BENEFITS SUMMARY.doc - CommonBond Communities

advertisement

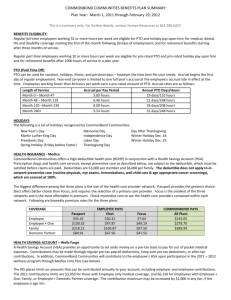

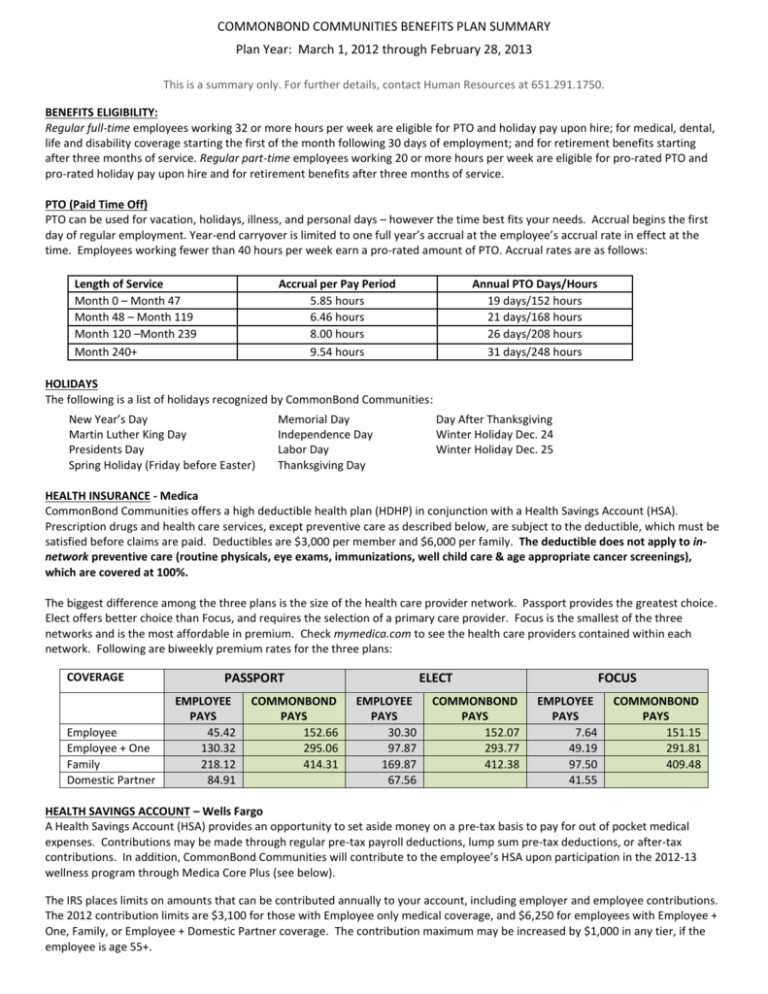

COMMONBOND COMMUNITIES BENEFITS PLAN SUMMARY Plan Year: March 1, 2012 through February 28, 2013 This is a summary only. For further details, contact Human Resources at 651.291.1750. BENEFITS ELIGIBILITY: Regular full-time employees working 32 or more hours per week are eligible for PTO and holiday pay upon hire; for medical, dental, life and disability coverage starting the first of the month following 30 days of employment; and for retirement benefits starting after three months of service. Regular part-time employees working 20 or more hours per week are eligible for pro-rated PTO and pro-rated holiday pay upon hire and for retirement benefits after three months of service. PTO (Paid Time Off) PTO can be used for vacation, holidays, illness, and personal days – however the time best fits your needs. Accrual begins the first day of regular employment. Year-end carryover is limited to one full year’s accrual at the employee’s accrual rate in effect at the time. Employees working fewer than 40 hours per week earn a pro-rated amount of PTO. Accrual rates are as follows: Length of Service Month 0 – Month 47 Month 48 – Month 119 Month 120 –Month 239 Month 240+ Accrual per Pay Period 5.85 hours 6.46 hours 8.00 hours 9.54 hours Annual PTO Days/Hours 19 days/152 hours 21 days/168 hours 26 days/208 hours 31 days/248 hours HOLIDAYS The following is a list of holidays recognized by CommonBond Communities: New Year’s Day Martin Luther King Day Presidents Day Spring Holiday (Friday before Easter) Memorial Day Independence Day Labor Day Thanksgiving Day Day After Thanksgiving Winter Holiday Dec. 24 Winter Holiday Dec. 25 HEALTH INSURANCE - Medica CommonBond Communities offers a high deductible health plan (HDHP) in conjunction with a Health Savings Account (HSA). Prescription drugs and health care services, except preventive care as described below, are subject to the deductible, which must be satisfied before claims are paid. Deductibles are $3,000 per member and $6,000 per family. The deductible does not apply to innetwork preventive care (routine physicals, eye exams, immunizations, well child care & age appropriate cancer screenings), which are covered at 100%. The biggest difference among the three plans is the size of the health care provider network. Passport provides the greatest choice. Elect offers better choice than Focus, and requires the selection of a primary care provider. Focus is the smallest of the three networks and is the most affordable in premium. Check mymedica.com to see the health care providers contained within each network. Following are biweekly premium rates for the three plans: COVERAGE Employee Employee + One Family Domestic Partner PASSPORT EMPLOYEE PAYS 45.42 130.32 218.12 84.91 COMMONBOND PAYS 152.66 295.06 414.31 ELECT EMPLOYEE PAYS 30.30 97.87 169.87 67.56 COMMONBOND PAYS 152.07 293.77 412.38 FOCUS EMPLOYEE PAYS 7.64 49.19 97.50 41.55 COMMONBOND PAYS 151.15 291.81 409.48 HEALTH SAVINGS ACCOUNT – Wells Fargo A Health Savings Account (HSA) provides an opportunity to set aside money on a pre-tax basis to pay for out of pocket medical expenses. Contributions may be made through regular pre-tax payroll deductions, lump sum pre-tax deductions, or after-tax contributions. In addition, CommonBond Communities will contribute to the employee’s HSA upon participation in the 2012-13 wellness program through Medica Core Plus (see below). The IRS places limits on amounts that can be contributed annually to your account, including employer and employee contributions. The 2012 contribution limits are $3,100 for those with Employee only medical coverage, and $6,250 for employees with Employee + One, Family, or Employee + Domestic Partner coverage. The