Centrepay Procedural Guide for Businesses

advertisement

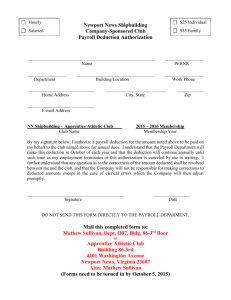

CENTREPAY PROCEDURAL GUIDE FOR BUSINESSES Procedural Guide for Businesses v1 Effective from 1 July 2015 Contents PROCEDURAL GUIDE FOR BUSINESSES ................................................................................................... 1 What is Centrepay? ................................................................................................................................. 3 1.1. Centrepay’s objective ......................................................................................................... 3 1.2. Purpose of this document ................................................................................................... 4 1.3. Important points to note .................................................................................................... 4 1.4. Centrepay framework ......................................................................................................... 4 1.5. Changes to the framework ................................................................................................. 5 Before you apply ..................................................................................................................................... 5 2.1. Understanding the policy and terms .................................................................................. 5 2.2. Changes to Business details ................................................................................................ 5 2.3. Business arrangements ....................................................................................................... 6 2.4. Centrepay service categories and service reasons ............................................................. 7 2.5. Included service reasons ..................................................................................................... 7 2.6. Excluded expenses and payment arrangements .............................................................. 11 2.7. Registrations and accreditations....................................................................................... 12 2.8. Provision of necessary information .................................................................................. 12 2.9. Fees associated with Centrepay........................................................................................ 12 2.10. Fee structure ..................................................................................................................... 12 2.11. Options for payment of fees ............................................................................................. 12 2.12. Fee reporting..................................................................................................................... 13 Applying for Centrepay.......................................................................................................................... 13 3.1. Application process ........................................................................................................... 13 3.2. Authority to complete the Business Application .............................................................. 13 3.3. Once approved .................................................................................................................. 13 Using Centrepay .................................................................................................................................... 14 4.1. Deduction Authority ......................................................................................................... 14 4.2. How Deductions are set up ............................................................................................... 15 4.3. Deductions through the department ................................................................................ 15 4.4. Deductions through Businesses ........................................................................................ 15 4.5. Deduction Authority consent wording.............................................................................. 16 4.6. Proof of authority.............................................................................................................. 17 4.7. Commencement of Deductions ........................................................................................ 17 4.8. Order of Deductions.......................................................................................................... 17 4.9. Types of Deductions .......................................................................................................... 18 4.10. Payment of Deductions ..................................................................................................... 18 4.11. Reasons why a full Deduction might not be made ........................................................... 19 4.12. Overpayments and Excess Credits .................................................................................... 19 4.13. Cancellation of Deductions ............................................................................................... 19 v1, 1 July 2015 PAGE 2 of 29 4.14. Promoting Centrepay ........................................................................................................ 20 4.15. Criteria............................................................................................................................... 20 4.16. Materials not permitted.................................................................................................... 20 4.17. Standard conventions ....................................................................................................... 21 4.18. Feedback and complaints ................................................................................................. 22 4.19. Important details .............................................................................................................. 22 Online services for Centrepay ................................................................................................................ 23 5.1. Centrelink Business Online Services (CBOS) ..................................................................... 23 5.2. How to get access ............................................................................................................. 23 5.3. Organisational Online Mail (OOM) ................................................................................... 24 5.4. Centrelink deduction and payment reconciliation report ................................................ 24 5.5. Deductions and Payments Application ............................................................................. 24 5.6. Varying Deductions ........................................................................................................... 25 5.7. Centrepay Bulk Upload Service ......................................................................................... 25 5.8. Service availability ............................................................................................................. 25 Business Responsibilities ....................................................................................................................... 25 6.1. Departmental Requirements for Business ........................................................................ 25 6.2. Customer Representatives ................................................................................................ 26 6.3. Centrepay program assurance reviews and audits ........................................................... 26 6.4. Failure to meet expectations ............................................................................................ 26 6.5. Review of departmental decisions .................................................................................... 27 6.6. How to lodge a request for a review ................................................................................ 27 6.7. Conduct of reviews ........................................................................................................... 27 6.8. Management of Customer information ............................................................................ 27 6.9. Withdrawing from Centrepay ........................................................................................... 28 6.10. Business obligations if withdrawing from Centrepay ....................................................... 29 6.11. Recommencing the use of Centrepay ............................................................................... 29 WHAT IS CENTREPAY? Centrepay is a voluntary bill-paying service that is free for Centrelink customers. Through Centrepay, a Customer can authorise the department to deduct regular amounts from their welfare payments to pay their bills and expenses to a Business. 