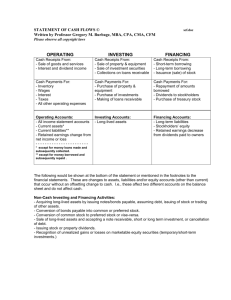

CF from operating activities

advertisement

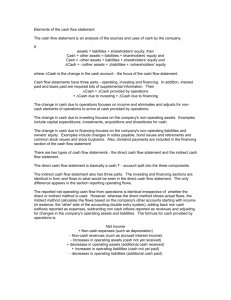

Chapter 12: Statement of Cash Flows 1 General Information on SCF Required for financial statements by SFAS 95 (1987). Primary purpose is to provide relevant information about cash receipts and cash disbursements of the company during the year. Serves to complement the other financial statements. Focus is on cash flows, not income. Reconciles the balance sheet and the income statement. 2 Content of Statement of Cash Flows Explains change in cash and cash equivalents. Cash equivalents are defined as short-term, highly liquid investments near to maturity. Examples of cash equivalents are Treasury bills commercial paper (short-term notes issued by corporations) and money market funds. Format of SCF includes the following three sections: A. Cash flow from operating activities. B. Cash flow from investing activities. C. Cash flow from financing activities. 3 A. Cash Flows from Operating Activities CF from operating activities is based on the income statement, and converts income activity to a cash basis in its presentation. There are two formats for the presentation of CF from operating activity: – direct method: this technique shows cash received from customers and cash paid to various entities for operating activities. – indirect method: this technique starts with net income and makes adjustments to net income to convert it to a cash basis. 4 Cash Flows from Operating Activities If the direct method is used, the indirect method must be presented in a supplementary schedule. The direct method is more informative, but the vast majority of companies present only the indirect method. FASB is considering a change to require the direct method. Our coverage of Chapter 12 will focus only on the indirect method. 5 B. Cash Flows from Investing Activities CF from investing activities explain the changes in cash from the purchase or sale of the company’s (primarily) long-term assets. Examples of investing activity includes: – cash paid for purchase of equipment, land, buildings, investments, intangible assets, and most other long term assets. – cash received from sale of equipment, land, buildings, investments, intangible assets, and most other long term assets. 6 C. Cash Flows from Financing Activities CF from financing activities explain the changes in cash from the issue or retirement of the company’s (primarily) long-term liabilities and equity. Examples of financing activity includes: – cash received from issue of bonds, mortgages and other long-term debt. – cash received from issue of common stock and preferred stock. – cash paid for the retirement of long-term debt. – cash paid for the repurchase of treasury stock. – cash paid for dividends. 7 Cash Flows from Financing Activities Note that cash paid for dividends is classified as a financing activity, but cash paid for interest is classified as an operating activity. Note that cash received for dividends and cash received for interest are both classified as operating activities. How is the cash paid for dividends different from the other activities? Why did the FASB choose to classify it as a financing activity? FASB chose to leave income related items (int. revenue, int. expense, div. income) in the operating section, rather than reclassify. However, dividends declared has nothing to do with net income, and must be classified with financing. 8 A. CF from Operations (indirect method): Specific Calculations To understand the adjustments to get from net income to CF from operations, we will classify the adjustments into 3 categories: (1) Noncash items. (2) Double counted gains and losses. (3) Change in related (accrual basis) assets and liabilities Remember: net income includes many activities that are noncash, or only partly cash. 9 (1) Indirect Method - Noncash Items Noncash activities include -Depreciation expense. For example: Depreciation Expense xx Accumulated Depreciation xx -Amortization expense on intangible assets such as patents. Amortization Expense xx Patent xx -Bad debt expense on the estimation of uncollectibles: Bad Debt Expense xx Allowance for Doubtful Accts. xx Since these expenses originally reduced net income, the amount of these expenses would need to be added back to net income to get to cash from operations. 10 (2)Indirect Method - Double Counted Items The double counted items come from gains and losses on investing and financing activity. For example, assume that land is sold for $10,000 cash, and the original cost was $9,000: Cash 10,000 Land 9,000 Gain on Sale of Land 1,000 In this case, the $10,000 cash received would be shown in Investing. However, if the gain is not adjusted out of net income, we would be “double counting” that effect. 11 (2)Indirect Method - Double Counted Items Therefore, any gains or losses from sale of investing (nonoperating) assets (equipment, land, buildings, AFS and equity investments, intangibles). The adjustment to reverse out the effects would be: – add the amount of loss to net income. – subtract the amount of the gain from net income. The same holds true for gains and losses from the early extinguishment of debt (like the gains/losses from the retirement of bonds). – add the amount of loss to net income. – subtract the amount of the gain from net income. 12 (3) Indirect Method Change in Related Assets and Liabilities The third category examines the change in the assets and liabilities that relate to the remaining income statement items, after the items in (1) and (2) have been removed. The adjustment for the effect of these changes is to effectively “squeeze” the income statement item from the accrual basis of accounting to the cash basis of accounting. 13 (3) Indirect Method Change in Related Assets and Liabilities Example: Sales = 100,000, and change in A/R from 2,000 to 3,000 or 1,000 increase . A/RB + Sales - A/RE = Cash Collections 2,000 + 100,000 - 3,000 = Cash Collections 99,000 = Cash Collections Note that, to convert from accrual basis sales revenues to cash basis sales revenues, an increase in A/R should be subtracted from net income to convert net income to a cash basis. Correspondingly, a decrease in A/R should be added to net income to convert net income to a cash basis. 14 (3) Indirect Method Change in Related Assets and Liabilities This pair of rules can be expanded to a general set of rules to convert NI from accrual to cash basis: Subtract increases in related assets. Add decreases in related assets. Add increases in related liabilities. Subtract decreases in related liabilities. Mnemonic to help you remember: AOLS Assets Opposite, Liabilities Same 15 (3) Indirect Method Change in Related Assets and Liabilities The types of assets that relate to the income statement are primarily current assets, but not always. To decide, you must look at each asset and its related income statement component. Also, remember that we are looking at the remaining assets and liabilities (after the eliminations in part 1). Since we have already eliminated depreciation expense and amortization expense, etc., we would not include the changes in these related assets (Accum. Depr., Patents, etc.). 16 (3) Indirect Method Change in Related Assets and Liabilities (primarily current assets and liabilities) Examples of related assets are: Accounts Receivable. Interest Receivable. Inventories. Prepaid Expenses. Examples of related liabilities include: Accounts Payable. Interest Payable. Wages Payable. Income Tax Payable. Other Current Liabilities. Unearned Revenues. 17 Additional Issues - SCF The FASB requires that significant noncash investing and financing activities be disclosed in a note or supplementary schedule to the SCF. Examples of significant noncash investing and financing activities include: – conversion of bonds or preferred stock to common stock. – purchase of assets with issue of stock. – purchase of assets with debt. – declaration (but not payment) of cash dividend. 18