Click here to read

advertisement

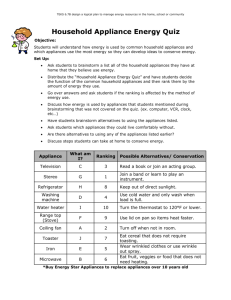

Investing in China’s Small Household Appliances Market By: Jake Liddle, Dezan Shira & Associates Word count: 734 2014 proved a hard year for China’s household appliances industry, caused by global economic uncertainty, a slump in the country’s housing market and cuts made to household appliance subsidies by the government. Despite this, China’s large consumer market – in particular the rising middle class – continues to boost sales of small household appliances, which occupies a large quantity of the country’s overall electronics market. According to IBIS World’s 2015 Home Appliance Stores Market Research Report, Chinese home appliance stores’ annual revenue has increased at a rate of 6.1 percent to US$176.1 billion in the last five years. HKTDC’s China Kitchen Electrical Appliance Market Report claims that China’s urbanization rate, which stood at 53.7 percent in 2013 and has increased annually by more than one percent, is the main reason for the industry’s stable growth. Additionally, rural populations are also becoming more susceptible to an evolving small appliance market, causing China to become the world’s biggest consumer and manufacturer of electrical appliances. Classified as encouraged in China’s Catalogue for Foreign Investment Industries, there is ample opportunity for foreign investors in this growing market. Consumer trends and purchasing habits HKTDC’s survey reports that replacing older or existing broken products and improving quality of life are the main reasons that Chinese households purchase small appliances. Changing consumption trends, which reflects increasing disposable income of consumers, have forced domestic electronics giants to widen their range of household appliances. Middle class consumers, who tend to prefer more mid to high-end ranges, now look beyond price, quality and brand of products when purchasing small appliances; the report shows that 88 percent of respondents are now more concerned with energy efficiency, environmental protection, nontoxic materials, durability, and ease of operation of products, and are willing to pay an extra 11 percent for these functions. These are features which have become the norm in the west, where CHINA | HONG KONG | INDIA | VIETNAM | SINGAPORE www.asiabriefing.com energy efficiency and hygiene standards are highly regulated and developed. Furthermore, middle class consumers are more trusting of foreign branded products, giving rise to ease of integration in the existing market. In addition, smart functions have been one of the market’s more dramatic developments, with consumers preferring products which are compatible with smart phones or are remotely controllable, or ones with the capability to automatically detect external factors such as heat or pressure and adjust accordingly. However, China Trade Research’s findings indicate that a growing proportion of consumers tend to purchase full kitchen sets, attracted by same brand discounts, unified design and post purchase services. Furthermore, full kitchen suites with inbuilt appliances are replacing individual standalone small appliances, providing convenience and space-saving solutions in a market where property space is a premium. Online shopping is becoming an important option for consumers, primarily on China’s largest ecommerce platforms taobao.com, Tmall.com and JD.com, which are expanding their delivery scope to more rural areas. However, market research shows that a large majority of consumers still purchase small electrical appliances at traditional outlets such as shopping malls and specialist electronic stores, meaning that electronics retailers are going to have to maintain a balance between online and offline sales methods. Domestic giants Unsurprisingly, large domestic brands such as Haier, Midea, Hisense and Supor dominate the Chinese small appliances market, maintaining extensive marketing campaigns, regular product updates, distribution networks, brand reputations and tight competition in almost every part of the country. This has resulted in smaller local companies’ profits and scope to dwindle. IBIS World’s report remarks that the four largest electronics companies together account for 23 percent of the industry revenue in 2015, aided by the high development of the large electronic chain outlets GOME and Suning, which dominate retail stores in bigger cities across China. Future of the industry and opportunities for investors CHINA | HONG KONG | INDIA | VIETNAM | SINGAPORE www.asiabriefing.com As part of its 12th Five Year Plan, the Chinese Government has built over 36 million new lowincome housing units, and with more to be built in the future – combined with China’s improving living standards – the small appliances industry is sure to make exceptional growth. Indeed, the EMIS China Electrical Appliances Sector 2014 Report forecasts a compound annual growth rate of 9.9 percent for the industry, and predicts electronic base prices to remain stable due to the relatively low price of raw materials. Because of developments in consumers’ preference for design, function and greenness over price, there are opportunities for foreign investors to expand in the market, especially where demand exists for better energy efficiency and hygiene. This article was first published on Insert Hyperlink. Since its establishment in 1992, Dezan Shira & Associates has been guiding foreign clients through Asia’s complex regulatory environment and assisting them with all aspects of legal, accounting, tax, internal control, HR, payroll and audit matters. As a full-service consultancy with operational offices across China, Hong Kong, India and emerging ASEAN, we are your reliable partner for business expansion in this region and beyond. For inquiries, please email us at info@dezshira.com. Further information about our firm can be found at: www.dezshira.com. CHINA | HONG KONG | INDIA | VIETNAM | SINGAPORE www.asiabriefing.com