1.1. Centrepay’s objective The objective of Centrepay is to assist Customers in managing expenses that are consistent with the purposes of their welfare payments, and reducing financial risk by providing a facility to have regular Deductions made from their welfare payments. v1, 1 July 2015 PAGE 3 of 29 1.2. Purpose of this document This procedural guide provides practical information about the operation of Centrepay. This guide should be read in conjunction with Centrepay Policy and Terms that details the rule setting and conditions for Centrepay. Words and terms used in this procedural guide have the same meaning as defined in Centrepay Policy and Terms. User guides are also available with step-by-step details for specific processes. All documents are available on our website at humanservices.gov.au/centrepayorgs Note: there will also be a Centrepay Procedural Guide for Customers which will provide information for Customers about using and managing their Centrepay Deductions. 1.3. Important points to note • Centrepay is voluntary and Customers may withdraw or change their Deduction Authorisation at any time. • Centrepay is not a guaranteed source of payment for goods and services. • A Customer’s welfare payment may be varied by a number of factors (such as debts owed, earnings impacting payments received or participation reasons) that may affect the amount that can be paid to a Business. • Businesses are responsible for accounting for any amounts owed as a result of a Customer’s reduced welfare payment. Businesses must keep accurate records of the Customer’s Deduction instructions. It is mandatory to obtain a Deduction Authority from the Customer or their Customer Representative before actioning any Centrepay Deductions. 1.4. Centrepay framework The Centrepay framework comprises the following: Policy and Terms • • Policy—provides Centrelink stakeholders with an understanding of Centrepay and how it operates Terms—sets out contractual terms that would apply to both the department and Business approved to use Centrepay Procedural Guide for Businesses • Provides practical information about the operational aspects of Centrepay and advice on where to go for further information Business Application • Completed by a Business seeking approval to use Centrepay and used by the department to determine whether approval should be provided v1, 1 July 2015 PAGE 4 of 29 Approval letter • Confirms the department's approval for a Business to use Centrepay and outlines the category of goods and services approved, fees, Centrelink Business Online Services (CBOS) access level, Deduction report frequency, and any additional conditions to the policy and terms that may apply Deduction Authority • A record of consent from a Customer or their Customer Representative, to add or vary a Centrepay Deduction Businesses are responsible for keeping up to date with any variations to the Centrepay framework. Where a Business does not agree with an aspect of the Centrepay framework, it should contact the department to discuss this or reconsider its use of Centrepay. 1.5. Changes to the framework The department may, from time to time, make changes to the Centrepay framework (including this Procedural Guide) and publish advice of these updates on our website: humanservices.gov.au/centrepayorgs Businesses are responsible for accessing and understanding the latest Centrepay framework prior to using or applying to use Centrepay. BEFORE YOU APPLY 2.1. Understanding the Policy and Terms The Policy describes the Centrepay business model and sets out the rules and approach that govern Business’s approval and use of Centrepay. The Terms set out the conditions under which the department agrees to make Centrepay available to Businesses. Businesses need to ensure that all employees, agents or contractors who are involved with Centrepay read and understand the new Policy and Terms and this Procedural Guide. The Business needs to accept the Centrepay terms and agree to act consistently with the Policy, Terms and Procedural Guide for Businesses. The department cannot provide legal advice on the Policy and Terms and encourages Businesses, if they have any legal queries, to seek independent legal advice before deciding to apply to use Centrepay. 2.2. Changes to Business details a. Change to information provided Changes to any of the information provided by the Business, including on the Business Application, must be notified to the department within five business days. This includes (but is not limited to) changes to: the Business name (legal, business or trading) v1, 1 July 2015 PAGE 5 of 29 physical or postal address contact details (email address, phone number, fax number) goods and/or services provided (if intending to use Centrepay in relation to these) bank account details contact officer licences, registrations or accreditations. Change in Business ownership Where there is a change in the ownership of a Business and the new Business wishes to continue using Centrepay, the new Business must apply to the department via their Account Manager to enable the transfer of existing Deduction Authorities from one organisation to the new organisation. If the department allows existing Deduction Authorities to be transferred, the existing Business must notify each Customer, in writing and at least 14 calendar days before the transfer of the operations, that if the Customer does not consent to the new ownership using the existing Deduction Authority, the Customer must advise the Business or department that their consent is withdrawn. If the transfer is not known 14 days in advance, the existing Business must notify each Customer as soon as practicable after the transfer is known. If a Customer advises the Business of their intention to withdraw their Deduction Authority before the transfer of ownership, the Business must notify the new Business that the Customer’s consent is withdrawn. If a new Business has taken over operations and Customers were not previously notified, the new Business must notify each Customer as soon as practicable and provide the Customers with an option to withdraw from their Centrepay arrangements. Change to goods and services Businesses are approved to use Centrepay for specific goods and services which are notified in the approval letter. If a Business changes the goods or services it provides or wants to use Centrepay for additional goods or services, the Business is required to seek new approval by submitting a new Business Application to the department. 2.3. Business arrangements Centrepay is a payment method for Businesses that provide goods or services directly to Customers. There may be instances where some of the Business’s management or administration arrangements (such as ICT support or financial accounting) are outsourced and include activities related to Centrepay. These arrangements include: • Outsourced agent: this is where the Business has third party outsourcing arrangements in place • Head office administered: this is where a Business’s goods or services are provided by local outlets. This includes some franchise arrangements. These types of arrangements do not relieve the Business of its liabilities or obligations under the Centrepay Policy and Terms. The Business is responsible for any third party compliance for Centrepay and any default in its performance. Note: this differs from the exclusion (see 2.6 Excluded expenses and payment arrangements) relating to brokers, arrangers or similar ‘middle men’ arrangements that are not eligible for Centrepay. v1, 1 July 2015 PAGE 6 of 29 2.4. Centrepay service categories and service reasons Service categories are used in the policy to describe general categories of types of goods and services that can or cannot be paid for using Centrepay. Service reasons are used to describe specific goods and services that a Business has been approved to use Centrepay for. These are included in the approval letter sent to a Business when it has been approved to use Centrepay. Service reasons are used in the deduction and reconciliation reports provided to Businesses as well as statements and reports received by Customers. Businesses who provide only goods and services specifically excluded in the Centrepay Policy and Terms are not eligible for Centrepay. Businesses uncertain of their suitability for Centrepay should contact the Centrepay Helpdesk on 1800 044 063 to get assistance. The department’s decision not to allow Centrepay to be used for certain goods and services is final. Note: approval for one service reason does not imply approval for additional service reasons. Should a Business wish to receive Deductions under one or more additional service reasons, a new Business Application will need to be submitted. 