illustrated below: Actual expenses (including insurance premiums) less Revenue received under Natural Disaster Recovery Relief Arrangements (NDRRA) less Payments from external insurer equals State’s NNDE Above or below average p.c. NNDE drives GST allocation Our reading of the review of State insurance arrangements undertaken by DoFD, suggest there are significant differences that exist between the States in terms of the coverage of insurance and definition of essential public assets, which are policy influenced. The former (and perhaps latter) flows through to a State’s natural disaster expenses, and therefore its share of GST funding. The ACT agrees with the CGC’s view that it is best not to attempt to estimate premiums or payouts and make no adjustment to the expenses of Tasmania and the NT (the two States without non-road insurance arrangements) as this would result in an increase in the GST shares of these two States. Page | 3 Given that there were no natural disasters for Tasmania and the NT in 2010-11, it makes no sense to adjust the notional insurance premium or the notional insurance payout. Such as approach would, however, make sense if there was a natural disaster of substance. Issue Road assets The DoFD report found that only Victoria and the ACT had insurance cover for roads. It acknowledged, however, that insuring for road assets is, for many States, not cost effective and/or there is no appetite in the commercial insurance market to underwrite such risks. The report noted that recent approaches to the market by Queensland and South Australia demonstrated the limited appetite and capacity in the market to cover Australian road assets. Neither State was successful in securing cover. Further, the report noted the failure to clearly define or quantify essential public assets (EPA). Most States assumed, explicitly or implicitly, that all their assets were included as EPA. The CGC has noted that the impression from the DoFD report is that the lack of insurance for road assets is not a policy choice. It reflects the lack of cost effectiveness and the high risk exposure of road assets. Therefore, the CGC thinks that this does not invalidate the current APC assessment. States with road assets insurance are compensated for the higher premium paid because it is included in the expenses covered by the assessment. ACT Position Road Assets The ACT does not agree with the CGC’s views regarding road assets. While it is noted that there may be a lack of effectiveness regarding insuring some road assets, these assets should not be captured in the natural disasters assessment as: it does not reflect ‘What States do’ – States do not insure roads on average: it is not the standard policy of the States to insure road assets (only 2 out of 8 States insure road assets): for that matter, the ACT only insures a very small proportion of the value of its road assets given that to do otherwise would be excessively costly; while States with road assets insurance are compensated for the higher premium paid because it is included in the expenses covered by the APC assessment, this ‘socalled compensation’ appears to be more than offset by the amount redistributed by the CGC’s natural disasters assessment for a State that has no insurance; and given the non-insurance of assets affects GST outcomes, the CGC should assess the roads assets component of the natural disasters assessment on an EPC basis. These last two dot points are discussed further below. Page | 4 The ACT does not support the statement by the CGC that ‘States with road assets insurance are compensated for the higher premium paid because it is included in the expenses covered by the assessment’. Hypothetically, Victoria and the ACT will end up subsidising States with no insurance when the latter face a natural disaster. This is because compensation for insurance premiums appears to be more than offset by the amount redistributed by the CGC’s natural disasters assessment for a State that has no insurance, as NNDE will not be reduced by payments from the external insurer (these will be zero unless the CGC calculates a notional payout and deducts it), thus inflating NNDE relative to a State with insurance. Take for example, States A and B in the following figure. State A is insured (similar to Victoria’s arrangements) and State B is uninsured. The actual expenses arising from a natural disaster for State A and B are similar ($200m), but are $9.1m higher for the former reflecting the premium paid for insurance for Victoria in 2010-11 (Table 1 of CGC Paper – State insurance arrangements). State A is compensated for higher insurance premiums as they are included in the formula. Both States receive the same NDRRA assistance given the same loss of assets from the natural disaster. State A receives $50m from the external insurer, lowering its NNDE relative to State B. State B has no insurance, so receives nothing. While State A is compensated for ‘the higher premium paid because it is included in the expenses covered by the assessment’, it is not compensated for the more than offsetting payment from the external insurer which reduces its NNDE and the subsidisation of States without insurance. State A Insured $m State B Not insured $m 209.1 200 100 100 50 0 59.1 100 NNDE $pc 10.59pc 17.92pc Loss $pc -3.66pc 3.66pc Actual expenses including insurance premiums Less Revenue received under NDRRA Less Payments from external insurer Equals State's net natural disaster expenses (NNDE) Aust avg State A compensated for higher insurance premiums as these are included in actual expenses State B benefits from receiving zero payments from external insurer in terms of calculation of NNDE, as this is higher than it would be if it had insurance GST impact calculations State B Better off $pc $m 14.26pc In terms of the effect on NNDE, the reduction to NNDE from external insurer payments ($50m) far outweighs gains from including premiums in actual expenses ($9.1m). 3.66pc 20.5m * Analysis excludes insurance excesses that are required to be paid. ** Analysis based on natural disaster threshold being met, which in Victoria's case for the first threshold is 0.225% of the State's total general government sector revenue for 2010-11 which equates to $103.6m for Category B. Revenue from the Commonwealth under NDRRA would be equivalent to 50% of State expenditure on Category B measures ie. 50% of $200m = $100m. Eligible natural disaster costs exclude insurance payments. Page | 5 Given the implications of non-insurance of assets affecting GST outcomes as outlined above, the CGC should assess the roads assets component of the natural disasters assessment on an EPC basis. This would also be consistent with the principle that it is not the standard policy of the States to insure road assets. Treatment of Commonwealth Payments in the Commonwealth’s Final Budget Outcome 2011-12 Industry and Indigenous Skill Centres Issue Australian Government funding will be used to support industry and/or Indigenous community organisations for the purchase, construction, fit out or refurbishment of facilities intended for the delivery of vocational education and training (VET). Funding is not intended to be available for TAFE institutions, and any assets created from the funding will not be State assets. CGC staff consider the payment should not affect the relativities because it is passed to third parties and does not create a State asset. ACT Position The ACT supports the CGC staff position that the Industry and Indigenous Skill Centres funding should not impact on the relativities because the payment will be provided to third parties and does not create a State asset. Mission Beach Safe Anchorage Issue Australian Government funding has been made to Queensland in 2011-12 to undertake a scoping study for community consideration and if funds are left construct a safe anchorage at Mission Beach. ACT Position The ACT supports the position that the Mission Beach Safe Anchorage funding should impact on the relativities because a safe harbour or harbour facility (including planning or scoping for such a facility) is a standard budget function; it will add to Queensland’s net financial worth, and it is being partly funded by the Commonwealth defraying Queensland’s costs. Page | 6