contribution maximum may be increased by $1,000 in any tier, if the employee is age 55+. COMMONBOND COMMUNITIES BENEFITS PLAN SUMMARY Plan Year: March 1, 2012 through February 28, 2013 WELLNESS PROGRAM – Medica Core Plus Employees enrolled in health insurance through Medica have the opportunity to participate in Medica’s Core Plus wellness program. Upon completion of certain health actions on the wellness scorecard and as described below, CommonBond will deposit the following amounts into the employee’s HSA. MEDICAL COVERAGE LEVEL Employee Employee + One Family COMPLETION OF HEALTH ASSESSMENT AND BIOMETRIC SCREEN $200 $350 $500 COMPLETION OF PERSONAL HEALTH SCORECARD $200 $350 $500 DENTAL – MetLife Preventive and basic services are covered at 100% and major services are covered at 60% up to a $2,000 plan year maximum at participating in-network and out-of-network dental clinics. Following are biweekly premium rates for the dental plan: COVERAGE Employee Employee + One Family Domestic Partner EMPLOYEE PAYS $8.27 $18.28 $27.06 $8.75 COMMONBOND PAYS $8.27 $18.28 $27.06 $8.75 LONG TERM DISABILITY – Unum Coverage is 60% of pre-disability wages, up to $5,000/month, payable after 90 days of continuous disability, which must be documented by a health care provider. The premium is paid by CommonBond. Claims decisions are made by Unum. SHORT TERM DISABILITY – Unum Coverage is 60% weekly gross compensation up to $800/week, payable after 14 days of continuous disability, which must be documented by a health care provider. The premium is paid by CommonBond. Claims decisions are made by Unum. BASIC LIFE INSURANCE AND ACCIDENTAL DEATH & DISMEMBERMENT – Unum Coverage is 1 x salary, with a minimum benefit of $50,000 and a maximum benefit of $200,000. The premium is paid by CommonBond. VOLUNTARY LIFE and AD&D INSURANCE – Unum Employees may purchase additional life insurance and/or AD&D coverage at group rates. Employees may purchase up to 5x salary or $130,000, whichever is less, without evidence of insurability. Employees may request coverage in excess of the guarantee issue, but that coverage is subject to evidence of insurability. Coverage is also available for the spouse and children of the employee. FLEXIBLE SPENDING ACCOUNTS - Optum Employees may establish flexible spending accounts with pre-tax dollars and use those accounts to cover certain health care and/or dependent care expenses. We use the services of a third-party administrator called Optum. Employees may receive reimbursements by check or direct deposit. Health Care FSA: The Full Scope healthcare FSA is for those who do not participate in a Health Savings Account and may be used to cover health care expenses that are not paid by health or dental insurance, or other sources. The Limited Scope healthcare FSA is for those who participate in a Health Savings Account, and is limited to use for vision and dental (including orthodontic) expenses. Dependent Care FSA allows you to establish an account and use that the dollars to cover eligible expenses related to caring for your dependents while you are working. 401(k) RETIREMENT SAVINGS PLAN - ADP Regular full-time and regular part-time employees are eligible for coverage the first of the month following 3 months of employment. On-call, temporary, and other part time employees are eligible after 1000 hours of service in a plan year. Plan allows for pre-tax salary deferrals up to the maximum allowable under law. CommonBond matches 100% of the first 1% and 50% of the next 5% of wages an employee contributes. Match is deposited bi-weekly and is vested after two years. PAY PERIODS AND DIRECT DEPOSIT CommonBond employees are paid every other Friday, generally 26 paychecks per year. Employees have the option to directly deposit their net earnings in up to three checking accounts and/or three savings accounts.