2.5. Included service reasons Centrepay Deductions can be made for the range of goods and services that fall within one of the categories in the following list: Service reason category – Accommodation (includes rent, bond and arrears) Service reason – Boarding House Accommodation Service reason code – BDH Description – Payment for board and/or lodgings either in a private home or other shared accommodation. Service reason – Caravan Park Fees Service reason code – CPF Description – Rental and/or site costs in a caravan park. Service reason – General Community Housing Service reason code – GCH Description – Accommodation provided by community organisations. Service reason – Indigenous Community Housing Service reason code – DIH Description – Accommodation provided by Indigenous community organisations. Service reason – Short-Term Accommodation Service reason code – STA Description – Short-term accommodation not specifically for Indigenous Australians, including sheltered accommodation, disability, rehabilitation and hostels. Service reason – Indigenous Short-Term Accommodation Service reason code – ISH Description – Short-term accommodation for Indigenous Australians, including sheltered accommodation, disability, rehabilitation and hostels. Service reason – Private Landlords Service reason code – PRD v1, 1 July 2015 PAGE 7 of 29 Description – Rent charged by landlords for private accommodation. Service reason – Real Estate Agents Service reason code – EAG Description – Rent paid to an appointed real estate agent. Service reason – Property Management Service reason code – PMG Description – Rent paid to an appointed property manager. Service reason – Supported Accommodation Service reason code – RVF Description – Fees and charges for retirement village, nursing home, lifestyle village or hospice style accommodation. Service reason category – Education and Employment Service reason – Child Care Services Service reason code – CHC Description – Ongoing, after school, occasional and holiday child care services by registered carers and child care providers approved by the Department of Social Services. Can include arrears payments. Service reason – Education Expenses Service reason code – EDF Description – Fees and charges for education services to any registered educational provider, and any related educational expenses including uniforms, equipment, workshops and excursions. Can include arrears payments. Service reason – Employment Expenses Service reason code – TOT Description – Employment-related expenses, including tools of trade, work uniforms, protective clothing, training and footwear. Service reason category – Health Service reason – Funeral Expenses Service reason code – FBF Description – Funeral plans and bonds, prepaid funerals and actual costs of a funeral to funeral homes, funeral directors or other providers that hold appropriate accreditations and registrations. Does not include funeral insurance. Service reason – Ambulance Service reason code – AMB Description – Provision of ambulance or associated services such as payments for services provided by the Flying Doctor Service, emergency helicopter transfer service and other similar services. Service reason – Medical Services and Equipment Service reason code – MEX Description – Medical services such as consultations, medication, hospital costs and rehabilitation. Equipment such as wheelchairs, crutches, oxygen tanks. This service reason also includes veterinarian expenses for domestic pets. Service reason category – Finance (Only loans listed in this section are permitted under Centrepay) Service reason – Community Group Loans Service reason code – CGR Description – Repayment of loans to approved community organisations for assistance with: v1, 1 July 2015 PAGE 8 of 29 o the purchase of household items o establishing proof of identity o assistance with money management Includes Family Income Management Scheme no interest loans. Note: for no interest loans offered by Good Shepherd Microfinance, refer to service reason ‘No Interest Loans’. Service reason – No Interest Loans Service reason code – FIL Description – Repayments of Department of Social Services (DSS) approved ‘No Interest Loans’ (NILS) issued by Good Shepherd Microfinance. Service reason – General Community Housing Loans Service reason code – GCL Description – Repayments of low interest housing loans provided by approved community organisations. Service reason – Indigenous Community Housing Loans Service reason code – IHL Description – Repayments of low interest housing loans provided by approved Indigenous community organisations. Service reason – Special Interest Loans Service reason code – SIL Description – Repayments of Centrepay approved appropriate loans including special and low interest loans. Service reason – Insurance Services Service reason code – ISR Description – House, home contents, vehicle, boat, caravan, private health insurance cover through approved and regulated insurance providers. Does not include funeral, life or income protection insurance, or payments to insurance agents or brokers. Service reason category – Legal and Professional Services Service reason – Court Fines Service reason code – CRT Description – Court-imposed fines and expiation notices including payment of compensation to victims of crime. Service reason – Court Infringements Service reason code – CTI Description – Infringements, such as speeding or parking fines. Service reason – Professional Services Service reason code – LAF Description – Professional services and related expenses including legal, accounting, financial planning services, and costs associated with births, deaths and marriages reports. Service reason category – Travel and Transport Service reason – Motor Vehicle Registration Service reason code – MVR Description – Registration of vehicles including cars, motorbikes, caravans, boats and trailers, and payment for compulsory third party insurance. Service reason – Travel and Transport v1, 1 July 2015 PAGE 9 of 29 Service reason code – TVL Description – Travel and transport costs and expenses, including ‘Return to Country’, general transportation costs, furniture removal and storage, vehicle repairs and fuel. Does not include taxi fares, hire cars or vehicle leases. Service reason category – Utilities Service reason – Council Services Service reason code – LRD Description – Land, water, sewerage, rates and other services provided by local councils, shires or authorities. Service reason – Local Council Community Services Service reason code – LCS Description – Community service costs provided by local council/shires. Service reason – Electricity Service reason code – ELE Description – Provision of electricity by commercial providers. Service reason – Gas Service reason code – GAS Description – Provision of mains and/or bottled gas by commercial providers. Service reason – Telecommunications Service reason code – TEL Description – Telecommunication services including fixed telephone line rental and use, mobile, internet and data services. Service reason – Water Service reason code – WAT Description – Connection and provision of water services by commercial providers. Does not include bottled water. Service reason category – Household Service reason – Basic Household Items Service reason code – CFW Description – Purchase of basic items for use by household members, such as clothing and footwear, small appliances, whitegoods and furniture. Also includes repair services for appliances and whitegoods. Service reason – Household Goods Lease and Rental Service reason code – WGS Description – Rental of household goods (including whitegoods, electrical and furniture) – only through leases regulated under the National Consumer Credit Protection Act 2009 and where the lessor holds an Australian Credit Licence. Service reason – Food Provision Service reason code – FPR Description – Food (and personal items) related costs, including grocery and community store purchases, ‘meals on wheels’. Does not include alcohol or tobacco products. Service reason – Home-care and Trade Services Service reason code – HCS v1, 1 July 2015 PAGE 10 of 29 Description – Home-care services including domiciliary care, household maintenance, pest control, home security, technical aids, and home modifications to assist mobility. Trade services, such as those provided by electricians, technicians, plumbers and gardeners. Service reason – School Nutrition Programme Service reason code – SNP Description – Community and school-based nutritional programs for students. Service reason category – Social and Recreational Service reason – Social and Recreational Commitments Service reason code – SOR Description – Fees or donations, including sporting and musical activities and equipment, church donations, sponsorships. 