A simple example of career concerns by Rick Young This is a story

advertisement

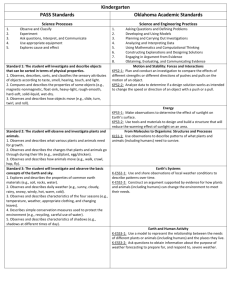

A simple example of career concerns by Rick Young This is a story of moral hazard in the presence of career concerns by managers. Imagine a risk neutral manager currently employed who can affect her firm’s success by her choice of an action denoted by a. Other things being equal, the current firm would like the manager to choose a large value for a. However, this action has a private cost to the manager equal to c(a) = 0.5a2. Think of the manager’s pay from the current firm as sunk, meaning it cannot be affected by this period’s actions. However, success in this period potentially affects next period’s salary. Next period the manager will enter a competitive labor market that will pay her an amount equal to the next employer’s expectation of the manager’s skill, s. Before observing the manager’s performance with her current firm, the market perceives the manager’s skill to be normally distributed with mean S and variance 𝜎𝑆2 . It will be helpful also to think of the precision of the market’s prior estimate of the manager’s mean skill as being the reciprocal of the variance, i.e., 𝜏𝑆 = 1/𝜎𝑆2 . Efficiency Consider now the socially optimal value of a. This period’s efficient production level is that which maximizes: E[x|a] – .05 a2, where implicitly the manager is compensated precisely for his private cost (plus a suitable fixed wage). The socially optimal value of aFB is the value of a that solves the following first order condition: 1 – a = 0, or aFB = 1. Labor Market In general, the competitive labor market determines a wage equal to their revised expectation of the manager’s skill, which is based on the market’s information and its prior beliefs about s. Let the market observe a noisy signal h with (non-zero and finite) variance 𝜎ℎ2 . Define its precision 𝜏ℎ to be equal to 1/𝜎ℎ2 . While the market has prior beliefs about the manager’s skill s, it updates those beliefs rationally based on observation of the manager’s performance with his current firm, meaning using Bayes’ Theorem. Given the normality assumptions, Bayes’ Theorem works in a particularly intuitive way. The posterior estimate about s is a weighted combination of the an unbiased estimate of S, initially denoted by h, and the prior mean S, where the weights are equal to the precision of the estimates. 𝑊 = 𝐸[𝑠] = ℎ𝜏ℎ +𝑆𝜏𝑆 𝜏ℎ +𝜏𝑆 The manager understands how the market determines her wage, and her expected utility is her expected wage minus the private cost of her action: Many thanks to Anil Arya and Brian Mittendorf for their inspiration and comments on this note. 𝐸ℎ [𝑈] = 𝐸[𝑊] − 𝑐(𝑎) = 𝐸 [ ℎ𝜏ℎ +𝑆𝜏𝑆 𝜏𝑒 +𝜏𝑆 ] − 5𝑎2 , where (notice) the expectation is taken over h. At issue is whether the manager can influence the market to make them believe she is of a higher type. The answer we shall see depends on h, that is the information the market has about the manager’s action. Performance measure We now put some structure on the market’s information h. Throughout, we assume there exists a publicly observable performance measure x affected by three things: (1) the manager’s action a, (b) the manager’s skill s, (c) and a normally distributed noise term e with mean 0 and variance 𝜎𝑒2 . Below is the precise relationships: x = s + a + e. We consider two cases. In the first the market observes the performance measure x and also the manager’s act a. In the second it only observes x. Act observable by the market To find the manager’s optimal act, first substitute the market’s information into the expression above for W. Here the market observes both x and a, so it can “back out” a from x. With x = s + a + e, h = x – a = s + e, with e being the random component. Notice the expected value of the information h is E[h|a] = E[x – a] = E[s + e] = S; so it is an unbiased estimator of S. Also, the precision of h is equal to the precision of e, or 𝜏𝑒 = 1/𝜎𝑒2 . Importantly, from the manager’s point of view now, the market’s expectation of s will not be affected by her act. Because the manager’s expected utility is independent of the market’s assessment of s, and his private cost of action is decreasing in a, the optimal a when the act is observable by the market is zero – a sad state of affairs as far as the manager’s current firm is concerned. 𝑑 𝑎 𝑑 [𝐸[𝑊] − .5𝑎2 ] = [𝐸 [ 𝑎 (𝑠+𝑒)𝜏𝑒 +𝑆𝜏𝑆 𝜏𝑒 +𝜏𝑆 ] − .5𝑎2 ] = − 𝑎 ≤ 0 Here, where the market can observe a, the manager cannot “fool” it into predicting her type is high by choosing a high value of a so as to (in expectation) produce a large value of x. Thus, the expected utility of the manager is maximized at a = 0! The market in this case where they observe both x and a does not gain by using x to infer s, so the manager has no incentive to incur the private cost associated with a. Hence, she chooses a = 0, and the current firm is very unsatisfied (and production is socially inefficient). The moral hazard problem is severe here, because there is no reason for the manager to try to succeed with her current firm. Of course, we should remember 2 we have assumed (for the sake of simplicity) the current firm cannot commit to a performance-based contract. Act unobservable by the market Now assume the labor market does not observe a. However, in equilibrium they must have correct conjectures about a. Essentially, the market cannot separate the manager’s action from his type. Denote the manager’s conjecture about the market’s assessment of a by 𝑎′. Substituting h = x – a’ = s + a + e – a’, the manager’s optimal act is found by solving the following first order condition: 𝑑 𝑎 𝑑 [𝐸[𝑊] − .5𝑎2 ] = [𝐸 [ 𝑎 The condition simplifies to: 𝜏 𝑎∗= 𝜏𝑒 𝜏𝑒 +𝜏𝑆 (𝑠+𝑎+𝑒−𝑎′)𝜏𝑒 +𝑆𝜏𝑆 𝜏𝑒 𝑒 +𝜏𝑆 𝜏𝑒 +𝜏𝑆 ] − .5𝑎2 ] = 0. − 𝑎 = 0, so the optimal action is . Notice that under our assumptions a* is strictly between 0 and 1. Thus, the situation for the current firm is improved by the market’s inability to observe her action, although it will not be socially efficient. The key is the market’s assessment of the manager’s skill is increased if she chooses a higher act a. Thus, the manager now has incentives to provide a high action for her current firm to enhance the market’s beliefs about what her value. Further, if there were many periods the manager will not “shirk” (choose a = 0) in any period (but her last). I think it is not hard to see that the manager has a reason to enhance its reputation for being a productive type by choosing a > 0, as long as there a sufficiently high probability she has an interest in being employed in the subsequent period. The interested reader is referred to the following papers. Arya, A. and J. Glover. 2013. On the upside of aggregation, Ohio State University working paper. Arya, A. and B. Mittendorf. 2011. The benefits of aggregate performance metrics in the presence of career concerns. Management Science Holmstrom, B. 1999. Managerial incentive problems: A dynamic perspective. Review of Economic Studies Stein, J. 1989. Efficient capital markets, inefficient firms: A model of myopic corporate behavior. The Quarterly Journal of Economics 104 (4) 655-669. 3