Module 10: Cash Flows

advertisement

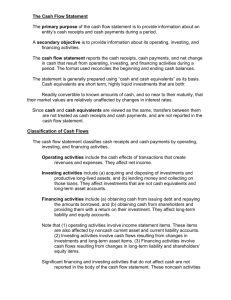

Module 10 Statement of Cash Flows • • • • Primary purpose is to provide relevant information about cash receipts and cash disbursements of the company during the year. Explains change in cash and cash equivalents. Examples of cash equivalents are Treasury bills commercial paper (short-term notes issued by corporations) and money market funds. Format of SCF includes the following three sections: A. Cash flow from operating activities. B. Cash flow from investing activities. C. Cash flow from financing activities. A. Cash Flows from Operating Activities • • CF from operating activities is based on the income statement, and converts income activity to a cash basis in its presentation. There are two formats for the presentation of CF from operating activity: – direct method: this technique shows cash received from customers and cash paid to various entities for operating activities. – indirect method: this technique starts with net income and makes adjustments to net income to convert it to a cash basis. – Most companies use the indirect method. B. Cash Flows from Investing Activities • • CF from investing activities explain the changes in cash from the purchase or sale of the company’s (primarily) long-term assets. Examples of investing activity includes: – cash paid for purchase of equipment, land, buildings, investments, intangible assets, and most other long term assets. – cash received from sale of equipment, land, buildings, investments, intangible assets, and most other long term assets. C. Cash Flows from Financing Activities • • CF from financing activities explain the changes in cash from the issue or retirement of the company’s (primarily) long-term liabilities and equity. Examples of financing activity includes: – cash received from issue of bonds, mortgages and other long-term debt. – cash received from issue of common stock and preferred stock. – cash paid for the retirement of long-term debt. – cash paid for the repurchase of treasury stock. – cash paid for dividends. A. CF from Operations (indirect method) To understand the adjustments to get from net income to CF from operations, we will classify the adjustments into 3 categories: (1) Non-cash expense items. (2) Gains and losses. (3) Changes in operating-related current assets and liabilities Remember: net income includes many activities that are noncash, or only partly cash. (1) Non-cash Expense Items Noncash expense activities include: -Depreciation expense. For example: Depreciation Expense xx Accumulated Depreciation xx -Amortization expense on intangible assets such as patents. Amortization Expense xx Patents xx -Bad debt expense on the estimation of uncollectibles: Bad Debt Expense xx Allowance for Doubtful Accts. xx Since these expenses originally reduced net income, the amount of these expenses would need to be added back to net income to get to cash from operations. (2) Gains and Losses Gains and losses occur on investing and financing activity. For example, assume that land is sold for $10,000 cash, and the original cost was $9,000: Cash 10,000 Land 9,000 Gain on Sale of Land 1,000 In this case, the $10,000 cash received would be shown in Investing. However, if the gain is not adjusted out of net income, we would be “double counting” that effect. • • Therefore, any gains or losses from sale of long-term assets (equipment, land, buildings, AFS and equity investments, intangibles) . The adjustment to reverse out the effects would be: – add the amount of loss to net income. – subtract the amount of the gain from net income. The same holds true for gains and losses from the retirement of bonds). (3) Changes in Operating-Related Current Assets and Liabilities • Changes in operating current assets: • Changes in operating current liabilities: – Accounts Receivable – Accrued Receivables, such as interest, dividends – Inventories – Prepaid Expenses – Accounts Payable – Accrued liabilities for wages, taxes, interest… – Unearned Revenues In general, Subtract increases in related assets. Add decreases in related assets. Add increases in related liabilities. Subtract decreases in related liabilities. Example: Sales = $100,000, and change in A/R from 2,000 to 3,000 or 1,000 increase . The $1,000 increase in A/R should be subtracted from net income to convert net income to a cash basis because this was cash that was not collected from customers. . Additional Issues - SCF • • The FASB requires that significant noncash investing and financing activities be disclosed in a note or supplementary schedule to the SCF. Examples of significant noncash investing and financing activities include: – conversion of bonds or preferred stock to common stock. – purchase of assets with issue of stock. – purchase of assets with debt. – declaration (but not payment) of cash dividend.