2.6. Excluded expenses and payment arrangements In keeping with the objective of Centrepay, the following expenses and payment arrangements are excluded from Centrepay: rental or lease payments for goods, where the consumer lease is not regulated under the National Consumer Credit Protection Act 2009 (i.e. the lease is for less than four months or of indefinite duration) or where the lessor does not hold an Australian Credit Licence payments to any broker, arranger or similar that acts as a ‘middle man’, rather than being the provider of a Centrepay approved good or service short-term loan repayments to cash lenders, payday lenders or pawnbrokers credit card payments and fees payments for funeral insurance, life insurance, or any other product where the Customer has to continue making payments until the death of a nominated person to receive benefits payments for income protection insurance the purchase of alcohol, tobacco products, pornographic material, gambling products or services, gift cards, vouchers or homebrew products layby or instalments through payment plan arrangements, where the business primarily trades in hamper style goods and services vehicle leasing payments and expenses payments for taxi services or hire cars any expenses or payment arrangements that, in the department’s view: i. are inconsistent with the purposes of welfare payments ii. have significant potential for high-cost but low-value goods or services iii. have unfavourable clauses, or iv. expose customers to unacceptable risks of financial stress or exploitation. any arrangement where the Deduction would not be paid (directly or indirectly) to the Business that provided the goods or services to the Customer (e.g. Part IX debt agreements and where the debt has been 'sold’ by a Business to a debt collection agency). v1, 1 July 2015 PAGE 11 of 29 2.7. Registrations and accreditations The department requires all Centrepay Businesses to have all the registrations, licences and accreditations required by any Commonwealth, state, territory or local government. Businesses should independently consult any relevant government agency to ensure all appropriate registrations, licences and accreditations are obtained. If any of these are revoked, the Business is to notify the department. 2.8. Provision of necessary information As part of the application process and from time to time, the department may request information from a Business to ensure its initial and ongoing eligibility. This may also include when doing business assurance and compliance activities conducted by the department (see 6.5 Centrepay program assurance reviews and audits). Depending on the reason for the request, failure to provide the information may result in suspension of Centrepay use or, in more serious cases, termination of the Business from Centrepay. 2.9. Fees associated with Centrepay Businesses are charged a transaction fee for each Deduction made from a Customer’s payment. Businesses are not permitted to charge Customers any fees or costs associated with the use of Centrepay, or to pass the transaction fee on to Customers. 2.10. Fee structure Each Centrepay transaction incurs the following fee: Amount of transaction fee (exclusive of GST) - $0.90 GST - $0.09 Total transaction fee (inclusive of GST) - $0.99 This fee is charged for each successful Deduction paid by the department to a Business, including where only part of the agreed Deduction amount could be paid (see 4.8 Order of Deductions). Where the department is unable to make any Deduction from a Customer’s payment, a transaction fee will not be charged. Note: selected service reasons may incur a varied fee. This is discussed with relevant Businesses and implemented at the time of application for Centrepay. 2.11. Options for payment of fees Billing at source: Fees are automatically withheld from Deductions before they are made to the Business. Billing in arrears: If authorised by the department, Businesses may pay the department owed transaction fees in arrears. This allows Businesses to receive the full payment that is deducted from a Customer’s payment, and to be invoiced for the fees at the end of the billing period, usually monthly. v1, 1 July 2015 PAGE 12 of 29 2.12. Fee reporting Businesses are able to access fee information via standard online reporting (see 5.3 Organisational Online Mail for more information). APPLYING FOR CENTREPAY 3.1. Application process A Business must make an application to be approved by the department to use Centrepay. To apply, follow the steps below: 1. 2. 3. 4. Visit humanservices.gov.au/centrepayorgs Download and read the Centrepay Policy and Terms Download, read and complete the Centrepay Business Application Send the completed Centrepay Business Application form and required attachments to the department by fax on 1300 727 760 or post to: Department of Human Services Reply Paid CANBERRA ACT 2610 Completion of an application does not guarantee approval to use Centrepay. The department will only consider a Business Application if all applicable questions have been completed and all required documents are attached. To assess the application, the department may contact the Business to request further information in relation to the application. The department will provide written notification of the outcome of the application. 3.2. Authority to complete the Business Application The Business Application must be completed by a person authorised to contractually bind the Business (where the business is a legal entity), or the individual(s) that will accept contractual responsibility for the actions of the Business (where the Business is an unincorporated association). The Business Application must be signed. If not signed, the Business Application will not be considered. It must be signed by the person(s) who has or have been properly authorised to do so. Note: the department cannot provide legal advice on the contract and suggests Businesses seek independent legal advice if necessary. 3.3. Once approved Upon approval for Centrepay, Businesses will receive an approval letter. The approval letter includes: service reason(s) under which the Business is approved for Centrepay Business Centrelink Reference Number the bank account to which Deduction payments will be made to the Business access level for Centrelink Business Online Services transaction fee payable v1, 1 July 2015 PAGE 13 of 29 additional conditions (if any) details of the Centrepay Account Manager Centrelink Reference Number The Centrelink Reference Number (CRN) is the unique identifier provided to all Customers and Businesses who interact with the department. CRNs comprise of nine numbers and one letter. This unique CRN appears on all correspondence from the department and is required to access online services. Businesses should state their CRN when contacting the department. Businesses should provide Customers with the Business’s CRN to ensure Deductions are correct, where Customers choose to set up Deductions through the department. Conditions As part of the approval process, the department may seek to include additional conditions to a Business's use of Centrepay. This may be the case where a Business would be deemed ineligible for the Centrepay service without the imposition of these conditions. Details of any additional or different conditions will be included in the approval letter. If a Business does not accept these conditions, its use of Centrepay will not be approved. Access level Once approved, a Business will be provided with access to undertake specified activities online; e.g. to view, start, vary down, vary up or cancel Customer Deductions. The level of access will generally depend on a Business’s arrangements and type of goods or services it provides. USING CENTREPAY 4.1. Deduction Authority A Deduction Authority must be obtained from a Customer or their Customer Representative and provided to the department for Centrepay Deductions to be made. A Deduction Authority is the Customer’s instructions and consent for Deductions and can be provided in the following ways: Centrepay Deduction form SA325 – Centrepay the easy way to pay your bills an internal form created by a Business and approved by the department a verbal request (as long as it can be documented) by the Customer to either a Business or the department an online request by the Customer via the Business’s or the department’s website Failure to obtain and store a valid Deduction Authority from a Customer may result in the department withdrawing a Business’s approval to use Centrepay. Businesses are authorised to obtain Deduction Authorities on behalf of Customers. Businesses are responsible for: • confirming the identity of the Customer v1, 1 July 2015 PAGE 14 of 29 • ensuring that the standard Customer Deduction Authority wording is used in any Deduction Authority submitted to the department • storing Deduction Authorities for a minimum of two years from the date of the Authority, or while the Deduction is in place—whichever is the longer • ensuring that Deduction Authorities are stored in a record that can be audited by the department if required. 4.2. How Deductions are set up A Customer can set up a Deduction in a number of ways: • via their Centrelink online account • by contacting the department • by completing the Centrepay Deduction form SA325 – Centrepay the easy way to pay your bills and lodging it with the department or the Business • through a Centrepay approved Business The minimum Deduction amount for Centrepay is $10. Businesses are responsible for advising Customers where they wish to set a greater minimum Deduction amount payable. 4.3. Deductions through the department Customers can lodge a completed form SA325 – Centrepay the easy way to pay your bills, with the department or call the department directly to set up a Deduction by providing the following information: • • • • • • • their Centrelink Customer Reference Number (CRN) the name of the Business they wish to pay the Centrelink Reference Number (CRN) of the Business (if known) the account or billing or reference number the amount they wish to have Deducted each fortnight and which welfare payment it is to be paid from the date on which they wish to commence the Deductions any date the Deduction should stop or total amount (target) that is to be reached. 4.4. Deductions through Businesses Businesses can add Centrepay Deductions by receiving a Deduction Authority from the Customer and undertaking the following actions: • where an SA325 – Centrepay the easy way to pay your bills or another approved form is used, faxing the form to the department, or • using CBOS, through which Businesses can add, vary or terminate a Customer’s Centrepay Deductions, subject to the Business’s level of access. Note: a Business can decrease the amount of a Deduction, or cancel/suspend an existing Deduction Authority, without the Customer’s consent. However, a Business undertaking such an action should advise the Customer before doing so. Note: a Business must have consent and advise the Customer, if increasing the amount of a Deduction. v1, 1 July 2015 PAGE 15 of 29 Businesses are responsible for ensuring the accuracy of information provided to the department in a Deduction Authority. The department will not be liable for any errors that result from incorrect Deduction Authority information being provided by a Business. 4.5. Deduction Authority consent wording I give permission for the Department of Human Services to make a Deduction of $[amount] each fortnight from my [name of payment] and pay this amount to [Business name]. I give permission for the Department of Human Services to disclose my information to [Business name] for the purposes of checking my account number, billing number and amount I want to pay, and reconciling my payment Deduction details. I also authorise [Business name] to give the Department of Human Services my correct account and billing number if required. I understand that: it is my choice to have this amount deducted from my Centrelink payments, and that I can change or cancel the Deduction at any time by contacting the Department of Human Services or [Business name] if I have a current Centrepay Deduction and I transfer to another eligible Centrelink payment in the future, my Deductions may continue if I have a current Centrepay Deduction and I lodge a new claim for Centrelink payments, the existing Deduction(s) will not be carried over to the new payment and I will have to provide new Deduction Authorities to have these set up when the new payment is granted [if applicable] if I stop using [Business name]’s services but do not stop my Centrepay Deduction, [Business name] may instruct the Department of Human Services to stop the Deduction if my Deduction has a target amount and the final Deduction is set to pay less than $2, my second last Deduction will be increased by up to $2 to cover the final amount the Department of Human Services will notify me in writing of any changes to my Deduction details including changes requested by [Business name] my Deduction Authority consent will be noted on my account record with [Business name] when a payment has been made to [Business name] after my Deduction Authority has been cancelled or suspended, the Department of Human Services may be able to assist me to recover the Centrepay Deduction if my Deduction is for rent, any updates I make to Centrepay Deductions for rent will not automatically update my rent assistance. I may need to contact the Department of Human Services and update this separately If I cease to be a Customer of [Business name], I will need to advise the Department of Human Services to stop my Deduction. Name: Signed: Dated: v1, 1 July 2015 PAGE 16 of 29 4.6. Proof of authority Businesses must advise the department within three working days of obtaining a Customer’s authority to make Deductions. Where a Customer has submitted an SA325 – Centrepay the easy way to pay your bills form to the Business, the Deduction Authority should be forwarded to the department using CBOS or sent within three working days for processing. See 4.19d DHS address details for the appropriate forwarding address. If written consent has been provided via a modified form of the Business (if the Business has been authorised to do so), the Deduction Authority can be processed through CBOS, or by forwarding the modified form to the department. Businesses that are authorised to receive Deduction Authorities verbally must process this through CBOS and maintain a record of the Customer’s consent for the authority (see 5. Online Services for Centrepay). The format of this record may vary between Businesses (e.g. electronic database); however, it must contain, as a minimum, the following information: • type of request • amount to be deducted • copy of the verbal script read to the Customer (or reference to) • time and date verbal consent was provided. 4.7. Commencement of Deductions On receipt of a Deduction Authority from a Customer, or upon notice from the Business in accordance with the outlined process, the department will process the Deduction to take place on the Customer’s next available payment date or as instructed by the Customer. Note: if the department receives a Deduction Authority within five business days of the Customer’s next payment date, a Deduction may not commence until the following payment date. Businesses can check the start date of Customer Deductions via the Deduction and Payment Application (DAPA) through CBOS (see 5.4 Centrelink deduction and payment reconciliation report). 4.8. Order of Deductions Where a customer has Centrepay Deductions for multiple Businesses or purposes, the order in which the Deductions are made will be: • as advised by the Customer, or (if there are no instructions from the Customer) • the order in which the Deduction Authorities were processed by the department. Customers may modify the order of their Deductions at any time by contacting the department. A Customer’s welfare payment may vary in some cases, leaving insufficient funds for all Centrepay Deductions to be paid in full. Following the priority order, as many Deductions as possible will be paid in full, with a partial amount being paid when available funds have been exhausted. Note: Businesses should discuss this directly with Customers where this occurs. Businesses are responsible for collecting any arrears payments from the Customer. v1, 1 July 2015 PAGE 17 of 29 4.9. Types of Deductions Centrepay enables Customers to make different types of Deductions. Any of these Deduction types can be varied or stopped at any time by the Customer. Businesses may benefit from encouraging the use of target amounts or end dates, as these features may assist in preventing overpayments and unnecessary actions by the Business or the Customer in relation to ceasing the Deduction. The following types of Deductions are available: Ongoing Deductions These Deductions continue until the Customer requests the Deductions stop, or the Customer’s payment stops. One-off Deductions A Customer may authorise a single Deduction to be paid to a Business. Target amounts A Customer may authorise a Deduction be paid until a specific target amount has been reached, at which time the Deduction will automatically cease. End dates A Customer may authorise a Deduction be paid until a specified time (end date) has been reached, at which time the deduction will automatically cease. End dates can be applied to Deductions up to 12 months in advance. Suspended Deductions A Customer may authorise a Deduction to be suspended for a period of time (maximum of 13 weeks). Suspending a Deduction that is temporarily not required can reduce the likelihood of an overpayment being made. Once a suspension end date has been reached, the Deduction will automatically recommence. Tailored Deductions A Customer may authorise to temporarily change (increase or decrease) a Deduction for a specified period of time (maximum 13 weeks). Once the nominated end date for the varied amount has been reached, the Deduction will revert back to the regular amount. Tailoring Deductions can be useful to help spread out responses to underpayments and avoid overpayments. 4.10. Payment of Deductions The department pays Customer Deductions by electronic funds transfer direct to a Business’s bank account. It is essential that the Business: • maintains its correct bank account details with the department at all times while it is an approved Centrepay Business • advises the department (in writing or through their Account Manager) of any changes to their bank account, no later than five business days before the next due date of a Deduction The department will not be liable to make any additional or interim payments where: • details of the Business’s bank account are incorrectly advised by the Business, or v1, 1 July 2015 PAGE 18 of 29 • a change in the Business’s bank account is advised after the cut-off date of five business days before the next due date of a Deduction. Important: a Business must not impose any penalty upon Customers because the Business has not received any Deduction due to these circumstances. The department will not be liable or responsible for any fees or other charges incurred by the Business as a result of Deductions being paid (or not paid) into the Business’ bank account, unless the Deductions were paid (or not paid) in error by the department. Where a Deduction has been directed to a Business’s nominated bank account, but for whatever reason was not received, the department will use its best endeavours to trace that Deduction. Once the department has confirmation that the amount has been returned to the department, the department will ensure that the Deduction is promptly redirected to the Business. 4.11. Reasons why a full Deduction might not be made At times, the department may not be able to deliver the amount expected from a Customer’s welfare payment. Should this occur, Businesses should discuss this directly with the Customer. Customers are encouraged to contact Businesses to make alternative payment arrangements if they are aware that the full Deduction amount will not be paid. Due to privacy protections the department is unable to provide details relating to why a Customer’s payment has stopped or is insufficient to cover the expected Deduction amount. 4.12. Overpayments and Excess Credits Overpayments include: • where a Deduction is paid to a Business that was not authorised by the Customer via a Deduction Authority, including payment of an amount greater than what was authorised, and • where Deductions are paid to a Business on behalf of a Customer after the cancellation or suspension of the relevant Deduction Authority. Excess Credits refer to an amount of money that has been received from a Customer but is unlikely to be required to pay a future bill. For example, a Customer may have a Deduction in place for electricity and it is discovered that the Deduction amount far exceeds their fortnightly power usage. The Business must advise the department of this so that the Deduction can be amended or temporarily suspended, or the Business should return the Excess Credits to the Customer. If the Business becomes aware of an Overpayment or Excess Credit, the Business must immediately advise the department by contacting the Centrepay Helpdesk. The Business will then be advised of the process for returning the excess funds to the Customer or the department. 4.13. Cancellation of Deductions Centrepay is voluntary and Customers may withdraw or change their Deduction Authorisation at any time without having to give any reason to the Business or the department. It is mandatory to obtain a new Deduction Authority before recommencing a Deduction, even if the details (such as amount, reference number etc.) have not changed. v1, 1 July 2015 PAGE 19 of 29 Where the Business becomes aware a Customer has ceased to be a current customer or ceased to use any services provided by the Business, the Business must request within three business days that the department cancel the Deduction Authority within three business days. 4.14. Promoting Centrepay Once approved for Centrepay, Businesses will be listed on our Find a business or organisation search available at humanservices.gov.au/centrepayorgs to enable customers to identify approved Centrepay Businesses. Note: this excludes private landlords or other Businesses that do not wish to be included on the search facility. Businesses can request removal from this search facility by calling the Centrepay Helpdesk, on 1800 044 063 and ask for a referral to your state Account Manager. Approved Businesses will also be permitted to advise Customers on promotional materials that they have Centrepay as an available method of payment. The Business must not represent its approval to use Centrepay in a manner that represents endorsement of the Business or its goods or services by the department or the Australian government. There are specific rules and protocols relating to the use of departmental promotional material, such as logos, brands and trademarks (see 4.17 Endorsed logos and promotional text). 4.15. Criteria • • • • • Only the text and logo in 4.17 below is approved for use. Where possible text should include reference to the Human Services website—‘Go to humanservices.gov.au/Centrepay for more information’. When Centrepay is being referred to as a payment option it must be listed alongside and equal to other payment methods. The Unity Star can only be used in conjunction with the Centrepay wording in the ‘How to Pay’ section of a bill. It cannot be used elsewhere without the Department of Human Services Brand team’s written permission. Providers are not permitted to use the Department of Human Services logo, brand or trademark within any advertising materials (see 4.16 below). Any requests for the use of non-standard Centrepay references must be referred to the relevant Account Manager. 4.16. Materials not permitted The following are examples of advertising materials where use of the Department of Human Services logo, brand or trademark is not permitted: • flyers, brochures, posters, and vouchers • print media (newspaper, catalogues, magazines) • internet advertising (including Yellow Pages, YouTube, online catalogues, and classified ads) • social media advertising (Facebook etc) • television and radio advertising. Note: this list is not comprehensive. v1, 1 July 2015 PAGE 20 of 29 4.17. Summary of standard conventions Category Endorsed text or instructions for use of logo Category 1 DHS internal use Category 2 Generic promotion to Customers by the department or Businesses Centrepay – the easy way to pay your bills and expenses Centrepay is a voluntary bill-paying service that is free for Centrelink customers. Use Centrepay to arrange regular Deductions from your Centrelink payment. You can start or change a Deduction at any time. The quickest way to do it is through your Centrelink account online. Category 2A Optional addition to Category 2 For generic promotion of Centrepay to Customers You can use Centrepay to pay bills and ongoing expenses like rent, gas, electricity, water and phone, as well as other household costs. Category 2B Optional addition to Category 2 For generic promotion of Centrepay to Customers Use Centrepay to manage expenses such as: Housing and accommodation related expenses Utilities including telephone, electricity and gas Education, child care and employment related expenses Medical, health, cost of funerals and veterinary related expenses Legal expenses including court fines No interest loans Accounting and other professional services Travel and transport related expenses Category 3 For Businesses to use on bills to promote Centrepay Use Centrepay to make regular Deductions from your Centrelink payments. Centrepay is a voluntary and easy payment option available to Centrelink customers. Go to humanservices.gov.au/Centrepay for more information and to set up your Centrepay Deductions. Category 4 Use of logo by Businesses The Australian Government Department of Human Services Unity Star may be used in conjunction with Category 3 approved wording. The following conditions apply to the use of the Unity Star: v1, 1 July 2015 The Unity Star should be at least two lines tall. The Unity Star needs to always remain visible, and cannot be shrunk down to a size where it is no longer recognisable as the Unity Star. The colours of the Unity Star must only be colour (approved PMS colours/trademarked), black or white. The Unity Star must not be distorted or changed (i.e. centre filled in) in any way. The Unity Star can only be used in conjunction with the Centrepay wording in the ‘How to Pay’ section of the bill. It must not be used elsewhere without the Department of Human Services Brand team’s written permission. The Unity Star is protected in legislation and must be used according to these Department of Human Services Unity Star guidelines. The Centrepay name should not be created as a logo with it touching the Unity Star. PAGE 21 of 29 Businesses requiring further information on the above can contact their Account Manager. 4.18. Feedback and complaints The department welcomes feedback on the operation of Centrepay. Where a Customer has a complaint about an action of a Business in relation to Centrepay, the department will investigate and may undertake a compliance review and/or refer the details to relevant Regulatory bodies. Where a Customer has a complaint about goods and/or services, the department will advise the Customer to contact the relevant Business. There may be instances where the department may refer the Customer and/or concern to a relevant government or advisory body; for example, where the matter has been identified as a consistent issue or the Customer has already raised the issue with the Business. If a Business has a complaint about the department’s action in relation to Centrepay, or the operation of Centrepay, the complaint can be made to the Centrelink feedback and complaints line on 1800 132 468 and the department will investigate. The department responds to complaints received as soon as possible. You can find further information, including relevant Helpdesk contact details, at humanservices.gov.au/feedback. Note: if a Business or Customer is dissatisfied with the way a complaint is handled by the department they can refer the matter for further investigation to other regulatory and oversight bodies, including the Office of the Commonwealth Ombudsman. 4.19. Important details National Business Gateway National Business Gateway is the department’s dedicated contact centre for Australian businesses, providing support and services for Centrepay and a number of other departmental programs and initiatives. Read more about the National Business Gateway at humanservices.gov.au/business Centrepay Helpdesk For support with Centrepay, including using online services, you can contact the Centrelink Business Support Helpdesk during business hours within the National Business Gateway. Email: Freecall™: centrelink.business.support@humanservices.gov.au 1800 044 063 When calling the Centrelink Business Support Helpdesk, ensure you provide the following information: • Business name • Centrelink Reference Number (CRN)—usually begins with 555 • description of the problem or error. v1, 1 July 2015 PAGE 22 of 29 Department of Human Services Bank Account The following information is the bank account used by the department to make Deductions to Businesses. It should be used by Businesses when returning Overpayments or other debts owed to the department. Name: Branch: BSB no: Account no: Account name: Reserve Bank of Australia Canberra 092 009 112 498 CSDA Departmental Payments and Receipts DHS address details Use the following address for forwarding written advices, such as Deduction Authorities, changes to Business details and advice of Overpayments. This address can also be used for general written correspondence and notices to the department Centrepay GPO Box 689 Hobart TAS 7001 Telephone: 1800 044 063 Fax: 1300 766 412 Email: centrelink.business.support@humanservices.gov.au ONLINE SERVICES FOR CENTREPAY 5.1. Centrelink Business Online Services (CBOS) CBOS enables Businesses to conduct Centrepay Deduction activities online using a single secure website. For the purposes of Centrepay, Businesses can access: Organisational Online Mail (OOM) Centrelink deduction and payment reconciliation reports (accessed through OOM) Deductions and Payments Application (DAPA) Centrepay Bulk Upload Service (CBUS) Guides for using these services are available on the main page of CBOS. Any important notifications or messages concerning the service will be posted on the main page. 5.2. How to get access To register for CBOS, Businesses need to complete and submit an SA445 Business Online Services – User Details form. Details of each individual staff member who requires CBOS access must be included on the form. Businesses will need the following information to successfully register for CBOS: • Australian Business Number (ABN) v1, 1 July 2015 PAGE 23 of 29 • AUSkey (if available)* • Business name and address • contact details for the individual CBOS applicant • name and contact details for the primary Business contact and user (if different from above) • name and contact details of the authorised person (if not the applicant) who is designated to accept terms and conditions associated with CBOS on the Business’s behalf • Businesses can register for CBOS by visiting humanservices.gov.au/centrelinkbusinessonline * AUSkey is an online security pass introduced by the Australian Government to streamline access by businesses to online services across government. The AUSkey enables faster registration, access to more functions and access to Centrelink Business Online Services without having to maintain a separate password. Visit abr.gov.au/auskey for more information or to register for an AUSkey. 5.3. Organisational Online Mail (OOM) This online service is available through CBOS to registered Businesses and operates like an email account. OOM enables Businesses to receive their Electronic Data Transfer (EDT) and their Centrepay Deduction Reports that may be viewed, printed or saved for up to 91 days before they are archived. The department will deliver EDT instructions and/or payment reports and any applicable tax invoices to registered Businesses. This service allows Businesses to monitor their Customer's payment activities simply and securely online. The department will send an email advice when a new letter, report or payment summary is available for viewing on the OOM service. OOM users can access the Centrelink Deduction Report User Guide to increase their understanding of OOM functionality. Businesses can access this report using CBOS through humanservices.gov.au/centrelinkbusinessonline 5.4. Centrelink deduction and payment reconciliation report Businesses approved to use Centrepay are provided with the Centrelink Deduction Report via OOM, which provides information on Centrepay transactions and can be tailored to Business requirements including frequency of delivery (e.g. daily, weekly, fortnightly or monthly reports). More information is available in the Centrelink Deduction Report User Guide that Businesses can access using CBOS through humanservices.gov.au/centrelinkbusinessonline 5.5. Deductions and Payments Application Businesses will receive access to the Deductions and Payments Application (DAPA), which is an online service that allows Businesses to add, vary or cancel Centrepay Deductions (with an appropriate Deduction Authority), subject to the Business’s access level. DAPA also allows Businesses to view their Customers’ current and future Centrepay Deductions as well as some historical Deduction information. More information about DAPA is available in the Deduction and Payments Application User Guide that Businesses can access using CBOS through humanservices.gov.au/centrelinkbusinessonline v1, 1 July 2015 PAGE 24 of 29 5.6. Varying Deductions Subject to approval, a Business may have the ability to: start new Deductions (‘Add a Deduction’) stop Deductions (‘Cancel a Deduction’) increase the amount of a Deduction (‘Vary up’) reduce the amount of a Deduction (‘Vary down’) enter or vary a target amount for a Deduction enter or vary an end date for a Deduction 5.7. Centrepay Bulk Upload Service Similar to DAPA, the Centrepay Bulk Upload Service (CBUS) is an online service that enables approved Centrepay Businesses to add, vary or cancel Centrepay Deductions (with an appropriate Deduction Authority), subject to the Business’s access level. CBUS enables Businesses to process Deductions for multiple Customers at a time, whereas DAPA only enables actions for individual Customer Deductions. Note: under CBUS, Businesses cannot view current and future Centrepay Deductions or any historical Deduction information. The range of functions available to each Business depends on the type of goods or services provided to Customers and the level of access granted by the department. Businesses can find more information about CBUS in the Centrepay Bulk Upload Service User Guide and can access the service via CBOS through humanservices.gov.au/centrelinkbusinessonline 5.8. Service availability Occasional, unforeseen disruptions to online services may be experienced, which may impact access to Centrepay services online. Additionally, scheduled maintenance is conducted to continually improve and enhance functionality. You can find up-to-date information about unexpected service issues or scheduled maintenance dates and times on humanservices.gov.au/centrelinkbusinessonline Businesses requiring immediate support when service is unavailable during business hours should contact the Centrepay Helpdesk on 1800 044 063. BUSINESS RESPONSIBILITIES 6.1. Departmental Requirements for Business The Centrepay framework outlines how Businesses should conduct their activities with Centrepay Customers. To remain eligible, the department expects an approved Centrepay Business will conduct itself in a lawful and ethical manner, and in a way which is beneficial to Customers and not detrimental to the department. Lawful conduct includes complying with all laws that regulate the Business, including, but not limited to, consumer protection, registration, licensing and accreditation, financial and privacy laws, the provision of layby, anti-hawking, cooling off periods and the provision of consumer credit. v1, 1 July 2015 PAGE 25 of 29 Ethical behaviour includes, but is not limited to, dealing with Customers in a fair, honest and equitable manner which does not take unfair advantage of Customers. Some examples of nonethical behaviour includes unsolicited meetings (such as door-knocking with a potential Customer which occurs as a result of a Business approaching that person without a direct invitation from that person), or activities which target, or are predatory towards the disadvantaged or vulnerable. 6.2. Customer Representatives A Customer Representative is a person authorised by the Customer, or by law, to represent the Customer or to manage the Customer’s affairs. Customer Representatives can be appointed by the Court, nominated in a Will or selected by the Customer. Businesses are responsible for confirming the authority of any person or organisation claiming to be a Customer Representative before allowing that person or organisation to take any action on behalf of the Customer. The Business must be able to prove the person’s or organisation’s authority if requested by the Customer or department. 6.3. Centrepay program assurance reviews and audits The department, the Australian National Audit Office, the Information Commissioner or the Privacy Commissioner may conduct program assurance reviews or audits at any time. Reviews and audits may respond to complaints or information received, be part of a planned schedule or be a result of random selection. Businesses are required to support such reviews and audits through provision of information and access to records. Centrepay program assurance reviews and audits are undertaken to assess conformance with the department’s expectations as set out in the Centrepay Policy and Terms and approval letter. Failure to meet the expectations may result in withdrawal of approval for a Business to use Centrepay. 6.4. Failure to meet expectations If a Business is identified as having not complied with the Centrepay Policy and Terms, the department has a range of actions available to use when managing or addressing compliance issues, including: Centrepay Account Managers may engage with the Business to provide advice and support to the Business to remedy identified instances of non-compliance. A breach and/or remedy notice may be issued requesting the business to show proof of having rectified any non-compliance issue. A remedy notice provides the details of the noncompliant event and advises a due date by which time the Business must rectify the situation. Upon receipt of a remedy notice, Businesses are required to respond to the department in writing by the due date, to advise what action has been taken to rectify the non-compliant event/s. Failure to respond to a remedy notice will incur a show cause letter from the department. The show cause letter requires a business to provide evidence, by the due date, as to why the department should not withdraw approval to use Centrepay. The department may suspend the payment of Deductions for any new Customers or withdraw approval to use Centrepay. v1, 1 July 2015 PAGE 26 of 29 The department may undertake subsequent, targeted reviews and audits to seek information for the Business to ensure identified instances of non-compliance have been remedied and no additional instances have arisen. 6.5. Review of departmental decisions A Business can request a review of a departmental decision to: • refuse to approve the Business to use Centrepay • vary the Centrepay Terms or impose conditions on the Business’ approval to use Centrepay • suspend payments to the Business, or • withdraw or terminate the Business’ approval to use Centrepay 6.6. How to lodge a request for a review A request to review a decision must be made in writing to the department and lodged within 14 days of being notified of the decision, which will be provided in writing. The letter outlining the decision will provide details on the review process, including the postal address for submitting the request (see also 4.19 Important details). The request should outline the reasons for seeking the review and include any information to support this request. 6.7. Conduct of reviews A review will be conducted by an officer not involved in the original decision and the Business will be notified of the review decision within 30 days of the department receiving the request for review. The Business will be given reasonable opportunity to make any additional submissions to the officer undertaking the review before a final decision is made. The reviewing officer may also undertake one or more of the following actions as appropriate: • review any relevant application, records and/or documents used to make the decision • review the original decision-maker’s notes • consider the information contained in the request to review the decision • contact the Business to discuss the matter further, and/or • make corrections where appropriate. At the completion of the review, the review officer will affirm the original decision, vary the decision or issue a new decision. Note: the review decision is final and there are no further merits or internal reviews possible. 6.8. Management of Customer information Secure storage Businesses must securely store all information received from the department or its Customers. The Business must not adopt, use or disclose a Customer’s CRN for any purpose other than Centrepay. Examples of secure storage include: v1, 1 July 2015 PAGE 27 of 29 • • • • • a secure cupboard that has a key lock, a pad lock or combination lock that can only be accessed by individuals who are authorised by the Business to view confidential Customer information a safe that is locked at all times and only accessible by authorised individuals a secure office that is locked and only accessible by authorised individuals a password protected computer that only authorised individuals can access; or, if on a computer without password protection, confidential electronically stored documents and files must be password protected an area that is secure and does not allow customer access (e.g. in an open plan office there may be a part of the office dedicated to files that are in a secure area away from customer access and not considered a public contact area). Secure storage would not include: • having documents or files in view, in a non-secure public area • having documents or files that are able to be viewed by staff that are not authorised • locating documents or files in an area that is accessible to the public (e.g. a bookshelf, on an office desk in a public area, on or under a counter) • having electronic documents or files accessible on a public computer that non-authorised individuals have access to. Privacy obligations Businesses must: • take all reasonable steps to ensure that a Customer's personal information (including CRN) in their possession or control in connection with Centrepay is protected against loss and unauthorised use, access, modification or disclosure • act, at all times, in accordance with the Australian Privacy Principles • ensure their staff and any other person who may have access to a Customer’s personal information held by the Business are aware of and act in accordance with the Australian Privacy Principles • refrain from any action that would result in the department being in breach of the Privacy Act 1988 or which in the department’s view would be likely to have been considered as a breach of the Act had the action been undertaken by the department • cooperate with any demands or enquiries made by the Privacy Commissioner. Where the department receives a complaint or other evidence of interference with the privacy of a Customer in relation to Centrepay, the department will immediately investigate the matter, and will consider if the interference constitutes a breach. The department will notify any relevant Business in writing of the nature of a relevant breach. You can find more information about the Australian Privacy Principles at the Office of the Australian Information Commissioner’s website oaic.gov.au 6.9. Withdrawing from Centrepay A Business can withdraw from Centrepay by giving the department at least 28 days notice in writing (see 4.19 Important details). If applicable, alternative arrangements should be put in place with Customers during this time before their Centrepay Deductions cease. When a Business withdraws from Centrepay, the department will stop accepting Deduction Authorities for the Business and will remove the Business’s access to the relevant online services. v1, 1 July 2015 PAGE 28 of 29 Any Customers with Deductions to the Business still in place will be notified that their Deduction has ceased in line with standard procedure for the cessation of Centrepay Deductions. 6.10. Business obligations if withdrawing from Centrepay Notifying Customers Businesses seeking to withdraw from Centrepay should ensure Customers are made aware of the upcoming changes, to allow alternative payment methods to be put in place and avoid non-payment (if applicable). Prior to ceasing the use of Centrepay, Businesses should ensure Centrepay payments are reconciled appropriately to their Customer’s accounts. Promotional materials Any Centrepay or Department of Human Services promotional material should be removed when a Business withdraws from the use of Centrepay. This includes references to Centrepay or the department on the Business’s website, promotional materials and correspondence. Centrepay fees Where the transaction fees for a withdrawing Business are billed in arrears by invoice, the Business will be required to finalise its account. The department will issue a final invoice to the Business for this amount. 6.11. Recommencing the use of Centrepay Businesses wishing to recommence the use of Centrepay must reapply via the Business Application process. Businesses will need their CRN and details of their previous arrangements under Centrepay for this process. v1, 1 July 2015 PAGE 29 of 29